a)1

Determine the total materials cost variance, price and usage variance, the cause of variance and responsible management position.

a)1

Explanation of Solution

Compute the total variance:

Hence, the total variances are $336,200 which is an unfavorable variance.

Compute the total materials price variance:

Hence, the total materials price variances are $172,200 which is an unfavorable variance.

Compute the total materials usage variance:

Hence, the total materials usage variances are $164,000 which is unfavorable variance.

K Company paid more than the budgeted for planks of wood.

The purchasing agent is responsible for the price variance. The variances are occurred because of factors like lumber shortage, and inflation.

K Company used more materials than planned which leads to unfavorable usage variance.

The production supervisor is the responsible party. The variances are occurred because of factors like lack of physically control over inventory and lack of motivation to workers.

2)

Determine the labor cost, price, and usage variance and the cause of variance and responsible management position.

2)

Explanation of Solution

Compute the total labor cost variance:

Hence, the labor variance is $49,200 which is an unfavorable variance.

Compute the labor price variance:

Hence, the labor price variance is $118,900 which is an unfavorable variance.

Compute the labor usage variance:

Hence, the labor usage variance is $69,700 which is a favorable variance.

K Company paid more than the budgeted.

The personnel manager and production supervisors are responsible for the variance. The variances are occurred because of factors like the minimum wages could have been raised by the government.

K Company used less labor than planned which leads to favorable usage variance.

The production supervisor or personal managers are the responsible party. These people motivate the employees and hired more competent people.

3)

Determine the fixed cost spending and variance and the cause of variance and refer whether the actual fixed cost per unit is lower or higher than the budgeted fixed cost per unit.

3)

Explanation of Solution

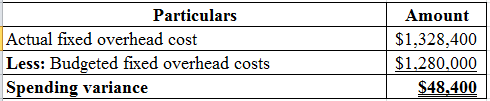

Compute the fixed cost spending variance:

Table (1)

Hence, the spending variance is $48,400 which is unfavorable variance.

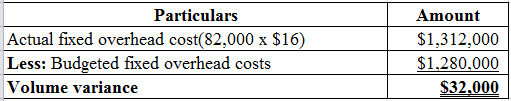

Compute the fixed cost volume variance:

Table (2)

Hence, the volume variance is $32,000 which is favorable variance.

Working note:

Calculate the the predetermined

Hence, the predetermined overhead rate is $16 per table.

The Company K has paid more than the planned with respect to fixed cost. The plant manager is responsible for the rent on manufacturing equipment. The personnel manager is responsible for the salaries paid to the company supervisor.

More units were produced and sold which leads to favorable volume variance. This reduces the fixed cost per unit.

b)

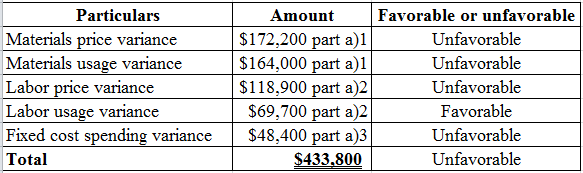

Indicate that the total of material, labor, and overheads variance are equal to the total flexible

b)

Explanation of Solution

Note:

Refer the above part for the calculated values.

Table (3)

c)

Discuss the reaction of Person D reacts to the variance information

c)

Explanation of Solution

Discuss the reaction of Person D reacts to the variance information:

Person D should make an impartible and fair investigation on the responsible parties and causes.

Monitoring the performance is sufficient for the improvement and in the circumstances of intentional disregard and consistent incompetence the disciplinary actions can be taken.

Want to see more full solutions like this?

Chapter 15 Solutions

Survey Of Accounting

- Sitka Industries uses a cost system that carries direct materials inventory at a standard cost. The controller has established these standards for one ladder (unit): Sitka Industries made 3,000 ladders in July and used 8,800 pounds of material to make these units. Smith Industries bought 15,500 pounds of material in the current period. There was a $250 unfavorable direct materials price variance. A. How much in total did Sitka pay for the 15,500 pounds? B. What is the direct materials quantity variance? C. What is the total direct material cost variance? D. What ii 9,500 pounds were used to make these ladders, what would be the direct materials quantity variance? E. It there was a $340 favorable direct materials price variance, how much did Sitka pay for the 15,500 pounds of material?arrow_forwardComputing materials variances D-List Calendar Co. specializes in manufacturing calendars that depict obscure comedians. The company uses a standard cost system to control its costs. During one month of operations, the direct materials costs and the quantities of paper used showed the following: Calculate the following: 1. Total cost of purchases for the month 2. Materials purchase price variance 3. Materials quantity variance 4. Net materials variancearrow_forwardRefer to the data in Exercise 9.15. Required: 1. Compute overhead variances using a two-variance analysis. 2. Compute overhead variances using a three-variance analysis. 3. Illustrate how the two- and three-variance analyses are related to the four-variance analysis. Oerstman, Inc., uses a standard costing system and develops its overhead rates from the current annual budget. The budget is based on an expected annual output of 120,000 units requiring 480,000 direct labor hours. (Practical capacity is 500,000 hours.) Annual budgeted overhead costs total 787,200, of which 556,800 is fixed overhead. A total of 119,400 units using 478,000 direct labor hours were produced during the year. Actual variable overhead costs for the year were 230,600, and actual fixed overhead costs were 556,250. Required: 1. Compute the fixed overhead spending and volume variances. How would you interpret the spending variance? Discuss the possible interpretations of the volume variance. Which is most appropriate for this example? 2. Compute the variable overhead spending and efficiency variances. How is the variable overhead spending variance like the price variances of direct labor and direct materials? How is it different? How is the variable overhead efficiency variance related to the direct labor efficiency variance?arrow_forward

- During its first year of operations, Snobegon, Inc. (located in Lake Snobegon, Minnesota), produced 40,000 plastic snow scoops. Snow scoops are oversized shovel-type scoops that are used to push snow away. Unit sales were 38,200 scoops. Fixed overhead was applied at 0.75 per unit produced. Fixed overhead was underapplied by 2,900. This fixed overhead variance was closed to Cost of Goods Sold. There was no variable overhead variance. The results of the years operations are as follows (on an absorption-costing basis): Required: 1. Calculate the cost of the firms ending inventory under absorption costing. What is the cost of the ending inventory under variable costing? (Round unit costs to five significant digits.) 2. Prepare a variable-costing income statement. Reconcile the difference between the two income figures.arrow_forwardRefer to Exercise 8.27. At the end of the year, Meliore, Inc., actually produced 310,000 units of the standard model and 115,000 of the deluxe model. The actual overhead costs incurred were: Required: Prepare a performance report for the period. In an attempt to improve budgeting, the controller for Meliore, Inc., has developed a flexible budget for overhead costs. Meliore, Inc., makes two types of products, the standard model and the deluxe model. Meliore expects to produce 300,000 units of the standard model and 120,000 units of the deluxe model during the coming year. The standard model requires 0.05 direct labor hour per unit, and the deluxe model requires 0.08. The controller has developed the following cost formulas for each of the four overhead items: Required: 1. Prepare an overhead budget for the expected activity level for the coming year. 2. Prepare an overhead budget that reflects production that is 10 percent higher than expected (for both products) and a budget for production that is 20 percent lower than expected.arrow_forwardCalculating factory overhead: two variances Munoz Manufacturing Co. normally produces 10,000 units of product X each month. Each unit requires 2 hours of direct labor, and factory overhead is applied on a direct labor hour basis. Fixed costs and variable costs in factory overhead at the normal capacity are 2.50 and 1.50 per direct labor hour, respectively. Cost and production data for May follow: a. Calculate the flexible-budget variance. b. Calculate the production-volume variance. c. Was the total factory overhead under- or overapplied? By what amount?arrow_forward

- Direct materials and direct labor variance analysis Lenni Clothing Co. manufactures clothing in a small manufacturing facility. Manufacturing has 25 employees. Each employee presently provides 40 hours of productive labor per week. Information about a production week is as follows: Instructions Determine (A) the standard cost per unit for direct materials and direct labor; (B) the price variance, quantity variance, and total direct materials cost variance; and (C) the rate variance, time variance, and total direct labor cost variance.arrow_forwardFactory overhead cost variance report Feeling Better Medical Inc., a manufacturer of disposable medical supplies, prepared the following factory overhead cost budget for the Assembly Department for October of the current year. The company expected to operate the department at 100% of normal capacity of 30,000 hours. During October, the department operated at 28,500 hours, and the factory overhead costs incurred were indirect factory wages, 234,000; power and light, 178,500; indirect materials, 50,600; supervisory salaries, 126,000; depreciation of plant and equipment, 70,000; and insurance and property taxes, 44,000. Instructions Prepare a factory overhead cost variance report for October. To be useful for cost control, the budgeted amounts should be based on 28,500 hours.arrow_forwardRefer to Cornerstone Exercise 8.13. In March, Nashler Company produced 163,200 units and had the following actual costs: Required: 1. Prepare a performance report for Nashler Company comparing actual costs with the flexible budget for actual units produced. 2. What if Nashler Companys actual direct materials cost were 1,175,040? How would that affect the variance for direct materials? The total cost variance?arrow_forward

- Use the following standard cost card for 1 gallon of ice cream to answer the questions. Actual direct costs incurred to make 50 gallons of ice cream: 275 quarts of cream at $1.05 per quart 832 ounces of sugar at $0.075 per ounce 165 minutes of labor at $37 per hour All materials used were bought during the current period. A. Compute the material and labor variances. B. comment on the results and possible causes of the variances.arrow_forwardUse the following standard cost card for 1 gallon of ice cream to answer the questions. Actual direct costs incurred to make 50 gallons of ice cream: 275 quarts of cream at $1.05 per quart 832 ounces of sugar at $0.075 per ounce 165 minutes of labor at $37 per hour All material used was bought during the current period. A. Compute the material and labor variances. B. Comment on the results and possible causes of the variances.arrow_forwardDirect labor time variance Maywood City Police uses variance analysis to monitor police staffing. The following table identifies three common police activities, the standard time to perform each activity, and their actual frequency to establish the expected cost to serve these activities. Police Activity Standard Hours per Activity Actual Activities for Year Total Employee Hours Theft 0.60 7,000 4,200 Arrest 1.50 18,000 27,000 Patrol activities 0.30 9,000 2,700 33,900 The police are paid 25 per hour. The actual amount of hours per activity for the year were as follows: Police Activity Actual Hours per Activity Theft 0.75 Arrest 2.00 Patrol activities 0.40 A. Determine the total budgeted cost to perform the three police activities. B. Determine the total actual cost to perform the three police activities. C. Determine the direct labor time variance. D. What does the time variance suggest?arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College