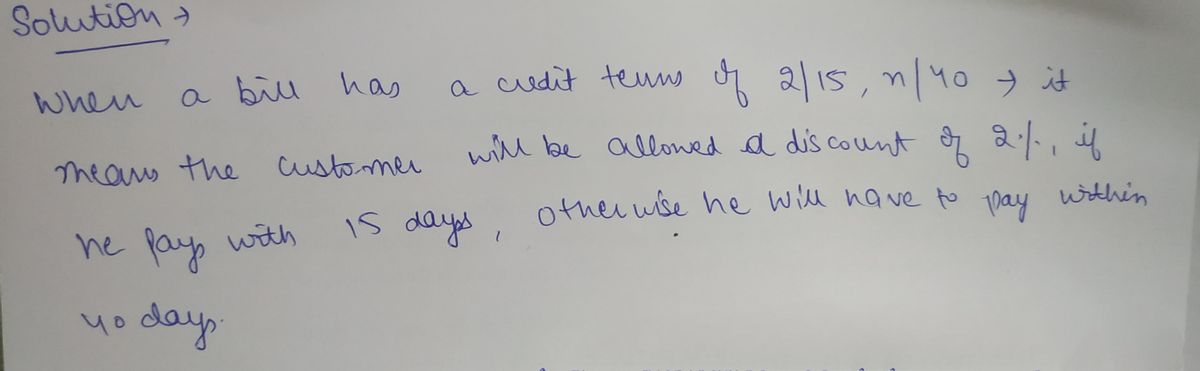

The invoice date for a bill is September 15 with the terms 2/15, n/40. The discount date and due date are A.September 30 and October 25 b.September 30 and December 9 c.September 17 and October 25 d. October 2 and October 25

The invoice date for a bill is September 15 with the terms 2/15, n/40. The discount date and due date are A.September 30 and October 25 b.September 30 and December 9 c.September 17 and October 25 d. October 2 and October 25

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter7: Employee Earnings And Deductions

Section: Chapter Questions

Problem 3E

Related questions

Question

The invoice date for a bill is September 15 with the terms 2/15, n/40. The discount date and due date are

A.September 30 and October 25

b.September 30 and December 9

c.September 17 and October 25

d. October 2 and October 25

Transcribed Image Text:... .

Percentage Method Tables for Income Tax Withholding

(For Wages Paid in 2012)

TABLE 1-WEEKLY Payroll Period

(a) SINGLE person (including head of household)-

If the amount of wages (after

subtracting withholding allowances) The amount of income tax

is:

Not over $41

Over-

$41

$209

$721

$1,688

$3.477

$7,510.

(b) MARRIED person-

If the amount of wages (after

subtracting withholding allowances)

is:

Not ovor $150

Över-

$156

$490

$1,615

$2,900

$4,338

$7,624.

The armount of income tax

to withhold is:

to withhold is:

.SO

.-.

But not over-

-%24209 . . .$0.00 plus 10%

$721 . ..$16.80 plus 16%

$1,688

$3,477. . $335.35 plus 289%

$7,510

of excess over-

-$41

-$209

-2721

$1,688

$3,477

-$7,510

But not over-

$490

21,515 . .

%$42,900

$4,338

-$7,624

.$0.00 plus 10%

.$33.40 plus 15%

$187.15 plus 25%

$533.40 plus 28%

$936.04 plus 33%

$2,020.42 plus 35%

of excess over-

-$156

-$490

-$1,515

$2,900

$4,338

-$7,624

$93.60 plus 25%

$836.27 plus 33%

$2,167.16 plus 35%

TABLE 2-BIWEEKLY Payroll Period

(a) SINGLE person (including head of household)-

If the amount of wages (after

subtracting withholding allowances) The amount of Income tax

(b) MARRIED person-

If the amount of wages (after

subtracting withholding allowances)

is:

Not over $312..

Over-

$312

$981

$3,031

$5,800

$8.675

$15,248

The amount of income tax

to withhold is:

Is:

to withhold is:

$0

Not over $83

Over-

$83

$417

$1,442

$3,377

$6,954

$15,019

.. SO

But not over

-%2417

-$1,442.. . .$33.40 plus 15%

$3,377. .

$6,954

$15,019

of excess over-

-%2483

$417

-$1,442

$3,377

-%246,954

$15,019

But not over-

-$981

-$3,031

$5,800 .. . .$374.40 plus 25%

$8,675. . .$1,066.65 plus 28%

-%2415.248

of oxcess over-

-$312

-$981

$3,031

-$5,800

-$8,675

-$15,248

$0.00 plus 10%

.$0.00 plus 10%

$66.90 plus 15%

. $187.15 plus 25%

$670.90 plus 28%

$1,672.46 plus 33%

$4,333.91 plus 35%

$1,871.65 plus 33%

$4,040.74 plus 35%

TABLE 3-SEMIMONTHLY Payroll Period

(a) SINGLE person (including head of household)-

If the amount of wages (after

subtracting withholding allowances) The amount of income tax

is:

Not over $90

Over-

$90

$452

$1.563

$3,658

$7,533

$16.271

(b) MARRIED person-

Ir the amount of wages (after

subtracting withholaing allowances)

is:

Not over $338

Over-

$338

$1,063

$3,283

$6,283

$9,398

$16,519.

The amount of Income tax

to withhold is:

$0

to withhold is:

.. $0

But not over-

-S452..

$1,563

$3,658

-$7,533

-$16.271

of excess over-

But not over-

$0.00 plus 10%

$36.20 plus 15%

. $202.85 plus 25%

. $726.60 plus 28%

.$1,811.60 plus 33%

$4,695.14 plus 35%

of excess over-

-$338

$1,063

-$3.283

$6.283

$9,398

-$16,519

-$1,063

-$43,263

.$0.00 plus 10%

$72.50 plus 15%

-$6,283 . .$405.50 plus 25%

-%$49,398 .. . .$1,155.50 plus 28%

$2,027.70 plus 33%

.$4,377.63 plus 35%

...

$452

$1,563

$3,658

$7,533

-2416,271

-$16,519

TABLE 4-MONTHLY Payroll Period

(a) SINGLE person (including head of household)-

If the amount of wages (after

subtracting withholding allowances) The amount of income tax

is:

Not over $179

(b) MARRIED person

If the amount of wages (after

subtracting withholding allowances)

is:

Not over $675

Over-

$675

$2,125

$6,667

$12,567

$18,796

$33,038

to withhold is:

SO

The amount of income tax

to withhold is:

over

$179

$904

$3,125

$7,317

$15,067

$32,542

But not over-

-$904

-$43,125

$7.317 .

$15,067

-%$32.542

$0.00 plus 10%

$72.50 plus 15%

$405.65 plus 25%

$1,453.65 plus 28%

$3.623.65 plus 33%

$9,390.40 plus 35%

of excess over-

$179

$904

$3,125

$7,317

$15,067

-S32,542

But not over

$2.125

$6,567

$12.567

$18,796

$33.038

$0.00 plus 10%

$145.00 plus 15%

$811.30 plus 25%

$2,311.30 plus 28%

$4.055.42 plus 33%

$8,755.28 plus 95%

of excess over-

$675

-%242,125

-$46,567

$12,587

$18,796

$33,038

Payroll Period

One Withholding

Allowance

Weekly.

Biweekly

Semimonthly

Monthly

Quarterly

Semiannually

Annually

Daily or miscellaneous (each day of the payroll

perlod)

$73.08

146.15

158.33

316.67

950.00

1,900.00

3,800.00

14.62

Expert Solution

Step 1

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning