Concept explainers

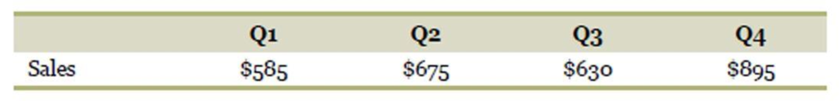

Calculating Cash Collections. The Jallouk Company has projected the following quarterly sales amounts for the coming year:

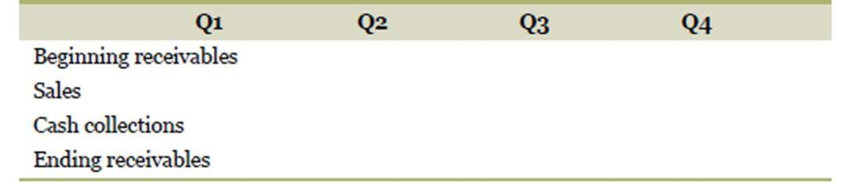

a. Accounts receivable at the beginning of the year are $330. The company has a 45-day collection period. Calculate cash collections in each of the four quarters by completing the following:

b. Rework part (a) assuming a collection period of 60 days.

c. Rework part (a) assuming a collection period of 30 days.

a)

To determine: The cash collection for each four quarters, when the collection period is 45days.

Introduction:

Cash collection is the amount collected through business. It is a task of accounts receivables.

Answer to Problem 5QP

Q1-$623

Q2-$630

Q3-$653

Q4-$763

Explanation of Solution

Given information:

Accounts receivable at the beginning of the year is $345, and the collection period is 45 days.

Compute the cash collection for each four quarters:

Note: All the receivables, which are outstanding, will be collected in the current year.

Compute the ending receivables for quarter 1:

Therefore, the ending receivable will be half of the current year sales.

Hence, the ending receivables are $293.

Compute the cash collection for quarter 1:

Hence, the cash collected for the quarter 1 is $623.

Compute the ending receivables for quarter 2:

Hence, the ending receivables are $338.

Compute the cash collection for quarter 2:

Hence, the cash collected for the quarter 2 is $630.

Compute the ending receivables for quarter 3:

Hence, the ending receivables are $315.

Compute the cash collection for quarter 3:

Hence, the cash collected for the quarter 1 is $653.

Compute the ending receivables for quarter 4:

Hence, the ending receivables are $448.

Compute the cash collection for quarter 4:

Hence, the cash collected for the quarter 1 is $763.

b)

To determine: The cash collection for each four quarters, when the collection period is 60 days.

Introduction:

Cash collection is the amount collected through business. It is a task of accounts receivables.

Average cash collection period is the number of days taken to collect the cash from the customers.

Answer to Problem 5QP

Q1-$720

Q2-$645

Q3-$645

Q4-$807

Explanation of Solution

Given information:

Accounts receivables at the beginning of the year are $345 and the collection period is 60 days.

Compute the cash collection for each four quarters:

Note: All the receivables, which are outstanding, will be collected in the current year.

Compute the ending receivables for quarter 1:

Therefore, the ending receivable will be half of the current year sales.

Hence, the ending receivables are $195.

Compute the cash collection for quarter 1:

Hence, the cash collected for the quarter 1 is $720.

Compute the ending receivables for quarter 2:

Hence, the ending receivables are $225.

Compute the cash collection for quarter 2:

Hence, the cash collected for the quarter 2 is $645.

Compute the ending receivables for quarter 3:

Hence, the ending receivables are $210.

Compute the cash collection for quarter 3:

Hence, the cash collected for the quarter 1 is $645.

Compute the ending receivables for quarter 4:

Hence, the ending receivables are $298.

Compute the cash collection for quarter 4:

Hence, the cash collected for the quarter 1 is $807.

c)

To determine: The cash collection for each four quarters, when the collection period is 30 days.

Introduction:

Cash collection is the amount collected through business. It is a task of accounts receivables.

Average cash collection period is the number of days taken to collect the cash from the customers.

Answer to Problem 5QP

Q1-$525

Q2-$615

Q3-$660

Q4-$718

Explanation of Solution

Given information:

Accounts receivable at the beginning of the year is $345, and the collection period is 30 days.

Compute the cash collection for each four quarters:

Note: All the receivables, which are outstanding, will be collected in the current year.

Compute the ending receivables for quarter 1:

Therefore, the ending receivable will be half of the current year sales.

Hence, the ending receivables are $390.

Compute the cash collection for quarter 1:

Hence, the cash collected for the quarter 1 is $525.

Compute the ending receivables for quarter 2:

Hence, the ending receivables are $450.

Compute the cash collection for quarter 2:

Hence, the cash collected for the quarter 2 is $615.

Compute the ending receivables for quarter 3:

Hence, the ending receivables are $420.

Compute the cash collection for quarter 3:

Hence, the cash collected for the quarter 1 is $660.

Compute the ending receivables for quarter 4:

Hence, the ending receivables are $597.

Compute the cash collection for quarter 4:

Hence, the cash collected for the quarter 1 is $718.

Want to see more full solutions like this?

Chapter 16 Solutions

Essentials of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

- The George Company has a policy of maintaining an end-of-month cash balance of at least $30,000.In months where a shortfall is expected, the company can draw in $1,000 increments on a line ofcredit it has with a local bank, at an interest rate of 12% per annum. All borrowings are assumed forbudgeting purposes to occur at the beginning of the month, while all loan repayments (in $1,000increments of principal) are assumed to occur at the end of the month. Interest is paid at the end ofeach month. For April, an end-of-month cash balance (prior to any financing and interest expense)of $18,000 is budgeted; for May, an excess of cash collected over cash payments (prior to any interest payments and loan repayments) of $22,000 is anticipated. What is the interest payment estimatedfor April (there is no bank loan outstanding at the end of March)? What is the total financing effect(cash interest plus loan transaction) for May?arrow_forwardKamal Co. has an average collection period (ACP) of 30 days and an operating cycle of 170 days. It has a policy of keeping at least RO 15,000 on hand as a minimum cash balance, and has a beginning cash balance for the first quarter of RO 20,000. Beginning receivables for the first quarter amount to RO 30,000 Sales for the first second and the third quarters are expected respectively to be RO 100,000; RO120,000; and RO 150,000. The purchases amount represents 50% of the next quarter's forecasted sales. The quarterly wages and other expenses is RO 7,000. The capital spending occurs in the second quarter and equals to RO 15,000. The accounts payable period is 45 days. The beginning accounts payable is RO 10,000. A. What are cash collections in the first and second quarters? B. What are cash disbursements for the first and second quarters ? C. What is the cumulative surplus (deficit) at the end of the first and second quarters ?arrow_forwardThe Morning Jolt Coffee Company has projected the following quarterly sales amounts for the coming year 01 02 04 Sales # 330 $390 a. Accounts receivable at the beginning of the year are $360. The company has a 45-day collection period. Calculate cash collections in each of the four quarters by completing the following: Note: Do not round intermediate calculations and round your answers to the nearest whole number, e.g., 32. Beginning receivables Sales Cash collections Ending receivables 03 $450 Beginning receivables Sales Cash collections Ending receivables S Beginning receivables Sales Cash collections Ending receivables 01 01 300 330 01 330 b. Accounts receivable at the beginning of the year are $360. The company has a 60-day collection period Calculate cash collections in each of the four quarters by completing the following: Note: Do not round intermediate calculations and round your answers to the nearest whole number, e-g.. 32. 02 330 02 390 Q² 390 03 350 03 450 03 c. Accounts…arrow_forward

- The Morning Jolt Coffee Company has projected the following quarterly sales amounts for the coming year: 01 Sales $ 330 Q2 $ 390 Beginning receivables Sales Cash collections Ending receivables a. Accounts receivable at the beginning of the year are $360. The company has a 45-day collection period. Calculate cash collections in each of the four quarters by completing the following: Note: Do not round intermediate calculations and round your answers to the nearest whole number, e.g., 32. Beginning receivables Sales Cash collections Ending receivables Q3 $ 450 Show Transcribed Text Beginning receivables Sales Cash collections Ending receivables Q1 Q1 Q1 330 04 $ 600 330 b. Accounts receivable at the beginning of the year are $360. The company has a 60-day collection period. Calculate cash collections in each of the four quarters by completing the following: Note: Do not round intermediate calculations and round your answers to the nearest whole number, e.g., 32. 330 Q2 Q2 Q2 390 390 390…arrow_forwardCrane Company management wants to maintain a minimum monthly cash balance of $20,000. At the beginning of April, the cash balance is $20,000, expected cash receipts for April are $196,000, and cash disbursements are expected to be $204,000. How much cash, if any, must be borrowed to maintain the desired minimum monthly balance? Amount to be borrowed to maintain the desired minimum monthly balance $11 Crane Company management wants to maintain a minimum monthly cash balance of $20,000. At the beginning of April, the cash balance is $20,000, expected cash receipts for April are $196,000, and cash disbursements are expected to be $204,000 How much cash, if any, must be borrowed to maintain the desired minimum monthly balance? Amount to be borrowed to maintain the desired minimum monthly balance $ I Iarrow_forward6. Smith Company was organized on August 1 of the current year. Projected sales for the next three months are: August $250,000 September 200,000 October 275,000 The company expects to sell 50% of its merchandise for cash and 50% for sales on account. Of the sales on account, 30% are expected to be collected in the month of the sale and the remainder in the following month. Prepare a schedule indicating cash collections from cash and accounts receivable for the three months.arrow_forward

- The Morning Jolt Coffee Company has projected the following quarterly sales amounts for the coming year: Sales Q1 $ 540 Q2 $ 570 Q3 Q4 $ 630 $ 780 a. Accounts receivable at the beginning of the year are $300. The company has a 45-day collection period. Calculate cash collections in each of the four quarters by completing the following: Note: Do not round intermediate calculations and round your answers to the nearest whole number, e.g., 32. Beginning receivables Sales Cash collections Ending receivables Q1 540 Q2 570 Q3 630 Q4 780 b. Accounts receivable at the beginning of the year are $300. The company has a 60-day collection period. Calculate cash collections in each of the four quarters by completing the following: Note: Do not round intermediate calculations and round your answers to the nearest whole number, e.g., 32. Beginning receivables Sales Cash collections Ending receivables Q1 540 Q2 570 Q3 630 Q4 780 c. Accounts receivable at the beginning of the year are $300. The company…arrow_forwardThe beginning cash balance is $16,500. Sales are forecasted at $820,000 of which 80% will be on account. Seventy percent of credit sales are expected to be collected in the year of sale. Cash expenditures for the year are forecasted at $472,000. Accounts Receivable from previous accounting periods totaling $11,800 will be collected in the current year. The company is required to make a $16,500 loan payment and an annual interest payment on the last day of every year. The loan balance as of the beginning of the year is $90,000, and the annual interest rate is 9%. Compute the excess of available cash over cash disbursements. Excess of available cash over cash disbursements $arrow_forwardPreparing a Schedule of Cash Collections on Accounts Receivable Kailua and Company is a legal services firm. All sales of legal services are billed to the client (there are no cash sales). Kailua expects that, on average, 20% will be paid in the month of billing, 50% will be paid in the month following billing, and 25% will be paid in the second month following billing. For the next 5 months, the following sales billings are expected: May $84,000 June 100,800 July 77,000 August 86,800 September 91,000 Required: Prepare a schedule showing the cash expected in payments on accounts receivable in August and in September. If an amount box does not require an entry, leave it blank or enter "0". Be sure to enter percentages as whole numbers.arrow_forward

- Preparing a Schedule of Cash Collections on Accounts Receivable Kailua and Company is a legal services firm. All sales of legal services are billed to the client (there are no cash sales). Kailua expects that, on average, 20% will be paid in the month of billing, 50% will be paid in the month following billing, and 25% will be paid in the second month following billing. For the next 5 months, the following sales billings are expected: May $84,000 June 100,800 July 77,000 August 87,800 September 93,000 Required: Prepare a schedule showing the cash expected in payments on accounts receivable in August and in September. If an amount box does not require an entry, leave it blank or enter "0". Be sure to enter percentages as whole numbers. Kailua and Company Schedule August September June: $fill in the blank 1 × fill in the blank 2 % $fill in the blank 3 $fill in the blank 4 July: $fill in the blank 5 × fill in the blank…arrow_forwardPreparing a Schedule of Cash Collections on Accounts Receivable Kailua and Company is a legal services firm. All sales of legal services are billed to the client (there are no cash sales). Kailua expects that, on average, 20% will be paid in the month of billing, 50% will be paid in the month following billing, and 25% will be paid in the second month following billing. For the next 5 months, the following sales billings are expected: May $84,000 June 100,800 July 77,000 August 87,500 September 91,000 Required: Prepare a schedule showing the cash expected in payments on accounts receivable in August and in September. If an amount box does not require an entry, leave it blank or enter "0". Be sure to enter percentages as whole numbers. Kailua and Company Schedule August September June: $fill in the blank 1 × fill in the blank 2 % $fill in the blank 3 $fill in the blank 4 July: $fill in the blank 5 × fill in the blank…arrow_forwardMarlin Company projects the follwoing sales for the first thre months of the year: $11500 in January; $10100 in February and $10400 in March. the company expects 60% of the sales to be cash and the remainder on accounts. Sales on account are collected 50% in the month of the sale and 50% in the following month. The Account Receivable account has a zero on January. 1. Prepare a schedule of cash receipts for Marlin for January, February and March. What is the balance in Accounts Receivable on March 31? 2. Prepare a revised schedule of cash receipts if receipts from sales on account are 70% in the month of the sale, 20% in the following month of the sale and 10% in the second month of the sale. What is the balance in Accounts Receivable on March 31?arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College