Foundations of Finance (9th Edition) (Pearson Series in Finance)

9th Edition

ISBN: 9780134083285

Author: Arthur J. Keown, John D. Martin, J. William Petty

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 2, Problem 14SP

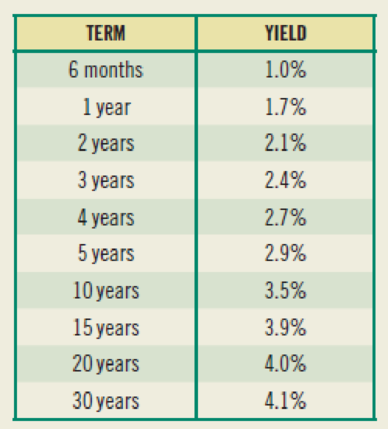

(Yield curve) If yields on Treasury securities were currently as follows:

- a. Plot the yield curve.

- b. Explain this yield curve using the unbiased expectations theory and the liquidity preference theory.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

i) Calculate the expected return for each stock assuming the Capital Asset Pricing Model (CAPM) is valid, and explain if they are correctly priced. Show your calculations.

The table below contains the covariance matrix of stock returns and the market. Assume that the assumptions of CAPM hold.

1. Find the market risk.

2. Find the systematic risk of BlueChip.

The Capital Asset Pricing Model (CAPM) considers which type of risk in pricing the expected returns and risk of securities? A) Systemic risk. B) Unsystemic risk. C) Diversifiable risk. D) Non-market risk.

Chapter 2 Solutions

Foundations of Finance (9th Edition) (Pearson Series in Finance)

Ch. 2 - Prob. 1RQCh. 2 - Prob. 2RQCh. 2 - Prob. 3RQCh. 2 - Prob. 4RQCh. 2 - Prob. 5RQCh. 2 - Prob. 6RQCh. 2 - Prob. 7RQCh. 2 - Prob. 8RQCh. 2 - Prob. 9RQCh. 2 - Prob. 10RQ

Ch. 2 - Prob. 11RQCh. 2 - Prob. 12RQCh. 2 - Prob. 13RQCh. 2 - Prob. 14RQCh. 2 - Prob. 15RQCh. 2 - Prob. 1SPCh. 2 - Prob. 2SPCh. 2 - Prob. 3SPCh. 2 - Prob. 4SPCh. 2 - Prob. 5SPCh. 2 - Prob. 6SPCh. 2 - Prob. 7SPCh. 2 - Prob. 8SPCh. 2 - Prob. 9SPCh. 2 - Prob. 10SPCh. 2 - Prob. 11SPCh. 2 - (Interest rate determination) Youre looking at...Ch. 2 - Prob. 13SPCh. 2 - (Yield curve) If yields on Treasury securities...Ch. 2 - (Unbiased expectations theory) Currently you have...Ch. 2 - On the first day of your summer internship, you’ve...Ch. 2 - On the first day of your summer internship, you’ve...Ch. 2 - Prob. 3MCCh. 2 - The maturity-risk premium is estimated by the...Ch. 2 - SanBlas Jewels’ bonds will be traded on the New...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A yield curve compares expected returns of stock and bonds to their maturities. Select one: True OR Falsearrow_forwardThe yield curve varies over time based the relative riskiness of buying a single long-term bond versus purchasing multiple short-term bonds. This explanation of the yield curve is most consistent with A.the Fisher Effect theoryB.the market segmentation theoryC.the unbiased expectations theoryD.the liquidity preference theoryarrow_forwardThe slope of the Security Market Line equals to ____, and the slope of Capital Allocation Line equals to____. Select one: A. Beta; Sharpe Ratio B. Market Risk Premium; Sharpe Ratio C. Risk free rate; Volatility D. Market Risk Premium; Volatilityarrow_forward

- What is a characteristic line? How is this line used to estimate a stocks beta coefficient? Write out and explain the formula that relates total risk, market risk, and diversifiable risk.arrow_forwardWhat does the capital asset pricing model (CAPM) calculate? a. The expected rate of return on an individual stock with respect to the risk-free rate of return b. The expected rate of return of an individual stock based on its overall risk c. The expected rate of return of an individual stock with respect to its market risk only d. The expected rate of return of an individual stock reflecting its financial risk Clear my choicearrow_forwardDescribe each of the following methods for estimating the cost of equity: (a) the CAPM, (b) DCF,and (c) the bond-yield-plus-risk-premium.Where can you obtain inputs for each of thesemethods, and how accurate are estimates basedon each procedure? Can you state categoricallythat one method is better than the others, or doesthe “best” method depend on the circumstances?arrow_forward

- According to the capital asset pricing model (CAPM), fairly priced securities should have __________. Select one: a. A fair return based on the level of systematic risk. b. A beta of 1. c. A return equal to the market return. d. A fair return based on the level of unsystematic risk.arrow_forwardFundamental analysis is a method of______________________________to determine intrinsic value of the stock.a. Measuring the intrinsic value of a security using the market indexb. Using qualitative and quantitative factorsc. Using statistical analysis such as standard deviation, coefficients and probabilitiesd. Using historical price movementse. B and C onlyarrow_forwardAn efficient capital market is best defined as a market in which security prices reflect which one of the following? Multiple Choice A Current inflation B A risk premium C All available information D The historical arithmetic rate of return E The historical geometric rate of returnarrow_forward

- (a) the expected returns of the stocks A and B.arrow_forwardHow do stock prices vary with the following: 1. the expected growth rate of dividends (earnings); 2. the benchmark (risk-free) interest rate: 3. the equity premiumarrow_forwardWhat are the differences between stocks and bonds in terms of predicted future payments? Which sort of investment is regarded to be riskier (stocks or bonds)? Given your knowledge, which investment (stocks or bonds) do you believe is often referred to as "fixed income"?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning

Portfolio return, variance, standard deviation; Author: MyFinanceTeacher;https://www.youtube.com/watch?v=RWT0kx36vZE;License: Standard YouTube License, CC-BY