Financial And Managerial Accounting

15th Edition

ISBN: 9781337902663

Author: WARREN, Carl S.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 16, Problem 4MAD

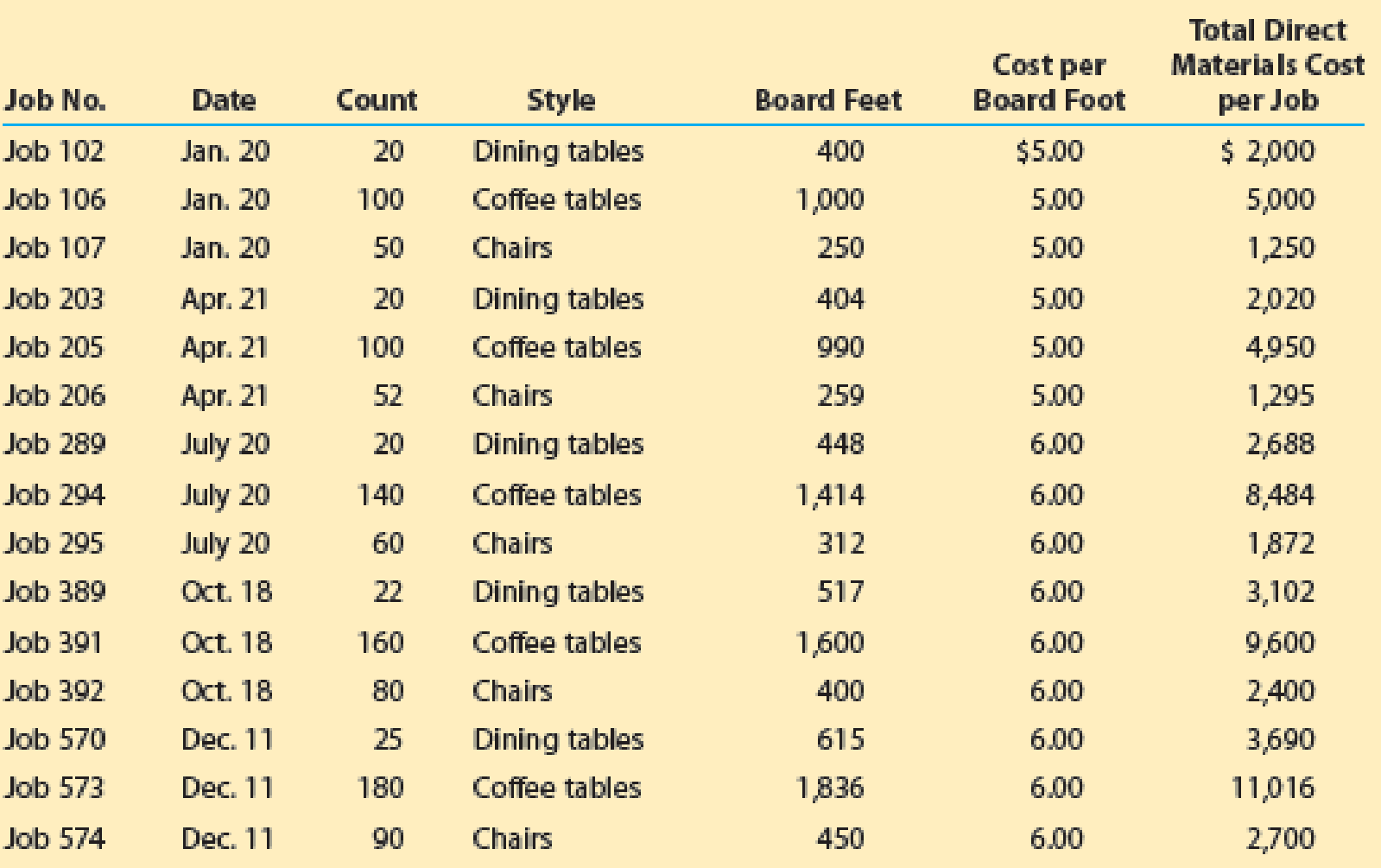

Brady Furniture Company manufactures wooden oak furniture. The company employs a

Dining tables are the most difficult furniture item in Brady’s catalog to manufacture. Thus, the most skilled employees are scheduled to make dining tables, unless they are required for other jobs.

- a. Determine the material cost per unit for each job.

- b. Use the January material cost per unit for each type of furniture as the base material cost. For each month and each type of furniture, determine the unit material cost as a percent of the base unit material cost. Round percent to one decimal place. Use the following table format:

- c. Develop a line chart of the percent of unit material cost to the base unit material cost. Place the months on the horizontal axis and use three lines for the three different types of furniture.

- d.

Interpret the chart. What is happening to the dining tables?

Interpret the chart. What is happening to the dining tables?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

How can I get this problem resolve?

High Desert Potteryworks makes a variety of pottery products that it sells to retailers. The company uses a job-order costing system in which departmental predetermined overhead rates are used to apply manufacturing overhead cost to jobs. The predetermined overhead rate in the Molding Department is based on machine-hours, and the rate in the Painting Department is based on direct labor-hours. At the beginning of the year, the company provided the following estimates:

Department

Molding

Painting

Direct labor-hours

36,500

59,800

Machine-hours

87,000

34,000

Fixed manufacturing overhead cost

$

208,800

$

532,220

Variable manufacturing overhead per machine-hour

$

3.20

-

Variable manufacturing overhead per direct labor-hour

-

$

5.20

Job 205 was started on August 1 and completed on August 10. The company's cost records show the following information concerning the job:

Department…

Wheeler's Bike Company manufactures custom racing bicycles. The company uses a job order cost system to determine the cost of

each bike. Estimated costs and expenses for the coming year follow:

Bike parts

Factory machinery depreciation

Factory supervisor salaries

Factory direct labor

Factory supplies

Factory property tax

Advertising cost

Administrative salaries

Administrative-related depreciation

Total expected costs

Required:

1. Calculate the predetermined overhead rate per direct labor hour if the average direct labor rate is $11.91 per hour.

2. Determine the amount of applied overhead if 18,600 actual hours are worked in the upcoming year.

Required 1 Required 2

Complete this question by entering your answers in the tabs below.

$ 341,800

61,500

140,000

211,998

Predetermined Overhead Rate

39,400

33,750

22,500

55,000

19, 200

$925,148

Calculate the predetermined overhead rate per direct labor hour if the average direct labor rate is $11.91 per hour.

Note: Round your answer to 2 decimal…

Speedy Auto Repairs uses job-order costing. Its direct materials consist of replacement parts installed in customer vehicles, and its

direct labor consists of the mechanics' hourly wages. Speedy's overhead costs include various items, such as the shop manager's

salary, depreciation of equipment, utilities, insurance, and magazine subscriptions and refreshments for the waiting room.

The company applies all of its overhead costs to jobs based on direct labor-hours. At the beginning of the year, it made the following

estimates:

Direct labor-hours required to support estimated output

Fixed overhead cost

Variable overhead cost per direct labor-hour

Required:

1. Compute the predetermined overhead rate.

2. During the year, Mr. Wilkes brought in his vehicle to replace his brakes, spark plugs, and tires. The following information pertains to

his job:

Direct materials

Direct labor cost

Direct labor-hours used

36,000

$ 540,000

$ 1.00

$ 685

$ 153

7

Compute Mr. Wilkes' total job cost.

3. If Speedy…

Chapter 16 Solutions

Financial And Managerial Accounting

Ch. 16 - A. Name two principal types of cost accounting...Ch. 16 - What kind of firm would use a job order cost...Ch. 16 - Prob. 3DQCh. 16 - Prob. 4DQCh. 16 - What is a job cost sheet?Ch. 16 - Prob. 6DQCh. 16 - Discuss how the predetermined factory overhead...Ch. 16 - A. How is a predetermined factory overhead rate...Ch. 16 - A. What is (1) overapplied factory overhead and...Ch. 16 - Describe how a job order cost system can be used...

Ch. 16 - Issuance of materials On May 7, Bergan Company...Ch. 16 - Direct labor costs During May, Bergan Company...Ch. 16 - Factory overhead costs During May, Bergan Company...Ch. 16 - Applying factory overhead Bergan Company estimates...Ch. 16 - Job costs At the end of May, Bergan Company had...Ch. 16 - Cost of goods sold Pine Creek Company completed...Ch. 16 - Transactions in a job order cost system Five...Ch. 16 - The following information is available for the...Ch. 16 - Cost of materials issuances under the FIFO method...Ch. 16 - Prob. 4ECh. 16 - Kingsford Furnishings Company manufactures...Ch. 16 - A summary of the time tickets is as follows:...Ch. 16 - Entry for factory labor costs The weekly time...Ch. 16 - Schumacher Industries Inc. manufactures...Ch. 16 - Eclipse Solar Company operates two factories. The...Ch. 16 - Exotic Engine Shop uses a job order cost system to...Ch. 16 - Predetermined factory overhead rate Obj. 2...Ch. 16 - The following account appears in the ledger prior...Ch. 16 - Collegiate Publishing Inc. began printing...Ch. 16 - The following events took place for Rushmore...Ch. 16 - Job order cost accounting for a service company...Ch. 16 - Job order cost accounting for a service company...Ch. 16 - Barnes Company uses a job order cost system. The...Ch. 16 - Entries and schedules for unfinished jobs and...Ch. 16 - Job cost sheet Remnant Carpet Company sells and...Ch. 16 - Analyzing manufacturing cost accounts Fire Rock...Ch. 16 - Prob. 5PACh. 16 - Entries for costs in a job order cost system Royal...Ch. 16 - Entries and schedules for unfinished jobs and...Ch. 16 - Job cost sheet Stretch and Trim Carpet Company...Ch. 16 - Analyzing manufacturing cost accounts Clapton...Ch. 16 - Prob. 5PBCh. 16 - Antolini Enterprises produces mens sports coats...Ch. 16 - Alvarez Manufacturing Inc. is a job shop. The...Ch. 16 - Raneri Trophies Inc. uses a job order cost system...Ch. 16 - Brady Furniture Company manufactures wooden oak...Ch. 16 - Ethics in Action TAC Industries Inc. sells heavy...Ch. 16 - Team Activity As an assistant cost accountant for...Ch. 16 - Prob. 3TIFCh. 16 - RIRA Company makes attachments such as backhoes...Ch. 16 - Todd Lay just began working as a cost accountant...Ch. 16 - Baldwin Printing Company uses a job order cost...Ch. 16 - John Sheng, a cost accountant at Starlet Company,...Ch. 16 - Lucy Sportswear manufactures a specialty line of...Ch. 16 - Patterson Corporation expects to incur 70,000 of...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Antolini Enterprises produces mens sports coats that are sold by popular department stores. Each retail order is treated as a job that accumulates materials, labor, and overhead costs for a batch of sports coats. Management has obtained data on the labor costs for four selected jobs over a six-month period. Each selected job represents a similar style and size of sports coat. The data are as follows: a. Determine the direct labor cost per unit for each job. b. Interpret the trend in per-unit labor cost. c. Determine the direct labor hours per sports coat. d. Interpret what may be happening with Job 192.arrow_forwardGeneva, Inc., makes two products, X and Y, that require allocation of indirect manufacturing costs. The following data were compiled by the accountants before making any allocations: The total cost of purchasing and receiving parts used in manufacturing is 60,000. The company uses a job-costing system with a single indirect cost rate. Under this system, allocated costs were 48,000 and 12,000 for X and Y, respectively. If an activity-based system is used, what would be the allocated costs for each product?arrow_forwardSan Mateo Optics, Inc., specializes in manufacturing lenses for large telescopes and cameras used in space exploration. As the specifications for the lenses are determined by the customer and vary considerably, the company uses a job-order costing system. Manufacturing overhead is applied to jobs on the basis of direct labor hours, utilizing the absorption- or full-costing method. San Mateos predetermined overhead rates for 20x1 and 20x2 were based on the following estimates. Jim Cimino, San Mateos controller, would like to use variable (direct) costing for internal reporting purposes as he believes statements prepared using variable costing are more appropriate for making product decisions. In order to explain the benefits of variable costing to the other members of San Mateos management team, Cimino plans to convert the companys income statement from absorption costing to variable costing. He has gathered the following information for this purpose, along with a copy of San Mateos 20x1 and 20x2 comparative income statement. San Mateo Optics, Inc. Comparative Income Statement For the Years 20x1 and 20x2 San Mateos actual manufacturing data for the two years are as follows: The companys actual inventory balances were as follows: For both years, all administrative expenses were fixed, while a portion of the selling expenses resulting from an 8 percent commission on net sales was variable. San Mateo reports any over-or underapplied overhead as an adjustment to the cost of goods sold. Required: 1. For the year ended December 31, 20x2, prepare the revised income statement for San Mateo Optics, Inc., utilizing the variable-costing method. Be sure to include the contribution margin on the revised income statement. 2. Describe two advantages of using variable costing rather than absorption costing. (CMA adapted)arrow_forward

- Ventana Window and Wall Treatments Company provides draperies, shades, and various window treatments. Ventana works with the customer to design the appropriate window treatment, places the order, and installs the finished product. Direct materials and direct labor costs are easy to trace to the jobs. Ventanas income statement for last year is as follows: Ventana wants to find a markup on cost of goods sold that will allow them to earn about the same amount of profit on each job as was earned last year. Required: 1. What is the markup on cost of goods sold (COGS) that will maintain the same profit as last year? (Round the percentage to two significant digits.) 2. A customer orders draperies and shades for a remodeling job. The job will have the following costs: What is the price that Ventana will quote given the markup percentage calculated in Requirement 1? (Round the price to the nearest dollar.) 3. What if Ventana wants to calculate a markup on direct materials cost, since it is the largest cost of doing business? What is the markup on direct materials cost that will maintain the same profit as last year? (Round the percentage to two significant digits.) What is the bid price Ventana will use for the job given in Requirement 2 if the markup percentage is calculated on the basis of direct materials cost? (Round to the nearest dollar.)arrow_forwardNutts management is very concerned about the cost of overhead on its jobs. When jobs are complete, overhead costs should be between 15% and 20% of total costs. For example, the labor cost on Job 8958 is 25% of total costs, higher than the norm. Open Job 8961 and click the Chart sheet tab. A pie chart appears showing the cost components on that job. Record the labor cost percentage in the space provided. Repeat this for each of the jobs worked on in August. Did Nutt maintain good cost control on all its jobs? Explain. Worksheet. During September, Job 8963 required two additional material requisitions to complete the job. Open JOB8963 and modify the job cost sheet to include an area for four direct material requisition entries instead of three. Then enter the following two materials requisitions onto the worksheet: Preview the printout to make sure it will print neatly on one page, and then print the worksheet. Save the completed worksheet as JOBT. Chart. Open JOB8964 and click the Chart sheet tab. Prepare a bar chart for JOB8964 showing the amount of material, labor, and overhead required to complete the job. Use the Chart Data Table found in rows 4246 as a basis for preparing the chart. Enter your name somewhere on the chart. Save the file again as J0B8964. Print the chart.arrow_forwardRIRA Company makes attachments such as backhoes and grader and bulldozer blades for construction equipment. The company uses a job order cost system. Management is concerned about cost performance and evaluates the job cost sheets to learn more about the cost effectiveness of the operations. To facilitate a comparison, the job cost sheets for Job 206 (for 50 backhoe buckets completed in October) and Job 228 (for 75 backhoe buckets completed in December) were pulled and presented as follows: Management is concerned about the increase in unit costs over the months from October to December. To understand what has occurred, management interviewed the purchasing manager and quality manager. Purchasing Manager: Prices have been holding steady for our raw materials during the first half of the year. I found a new supplier for our bulk steel that was willing to offer a better price than we received in the past. I saw these lower steel prices and jumped on them, knowing that a reduction in steel prices would have a very favorable impact on our costs. Quality Manager: Something happened around mid-year. All of a sudden, we were experiencing problems with respect to the quality of our steel. As a result, weve been having all sorts of problems on the shop floor in our foundry and welding operation. a. Analyze the two job cost sheets and identify why the unit costs have changed for the backhoe buckets. Complete the following schedule to help in your analysis: b. How would you interpret what has happened in light of your analysis and the interviews?arrow_forward

- Peter co makes shirts that it sells to retailers. The company uses a job order costing system in which predetermined overhead rates are used to apply factory overhead cost to jobs. The predetermined rate in the sewing department is based on machine hours and in cutting department is based on direct labor cost. The following estimates are made at the beginning of the year: (see picture) 1. What would be the total cost of JOB 101?arrow_forwardMake a Decision: Analyze Antolini Enterprises' Job Costs Antolini Enterprises produces men's sports coats that are sold by popular department stores. Each retail order is treated as a job that accumulates materials, labor, and overhead costs for a batch of sports coats. Management has obtained data on the labor costs for four selected jobs over a six-month period. Each selected job represents a similar style and size of sports coat. The data are as follows: Count Direct Labor Hours Direct Labor Rate per Hour Total DirectLabor Cost Job 107 11 5.06 $15.00 70.40 Job 125 15 7.65 15.00 108.00 Job 160 17 9.52 15.00 132.60 Job 192 9 3.69 18.00 58.50 a. Determine the direct labor cost per unit for each job. b. Interpret the trend in per-unit labor cost. c. Determine the direct labor hours per sports coat. d. Interpret what may be happening with Job 192. Be sure to show your work.arrow_forwardPristine Painting Services uses a job order cost system to collect the costs of its home painting business. Each customer’s house is treated as a separate job. Overhead is applied to each job based on the number of painting hours required for each house. Listed below are the data for the current year: Estimated overhead $780,000 Actual overhead $772,450 Estimated painting hours 39,000 Actual painting hours 38,750 The company uses Operating Overhead in place of Manufacturing Overhead. Instructions (a) Compute the predetermined overhead rate. (b) Prepare the entry to apply the overhead for the year. (c) Determine whether the overhead was under- or overapplied and by how much. (d) If estimated overhead increases to $799,500, discuss how this…arrow_forward

- Waterway Guitar Company makes high-quality customized guitars. Waterway uses a job order costing system. Because the guitars are handmade, the company applies overhead based on direct labor hours. At the beginning of the year, the company estimated that total manufacturing overhead costs would be $307,500 and that 20,500 direct labor hours would be worked. At year-end, Daniel, the company’s founder and CEO, gives you the following information regarding Waterway’s operations. 1. The beginning balances in the inventory accounts were: Raw Materials Inventory $7,900 Work in Process Inventory $26,000 Finished Goods Inventory $31,500 2. During the year, the company purchased raw materials costing $102,000. All purchases were made on account. 3. The production department requisitioned $98,000 of raw materials for use in production. Of those, 70% were direct materials and 30% were indirect materials. 4. The company used 21,500 direct labor hours at a cost…arrow_forwardCan someone help me with this question? I keep getting the answers wrong. High Desert Potteryworks makes a variety of pottery products that it sells to retailers. The company uses a job-order costing system in which departmental predetermined overhead rates are used to apply manufacturing overhead cost to jobs. The predetermined overhead rate in the Molding Department is based on machine-hours, and the rate in the Painting Department is based on direct labor-hours. At the beginning of the year, the company provided the following estimates: Department Molding Painting Direct labor-hours 37,000 52,900 Machine-hours 88,000 40,000 Fixed manufacturing overhead cost $ 228,800 $ 529,000 Variable manufacturing overhead per machine-hour $ 2.20 - Variable manufacturing overhead per direct labor-hour - $ 4.20 Job 205 was started on August 1 and completed on August 10. The company's cost records show the following information…arrow_forwardHigh Desert Potteryworks makes a variety of pottery products that it sells to retailers such as Home Depot. The company uses a job-order costing system in which predetermined overhead rates are used to apply manufacturing overhead cost to jobs. The predetermined overhead rate in the Molding Department is based on machine-hours, and the rate in the Painting Department is based on direct labor-hours. At the beginning of the year, the company's management made the following estimates: Department Molding Painting Direct labor-hours 39,500 51,200 Machine-hours 87,000 33,000 Direct materials cost $186,000 $196,000 Direct labor cost $277,000 $513,000 Fixed manufacturing overhead cost $243,600 $465,920 Variable manufacturing overhead per machine-hour $2.60 - Variable manufacturing overhead per direct labor-hour - $4.60 Job 205 was started on August 1 and completed on August 10.…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY