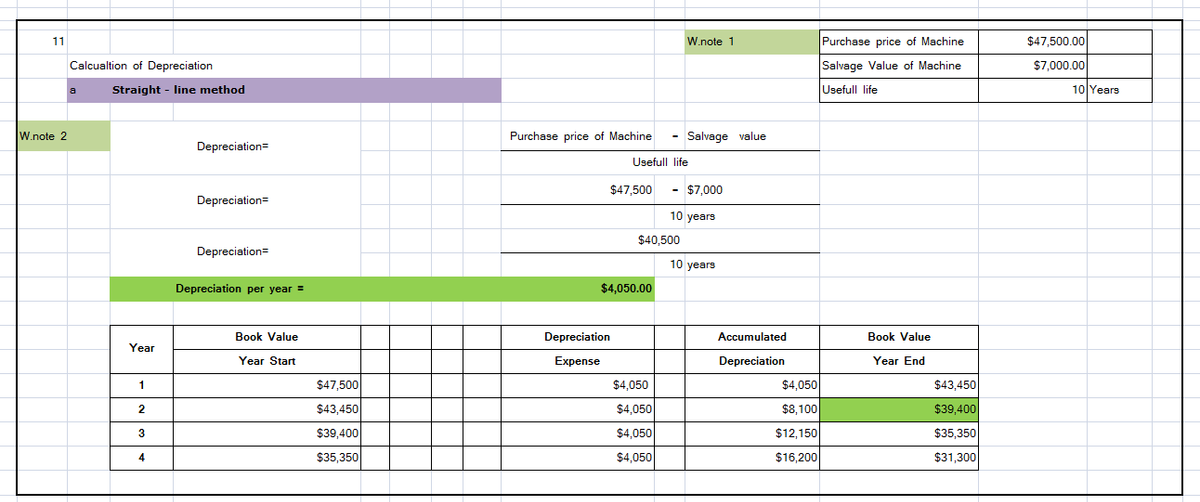

Required information Use the following information for the Exercises below. [The following information applies to the questions displayed below.] Ramirez Company installs a computerized manufacturing machine in its factory at the beginning of the year at a cost of $47,500. The machine's useful life is estimated at 10 years, or 405,000 units of product, with a $7,000 salvage value. During its second year, the machine produces 34,500 units of product. Exercise 8-4 Straight-line depreciation LO P1 Determine the machine's second-year depreciation and year end book value under the straight-line method.

Required information Use the following information for the Exercises below. [The following information applies to the questions displayed below.] Ramirez Company installs a computerized manufacturing machine in its factory at the beginning of the year at a cost of $47,500. The machine's useful life is estimated at 10 years, or 405,000 units of product, with a $7,000 salvage value. During its second year, the machine produces 34,500 units of product. Exercise 8-4 Straight-line depreciation LO P1 Determine the machine's second-year depreciation and year end book value under the straight-line method.

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter10: Long-lived Tangible And Intangible Assets

Section: Chapter Questions

Problem 29P

Related questions

Question

100%

![mework Assignment i

es

C

CON

Required information

Use the following information for the Exercises below.

[The following information applies to the questions displayed below.]

Exercise 8-4 Straight-line depreciation LO P1

Esc

Straight-Line Depreciation

Ramirez Company installs a computerized manufacturing machine in its factory at the beginning of the year at a cost of

$47,500. The machine's useful life is estimated at 10 years, or 405,000 units of product, with a $7,000 salvage value.

During its second year, the machine produces 34,500 units of product.

Determine the machine's second-year depreciation and year end book value under the straight-line method.

Choose Numerator: /

Cost minus salvage

$

Year 2 Depreciation

Year end book value (Year 2)

F1

F2

40,500/

Estimated useful life (years)

$

✔

F3

Choose Denominator:

#

Dashboard

F4J

10

4,050

Prev.

F5

%

=

=

E

Paraphrasing Tool ....

Annual Depreciation

Expense

1

Depreciation expense

$

Saved

S

2 3

F6 G

A

C

logitech

4,050

of 9

F7

&

Excelsior Career De... Nationw

7

Score.answer >

F8

*

8

F9

(

9

F10

C](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F75b9eb0a-6c09-4640-9bd0-d00c787ecce6%2Fcc76ba80-a5dc-4c77-b1c4-41842ad55b8d%2Fu40lw5q_processed.jpeg&w=3840&q=75)

Transcribed Image Text:mework Assignment i

es

C

CON

Required information

Use the following information for the Exercises below.

[The following information applies to the questions displayed below.]

Exercise 8-4 Straight-line depreciation LO P1

Esc

Straight-Line Depreciation

Ramirez Company installs a computerized manufacturing machine in its factory at the beginning of the year at a cost of

$47,500. The machine's useful life is estimated at 10 years, or 405,000 units of product, with a $7,000 salvage value.

During its second year, the machine produces 34,500 units of product.

Determine the machine's second-year depreciation and year end book value under the straight-line method.

Choose Numerator: /

Cost minus salvage

$

Year 2 Depreciation

Year end book value (Year 2)

F1

F2

40,500/

Estimated useful life (years)

$

✔

F3

Choose Denominator:

#

Dashboard

F4J

10

4,050

Prev.

F5

%

=

=

E

Paraphrasing Tool ....

Annual Depreciation

Expense

1

Depreciation expense

$

Saved

S

2 3

F6 G

A

C

logitech

4,050

of 9

F7

&

Excelsior Career De... Nationw

7

Score.answer >

F8

*

8

F9

(

9

F10

C

Expert Solution

Step 1

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you