Concept explainers

Review of Basic Capital Budgeting Procedures

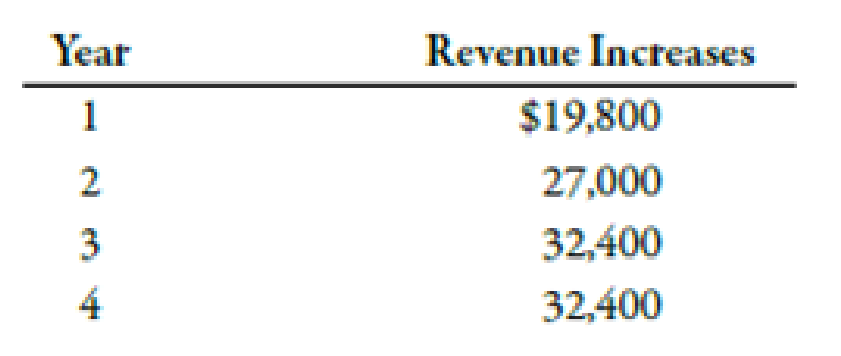

Dr. Whitley Avard, a plastic surgeon, had just returned from a conference in which she learned of a new surgical procedure for removing wrinkles around eyes, reducing the time to perform the normal procedure by 50%. Given her patient-load pressures. Dr. Avard is excited to try out the new technique. By decreasing the time spent on eye treatments or procedures, she can increase her total revenues by performing more services within a work period. In order to implement the new procedure, special equipment costing $74,000 is needed. The equipment has an expected life of 4 years, with a salvage value of $6,000. Dr. Avard estimates that her cash revenues will increase by the following amounts:

She also expects additional cash expenses amounting to $3,000 per year. The cost of capital is 12%. Assume that there are no income taxes.

Required:

- 1. Compute the payback period for the new equipment.

- 2. Compute the ARR. Round the percentage to two decimal places.

- 3. CONCEPTUAL CONNECTION Compute the

NPV andIRR for the project. Use 14% as your first guess for IRR. Should Dr. Avard purchase the new equipment? Should she be concerned about payback or the ARR in making this decision? - 4. CONCEPTUAL CONNECTION Before finalizing her decision. Dr. Avard decided to call two plastic surgeons who have been using the new procedure for the past 6 months. The conversations revealed a somewhat less glowing report than she received at the conference. The new procedure reduced the time required by about 25% rather than the advertised 50%. Dr. Avard estimated that the net operating cash flows of the procedure would be cut by one-third because of the extra time and cost involved (salvage value would be unaffected). Using this information, recompute the NPV of the project. What would you now recommend?

Trending nowThis is a popular solution!

Chapter 12 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

- Answer the following question with complete solution and cash flow diagram. An engineer launches a project in the country's top techohub. This involves rental of a computer unit for online class students. He felt that because of the density of students in the area, 90% of his 30-units will be occupied per sem (5 months each) per year. He desires a rate of return of 20%. Other pertinent data are the following: Office investment Computer investment per unit Cost of computers after 10 yrs Office rental per month Computer rental per unit per month Annual maintenance budget per unit Business tax P 1,000,000 P 35,000 P 5,000 P 9,000 P 2,000 P 5,000 1% of Total Investment Insurance 0.5% of Total Investment Assess the project using (A) ROR, (B) Present Worth Method, and (C) Future Worth Method. (D) Estimate the payback period of this project.arrow_forwardConsider how Root Valley River Park Lodge could use capital budgeting to decide whether the $13,000,000 River Park Lodge expansion would be a good investment. Assume Root Valley's managers developed the following estimates concerning the expansion: (Click the icon to view the estimates.) (Click the icon to view additional information.) The internal rate of return (IRR) of the expansion is Data table More info example 10-12% Number of additional skiers per day Average number of days per year that weather conditions allow skiing at Root Valley Useful life of expansion (in years) Average cash spent by each skier per day Average variable cost of serving each skier per day Cost of expansion Discount rate Get more help. 12-14% Print 15-16% 16-18% S Done 122 skiers 149 days Assume that Root Valley uses the straight-line depreciation method and expects the lodge expansion to have no residual value at the end of its nine-year life. The project is expected to have an average annual net cash…arrow_forwardMarginal cost-benefit analysis and the goal of the firm Ken Allen, capital budgeting analyst for Bally Gears, Inc., has been asked to evaluate a proposal. The manager of the automotive division believes that replacing the robotics used on the heavy truck gear line will produce total benefits of $566,000 (in today's dollars) over the next 5 years. The existing robotics would produce benefits of $357,000 (also in today's dollars) over that same time period. An initial cash investment of $226,400 would be required to install the new equipment. The manager estimates that the existing robotics be sold for $56,000. Show how Ken will apply marginal cost-benefit analysis techniques to determine the following: a. The marginal benefits of the proposed new robotics. b. The marginal cost of the proposed new robotics. c. The net benefit of the proposed new robotics. d. What should Ken recommend that the company do? Why? e. What factors besides the costs and benefits should be considered before the…arrow_forward

- Part 2 Please study the following capital budgeting project and then provide explanations for the questions outlined below: You have been hired as a consultant for Pristine Urban-Tech Zither, Inc. (PUTZ), manufacturers of fine zithers. The market for zithers is growing quickly. The company bought some land three years ago for $2.1 million in anticipation of using it as a toxic waste dump site but has recently hired another company to handle all toxic materials. Based on a recent appraisal, the company believes it could sell the land for $2.3 million on an after-tax basis. In four years, the land could be sold for $2.4 million after taxes. The company also hired a marketing firm to analyze the zither market, at a cost of $125,000. An excerpt of the marketing report is as follows: The zither industry will have a rapid expansion in the next four years. With the brand name recognition that PUTZ brings to bear, we feel that the company will be able to sell 3,600, 4,300, 5,200, and 3,900…arrow_forwardPlease study the following capital budgeting project and then provide explanations for the questions outlined below: You have been hired as a consultant for Pristine Urban-Tech Zither, Inc. (PUTZ), manufacturers of fine zithers. The market for zithers is growing quickly. The company bought some land three years ago for $2.1 million in anticipation of using it as a toxic waste dump site but has recently hired another company to handle all toxic materials. Based on a recent appraisal, the company believes it could sell the land for $2.3 million on an after-tax basis. In four years, the land could be sold for $2.4 million after taxes. The company also hired a marketing firm to analyze the zither market, at a cost of $125,000. An excerpt of the marketing report is as follows: The zither industry will have a rapid expansion in the next four years. With the brand name recognition that PUTZ brings to bear, we feel that the company will be able to sell 3,600, 4,300, 5,200, and 3,900 units each…arrow_forwardPlease study the following capital budgeting project and then provide explanations for the questions outlined below: You have been hired as a consultant for Pristine Urban-Tech Zither, Inc. (PUTZ), manufacturers of fine zithers. The market for zithers is growing quickly. The company bought some land three years ago for $2.1 million in anticipation of using it as a toxic waste dump site but has recently hired another company to handle all toxic materials. Based on a recent appraisal, the company believes it could sell the land for $2.3 million on an after-tax basis. In four years, the land could be sold for $2.4 million after taxes. The company also hired a marketing firm to analyze the zither market, at a cost of $125,000. An excerpt of the marketing report is as follows:The zither industry will have a rapid expansion in the next four years. With the brand name recognition that PUTZ brings to bear, we feel that the company will be able to sell 3,600, 4,300, 5,200, and 3,900 units each…arrow_forward

- Please study the following capital budgeting project and then provide explanations for the questions outlined below:You have been hired as a consultant for Pristine Urban-Tech Zither, Inc. (PUTZ), manufacturers of fine zithers. The market for zithers is growing quickly. The company bought some land three years ago for $2.1 million in anticipation of using it as a toxic waste dump site but has recently hired another company to handle all toxic materials. Based on a recent appraisal, the company believes it could sell the land for $2.3 million on an after-tax basis. In four years, the land could be sold for $2.4 million after taxes. The company also hired a marketing firm to analyze the zither market, at a cost of $125,000. An excerpt of the marketing report is as follows:The zither industry will have a rapid expansion in the next four years. With the brand name recognition that PUTZ brings to bear, we feel that the company will be able to sell 3,600, 4,300, 5,200, and 3,900 units each…arrow_forwardPlease study the following capital budgeting project and then provide explanations for the questions outlined below: You have been hired as a consultant for Pristine Urban-Tech Zither, Inc. (PUTZ), manufacturers of fine zithers. The market for zithers is growing quickly. The company bought some land three years ago for $2.1 million in anticipation of using it as a toxic waste dump site but has recently hired another company to handle all toxic materials. Based on a recent appraisal, the company believes it could sell the land for $2.3 million on an after-tax basis. In four years, the land could be sold for $2.4 million after taxes. The company also hired a marketing firm to analyze the zither market, at a cost of $125,000. An excerpt of the marketing report is as follows:The zither industry will have a rapid expansion in the next four years. With the brand name recognition that PUTZ brings to bear, we feel that the company will be able to sell 3,600, 4,300, 5,200, and 3,900 units each…arrow_forwardPlease study the following capital budgeting project and then provide explanations for the questions outlined below: You have been hired as a consultant for Pristine Urban-Tech Zither, Inc. (PUTZ), manufacturers of fine zithers. The market for zithers is growing quickly. The company bought some land three years ago for $2.1 million in anticipation of using it as a toxic waste dump site but has recently hired another company to handle all toxic materials. Based on a recent appraisal, the company believes it could sell the land for $2.3 million on an after-tax basis. In four years, the land could be sold for $2.4 million after taxes. The company also hired a marketing firm to analyze the zither market, at a cost of $125,000. An excerpt of the marketing report is as follows: The zither industry will have a rapid expansion in the next four years. With the brand name recognition that PUTZ brings to bear, we feel that the company will be able to sell 3,600, 4,300, 5,200, and 3,900 units…arrow_forward

- Please study the following capital budgeting project and then provide explanations for the questions outlined below: You have been hired as a consultant for Pristine Urban-Tech Zither, Inc. (PUTZ), manufacturers of fine zithers. The market for zithers is growing quickly. The company bought some land three years ago for $2.1 million in anticipation of using it as a toxic waste dump site but has recently hired another company to handle all toxic materials. Based on a recent appraisal, the company believes it could sell the land for $2.3 million on an after-tax basis. In four years, the land could be sold for $2.4 million after taxes. The company also hired a marketing firm to analyze the zither market, at a cost of $125,000. An excerpt of the marketing report is as follows: The zither industry will have a rapid expansion in the next four years. With the brand name recognition that PUTZ brings to bear, we feel that the company will be able to sell 3,600, 4,300, 5,200, and 3,900 units…arrow_forwardPlease study the following capital budgeting project and then provide explanations for the questions outlined below: You have been hired as a consultant for Pristine Urban-Tech Zither, Inc. (PUTZ), manufacturers of fine zithers. The market for zithers is growing quickly. The company bought some land three years ago for $2.1 million in anticipation of using it as a toxic waste dump site but has recently hired another company to handle all toxic materials. Based on a recent appraisal, the company believes it could sell the land for $2.3 million on an after-tax basis. In four years, the land could be sold for $2.4 million after taxes. The company also hired a marketing firm to analyze the zither market, at a cost of $125,000. An excerpt of the marketing report is as follows: The zither industry will have a rapid expansion in the next four years. With the brand name recognition that PUTZ brings to bear, we feel that the company will be able to sell 3,600, 4,300, 5,200, and 3,900 units each…arrow_forwardPlease study the following capital budgeting project and then provide explanations for the questions outlined below: You have been hired as a consultant for Pristine Urban-Tech Zither, Inc. (PUTZ), manufacturers of fine zithers. The market for zithers is growing quickly. The company bought some land three years ago for $2.1 million in anticipation of using it as a toxic waste dump site but has recently hired another company to handle all toxic materials. Based on a recent appraisal, the company believes it could sell the land for $2.3 million on an after-tax basis. In four years, the land could be sold for $2.4 million after taxes. The company also hired a marketing firm to analyze the zither market, at a cost of $125,000. An excerpt of the marketing report is as follows: The zither industry will have a rapid expansion in the next four years. With the brand name recognition that PUTZ brings to bear, we feel that the company will be able to sell 3,600, 4,300, 5,200, and 3,900 units each…arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning