Concept explainers

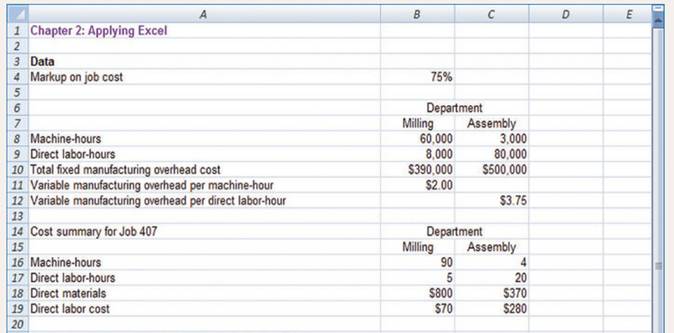

This Excel worksheet relates to the Dickson Company example that is summarized in Exhibit 2-5. Download the workbook containing this form from Connect, where you will also find instructions about how to use this worksheet form.

You should proceed to the requirements below only after completing your worksheet.

Required:

1. Check your worksheet by changing the total fixed

How much is the selling price of Job 407? Did it change? Why or why not?

Selling price: The cost incurred by selling the product in the market is known as the selling price.

Fixed overhead cost: The cost which does not vary even though there are changes in the business activity. Some of the costs which come under fixed overhead cost are rent, insurance, salaries etc.

Determine the missing figures. Once the figures are obtained, what is the change in the selling price if the fixed overhead cost is reduced to $300000 provided the total cost of Job 407 should be $2350.

Answer to Problem 1AE

Solution: There is a fall in the selling price since there is a change in the fixed overhead cost.

Explanation of Solution

This calculation should be done in the work book and it is explained below,

Part -1- Finding the missing figures:

| Chapter 2: Applying Excel | |||

| Data | |||

| Mark-up on job cost | 75% | ||

| Department | |||

| Milling | Assembly | ||

| 1 | Machine hours | 60000 | 3000 |

| 2 | Direct Labour Hours | 8000 | 80000 |

| 3 | Total fixed manufacturing overhead cost | $3,90,000.00 | $5,00,000.00 |

| 4 | Variable manufacturing overhead per machine hour | $2.00 | $ - |

| 5 | Variable manufacturing overhead per direct labour hour | $ - | $3.75 |

| Cost Summary for job 407 | Department | ||

| Milling | Assembly | ||

| 6 | Machine hours | 90 | 4 |

| 7 | Direct Labour Hours | 5 | 20 |

| 8 | Direct Materials | $800.00 | $370.00 |

| 9 | Direct Labour cost | $70.00 | $280.00 |

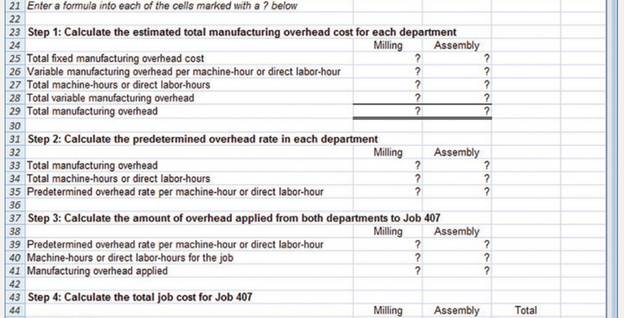

| Enter a formula into each of the cells marked with? below | |||

| Step 1: Calculate the estimated total manufacturing overhead cost for each department | |||

| Milling | Assembly | ||

| 10 | Total fixed manufacturing overhead (given) | $3,90,000.00 | $5,00,000.00 |

| 11 | Variable manufacturing overhead per machine hour or direct labour hour (given) | $2.00 | $3.75 |

| 12 | Total machine hours or direct labour hours (given) | 60000 | 80000 |

| 13 | Total Variable manufacturing overhead (11 x 12) | $1,20,000.00 | $3,00,000.00 |

| 14 | Total manufacturing overhead (10 + 13) | $5,10,000.00 | $8,00,000.00 |

| Step 2: Calculate the pre-determined overhead rate in each department | |||

| Milling | Assembly | ||

| 15 | Total manufacturing overhead (14) | $5,10,000.00 | $8,00,000.00 |

| 16 | Total machine hours or direct labour hours (given) | 60000 | 80000 |

| 17 | Pre-determined overhead rate per machine hour or direct labour hour (15 divided by 16) | $8.50 | $10.00 |

| Step 3: Calculate the amount of overhead applied to both departments to Job 407 | |||

| Milling | Assembly | ||

| 18 | Pre-determined overhead rate per machine hour or direct labour hour (17) | $8.50 | $10.00 |

| 19 | Machine hours or direct labour hours for the job (given) | 90 | 20 |

| 20 | Manufacturing overhead applied (18 x 19) | $ 765.00 | $ 200.00 |

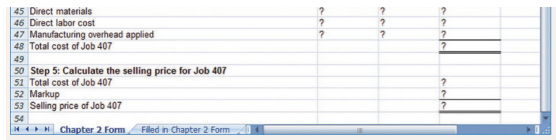

| Step 4: Calculate the total job cost for Job 407 | |||

| Milling | Assembly | ||

| 21 | Direct Materials (given) | $800.00 | $370.00 |

| 22 | Direct labour cost (given) | $70.00 | $280.00 |

| 23 | Manufacturing overhead applied (20) | $765.00 | $200.00 |

| 24 | Total cost of Job 407 (21 + 22 + 23) | $1,635.00 | $850.00 |

| Total cost of Job 407 (Milling + Assembly) | $2,485.00 | ||

| Step 5: Calculate the selling price for Job 407 | |||

| Milling | Assembly | ||

| 25 | Total cost of Job 407 ( 24) | $1,635.00 | $850.00 |

| 26 | Mark-up (24 x 75%) | $1,226.25 | $637.50 |

| 27 | Selling price of Job 407 (25 + 26) | $2,861.25 | $1,487.50 |

| Total Selling Price (Milling + Assembly) | $4,348.75 | ||

Part 2: To find the selling price of the job 407 after changes in the fixed overhead cost.

| Chapter 2: Applying Excel | |||

| Data | |||

| Mark-up on job cost | 75% | ||

| Department | |||

| Milling | Assembly | ||

| 1 | Machine hours | 60000 | 3000 |

| 2 | Direct Labour Hours | 8000 | 80000 |

| 3 | Total fixed manufacturing overhead cost | $3,90,000.00 | $5,00,000.00 |

| 4 | Variable manufacturing overhead per machine hour | $2.00 | $ - |

| 5 | Variable manufacturing overhead per direct labour hour | $ - | $3.75 |

| Cost Summary for job 407 | Department | ||

| Milling | Assembly | ||

| 6 | Machine hours | 90 | 4 |

| 7 | Direct Labour Hours | 5 | 20 |

| 8 | Direct Materials | $800.00 | $370.00 |

| 9 | Direct Labour cost | $70.00 | $280.00 |

| Enter a formula into each of the cells marked with ? Below | |||

| Step 1: Calculate the estimated total manufacturing overhead cost for each department | |||

| Milling | Assembly | ||

| 10 | Total fixed manufacturing overhead (given) | $3,00,000.00 | $5,00,000.00 |

| 11 | Variable manufacturing overhead per machine hour or direct labour hour (given) | $2.00 | $3.75 |

| 12 | Total machine hours or direct labour hours (given) | 60000 | 80000 |

| 13 | Total Variable manufacturing overhead (11 x 12) | $1,20,000.00 | $3,00,000.00 |

| 14 | Total manufacturing overhead) (10 + 13) | $4,20,000.00 | $8,00,000.00 |

| Step 2: Calculate the pre-determined overhead rate in each department | |||

| Milling | Assembly | ||

| 15 | Total manufacturing overhead (14) | $4,20,000.00 | $8,00,000.00 |

| 16 | Total machine hours or direct labour hours (given) | 60000 | 80000 |

| 17 | Pre-determined overhead rate per machine hour or direct labour hour (15 divided by 16) | $7.00 | $10.00 |

| Step 3: Calculate the amount of overhead applied to both departments to Job 407 | |||

| Milling | Assembly | ||

| 18 | Pre-determined overhead rate per machine hour or direct labour hour (17) | $7.00 | $10.00 |

| 19 | Machine hours or direct labour hours for the job (given) | 90 | 20 |

| 20 | Manufacturing overhead applied (18 x 19) | $630.00 | $200.00 |

| Step 4: Calculate the total job cost for Job 407 | |||

| Milling | Assembly | ||

| 21 | Direct Materials (given) | $800.00 | $370.00 |

| 22 | Direct Labour cost (given) | $70.00 | $280.00 |

| 23 | Manufacturing overhead applied (20) | $630.00 | $200.00 |

| 24 | Total cost of Job 407 (21 + 22 + 23) | $1,500.00 | $850.00 |

| Total cost of Job 407 (Milling + Assembly) | $2,350.00 | ||

| Step 5: Calculate the selling price for Job 407 | |||

| Milling | Assembly | ||

| 25 | Total cost of Job 407 ( 24) | $1,500.00 | $850.00 |

| 26 | Mark-up (14 x 75%) | $1,125.00 | $637.50 |

| 27 | Selling price of Job 407 (25 + 26 ) | $2,625.00 | $1,487.50 |

| 28 | Total Selling Price of Job 407 (Milling + Assembly) | $4,112.50 | |

The selling price of the Job 407 reduces from $4348.75 to $4112.50 since selling price is based on cost plus mark-up method. Hence, it is directly affected by the fall in Fixed Overhead cost.

Want to see more full solutions like this?

Chapter 2 Solutions

Introduction To Managerial Accounting

- The following information has been extracted from the cost accounting information system database for Victoria Furnitures Ltd. The company manufactures different types of furniture’s, including tables; The company manufactured 1,000 tables during the year 2020. Required: Using the information provided in the above table identify and explain how you classify each of the above costs according to the functional approach; Use the tables as the cost object in the classification of the costs.arrow_forwardDisplay Design Incorporated (DDI) is a new company that creates display cases for various types of collectibles. DDI has hired you as an accountant to help measure and evaluate costs. Your first day on the job, they provide you with the following interactive dashboard concerning the prior month's costs.arrow_forwardBuild a spreadsheet: Construct and excel spreadsheet to solve all of the preceding requirements. Show how both cost schedules and the income statement will change if raw material purchases amounted to $190,000 and indirect labor was $20,000.arrow_forward

- Bob Randall, cost accounting manager for Hemple Products, was asked to determine the costs of the activities performed within the company’s Manufacturing Engineering Department. The department has the following activities: creating bills of materials (BOMs), studying manufacturing capabilities, improving manufacturing process, training, employees, and designing tools. The resources costs (from the general ledger) and the times to perform one unit of each activity are provided below: Resource Cost Activities Unit Time Driver Salaries $500,000 Creating BOMs 0.5 hr. No. of BOMs Equipment 100,000 Designing Tools 5.4 hr. No. of tools designs Supplies 30,000 Improving processes 1.0 hr. Process improvement hrs Total $630,000 Training employees 2.0 hr. No. of training sessions Studying capabilities 1.0 hr. Study hrs. Total machine and labor hours (at practical capacity):…arrow_forwardUsing the direct method, compute for the factory overhead rate of the D department if it apply overhead based on direct labor hours and budgeted direct labor hours for the period total to 75,000 hours. (SOLUTIONS MUST BE IN GOOD ACCOUNTING FORM. EXCEL FORM WOULD BE GREAT. ACCOUNT TITLES ON THE LEFT, AMOUNTS ON THE RIGHT. USE TABLE IF NECESSARY. AVOID PARENTHETICAL SOLUTIONS. THANKS, A LOT!)arrow_forwardYour manager asks you to bring the following incomplete accounts of Endeavor Printing, Inc., up to date through January 31, 2017. Consider the data that appear in the T-accounts as well as the following information in items (a) through (j). Endeavor's normal-costing system has two direct-cost categories (direct material costs and direct manufacturing labor costs) and one indirect-cost pool (manufacturing overhead costs, which are allocated using direct manufacturing labor costs). Materials Control Wages Payable Control 12-31-2016 Bal. 30,000 1-31-2017 Bal. 6,000 Work-in-Process Control Manufacturing Overhead Control 1-31-2017 Bal. 114,000 Finished Goods Control Costs of Goods Sold 12-31-2016 Bal. 40,000 Additional information follows: a. Manufacturing overhead is allocated using a budgeted rate that is set every December. You forecast next year's manufacturing overhead costs and next year's direct manufactur- ing labor costs. The budget for 2017 is $1,200,000 for manufacturing overhead…arrow_forward

- Lowry Music manufacturers music books. They use an ABC costing system. The relevant cost information is provided below: Activity Cost Driver Estimated cost pool Estimated cost driver Printing DL hours $310,000 20,000 DL hours Finishing machine hours $260,000 13,000 machine hours Movement # moves $80,000 10 movements Total The actual cost driver information is as follows: 21,000 machine hours 12,500 DL hours 5 moves Calculate the total applied manufacturing overhead costs. Please provide your answer to the nearest whole dollar. Do not include the "$" sign. incorrect answer: 615500arrow_forwardUsing Excel to prepare a production cost report. Download an Excel temp/are for this problem online in MyAccountingLab or at http://www.pearsonhighered.com/Horngren. Salish Craft Beers provides the following information for the Malting Department for the month of August 2018: Requirements Complete a production cost report for the Malting Department for the month of August 2018 to determine the cost of the units completed and transferred out, and the cost of the ending Work-in-Process Inventory. Assume Salish Craft Beers uses the weighted-average method.arrow_forwardRequired information Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below.] Textra produces parts for a machine manufacturer. Parts go through two departments, Molding and Trimming. The company budgets overhead cost of $246,250 in the Molding department and $206,250 in the Trimming department. The company budgets 16,000 machine hours (MH) in Molding and 25,000 direct labor hours (DLH) in Trimming. Actual production information follows. Number of Molding Department Units Hours per Unit Total Hours Trimming Department Hours per Unit Total Hours Part Z Part X Totals 3,000 2.0 MH per unit 4,000 2.5 MH per unit 6,000 MH 10,000 MH 16,000 MH 3 DLH per unit 9,000 DLH 4 DLH per unit 16,000 DLH 25,000 DLH Exercise 17-7 (Algo) Plantwide overhead rate LO P1 Required: 1. Compute the plantwide overhead rate using direct labor hours as the allocation base. 2. Determine the overhead cost per unit for each part using the…arrow_forward

- Lowry Music manufacturers music books. They use an ABC costing system. The relevant cost information is provided below: Activity Cost Driver Estimated cost pool Estimated cost driver Printing machine hours $310,000 20,000 machine hours Finishing DL hours $260,000 13,000 DL hours Movement # moves $80,000 10 movements Total The actual cost driver information is as follows: 21,000 machine hours 12,500 DL hours 5 moves Calculate the total applied manufacturing overhead costs. Please provide your answer to the nearest whole dollar. Do not include the "$" sign.arrow_forwardBob Randall, cost accounting manager for Hemple Products, was asked to determine the costs of the activities performed within the company's Manufacturing Engineering Department. The department has the following activities: creating bills of materials (BOMs), studying manufacturing capabilities, improving manufacturing processes, training employees, and designing tools. The resource costs (from the general ledger) and the times to perform one unit of each activity are provided below. Resource Costs Activities Unit Time Driver Salaries $425,000 Creating BOMs 0.6 hr. No. of BOMs Equipment 92,000 Designing tools 3.7 hrs. No. of tool designs Supplies 43,000 Improving processes 1.1 hrs. Process improvement hrs. Total $560,000 Training employees 2.1 hrs. No. of training sessions Studying capabilities 2.1 hrs. Study hours Total machine and labor hours (at practical capacity): Machine…arrow_forwardThe following information has been extracted from the cost accounting information system database for Casio Ltd. The company manufactures Casio Calculators. The cost accountant wants to carry out some analysis on the following 5 costs to ascertain the behavior of the The cost accountant extracted the values of the 5 costs at three activity levels of 24,000 units,30,000 units and 36,000 units. (Note: The cost accountant intends to use the units produced as the activity level in the cost analysis. Units Produced 24,000 30,000 36,000 Costs Incurred: 1.Direct materials 108,000 135,000 162,000 2.Direct wages 124,800 156,000 187,200 3.Production overheads 132,400 158,500 184,600 4.Other overhead costs 169,200 210,000 250,800 5.Administration overheads 40,500 40,500 40,500 Required: Using the information provided in the above table identify and explain how you classify each of the above…arrow_forward

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub