c. 9,000 units remained in inventory at the end of 2021. Required: 1. Ignoring income taxes, prepare the 2021 journal entry to adjust the accounts to reflect the average cost method. 2. What is the effect of the change in methods on 2021 net income? Complete this question by entering your answers in the tabs below.

c. 9,000 units remained in inventory at the end of 2021. Required: 1. Ignoring income taxes, prepare the 2021 journal entry to adjust the accounts to reflect the average cost method. 2. What is the effect of the change in methods on 2021 net income? Complete this question by entering your answers in the tabs below.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter6: Cost Of Goods Sold And Inventory

Section: Chapter Questions

Problem 70APSA: Inventory Costing and LCM Ortman Enterprises sells a chemical used in various manufacturing...

Related questions

Question

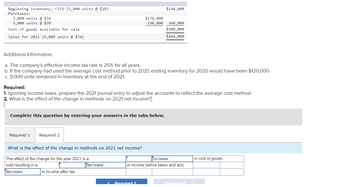

Transcribed Image Text:Beginning inventory, FIFO (5,000 units @ $28)

Purchases:

5,000 units @ $34

5,000 units @ $38

Cost of goods available for sale

Sales for 2021 (6,000 units @ $74)

Additional Information:

a. The company's effective income tax rate is 25% for all years.

b. If the company had used the average cost method prior to 2021, ending inventory for 2020 would have been $120,000.

c. 9,000 units remained in inventory at the end of 2021.

Complete this question by entering your answers in the tabs

Required 1

Required:

1. Ignoring income taxes, prepare the 2021 journal entry to adjust the accounts to reflect the average cost method.

2. What is the effect of the change in methods on 2021 net income?

Required 2

What is the effect of the change in methods on 2021 net income?

The effect of the change for the year 2021 is a

sold resulting in a

decrease

$170,000

190,000

in income after tax.

decrease

$140,000

‹ Required 1

360,000

$500,000

$444,000

low.

increase

in income before taxes and a(n)

Required 2

in cost of goods

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

This answer is suppose to have numbers associated with the answer

Transcribed Image Text:Beginning inventory, FIFO (5,000 units @ $28)

Purchases:

5,000 units @ $34

5,000 units @ $38

Cost of goods available for sale

Sales for 2021 (6,000 units @ $74)

Additional Information:

a. The company's effective income tax rate is 25% for all years.

b. If the company had used the average cost method prior to 2021, ending inventory for 2020 would have been $120,000.

c. 9,000 units remained in inventory at the end of 2021.

Complete this question by entering your answers in the tabs

Required 1

Required:

1. Ignoring income taxes, prepare the 2021 journal entry to adjust the accounts to reflect the average cost method.

2. What is the effect of the change in methods on 2021 net income?

Required 2

What is the effect of the change in methods on 2021 net income?

The effect of the change for the year 2021 is a

sold resulting in a

decrease

$170,000

190,000

in income after tax.

decrease

$140,000

‹ Required 1

360,000

$500,000

$444,000

low.

increase

in income before taxes and a(n)

Required 2

in cost of goods

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning