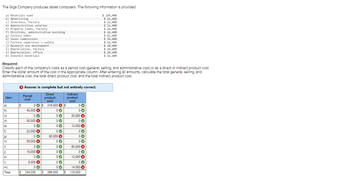

The Giga Company produces tablet computers. The following information is provided: a) Materials used b) Advertising $ 218,400 $ 42,400 c) Insurance, factory d) Administrative salaries e) Property taxes, factory f) Utilities, administrative building g) Factory labor h) Sales commissions i) Factory supervisor's salary j) Research and development k) Depreciation, factory 1) Depreciation, office m) Indirect materials Item a) b) c) d) e) f) g) h) 1) D) k) 1) Required: Classify each of the company's costs as a period cost (general, selling, and administrative cost) or as a direct or indirect product cost. Enter the dollar amount of the cost in the appropriate column. After entering all amounts, calculate the total general, selling, and administrative cost, the total direct product cost, and the total indirect product cost. m) Total Period cost Direct product cost $ 22,400 $ 52,400 $ 14,400 Indirect product cost $ 24,400 $ 82,400 $58,400 $ 62,400 $ 20,400 $ 14,400 $ 10,400 $ 16,400

The Giga Company produces tablet computers. The following information is provided: a) Materials used b) Advertising $ 218,400 $ 42,400 c) Insurance, factory d) Administrative salaries e) Property taxes, factory f) Utilities, administrative building g) Factory labor h) Sales commissions i) Factory supervisor's salary j) Research and development k) Depreciation, factory 1) Depreciation, office m) Indirect materials Item a) b) c) d) e) f) g) h) 1) D) k) 1) Required: Classify each of the company's costs as a period cost (general, selling, and administrative cost) or as a direct or indirect product cost. Enter the dollar amount of the cost in the appropriate column. After entering all amounts, calculate the total general, selling, and administrative cost, the total direct product cost, and the total indirect product cost. m) Total Period cost Direct product cost $ 22,400 $ 52,400 $ 14,400 Indirect product cost $ 24,400 $ 82,400 $58,400 $ 62,400 $ 20,400 $ 14,400 $ 10,400 $ 16,400

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter1: Introduction To Managerial Accounting

Section: Chapter Questions

Problem 4E: For apparel manufacturer Abercrombie Fitch, Inc. (ANF), classify each of the following costs as...

Related questions

Question

Transcribed Image Text:The Giga Company produces tablet computers. The following information is provided:

a) Materials used

b) Advertising

$ 218,400

$ 42,400

c) Insurance, factory

d) Administrative salaries

e) Property taxes, factory

f) Utilities, administrative building

g) Factory labor

h) Sales commissions

i) Factory supervisor's salary

j) Research and development

k) Depreciation, factory

1) Depreciation, office

m) Indirect materials

a)

b)

c)

d)

e)

f)

g)

h)

1)

D)

k)

1)

Required:

Classify each of the company's costs as a period cost (general, selling, and administrative cost) or as a direct or indirect product cost.

Enter the dollar amount of the cost in the appropriate column. After entering all amounts, calculate the total general, selling, and

administrative cost, the total direct product cost, and the total indirect product cost.

Item

m)

Total

Period cost

Direct product

cost

$ 22,400

$ 52,400

Indirect

product cost

$ 14,400

$ 24,400

$82,400

$58,400

$ 62,400

$ 20,400

$ 14,400

$ 10,400

$ 16,400

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

This answer is all incorrect.

Transcribed Image Text:The Giga Company produces tablet computers. The following Information is provided:

a) Materials used

$ 218,400

b) Advertising

$ 42,400

$ 22,400

$ 52,400

$ 14,400

$ 24,400

24,488

$ 82,400

c) Insurance, factory

d) Administrative salaries

e) Property taxes, factory

f) Utilities, administrative building

g) Factory labor

h) Sales commissions

1) Factory supervisor's salary

1) Research and development

k) Depreciation, factory

1) Depreciation, office

m) Indirect materials.

Required:

Classify each of the company's costs as a period cost (general, selling, and administrative cost) or as a direct or Indirect product cost.

Enter the dollar amount of the cost in the appropriate column. After entering all amounts, calculate the total general, selling, and

administrative cost, the total direct product cost, and the total Indirect product cost.

Item

a)

b)

c)

d)

e)

2

f)

g)

h)

i)

li)

k)

1)

m)

Total

> Answer is complete but not entirely correct.

Direct

product

cost

216,000 s

$

Period

cost

0 $

40,000 X

0♥

50,000 X

0♥

22,000 X

0

56,000 X

0♥

0♥

0✔

0

80,000 X

0

18,000 X

0

8,000 X

0

S 194.000 $ 298,000 Is

0✔

00

0✔

0✔

0♥

Indirect

product

cost

00

00

20,000 X

09

12,000 X

$ 58,400

$ 62,400

$ 20,400

$ 14,400

$ 10,400

$ 16,400

00

0♥

0

60,000 x

0

12,000 X

00

14,000x

118,000

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning