Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 19, Problem 5CE

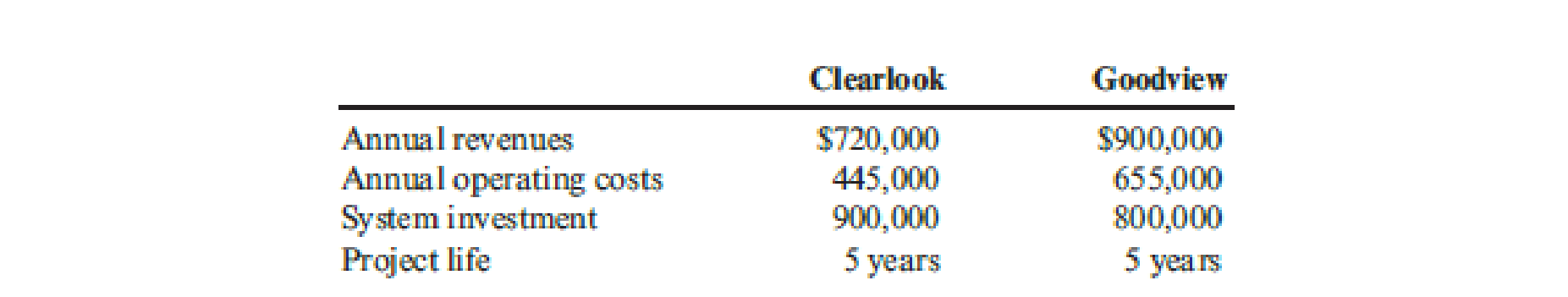

Keating Hospital is considering two different low-field MRI systems: the Clearlook System and the Goodview System. The projected annual revenues, annual costs, capital outlays, and project life for each system (in after-tax cash flows) are as follows:

Assume that the cost of capital for the company is 8 percent.

Required:

- 1. Calculate the

NPV for the Clearlook System. - 2. Calculate the NPV for the Goodview System. Which MRI system would be chosen?

- 3. What if Keating Hospital wants to know why

IRR is not being used for the investment analysis? Calculate the IRR for each project and explain why it is not suitable for choosing among mutually exclusive investments.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Keating Hospital is considering two different low-field MRI systems: the Clearlook System and the Goodview System. The projected annual revenues, annual costs, capital outlays, and project life for each system (in after-tax cash flows) are as follows:

Clearlook

Goodview

Annual revenues

$720,000

$900,000

Annual operating costs

445,000

655,000

System investment

900,000

800,000

Project life

5 years

5 years

Assume that the cost of capital for the company is 8 percent.

The present value tables provided in Exhibit 19B.1 and Exhibit 19B.2 must be used to solve the following problems.

Required:

Calculate the NPV for the Clearlook System.$

Calculate the NPV for the Goodview System.$

Which MRI system would be chosen?

Clearlook System

Goodview System3. What if Keating Hospital wants to know why IRR is not being used for the investment analysis? Calculate the IRR for each project. Round the discount factor to three decimal places. Round the IRR…

Keating Hospital is considering two different low-field MRI systems: the Clearlook System and the Goodview System. The projected annual revenues, annual costs, capital outlays, and project life for each system (in after-tax cash flows) are as follows:

Clearlook Goodview

Annual revenues $720,000 $900,000

Annual operating costs 445,000 655,000

System investment 900,000 800,000

Project life 5 years 5 years

Assume that the cost of capital for the company is 8%.

Required:

1. Calculate the NPV for the Clearlook System.

2. Calculate the NPV for the Goodview System. Which MRI system would be chosen?

3. What if Keating Hospital wants to know why IRR is not being used for the investment analysis? Calculate the IRR for each project and explain why it is not suitable for choosing among…

The supervisor of capital budgeting for Le Vie Clinic has estimated the following cash flow of dollars for a proposed new clinical service.

Please show your for letters a, b,c and d.

Chapter 19 Solutions

Cornerstones of Cost Management (Cornerstones Series)

Ch. 19 - Explain the difference between independent...Ch. 19 - Explain why the timing and quantity of cash flows...Ch. 19 - Prob. 3DQCh. 19 - Prob. 4DQCh. 19 - What is the accounting rate of return?Ch. 19 - What is the cost of capital? What role does it...Ch. 19 - Prob. 7DQCh. 19 - Explain how the NPV is used to determine whether a...Ch. 19 - Explain why NPV is generally preferred over IRR...Ch. 19 - Prob. 10DQ

Ch. 19 - Prob. 11DQCh. 19 - Prob. 12DQCh. 19 - Prob. 13DQCh. 19 - Prob. 14DQCh. 19 - Prob. 15DQCh. 19 - Jan Booth is considering investing in either a...Ch. 19 - Prob. 2CECh. 19 - Carsen Sorensen, controller of Thayn Company, just...Ch. 19 - Manzer Enterprises is considering two independent...Ch. 19 - Keating Hospital is considering two different...Ch. 19 - Prob. 6CECh. 19 - Prob. 7ECh. 19 - Prob. 8ECh. 19 - Each of the following scenarios is independent....Ch. 19 - Roberts Company is considering an investment in...Ch. 19 - NPV A clinic is considering the possibility of two...Ch. 19 - Refer to Exercise 19.11. 1. Compute the payback...Ch. 19 - Buena Vision Clinic is considering an investment...Ch. 19 - Consider each of the following independent cases....Ch. 19 - Gina Ripley, president of Dearing Company, is...Ch. 19 - Covington Pharmacies has decided to automate its...Ch. 19 - Postman Company is considering two independent...Ch. 19 - Prob. 18ECh. 19 - Prob. 19ECh. 19 - Prob. 20ECh. 19 - Assume there are two competing projects, X and Y....Ch. 19 - Prob. 22ECh. 19 - Assume that an investment of 100,000 produces a...Ch. 19 - Prob. 24PCh. 19 - Prob. 25PCh. 19 - Prob. 26PCh. 19 - Kent Tessman, manager of a Dairy Products...Ch. 19 - Friedman Company is considering installing a new...Ch. 19 - Okmulgee Hospital (a large metropolitan for-profit...Ch. 19 - Mallette Manufacturing, Inc., produces washing...Ch. 19 - Jonfran Company manufactures three different...Ch. 19 - Prob. 32P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Net Present Value and Internal Rate of Return. Below are the projected revenues and expenses for a new clinical nurse specialist program being established by your healthcare organization. The nurses would provide education while patients are in the hospital and home visits are on a fee-for-service basis after patients have been discharged Should the hospital undertake the program if its required rate of return is 12%? Note: it must be assumed that the revenues and costs in this problem represent cash flows. Present value analysis is based on cash, not revenue or expenses. Provide a response to support the findings in the table listed below. Your response should be at least a half page long in addition to the table. Please include citations. Year One Year Two Year Three Year Four Total Revenue $100,000 $150,000 $200,000 $250,000 $700,000 Costs $150,000 $150,000 $150,000 $150,000 $600,000 $ <50,000> $0 $50,000 $100,000…arrow_forwardTwo locations are considered for a new public small hospital. Location A would require an investrment of $3.4 million and $55,000 per ycar to maintain. Location B would cost $4.8 million to construct. The operating cost of location B will be $43,000 per year. The benefits will be $550,000 per year at location A and 5750000 at location B The disbenefits associated with each location are $35,000 per year for location A and $45,000 per year for location B. Assame the hospital will be maintained indefinitely Use an interest rate of 12% per year to determine which location, if either, should be selected on the basis of the BC method.arrow_forward. A hospital director is considering two alternative investment programs. Both have costs of $5,000 in year 1 only. Project 1 provides benefits of $2,000 in each of the first 4 years only. Project 2 provides benefits of $ 2,000 for years 6 to 10 only. a. Compute the net benefits using a discount rate of 6 percent. b. Knowing that the calculations are dependent on the discount rate, conduct a sensitivity analysis by re - calculating with a discount rate of 12 percent. Based on your calculations, which investment program should the director choose?arrow_forward

- Lutheran Regional Hospital uses a planning process to define a new radiology service line. The decision matrix gave it a high priority, and administrators want to evaluate its financial feasibility. Estimated fixed costs are $1 million, and the estimated net reimbursement level is $1,500 per procedure. Physician and other provider salaries on a direct basis are $340 per procedure, and total operating expenses will add another $160 per procedure. If Lutheran Regional discovered a way to reduce the total initial investment to $600,000, causing the average pricing level to fall to $1,200 and the other assumptions to stay the same, how many procedures would be required to break even?arrow_forwardThe modified B/C ratio for a city-owned hospital heliport project is 1.7. The initial cost is $1 million, annual benefits are $150,000, and the estimatedlife is 30 years. What is the amount of the annual M&O costs used in the calculation at a discount rate of 6% per year?arrow_forward(Calculating the expected NPV of a project) Management at the Physicians' Bone and Joint (PB&J) Clinic is considering whether to purchase a newly developed MRI machine that the manufacturer tells them will provide the basis for better diagnoses of foot and knee problems. The new machine is quite expensive but should last for a number of years. The clinic's CFO asked an analyst to work up estimates of the NPV of the investment under three different assumptions about the level of demand for its use (high, medium, and low). To carry out the analysis, the CFO assigned a 50 percent probability to the medium-demand state, a 33 percent probability to the high-demand state, and the remaining 17 percent to the low-demand state. After forecasting the demand for the machine based on the CFO's judgment and past utilization rates for MRI scans, the analyst made the following NPV estimates: E. a. What is the expected NPV for the MRI machine based on the above estimates? How would you interpret the…arrow_forward

- ABC Medical has invested RM2 million in a Health Diagnostic Support system. To maintain the system, the hospital has to pay the vendor RM10,000 monthly for monitoring and support activities. The system is projected to increase the hospital revenue by RM50,000 monthly. If the system is to be utilized by the hospital for 10 years, calculate the rate of return of the investment using ROI.arrow_forward(Calculating the expected NPV of a project) Management at the Physicians' Bone and Joint (PB&J) Clinic is considering whether to purchase a newly developed MRI machine that the manufacturer tells them will provide the basis for better diagnoses of foot and knee problems. The new machine is quite expensive but should last for a number of years. The clinic's CFO asked an analyst to work up estimates of the NPV of the investment under three different assumptions about the level of demand for its use (high, medium, and low). To carry out the analysis, the CFO assigned a 50 percent probability to the medium-demand state, a 33 percent probability to the high-demand state, and the remaining 17 percent to the low-demand state. After forecasting the demand for the machine based on the CFO's judgment and past utilization rates for MRI scans, the analyst made the following NPV estimates: a. What is the expected NPV for the MRI machine based on the above estimates? How would you interpret the…arrow_forwardSHOW ME HOW TO DO IT IN EXCEL (SHOW THE FUNCTIONS USED AND HOW YOU USED THEM) + CLERLY SHOW INPUTS AND OUTPUTS. Yakima Racks is evaluating two alternatives, mutually exclusive methods for a new kayak carrier frame. It has developed the following estimated after-tax cost savings for each alternative method. Project managers require an appropriately applied IRR methodology for their decisions. If the project discount rate is 11%, and the cash flows are those noted below, which method would you recommend? Provide results for both traditional NPV analysis and an appropriately applied IRR analysis. Explain your recommendation fully on your worksheet. Show all cash flows and related analyses. Clearly specify your recommendation and reasoning clearly on your worksheet. A: Titanium Pully CFs: T0=(115,000), T1=1,000; T2=5,000; T3=25,000; T4=45,000; T5=100,000 B: Metal Hook CFs: T0=(95,000), T1=45,000; T2=35,000; T3=30,000; T4=20,000; T5=10,000 THEN, ANSWER THIS QUESTION CHOOSE FROM…arrow_forward

- The hospital is considering the purchase of imaging equipment worth $25,000 to improve its visual capture results, and improve outcomes. The operating costs will be reduced by $7,000 per year. The computer has an estimated life expectancy of 5 years, and an estimated salvage value of $5,000. What is the profitability index if the discount rate is 8%. Ignore reimbursement considerations.arrow_forwardThe team lead of capital budgeting for Se Shine Clinic has estimated the following cash flow of dollars for a proposed new clinical service. Please show your calculations step by step for each letter : a,b,c and d.arrow_forwardA hospital administrator is faced with the problem of having a limited amount of funds available for capital projects. He has narrowed his choice down to two pieces of x-ray equipment, since the radiology department is his greatest producer of revenue. The first piece of equipment (Project A) is a fairly standard piece of equipment that has gained wide acceptance and should provide a steady flow of income. The other piece of equipment (Project B), although more risky, may provide a higher return. After deliberation with his radiologist and director of finance, the administrator has developed the following table: Discovering that the budget director of the hospital is taking courses in engineering, the hospital administratorhas asked him to analyze the two projects and make his recommendation. Prepare an analysis that will aid the budget director in making his recommendation. In this problem, do risk and reward travel in the same direction?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License