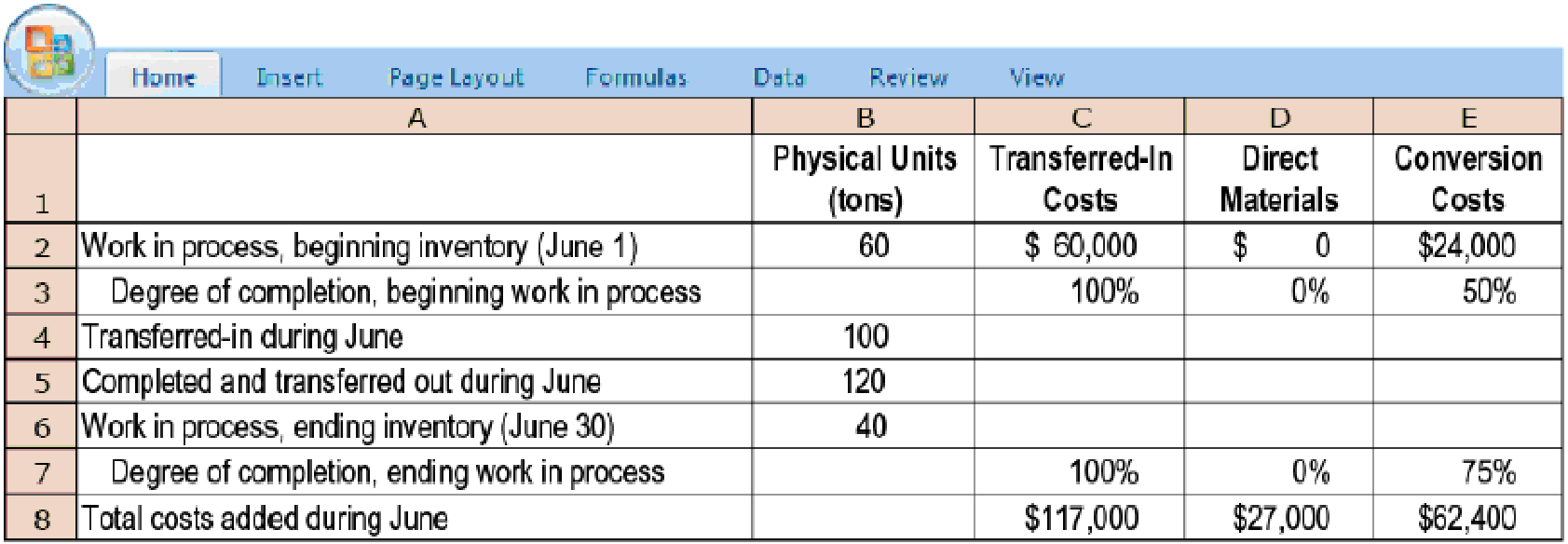

Transferred-in costs, FIFO method. Refer to the information in Exercise 17-31. Suppose that Trendy uses the FIFO method instead of the weighted-average method in all of its departments. The only changes to Exercise 17-31 under the FIFO method are that total transferred-in costs of beginning work in process on June 1 are $45,000 (instead of $60,000) and total transferred-in costs added during June are $114,000 (instead of $117,000).

Required

Do Exercise 17-31 using the FIFO method. Note that you first need to calculate equivalent units of work done in the current period (for transferred-in costs, direct materials, and conversion costs) to complete beginning work in process, to start and complete new units, and to produce ending work in process.

17-31 Transferred-in costs, weighted-average method. Trendy Clothing, Inc. is a manufacturer of winter clothes. It has a knitting department and a finishing department. This exercise focuses on the finishing department. Direct materials are added at the end of the process. Conversion costs are added evenly during the process. Trendy uses the weighted-average method of

- 1. Calculate equivalent units of transferred-in costs, direct materials, and conversion costs.

Required

- 2. Summarize the total costs to account for, and calculate the cost per equivalent unit for transferred-in costs, direct materials, and conversion costs.

- 3. Assign costs to units completed (and transferred out) and to units in ending work in process.

Learn your wayIncludes step-by-step video

Chapter 17 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Additional Business Textbook Solutions

Managerial Accounting (4th Edition)

Horngren's Accounting (11th Edition)

Managerial Accounting (5th Edition)

Principles of Accounting Volume 2

Intermediate Accounting (2nd Edition)

Intermediate Accounting

- Refer to the data in Exercise 7.18. When the capacity of the HR Department was originally established, the normal usage expected for each department was 20,000 direct labor hours. This usage is also the amount of activity planned for the two departments in Year 1 and Year 2. Required: 1. Allocate the costs of the HR Department using the direct method and assuming that the purpose is product costing. 2. Allocate the costs of the HR Department using the direct method and assuming that the purpose is to evaluate performance.arrow_forwardThe following product costs are available for Kellee Company on the production of eyeglass frames: direct materials, $32,125; direct labor, $23.50; manufacturing overhead, applied at 225% of direct labor cost; selling expenses, $22,225; and administrative expenses, $31,125. The direct labor hours worked for the month are 3,200 hours. A. What are the prime costs? B. What are the conversion costs? C. What is the total product cost? D. What is the total period cost? E. If 6.425 equivalent units are produced, what is the equivalent material cost per unit? F. What is the equivalent conversion cost per unit?arrow_forwardMultiple Choice $685 per order $675 per order $544 per order $665 per orderarrow_forward

- Hakara Company has been using direct labor costs as the basis for assigning overhead to its many products. Under this allocation system, product A has been assigned overhead of $26.87 per unit, while product B has been assigned $7.62 per unit. Management feels that an ABC system will provide a more accurate allocation of the overhead costs and has collected the following cost pool and cost driver information: Cost Pools Activity Costs $ 415,000 120,000 44,000 The following cost information pertains to the production of A and B, just two of Hakara's many products: Machine setup Materials handling Electric power Number of units produced Direct materials cost Direct labor cost Number of setup hours Pounds of materials used Kilowatt-hours Product A Product B A 5,000 $ 22,000 $ 39,000 Cost per Unit Cost Drivers Setup hours Pounds of materials Kilowatt-hours 200 2,000 4,000 B 20,000 $ 26,000 $ 37,000 Activity Driver Consumption 5,000 15,000 22,000 200 2,000 4,000 Required: 1. Use…arrow_forwardComputing departmental overhead allocation rates The Oakman Company (see Short Exercise S19-1) has refined its allocation system by separating manufacturing overhead costs into two cost pools—one for each department. The estimated costs for the Mixing Department, $510,000, will be allocated based on direct labor hours, and the estimated direct labor hours for the year are 170,000. The estimated costs for the Packaging Department, $300,000, will be allocated based on machine-hours, and the estimated machine hours for the year are 40,000. In October, the company incurred 38,000 direct labor hours in the Mixing Department and 10,000 machine hours in the Packaging Department. Requirements Compute the predetermined overhead allocation rates. Round to two decimal places. Determine the total amount of overhead allocated in October.arrow_forward1. Logo Inc. has two data services departments (Systems and Facilities) that provide support to the company's three production departments (Machining, Assembly, and Finishing). The overhead costs of the Systems Department are allocated to other departments on the basis of computer usage hours. The overhead costs of the Facilities Department are allocated based on square feet occupied (in thousands). Other information pertaining to Logo is as follows. Department Overhead Computer Usage Hours Square Feet Occupied Systems Facilities $200,000 300 1,000 100,000 900 600 Machining Assembly Finishing Totals 400,000 3,600 2,000 550,000 1,800 3,000 620,000 2,700 5,000 9,300 11,600arrow_forward

- Hakara Company has been using direct labor costs as the basis for assigning overhead to its many products. Under this allocation system, product A has been assigned overhead of $31.58 per unit, while product B has been assigned $8.69 per unit. Management feels that an ABC system will provide a more accurate allocation of the overhead costs and has collected the following cost pool and cost driver information: Activity Costs $ 198,000 Activity Driver Consumption 2,000 21,000 168,000 40,000 40,000 The following cost information pertains to the production of A and B, just two of Hakara's many products: Cost Pools Machine setup Materials handling Electric power Number of units produced Direct materials cost Direct labor cost. Number of setup hours Pounds of materials used Kilowatt-hours Product A Product B A 4,000 $ 31,000 $ 33,000 Cost per Unit 200 1,000 4,000 Cost Drivers Setup hours Pounds of materials Kilowatt-hours Required: 1. Use activity-based costing to determine a unit cost for…arrow_forwardMission Company is preparing its annual profit plan. As part of its analysis of the profitability of individual products, the controller estimates the amount of overhead that should be allocated to the individual product lines from the information provided below (CMA adapted) Multiple Choice Units produced Material moves per product line Direct labor-hours per product line Budgeted material handling costs: $594,000 Under a traditional costing system that allocates overhead on the basis of direct labor-hours, the materials handling costs allocated to one unit of Wall Mirrors would be O $1000 $1.350 $5,400 Wall Mirrors 210 5 1,050 $22.000 Specialty Nindows 25 46arrow_forwardXYZ Corporation has provided the following data concerning its overhead costs for the coming year: Wages and salaries Depreciation Rent Total The company has an activity-based costing system with the following three activity cost pools and estimated activity for the coming year: Activity Cost Pool Assembly Order processing Other Wages and salaries Depreciation $ 420,000 160,000 180,000 $760,000 Not Rent Total Activity 40,000 labor-hours 700 orders The Other activity cost pool does not have a measure of activity; it is used to accumulate costs of idle capacity and organization-sustaining costs. The distribution of resource consumption across activity cost pools is given below: applicable Assembly 35% 15% 35% Activity Cost Pools Order Processing 30% 45% 30% The activity rate for the Order Processing activity cost pool is closest to: Other 35% 40% 35% Total 100% 100% 100%arrow_forward

- Mia Company uses activity-based costing and reports the following for this year. Activity Cost Driver Machine hours (MH) Direct labor hours (DLH) Activity Cutting Budgeted Cost $ 28,000 Budgeted Activity Usage 4,000 machine hours Assembly 80,000 8,000 direct labor hours Total $ 108,000 (a) Compute an activity rate for each activity using activity-based costing. (b) Allocate overhead costs to a job that uses 30 machine hours and 25 direct labor hours. Complete this question by entering your answers in the tabs below. Required Required А В Allocate overhead costs to a job that uses 30 machine hours and 25 direct labor hours. Activity Activity Usage Activity Rate Allocated Cost machine 30 hours Cutting Assembly direct labor 25 hours Totalarrow_forwardRequired information [The following information applies to the questions displayed below.] Adria Company recently implemented an activity-based costing system. At the beginning of the year, management made the following estimates of cost and activity in the company's five activity cost pools: Expected Activity Overhead Expected Activity 6,500 DLHS 2,400 orders 700 receipts 1,400 relays 41,000 MHs Activity Cost Pool Labor-related Purchase orders Measure Cost $ 58,500 $ 12,000 $ 11, 200 $ 14,000 $369, 000 Direct labor-hours Material receipts Relay assembly General factory Number of orders Number of receipts Number of relays Machine-hours Required: 1. Compute the activity rate for each of the activity cost pools. Activity Cost Pool Activity Rate Labor-related per DLH Purchase orders per order Material receipts per receipt Relay assembly per relay General factory per MHarrow_forwardThe company is considering using a two-stage cost allocation system and wants to assess the effects on reported product profits. The company is considering using Engineering Hours and Users as the allocation base. Additional information follows. Toot! TiX Total Engineering hours 7,650 5,650 13,300 Users 9,500 17,100 26,600 Engineering – hour related administrative cost $ 114,380 User-related administrative cost $…arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning