College Accounting (Book Only): A Career Approach

13th Edition

ISBN: 9781337280570

Author: Scott, Cathy J.

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 1, Problem 1PA

On June 1 of this year, J. Larkin, Optometrist, established the Larkin Eye Clinic. The clinic’s account names are presented below. Transactions completed during the month follow.

- a. Larkin deposited $25,000 in a bank account in the name of the business.

- b. Paid the office rent for the month, $950, Ck. No. 1001.

- c. Bought supplies for cash, $357, Ck. No. 1002.

- d. Bought office equipment on account from NYC Office Equipment Store, $8,956.

- e. Bought a computer from Warden’s Office Outfitters, $1,636, paying $750 in cash and placing the balance on account, Ck. No. 1003.

- f. f. Sold professional services for cash, $3,482.

- g. Paid on account to Warden’s Office Outfitters, $886, Ck. No. 1004.

- h. Received and paid the bill for utilities, $382, Ck. No. 1005.

- i. Paid the salary of the assistant, $1,050, Ck. No. 1006.

- j. Sold professional services for cash, $3,295.

- k. Larkin withdrew cash for personal use, $1,250, Ck. No. 1007.

Required

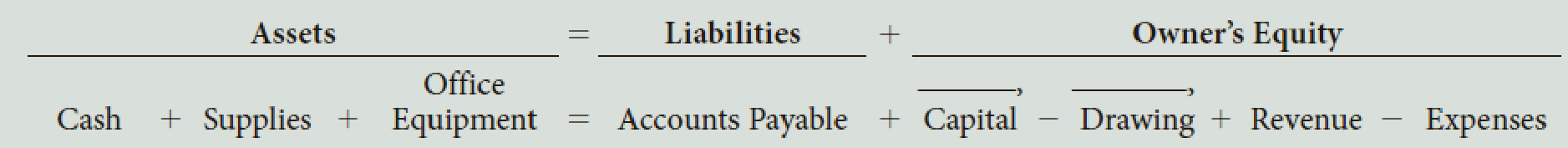

- 1. Record the transactions and the balance after each transaction.

- 2. Total the left side of the

accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Lena, Carrie, and Margaret work for a family physician. The doctor is knowledgeable about office management practices and has segregated the cash receipt duties as follows: Lena opens the mail and prepares a triplicate list of money received. Lena sends one copy of the list to Carrie, the cashier, who deposits the receipts daily in the bank. Margaret, the recordkeeper, receives a copy of the list and posts payments to the patients' accounts. About once a month, the office clerks have an expensive lunch they pay for as follows. First Carrie endorses a patient's check in the doctor's name and cashes it at the bank. Lena then destroys the remittance advice accompanying the check. Finally, Margaret posts payment to the customer's account as a miscellaneous credit. The three justify their actions by their relatively low pay and knowledge that the doctor will likely never miss the money. What went wrong with the doctor's internal controls?

Lena, Carrie, and Margaret work for a family physician. The doctor is knowledgeable about office management practices and has segregated the cash receipt duties as follows: Lena opens the mail and prepares a triplicate list of money received. Lena sends one copy of the list to Carrie, the cashier, who deposits the receipts daily in the bank. Margaret, the recordkeeper, receives a copy of the list and posts payments to the patients' accounts. About once a month, the office clerks have an expensive lunch they pay for as follows. First Carrie endorses a patient's check in the doctor's name and cashes it at the bank. Lena then destroys the remittance advice accompanying the check. Finally, Margaret posts payment to the customer's account as a miscellaneous credit. The three justify their actions by their relatively low pay and knowledge that the doctor will likely never miss the money.

Would a bank reconciliation uncover this office fraud?

Consider each of the transaction below independently. All expenditures were made in cash

In march, the Cleanway Laundromat bought equipment. Cleanway paid $5,000 down and signed a noninterest-bearing note requiring the payment of $30,000 in nine months. The cash price for the equipment was $34,000.

Prepare all necessary journal entries to record each the transaction. Use this format:

Date

Account Titles

DR

CR

Chapter 1 Solutions

College Accounting (Book Only): A Career Approach

Ch. 1 - Prob. 1QYCh. 1 - Prob. 2QYCh. 1 - Which of the following accounts would increase...Ch. 1 - Which of the following statements is true? a....Ch. 1 - M. Parish purchased supplies on credit. What is...Ch. 1 - Define assets, liabilities, owners equity,...Ch. 1 - Prob. 2DQCh. 1 - How do Accounts Payable and Accounts Receivable...Ch. 1 - Describe two ways to increase owners equity and...Ch. 1 - What is the effect on the fundamental accounting...

Ch. 1 - When an owner withdraws cash or goods from the...Ch. 1 - Define chart of accounts and identify the...Ch. 1 - What account titles would you suggest for the...Ch. 1 - Prob. 1ECh. 1 - Determine the following amounts: a. The amount of...Ch. 1 - Dr. L. M. Patton is an ophthalmologist. As of...Ch. 1 - Describe a business transaction that will do the...Ch. 1 - Describe a transaction that resulted in each of...Ch. 1 - Label each of the following accounts as asset (A),...Ch. 1 - Describe a transaction that resulted in the...Ch. 1 - Describe the transactions that are recorded in the...Ch. 1 - On June 1 of this year, J. Larkin, Optometrist,...Ch. 1 - On July 1 of this year, R. Green established the...Ch. 1 - S. Davis, a graphic artist, opened a studio for...Ch. 1 - On March 1 of this year, B. Gervais established...Ch. 1 - In April, J. Rodriguez established an apartment...Ch. 1 - In July of this year, M. Wallace established a...Ch. 1 - In March, K. Haas, M.D., established the Haas...Ch. 1 - P. Schwartz, Attorney at Law, opened his office on...Ch. 1 - In March, T. Carter established Carter Delivery...Ch. 1 - In October, A. Nguyen established an apartment...Ch. 1 - Why Does It Matter? MACS CUSTOM CATERING, Eugene,...Ch. 1 - What Would You Say? A friend of yours wants to...Ch. 1 - Prob. 3A

Additional Business Textbook Solutions

Find more solutions based on key concepts

For each of the following transactions, state which special journal (Sales Journal, Cash Receipts Journal, Cash...

Principles of Accounting Volume 1

Assume you are a CFO of a company that is attempting to race additional capital to finance an expansion of its ...

Financial Accounting, Student Value Edition (4th Edition)

Place the letter of the appropriate accounting cost in Column 2 in the blank next to each decision category in ...

Fundamentals Of Cost Accounting (6th Edition)

(a) Standard costs are the expected total cost of completing a job. Is this correct? Explain, (b) A standard im...

Managerial Accounting: Tools for Business Decision Making

Discussion Analysis A13-41 Discussion Questions 1. How do managers use the statement of cash flows? 2. Describ...

Managerial Accounting (5th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Home Office collected 100,000 from Branch’s customers on account. Requirements:a. Prepare the journal entries for both the Home Office and Branch books based on theabove transactions.arrow_forwardPrepare the following journal entry, all transactions that occurred in January: The Corporation purchased a Delivery Van for customer deliveries. The Delivery Van cost $21,400. A down payment of cash in the amount of $5,000 was paid to the Car Dealership, and a promissory note was signed for the remaining amount owed.arrow_forwardRick Rambis operates a ski lodge center at Bull Mountain in Alaska. He has just received the monthly bank statement at October 31 from Bull National Bank. The bank statement shows an ending balance at October 31 of $750. The following items are listed on the statement:1. The bank collected rent revenue for Rick in the amount of $330.2. Service charge of $10.3. Two NSF checks from customers totaling $110.4. Printing check charge of $11.In reviewing his cash records and the bank statement, Rick identifies the following:1. Outstanding checks totaling $603.2. Deposit in transit on October 31 of $1,770.3. An error made by Rick: Rick recorded a salary check for $31 but it cleared the bank at $310.Rick’s cash records show a balance on October 31 of $1,997.Requireda) Reconcile the bank account.b) Prepare journal entries that should be made as a result of the bank reconciliation.c) What should the balance in Rick’s Cash account be after the reconciliation?d) What total amount of cash should the…arrow_forward

- Yi Min started an engineering firm called Min Engineering. He began operations and completed seventransactions in May, which included his initial investment of $18,000 cash. After those seven transactions,the ledger included the following accounts with normal balances. Cash . . . . . . . . . . . . . . . . . . $37,600Office supplies. . . . . . . . . . 890Prepaid insurance. . . . . . . 4,600Office equipment. . . . . . . $12,900Accounts payable. . . . . . . 12,900Y. Min, Capital. . . . . . . . . . 18,000Y. Min, Withdrawals . . . . . . . . . . . $ 3,370Engineering fees earned. . . . . . . 36,000Rent expense. . . . . . . . . . . . . . . . 7,540 Required 1. Prepare a trial balance for this business as of the end of May. 2. The following seven transactions produced the account balances shown above. a. Y. Min invested $18,000 cash in the business. b. Paid $7,540 cash for monthly rent expense for May. c. Paid $4,600 cash in advance for the annual insurance premium beginning the next period. d.…arrow_forwardCatherine’s Cookies has a beginning balance in the Accounts Payable control total account of $8,200. In the cash disbursements journal, the Accounts Payable column has total debits of $6,800 for November. The Accounts Payable credit column in the purchases journal reveals a total of $10,500 for the current month. Based on this information, what is the ending balance in the Accounts Payable account in the general ledger? Record the following transactions in the sales journal: Jan. 15 Invoice # 325, sold goods on credit for $2,400, to Maroon 4, account # 4501 Jan. 22 Invoice #326, sold goods on credit for $3,500 to BTS, account # 5032 Jan. 27 Invoice #327, sold goods on credit for $1,250 to Imagine Fireflies, account # 3896arrow_forwardAn international children’s charity collects donations, which are used to buy clothing and toysfor children in need. The charity records donations of cash and other items as Donations Revenuewhen received. Prepare journal entries for the following transactions, which occurred during arecent month, and determine the charity’s preliminary net income.a. Received $4,000 in cash and checks from a door-to-door campaign.b. Paid $2,000 cash for employee wages this month.c. Paid $1,000 cash on a short-term loan from the bank (ignore interest).d. Bought $3,000 worth of new toy supplies from a large toy manufacturer, paying $1,000 cashand signing a short-term note for $2,000.e. The manufacturer generously donated an additional $2,500 of toy suppliearrow_forward

- Bridgette Keyes is a self-employed licenced dentist. She personally put $10,000 in her firm. Create an entry in the general journal to record this transaction.arrow_forwardS. Waweru starts business on 1st July 2020, when he deposits Shs. 18,000 into his business bank account and Shs. 2,500 in his cash account. During the month of July, he undertakes the following transactions:- 2020 July 3 He purchases shop fittings for sh. 2,500 and pays by cheque. July 4 He buys a motor vehicle from AB & Co. on credit Sh. 3,000. July 6 He buys stock for Sh. 1,500 and pays through bank. July 8 He sells goods for cash Sh.1,000. July 10 Buys goods on credit from XY & Co. for Sh. 1,200 July 12 Sells goods to A. Smith for Sh. 900 on credit July 13 Pays wages Sh. 120 by cash July 14 A. Smith returns goods worth Sh. 200 July 15 Pays to AB & Co. Sh. 3,000 by cheque July 17 Goods returned to XY & Co. amounting to Sh. 350 July 21 Receives from A. Smith a cheque for Sh. 700 July 25 Sells goods for cash Sh. 300. July 30…arrow_forwardS. Waweru starts business on 1st July 2020, when he deposits Shs. 18,000 into his business bank account and Shs. 2,500 in his cash account. During the month of July, he undertakes the following transactions:- 2020 July 3 He purchases shop fittings for sh. 2,500 and pays by cheque. July 4 He buys a motor vehicle from AB & Co. on credit Sh. 3,000. July 6 He buys stock for Sh. 1,500 and pays through bank. July 8 He sells goods for cash Sh.1,000. July 10 Buys goods on credit from XY & Co. for Sh. 1,200 July 12 Sells goods to A. Smith for Sh. 900 on credit July 13 Pays wages Sh. 120 by cash July 14 A. Smith returns goods worth Sh. 200 July 15 Pays to AB & Co. Sh. 3,000 by cheque July 17 Goods returned to XY & Co. amounting to Sh. 350 July 21 Receives from A. Smith a cheque for Sh. 700 July 25 Sells goods for cash Sh. 300. July 30…arrow_forward

- Following are some transactions and events of Business Solutions. February 26 The company paid cash to Lyn Addie for eight days' work at $120 per day. March 25 The company sold merchandise with a $2,100 cost for $3,300 on credit to Wildcat Services, invoice dated March 25. Required: 1. Assume that Lyn Addie is an unmarried employee. Her $960 of wages have deductions for FICA Social Security taxes, FICA Medicare taxes, and federal income taxes. Her federal income taxes for this pay period total $96. Compute her net pay for the eight days' work paid on February 26. 2. Record the journal entry to reflect the payroll payment to Lyn Addie as computed in part 1. 3. Record the journal entry to reflect the (employer) payroll tax expenses for the February 26 payroll payment. Assume Lyn Addie has not met earnings limits for FUTA and SUTA (the FUTA rate is 0.6% and the SUTA rate is 5.4% for the company). 4. Record the entries for the merchandise sold on March 25 if a 4% sales tax rate applies.…arrow_forwardO In June, a local Amtrak office established a petty cash fund with Terrell Noman as its custodian. Terrell received and cashed a company check of $175 to establish the fund. During that month, Terrell paid cash from the fund for supplies ($30), delivery charges ($80), and other minor office expenses ($40). On July 10, he received a company check for $150 to replenish the fund. Required: 1. Prepare the journal entry required in June. 2. Prepare the journal entry required in July. 3. Explain why it may be appropriate or inappropriate to wait until July to record the payments from the petty cash fund.arrow_forwardEna Sharples opened a retail shop on January 1. She invested $10,000 of her own money. She rented a store for $2,000 per month, paying first and last month’s rent on January 1. She bought store fittings for $5,000 in cash. She bought goods for resale at a cost of $10,000, on credit, payable on February 15. She incurred other expenses of $1,000 in January, all of which were paid for in cash. Her cash sales were $15,000, and she also sold $2,000 on credit, which she expects to collect by the end of February. At the end of January her inventory had a cost of $3,000. Amortization on the store fittings is estimated at $100 for the month. The sales revenue recognized in January was?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY