Fundamentals Of Financial Accounting

6th Edition

ISBN: 9781259864230

Author: PHILLIPS, Fred, Libby, Robert, Patricia A.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 2, Problem 14E

Calculating and Evaluating the

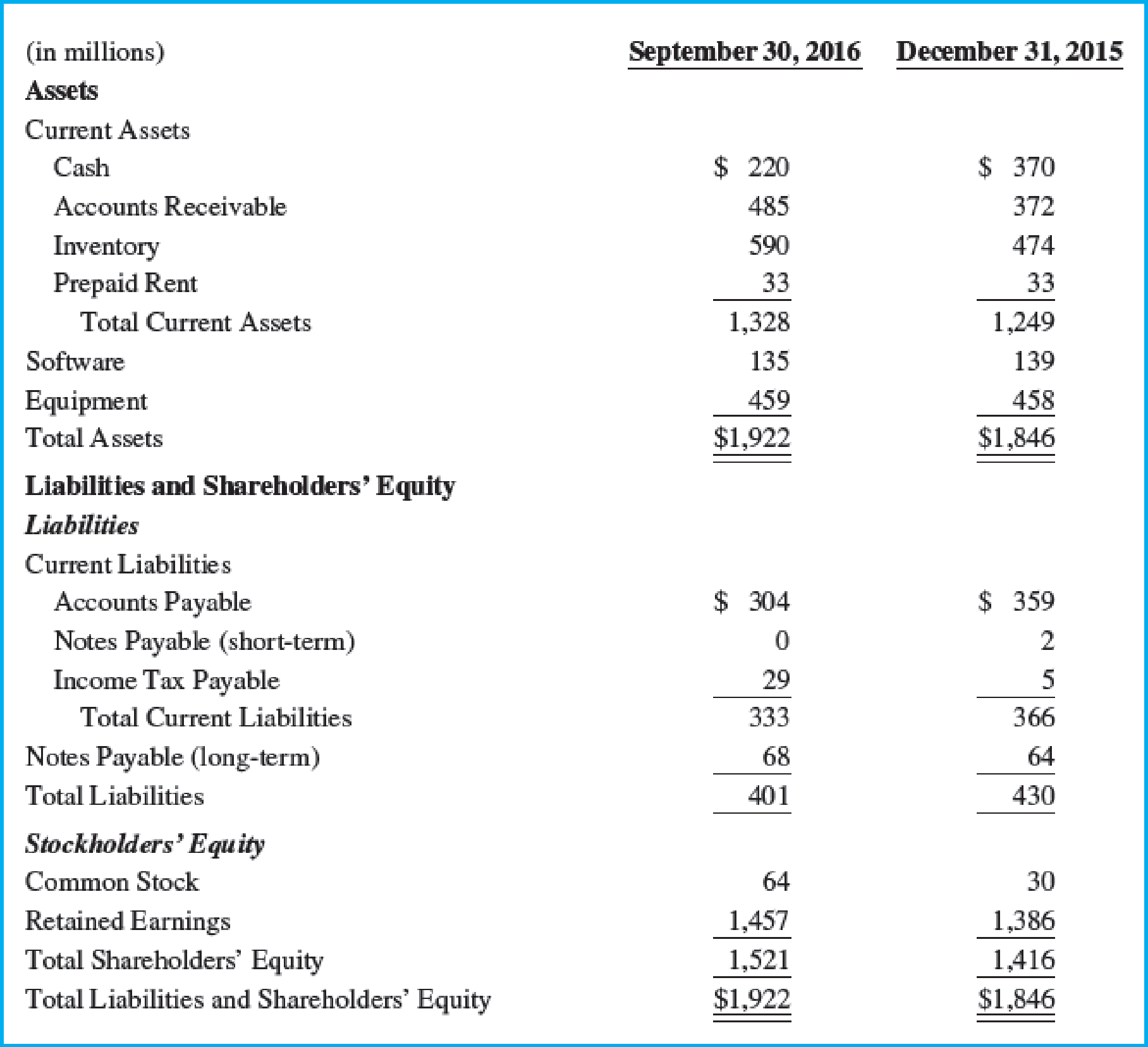

Columbia Sportswear Company reported the following in recent balance sheets (amounts in millions).

Required:

- 1. Calculate the current ratio (rounded to two decimal places) at September 30, 2016, and December 31, 2015.

- 2. Did the company’s current ratio increase or decrease? What does this imply about the company’s ability to pay its current liabilities as they come due?

- 3. What would Columbia’s current ratio have been on September 30, 2016, if the company were to have paid down $10 (million) of its Accounts Payable? Does paying down Accounts Payable in this case increase or decrease the current ratio?

- 4. Are the company’s total assets financed primarily by liabilities or stockholders’ equity at September 30, 2016?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Examine the financial data of Black Corporation. Show how to compute Black's current ratio from 2018 to 2020. Is the company's ability to pay its

current liabilities improving or deteriorating?

(Click the icon to view the balance sheet.)

(Round ratios to two decimal places.)

Formula:

2018

2019

2020

Black's ability to pay its current liabilities is

II

11

Current ratio

Analyzing the ability to pay liabilities

Big Beautiful Photo Shop has asked you to determine whether the company’s ability to pay current liabilities and total liabilities improved or deteriorated during 2018. To answer this question, you gather the following data:

Compute the following ratios for 2018 and 2017, and evaluate the company’s ability to Pay its current Liabilities and total liabilities:

a. Current ratio

b. Cash ratio

c. Acid-test ratio

d. Debt ratio

e. Debt to equity ratio

1. Compute the following ratios for the comparative periods (2018 and 2019). The company used 365 days in its computation for some of the ratios. Show your solution.

a. Working Capital

b. Current Ratio

c. Acid Test Ratio

d. Accounts Receivable Turnover Ratio

e. Average Collection Period

f. Inventory Turnover Ratio

g. Average Days in Inventory

h. Number of days in Operating Cycle

i. Debt to Total Assets Ratio

j. Debt to Equity Ratio

k. Times Interest Earned Ratio

l. Gross Profit Ratio

m. Profit Margin Ratio

n. Return on Assets

o. Return on Equity

p. Assets Turnover Ratio

Chapter 2 Solutions

Fundamentals Of Financial Accounting

Ch. 2 - Define the following: a. Asset b. Current asset c....Ch. 2 - Define a transaction anti give an example of each...Ch. 2 - For accounting purposes, what is an account?...Ch. 2 - What is the basic accounting equation?Ch. 2 - Prob. 5QCh. 2 - Prob. 6QCh. 2 - Prob. 7QCh. 2 - What is a journal entry? What is the typical...Ch. 2 - What is a T-account? What is its purpose?Ch. 2 - Prob. 10Q

Ch. 2 - Prob. 11QCh. 2 - Which of the following is not an asset account? a....Ch. 2 - Which of the following statements describe...Ch. 2 - Total assets on a balance sheet prepared on any...Ch. 2 - The duality of effects can best be described as...Ch. 2 - The T-account is used to summarize which of the...Ch. 2 - Prob. 6MCCh. 2 - A company was recently formed with 50,000 cash...Ch. 2 - Which of the following statements would be...Ch. 2 - Prob. 9MCCh. 2 - Prob. 10MCCh. 2 - Prob. 1MECh. 2 - Prob. 2MECh. 2 - Matching Terms with Definitions Match each term...Ch. 2 - Prob. 4MECh. 2 - Prob. 5MECh. 2 - Prob. 6MECh. 2 - Prob. 7MECh. 2 - Identifying Events as Accounting Transactions Half...Ch. 2 - Determining Financial Statement Effects of Several...Ch. 2 - Preparing Journal Entries For each of the...Ch. 2 - Posting to T-Accounts For each of the transactions...Ch. 2 - Reporting a Classified Balance Sheet Given the...Ch. 2 - Prob. 13MECh. 2 - Prob. 14MECh. 2 - Identifying Transactions and Preparing Journal...Ch. 2 - Prob. 16MECh. 2 - Prob. 17MECh. 2 - Prob. 18MECh. 2 - Prob. 19MECh. 2 - Prob. 20MECh. 2 - Prob. 21MECh. 2 - Prob. 22MECh. 2 - Prob. 23MECh. 2 - Prob. 24MECh. 2 - Prob. 25MECh. 2 - Prob. 1ECh. 2 - Identifying Account Titles The following are...Ch. 2 - Classifying Accounts and Their Usual Balances As...Ch. 2 - Determining Financial Statement Effects of Several...Ch. 2 - Recording Journal Entries Refer to E2-4. Required:...Ch. 2 - Prob. 6ECh. 2 - Recording Journal Entries Refer to E2-6. Required:...Ch. 2 - Analyzing the Effects of Transactions in...Ch. 2 - Inferring Investing and Financing Transactions and...Ch. 2 - Analyzing Accounting Equation Effects, Recording...Ch. 2 - Recording Journal Entries and Preparing a...Ch. 2 - Analyzing the Effects of Transactions Using...Ch. 2 - Explaining the Effects of Transactions on Balance...Ch. 2 - Calculating and Evaluating the Current Ratio...Ch. 2 - Prob. 15ECh. 2 - Determining Financial Statement Effects of Various...Ch. 2 - Recording Transactions (in a Journal and...Ch. 2 - Recording Transactions (in a Journal and...Ch. 2 - Prob. 1PACh. 2 - Recording Transactions (in a Journal and...Ch. 2 - Recording Transactions (in a Journal and...Ch. 2 - Determining Financial Statement Effects of Various...Ch. 2 - Prob. 2PBCh. 2 - Recording Transactions (in a Journal and...Ch. 2 - Finding and Analyzing Financial Information Refer...Ch. 2 - Finding and Analyzing Financial Information Refer...Ch. 2 - Prob. 4SDCCh. 2 - Prob. 5SDCCh. 2 - Accounting for the Establishment of a Business...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following financial information was obtained from the year ended 2024 income statements for Luigi Automotive and Steinbeck Automotive: (Click the icon to view the financial information.) Requirements 1. Compute the times-interest-earned ratio for each company. Round to two decimals. 2. Which company was better able to cover its interest expense? Requirement 1. Compute the times-interest-earned ratio for each company. Round to two decimals. Begin by showing the formula for the times-interest-earned ratio. Times-interest-earned ratio = C--) Data table Net income Income tax expense Interest expense Print $ Luigi Steinbeck 52,395 $ 20,590 550 Done 89,990 26,260 3,100 Xarrow_forward3.1 Calculate the ratio (expressed to two decimal places) for 2021 to reflect each of the following: 3.1.4 An indicator of how profitable a company is relative to its total assets. 3.1.5 Determination of how easily a company can pay the interest on its outstanding debt.3.1.6 The period that the company takes to collect the money owed to it from its credit sales. Answer the following questions above by using the information below: Disney LimitedStatement of Comprehensive Income for the year ended 31 December 2021RSales 1 960 000Cost of sales 1 240 000Operating profit 472 000Interest expense 48 000Profit before tax 424 000Profit after tax 305 280 STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER: 2021 (R) 2020 (R)AssetsNon-current assets 2 320 000 1 960 000Inventories 720 000 440 000Accounts receivable…arrow_forwardUse the information provided from Sapphire Ltd to calculate the ratios for 2022 (expressed to two decimal places) that would reflect each of the following:1. The profit of the company relative to sales after deducting the cost of sales.2. The ability of the company to profitably utilize its capital, which includes both debt and equity.3. The proportion of the total assets that are financed by total debt.4. The ability of the company to repay its short-term debts under distress conditions, on the assumption that inventories would have no value at all.5. The portion of the company's profit that is allocated to each outstanding ordinary share.6. An indication of the percentage of profit that has been put back into the company.arrow_forward

- Calculate the following ratios for 2025 and 2026. (Round current ratio to 2 decimal places, e.g. 12.61, debts to assets and gross profit rate to 0 decimal places, e.g.12, and all other answers to 1 decimal place, e.g. 12.6%) Please show your work. 1. Current ratio 2. Debts to assets 3. Gross profit rate 4. Profit margin 5. Return on assets (Total assets at November 1, 2024, were $35,180) 6. Return on common stockholder's equity (Total common stockholders' equity at November 1, 2024, was $25, 180. Dividends on preferred stock were $16,800 in 2025 and $18,000 in 2026)arrow_forwardUsing the following select financial statement information from Black Water Industries, compute the number of days sales in receivables ratios for 2018 and 2019 (round answers to two decimal places). What do the outcomes tell a potential investor about Black Water Industries?arrow_forwardReal-world annual report The financial statements for Nike, Inc. (NKE), are presented in Appendix E at the end of the text. The following additional information is available (in thousands): Instructions 1. Determine the following measures for the fiscal years ended May 31, 2017, and May 31, 2016. Round ratios and percentages to one decimal place. a. Working capital b. Current ratio c. Quick ratio d. Accounts receivable turnover e. Number of days sales in receivables f. Inventory turnover g. Number of days sales in inventory' h. Ratio of liabilities to stockholders equity i. Asset turnover j. Return on total assets, assuming interest expense is 82 million for the year ending May 31. 2017, and 33 million for the year ending May 31, 2016. k. k. Return on common stockholders equity l. Price-eamings ratio, assuming that the market price was 52.81 per share on May 31, 2017, and 54.35 per share on May 31, 2016. m. m. Percentage relationship of net income to sales 2. What conclusions can be drawn from these analyses?arrow_forward

- A Financial Analysis Statement Calculate the 2021 (year ended 12/31/21) current ratio for Twitter. Calculate the 2021 (year ended 12/31/2021) current ratio for Meta. Which company has a better current ratio and why? Explain in a short paragraph. Calculate the 2021 accounts receivable turnover ratio for Twitter. Calculate the 2021 accounts receivable turnover ratio for Meta. Calculate the average collection period for each company. Show answer as number of days plus 2 decimals. Which company has a better receivable turnover ratio and why? Explain in a short paragraph. Calculate the 2021 return on assets for Twitter. Calculate the 2021 return on assets for Meta. Which company has a better return on assets and why? Explain in a short paragraph. Calculate the 2021 debt-to-equity ratio for Twitter. Calculate the 2021 debt-to-equity ratio for Facebook. Describe in a short paragraph what the debt-to-equity ratio measures and why this would be important to a potential creditor.…arrow_forwardBelow is the balance sheet and income statement for Chin Corporation. You are needed to analyze the financial statements. Use the horizontal, vertical, ratio methods to analyze the financial statements. For the vertical and horizontal analysis, type the accounts and dollar values for the years 2018 and 2017 (as listed on the financial statements even if there is no dollar value for an account). For the ratio analysis, make sure to compute 2 ratios from each section. Income Statement Period Ending: 12/31/2018 12/31/2017 Total Revenue $76,512,000 $78,291,000 Cost of Revenue $54,884,000 $56,586,000 Gross Profit $21,628,000 $21,706,000 Operating Expenses Research and Development $0 $0 Sales, General, and Admin. $13,886,000 $13,599,000 Non-Recurring Items $0 $0 Other Operating Items $0 $0 Operating Income $7,832,000 $8,079,000 Add'l income/expense items -$323,000…arrow_forward1. Compute the following ratios for the comparative periods (2018 and 2019). The company used 365 days in its computation for some of the ratios. Show your solution. d. Accounts Receivable Turnover Ratio e. Average Collection Period f. Inventory Turnover Ratio g. Average Days in Inventory h. Number of days in Operating Cycle i. Debt to Total Assets Ratio j. Debt to Equity Ratio k. Times Interest Earned Ratio l. Gross Profit Ratio m. Profit Margin Ratio n. Return on Assets o. Return on Equity p. Assets Turnover Ratioarrow_forward

- If you are told that LSJ Company accounts payable at December 31, 2023 represents 15% of the company's total liabilities on their balance sheet…this would represent an example of what type of analysis: a. Vertical Analysis b. Horizontal Analysis c. Ratio Analysisarrow_forwardComputing times-interest-earned ratio The following financial information was obtained from the year ended 2018 income statements for Cash Automotive and Pennington Automotive: Requirements Compute the times-interest-earned ratio for each company Round to two decimals. Which company was better able to cover its interest expense?arrow_forwardFINANCIAL RATIO: Requirement: Compute for the following financial ratios for the year 2021 (round-off answers to two decimal places) a. Current ratio b. Quick (Acid-test) ratio c. Working capital d. Inventory turnover e. Days of inventory (use 365 days) f. Accounts receivable turnover (assume all sales are on credit) g. Days of receivable (use 365 days) h. Debt ratio i. Equity ratio j. Debt-to-equity ratio k. Gross profit ratio 1. Net profit ratio m. Return on assets n. Return on equityarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License