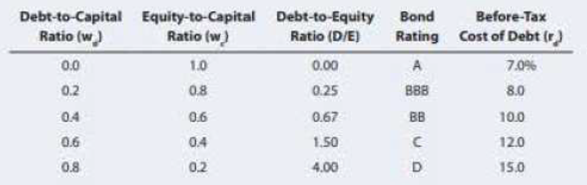

WACC AND OPTIMAL CAPITAL STRUCTURE Elliott Athletics is trying to determine its optimal capital structure, which now consists of only debt and common equity. The firm dots not currently use

Elliott uses the

- a. What is the firm's optimal capital structure, and what would be its WACC at the optimal capital structure?

- b. If Elliott's managers anticipate that the company's business risk will increase in the future, what effect would this likely have on the firm's target capital structure?

- c. If Congress were to dramatically increase the corporate tax rate, what effect would this likely have on Elliott's target capital structure?

- d. Plot a graph of the after-tax cost of debt, the

cost of equity , and the WACC versus (1) - e. the debt/capital ratio and (2) the debt /equity ratio.

Trending nowThis is a popular solution!

Chapter 14 Solutions

Fundamentals of Financial Management (MindTap Course List)

- WACC and Optimal Capital Structure F. Pierce Products Inc. is considering changing its capital structure. F. Pierce currently has no debt and no preferred stock, but it would like to add some debt to take advantage of low interest rates and the tax shield. Its investment banker has indicated that the pre-tax cost of debt under various possible capital structures would be as follows: F. Pierce uses the CAPM to estimate its cost of common equity, rs and at the time of the analysis the risk-free rate is 5%, the market risk premium is 6%, and the companys tax rate is 40%. F. Pierce estimates that its beta now (which is unlevered because it currently has no debt) is 0.8. Based on this information, what is the firms optimal capital structure, and what would be the weighted average cost of capital at the optimal capital structure?arrow_forwardWACC and Optimal Capital Structure F. Pierce Products Inc. is considering changing its capital structure. F. Pierce currently has no debt and no preferred stock, but it would like to add some debt to take advantage of the tax shield. Its investment banker has indicated that the pre-tax cost of debt under various possible capital structures would be as follows: Equity: Market Debt-to- Value Ratio (wa) 0.0 0.10 0.20 0.30 0.40 F. Pierce uses the CAPM to estimate its cost of common equity, rs, and at the time of the analaysis the risk-free rate is 5%, the market risk premium is 7%, and the company's tax rate is 25%. F. Pierce estimates that its beta now (which is "unlevered" because it currently has no debt) is 0.7. Based on this information, what is the firm's optimal capital structure, and what would be the weighted average cost of capital at the optimal capital structure? Do not round intermediate calculations. Round your answers to two decimal places. Debt: WACC: Market Equity-to-…arrow_forwardWhich of the following statements is most correct? Group of answer choices The optimal capital structure maximizes the WACC. None of these. Increasing the amount of debt in a firm's capital structure is likely to increase the cost of both debt and equity financing. If the after-tax cost of equity financing exceeds the after-tax cost of debt financing, firms are always able to reduce their WACC by increasing the amount of debt in their capital structure.arrow_forward

- OOOO As a financial analyst for a firm looking to make an investment in its operations, you are tasked with determining how upcoming projects are financed. Because the board of directors decided years ago that it would not offer preferred stock, the firm is comprised of only debt and equity financing. Given the following analysis of optional capital Ostructures, which is the optimal capital structure? Proportion of Debt After-Tax Cost Cost of Weighted Financing of Debt Equity Cost 0% 5% 9% 9.00% 10% 5% 9% 8.60% 20% 5% 9% 8.20% 30% 5% 9% 7.80% 40% 5% 10% 8.00% 50% 6% 11% 8.50% 60% 7% 13% 9.40% 70% 10% 17% 12.10% 80% 12% 20% 13.60% 90% 15% 25% 16.00% 100% 18% 25% 18.00% • . O · O 0 a. 30 percent b. 40 percent O c. 100 percent O d. 0 percent Icon Kovarrow_forward6. Backroads Sporting Goods is trying to determine its optimal capital structure, which now consists of only debt and common equity. The firm does not currently use preferred stock in its capital structure, and it does not plan to do so in the future. To estimate how much its debt would cost at different debt levels, the company's treasury staff has consulted with investment bankers and, on the basis of those cussions, has created the following table: 4 Debt-to-Capital Ratio 0.0 0.2 0.4 0.6 a 9.56% h 10.48% Equity-to- Capital Ratio 11.13% d. 11.45% e. 12.25 % (w.) 1.0 0.8 0.6 0.4 0.2 Debt-to-Equity Ratio (D/E) 0.00 0.25 0.67 1.50 4.00 Bond Rating A BBB BB Before-Tax Cost of Debt 65% 7.5 9.5 D Backroads uses the CAPM to estimate its cost of common equity. r.. The company estimates that the risk-free rate is 6%, the market risk premium is 5%, and its tax rate is 40%. Backroads estimates that if it had no debt, its "unlevered" beta, bu, would be 1.25. On the basis of this information,…arrow_forward4. Determining the optimal capital structure Understanding the optimal capital structure Review this situation: Transworld Consortium Corp. is trying to identify its optimal capital structure. Transworld Consortium Corp. has gathered the following financial information to help with the analysis. Debt Ratio Equity Ratio EPS DPS Stock Price 30% 70% 1.25 0.55 36.25 40% 60% 1.40 0.60 37.75 50% 50% 1.60 0.65 39.50 60% 40% 1.85 0.75 38.75 70% 30% 1.75 0.70 38.25 Which capital structure shown in the preceding table is Transworld Consortium Corp.’s optimal capital structure? Debt ratio = 30%; equity ratio = 70% Debt ratio = 40%; equity ratio = 60% Debt ratio = 50%; equity ratio = 50% Debt ratio = 60%; equity ratio = 40% Debt ratio = 70%; equity ratio = 30%arrow_forward

- The Cost of Capital: Cost of New Common Stock If a firm plans to issue new stock, flotation costs (investment bankers' fees) should not be ignored. There are two approaches to use to account for flotation costs. The first approach is to add the sum of flotation costs for the debt, preferred, and common stock and add them to the initial investment cost. Because the investment cost is increased, the project's expected return is reduced so it may not meet the firm's hurdle rate for acceptance of the project. The second approach involves adjusting the cost of common equity as follows:The difference between the flotation-adjusted cost of equity and the cost of equity calculated without the flotation adjustment represents the flotation cost adjustment. Quantitative Problem: Barton Industries expects next year's annual dividend, D1, to be $1.80 and it expects dividends to grow at a constant rate g = 4.2%. The firm's current common stock price, P0, is $20.60. If it needs to issue new common…arrow_forwardIf interaction effects make it difficult for a firm to adjust its capital structure based on prevailing conditions, then Group of answer choices the firm should use as much debt financing as possible when it is financially healthy in order to benefit from lower corporate taxes the firm should target a 50% debt/50% equity capital structure the firm should choose the capital structure that will minimize all transaction costs--both direct and indirect the firm should use more equity financing than is necessarily optimal todayarrow_forwardUnderstanding the impact of debt in the capital structure Suppose you are conducting a workshop on capital structure decisions and you want to highlight certain key issues related to capital structure. Your assistant has made a list of points for your session, but he thinks he might have made some mistakes. Review the Ilist and identify which items are correct. Check all that apply. Workshop Talking Points An increase in debt financing beyond a certain point is likely to increase the firm's cost of equity. An increase in debt financing decreases the risk of bankruptcy. An increase in the risk of bankruptcy is likely to reduce a firm's free cash flows in the future. Risks of bankruptcy increase management spending on perquisites and increase agency costs. The pretax cost of debt increases as a firm's risk of bankruptcy increases.arrow_forward

- Determining the Cost of Capital: Cost of New Common Stock If a firm plans to issue new stock, flotation costs (investment bankers' fees) should not be ignored. There are two approaches to use to account for flotation costs. The first approach is to add the sum of flotation costs for the debt, preferred, and common stock and add them to the initial investment cost. Because the investment cost is increased, the project's expected return is reduced so it may not meet the firm's hurdle rate for acceptance of the project. The second approach involves adjusting the cost of common equity as follows:LThe difference between the flotation-adjusted cost of equity and the cost of equity calculated without the flotation adjustment represents the flotation cost adjustment. Quantitative Problem: Barton Industries expects next year's annual dividend, D1, to be $1.70 and it expects dividends to grow at a constant rate gL = 5%. The firm's current common stock price, P0, is $23.60. If it needs to issue…arrow_forwardTopic: Capital Budgeting and Valuation with Leverage Is it possible to calculate the unlevered value of a firm using the APV method, without knowing the debt level, assuming the growth rate of the EBIT and the interest coverage ratio are constant? I don't think so because then you cannot find the pre-tax WACC. Given information: EBIT FCF Cost of debt CAPM Corporate tax rate Tax paid Interest paid Long-term debtarrow_forwardThe WACC is used as the discount rate to evaluate various capital budgeting projects. However, it is important to realize that the WACC is an appropriate discount rate only for a project of average risk. Analyze the cost of capital situations of the following company cases, and answer the specific questions that finance professionals need to address. Consider the case of Turnbull Co. Turnbull Co. has a target capital structure of 58% debt, 6% preferred stock, and 36% common equity. It has a before-tax cost of debt of 8.2%, and its cost of preferred stock is 9.3%. If Turnbull can raise all of its equity capital from retained earnings, its cost of common equity will be 12.4%. However, if it is necessary to raise new common equity, it will carry a cost of 14.2%. If its current tax rate is 25%, how much higher will Turnbull’s weighted average cost of capital (WACC) be if it has to raise additional common equity capital by issuing new common stock instead of raising the funds…arrow_forward

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT