During 20X2, Norton Company had the following transactions:

- a. Cash dividends of $20,000 were paid.

- b. Equipment was sold for $9,600. It had an original cost of $36,000 and a book value of $18,000. The loss is included in operating expenses.

- c. Land with a fair market value of $50,000 was acquired by issuing common stock with a par value of $12,000.

- d. One thousand shares of

preferred stock (no par) were sold for $14 per share.

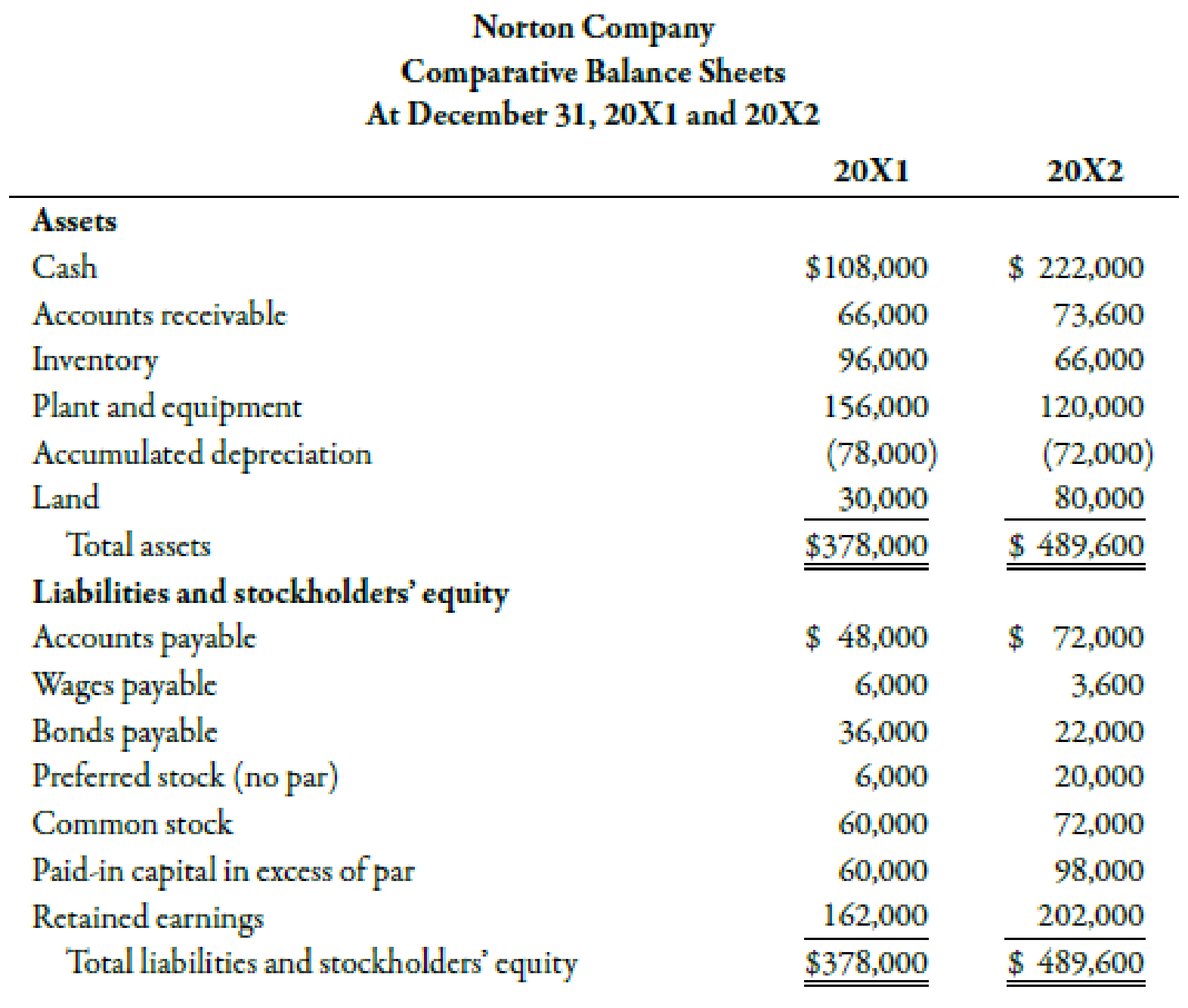

Norton provided the following income statement (for 20X2) and comparative balance sheets:

Required:

Prepare a worksheet for Norton Company.

Construct a worksheet for the N Company.

Explanation of Solution

Worksheet:

The chart prepared in a spreadsheet format as a helping tool in accounting is known as worksheet. With the help of worksheet, a cash flow statement can be prepared with less confusion and complexity.

The worksheet for the N Company is shown in the table below:

| Worksheet: N Company | ||||

| At December 31, 20X2 | ||||

| Transactions | ||||

| Particulars | 20X1 ($) | Debit ($) | Credit ($) | 20X2 ($) |

| Assets: | ||||

| Cash | 108,000 | (1) 114,000 | 222,000 | |

| Accounts receivable | 66,000 | (2) 7,600 | 73,600 | |

| Inventory | 96,000 | (3) 30,000 | 66,000 | |

| Plant and equipment | 156,000 | (4) 36,000 | 120,000 | |

| Accumulated depreciation | (78,000) | (4) 18,000 | (5) 12,000 | (72,000) |

| Land | 30,000 | (6) 50,000 | 80,000 | |

| Total assets | 378,000 | 489,600 | ||

| Liabilities and stockholder’s equity: | ||||

| Accounts payable | 48,000 | (7) 24,000 | 72,000 | |

| Wages payable | 6,000 | (8) 2,400 | 3,600 | |

| Bonds payable | 36,000 | (9) 14,000 | 22,000 | |

| Preferred stock | 6,000 | (10) 14,000 | 20,000 | |

| Common stock | 60,000 | (11) 12,000 | 72,000 | |

| Paid-in capital in excess of par | 60,000 | (11) 38,000 | 98,000 | |

| Retained earnings | 162,000 | (13) 20,000 | (12) 60,000 | 202,000 |

| Total liabilities and stockholder’s equity | 378,000 | 489,600 | ||

Table (1)

The analysis of transactions is as follows:

(1). Change in cash:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| Cash | 114,000 | ||

| Net increase in cash | 114,000 | ||

| (Being the change in cash recorded) |

Table (2)

Increase in accrual cash balance by $114,000 from the beginning to the end of the year is recorded.

(2). Change in accounts receivable:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| Accounts receivable | 7,600 | ||

| Operating cash | 7,600 | ||

| (Being the increase in accounts receivable recorded) |

Table (3)

Increase in accounts receivable by $7,600 is recognized on the income statement but is not collected. This cash inflow should be adjusted in the net income.

(3). Decrease in inventory:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| Operating cash | 30,000 | ||

| Inventory | 30,000 | ||

| (Being the increase in inventory recorded) |

Table (4)

With decrease in inventory by $30,000, the operating cash is increased. The decrease in inventory does not show an outflow of cash.

(4). Sale of equipment:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| Operating cash | 8,400 | ||

| Cash from investing activities | 9,600 | ||

| Accumulated depreciation | 18,000 | ||

| Plant and equipment | 36,000 | ||

| (Being the loss on sale of equipment recorded) |

Table (5)

The operating cash flows are increased by $8,400; so, the loss on sale should be added back to the net income for the adjustment. The cash from investing activities records the value at which the equipment is sold which is $9,600. The accumulated depreciation is debited to record the expense. The plant and equipment account is credited to record the original cost of the equipment.

(5). Accumulated depreciation expense:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| Operating cash | 6,000 | ||

| Accumulated depreciation | 6,000 | ||

| (Being the accumulated depreciation recorded) |

Table (6)

There is net decrease in accumulated depreciation of $6,000

(6). Land for common stock:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| Land | 50,000 | ||

| Noncash investing activities | 50,000 | ||

| (Being fair value of land recorded) |

Table (7)

Land account is debited with the fair value at which land is acquired. The noncash investing activities is credited with the amount to record the cash inflow by investing activities.

(7). Accounts payable:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| Operating cash | 24,000 | ||

| Accounts payable | 24,000 | ||

| (Being the increase in accounts payable recorded) |

Table (8)

The increase in accounts payable by $24,000 shows that all the purchases were not from cash. The increase in accounts payable should be added back to the net income. The increase in liability is recorded, hence it is credited.

(8). Wages payable:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| Wages payable | 2,400 | ||

| Operating cash | 2,400 | ||

| (Being the decrease in wages payable recorded) |

Table (9)

The decrease in accounts payable shows that the cash outflow is more than the wages expense recognized in the year by $2,400. The decrease in liability is recorded, hence wages payable is debited and operating cash is credited.

(9). Bonds payable:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| Bonds payable | 14,000 | ||

| Cash flow from financing activities | 14,000 | ||

| (Being the decrease in bonds payable recorded) |

Table (10)

The decrease in bonds payable by $14,000 shows a cash outflow from financing activities. With the decrease in bonds payable there is a reduction in debt.

(10). Preferred stock:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| Cash flow from financing activities | 14,000 | ||

| Preferred stock | 14,000 | ||

| (Being the issuance of preferred stock recorded) |

Table (11)

The cash flow from financing activities records an inflow with the issuance of preferred stock.

(11). Land for common stock:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| Noncash investing activities | 50,000 | ||

| Common stock | 12,000 | ||

| Paid-in capital in excess of par | 38,000 | ||

| (Being the amount of acquisition of land recorded) |

Table (12)

The noncash investing activity is recorded with the fair value of the land. The amount which is obtained by issuing the common stock is credited and the excess amount is credited in the paid-in capital.

(12). Net income:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| Operating cash | 60,000 | ||

| Retained earnings | 60,000 | ||

| (Being the amount of net income recorded) |

Table (13)

The value of net income is recorded in the section of operating cash flows.

(13). Payment of dividends:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| Retained earnings | 20,000 | ||

| Cash flow from financing activities | 20,000 | ||

| (Being the payment of dividends recorded) |

Table (14)

The amount by which payment of dividends is made is debited from the retained earnings. As payment of dividends is a cash outflow as financing activity, cash flow from financing activity is credited.

The final step is the cash flow statement which is prepared from the worksheet. The worksheet derived statement is shown in the table below:

| N Company | ||

| Statement of Cash Flows | ||

| For the year ended December 31, 20X2 | ||

| Cash flows from operating activities: | ||

| Debit ($) | Credit ($) | |

| Net income | (12) 60,000 | |

| Depreciation expense | (5) 12,000 | |

| Loss on sale of equipment | (4) 8,400 | |

| Decrease in inventory | (3) 30,000 | |

| Increase in accounts payable | (7) 24,000 | |

| Increase in accounts receivable | (2) 7,600 | |

| Decrease in wages payable | (8) 2,400 | |

| Cash flows from investing activities: | ||

| Sale of equipment | (4) 9,600 | |

| Cash flows from financing activities: | ||

| Reduction in bonds payable | (9) 14,000 | |

| Payment of dividends | (13) 20,000 | |

| Issuance of preferred stock | (10) 14,000 | |

| Net increase in cash | (1) 114,000 | |

| Noncash investing and financing activities: | ||

| Land acquired with common stock | (11) 50,000 | (6) 50,000 |

Table (15)

Want to see more full solutions like this?

Chapter 14 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

- The balance sheet data of Minx Company at the end of 20x7 and 20x6 follow: Land was acquired for $100,000 in exchange for ordinary shares, par $100,000, during the year; all equipment purchased was for cash. Equipment costing $10,000 was sold for $4,000; book value of the equipment was $8,000 and the loss was reported in net income. Cash dividends of $20,000 were charged to retained earnings and paid during the year; the transfer of net income to retained earnings was the only other entry in the Retained Earnings account. In the statement of cash flows for the year ended December 31, 20x7, for Minx Company: a The net cash provided by operating activities was $ Answer b The net cash provided (used) by investing activities was $ Answer c The net cash provided (used) by financing activities was $ Answerarrow_forwardOn January 1, Vienna Corporation purchased 40% of the outstanding common stock of the Marietta Corporation for $137,500. During the year, Marietta Corporation reported net income of $50,000 and paid cash dividends of $25,000.The balance of the Investment in the Marietta Corporation account on the books of Vienna Corporation at year-end is: Select one: A. $147,500 B. $135,000 C. $100,000 D. $110,000arrow_forwardFor each of the following separate transactions: Sold a building costing $37,000, with $22,800 of accumulated depreciation, for $10,800 cash, resulting in a $3,400 loss. Acquired machinery worth $12,800 by issuing $12,800 in notes payable. Issued 1,280 shares of common stock at par for $2 per share. Note payables with a carrying value of $41,400 were retired for $49,800 cash, resulting in a $8,400 loss. (a) Prepare the reconstructed journal entry.(b) Identify the effect it has, if any, on the investing section or financing section of the statement of cash flows.arrow_forward

- Rogrer Company received a machine with a fair value of $130,000 and a building with a fair value of $200,000 in exchange for 6,000 shares of $45 par value common stock and $50,000 cash. The entry to record this transaction would include: Select one: a. Credit to Common Stock for $280,000 b. Credit to Additional Paid in Capital for $10,000 c. Credit to Retained earnings for $10,000 d. Credit to Additional Paid in Capital for $280,000arrow_forwardJackson Moving & Storage Co. paid $120,000 for 25% of the common stock ofMcDonough Co. at the beginning of the year. During the year, McDonough earned netincome of $50,000 and paid dividends of $20,000. The carrying value of Jackson’s investment in McDonough at the end of the year isa. $150,000.b. $170,000.c. $120,000.d. $127,500.arrow_forwardDuring 20X1, Blue Corporation sold products for $3,000,000 with the sales returns and allowances of $80,000. The company incurred selling expenses for $150,000 and administrative expenses for $400,000. During the year, the company purchased 20,000 common shares of Francis Corporation at $11 per share and recorded the FV-NI investments, and purchased 15,000 shares of Davis Corporation at $10 per share and recorded the FV-OCI investments. On December 31, 20X1, the share prices of Francis Corporation and Davis Corporation were $7 per share and $12 per share, respectively. The company recognized interest income for $78,000. The beginning-of-year balance of inventory was $760,000 and the end-of-year balance of inventory was $890,000. During the year, the company purchased inventory for $2,000,000. On September 1, 20X1, the company discontinued operation of a division that had an income of $200,000 for its operation in 20X1. The discontinued division had the carrying value of net…arrow_forward

- Presented below is information related to Cullumber Company.1. On July 6, Cullumber Company acquired the plant assets of Doonesbury Company, which had discontinued operations. The appraised value of the property is: Land $200,000 Buildings 600,000 Equipment 400,000 Total $1,200,000 Cullumber Company gave 12,000 shares of its $100 par value common stock in exchange. The stock had a market price of $168 per share on the date of the purchase of the property.2. Cullumber Company expended the following amounts in cash between July 6 and December 15, the date when it first occupied the building. (Prepare consolidated entry for all transactions below.) Repairs to building $168,000 Construction of bases for equipment to be installed later 216,000 Driveways and parking lots 195,200 Remodeling of office space in building, including new partitions and walls 257,600 Special assessment by city on land 28,800 3. On December 20, the company paid cash…arrow_forwarda. On January 1, Yourkie Company acquired 30% of the outstanding stock of Harris Company for $300,000. DATE Debit Credit X/X b. For the year ended December 31, Harris Company earned income of $50,000. DATE Debit Credit X/X c. For the year ended December 31, Harris Company paid dividends of $8,000. DATE Debit Credit X/X d. On January 8th of the next year, Yorkshire Company sold the Harris Company stock for $301,000. DATE Debit Credit X/Xarrow_forwarda. On January 1, Yourkie Company acquired 30% of the outstanding stock of Harris Company for $300,000. DATE Debit Credit X/X b. For the year ended December 31, Harris Company earned income of $50,000. DATE Debit Credit X/X c. For the year ended December 31, Harris Company paid dividends of $8,000. DATE Debit Credit X/X d. On January 8th of the next year, Yorkshire Company sold the Harris Company stock for $301,000. DATE Debit Credit X/X i have a-c PLEASE ONLY HELP ON PART Darrow_forward

- During 20X1, Blue Corporation sold products for $2,500,000 (gross amount) with the sales returns and allowances of $50,000. The company incurred selling expenses for $120,000 and administrative expenses for $330,000. During the year, the company purchased 23,000 common shares of Francis Corporation at $8 per share and recorded the FV-NI investments, and purchased 18,000 shares of Davis Corporation at $12 per share and recorded the FV-OCI investments. On December 31, 20X1, the share prices of Francis Corporation and Davis Corporation were $11 per share and $10 per share, respectively. The company recognized interest expense for $62,000. The beginning-of-year balance of inventory was $640,000 and the end-of-year balance of inventory was $590,000. During the year, the company purchased inventory for $1,600,000. On September 1, 20X1, the company discontinued operation of a division that had a loss of $150,000 for its operation in 20X1. The discontinued division had the carrying value…arrow_forwardDigman Co. had retained earnings of $400,000 and $50,000 in cash.on January 15t. It made a net income of $300,000 in the year. The amortization expense was $250,000. Digman Co. issued additional common shares for $500,000 and borrowed $600,000 from the Bank of Toyland. Cash from financing activities was: Select one: $1,100,000 none of the above $ 600,000 $ 900,000 $ 500,000arrow_forwardHow to record the following transactions? 13. (!)Company repurchased from the market 20 of own shares at nominal value of 10 and purchase price of 4. All share were paid for in full cash. 14. Last year company issue 100 shares at a nominal price of $6 / share and issue price $7 / share with an emission expense $150. 15. The company received a return of the goods from client – value of goods 2 000. 16. Last year the company set up a warranty provision of 20 000. One of the clients asked for a repair of the products purchased which cost 2 800. Company used the warranty provision to settle the cost. 17.The company Alfa incurred R&D. Company stated that the research costs are equal 2 000 and second stage (development cost) of the project is not finished but usefulness of it is almost 3 000.18.Company obtained a grant from a government of 2 000 to conduct R&D activities over the next year.The company Alfa incurred R&D. Company stated that the second stage of the project…arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning