Concept explainers

Cornerstone Exercise 2-22 Transaction Analysis

The Mendholm Company entered into the following transactions:

- Performed services on account, 521,500.

- Collected $9,500 from client related to services performed in Item a.

- Find $500 dividend to stockholders.

- Paid salaries of $4,000 for the current month.

(Continued)

Required:

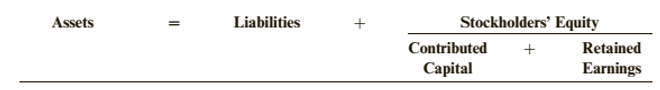

Show the effect of each transaction using the following model:

Concept Introduction:

Transaction Analysis- Every transaction is first analyzed by accountant with the help of accounting equation to see transactions that affects the business event. This is known as transaction analysis which states that each transaction is analyzed to determine the effect of each transaction in two parts or dual effect on each element of an accounting equation so that the equation is in balance. The accounting equation is shown as:

Requirement 1:

To show the effect on Mendholm Company when it performed services on account for $21500.

Answer to Problem 22CE

In this situation, when Mendholm Company performed services on account for $21500, it will increase assets and increases shareholder’s equity by $21500.

Explanation of Solution

When Mendholm Company performed services for which payment will be made later, this is known as ‘sale on account’. This creates an asset called accounts receivable which will be increased by $21500because payment is due from client. Also, revenue is recorded when service is performed and not when cash is received. Thus, retained earnings will also increase by $21500. This effect in accounting equation will be shown as:

Concept Introduction:

Transaction Analysis- Every transaction is first analyzed by accountant with the help of accounting equation to see transactions that affects the business event. This is known as transaction analysis which states that each transaction is analyzed to determine the effect of each transaction in two parts or dual effect on each element of an accounting equation so that the equation is in balance. The accounting equation is shown as:

Requirement 2:

To show the effect on Mendholm Companywhen cash of $9500 is collected from client for services performed on account.

Answer to Problem 22CE

When cash of $9500 is collected from client for services performed on account, it will increase assets for cash received and reduce assets at the same for decrease in accounts receivable created earlier.

Explanation of Solution

In this case, cash is collected from a client for services performed earlier on account which means that asset in the form of cash received has increased for Mendholm Company by $9500. Also, accounts receivable was increased at the time when the services were performed. So, now at the time pf payment, this will be reduced by $9500. Thus, the effect of this transaction on accounting equation will be shown as:

Concept Introduction:

Transaction Analysis- Every transaction is first analyzed by accountant with the help of accounting equation to see transactions that affects the business event. This is known as transaction analysis which states that each transaction is analyzed to determine the effect of each transaction in two parts or dual effect on each element of an accounting equation so that the equation is in balance. The accounting equation is shown as:

Requirement 3:

Toshow the effect on Mendholm Company whendividend of $500 is paid to stock holders.

Answer to Problem 22CE

In this case, if dividend is paid to stock holders, it will decrease assets(cash) and retained earnings from stockholder’s equity by $500.

Explanation of Solution

Dividends when declared are distributed from retained earnings as a contribution in stockholder’s equity fund. Thus, when Mendholm Company is paying dividend it will reduce the retained earnings by $500. Also, since it is cash dividend to stockholders, therefore, it will reduce assets in the form of cash by $500. This will be reflected in accounting equation as:

Concept Introduction:

Transaction Analysis- Every transaction is first analyzed by accountant with the help of accounting equation to see transactions that affects the business event. This is known as transaction analysis which states that each transaction is analyzed to determine the effect of each transaction in two parts or dual effect on each element of an accounting equation so that the equation is in balance. The accounting equation is shown as:

Requirement 4:

To show the effect on Mendholm Company whensalaries of $4000 is paid for current month.

Answer to Problem 22CE

In this case, salaries paid for current month will reduce assets by $4000 and decrease retained earnings by 4000.

Explanation of Solution

Since expense is a cost of asset consumed as a part of operating activity, so salaries are treated as an expense which when paid will reduce the retained earnings. Thus, retained earnings will be reduced by $4000. Also, since salaries are paid in cash, it will reduce assets by $4000. According to expense recognition principle, expenses are recorded in the same period when it helped to generate revenue. Since this transaction is related to Mendholm Company’s operations, therefore, it is classified as an operating activity. This will be shown in accounting equation as:

Want to see more full solutions like this?

Chapter 2 Solutions

Cornerstones of Financial Accounting

- Analyzing the Accounts The controller for Summit Sales Inc. provides the following information on transactions that occurred during the year: a. Purchased supplies on credit, $18,600 b. Paid $14,800 cash toward the purchase in Transaction a c. Provided services to customers on credit1 $46,925 d. Collected $39,650 cash from accounts receivable e. Recorded depreciation expense, $8,175 f. Employee salaries accrued, $15,650 g. Paid $15,650 cash to employees for salaries earned h. Accrued interest expense on long-term debt, $1,950 i. Paid a total of $25,000 on long-term debt, which includes $1.950 interest from Transaction h j. Paid $2,220 cash for l years insurance coverage in advance k. Recognized insurance expense, $1,340, that was paid in a previous period l. Sold equipment with a book value of $7,500 for $7,500 cash m. Declared cash dividend, $12,000 n. Paid cash dividend declared in Transaction m o. Purchased new equipment for $28,300 cash. p. Issued common stock for $60,000 cash q. Used $10,700 of supplies to produce revenues Summit Sales uses the indirect method to prepare its statement of cash flows. Required: 1. Construct a table similar to the one shown at the top of the next page. Analyze each transaction and indicate its effect on the fundamental accounting equation. If the transaction increases a financial statement element, write the amount of the increase preceded by a plus sign (+) in the appropriate column. If the transaction decreases a financial statement element, write the amount of the decrease preceded by a minus sign (-) in the appropriate column. 2. Indicate whether each transaction results in a cash inflow or a cash outflow in the Effect on Cash Flows column. If the transaction has no effect on cash flow, then indicate this by placing none in the Effect on Cash Flows column. 3. For each transaction that affected cash flows, indicate whether the cash flow would be classified as a cash flow from operating activities, cash flow from investing activities, or cash flow from financing activities. If there is no effect on cash flows, indicate this as a non-cash activity.arrow_forwardReturn on assets The following data (in millions) were adapted from recent financial statements of Tootsie Roll Industries Inc. (TR): What is Tootsie Roll’s percent of the cost of sales to sales? Round to one decimal place.arrow_forwardSingle-step income Statement and balance sheet Selected accounts and related amounts for Kanpur Co. for the fiscal year ended June 30. 20Y7. arc presented in Problem 5-5B. Instructions 1.Prepare a single-step income statement in the format shown in Exhibit 13. 2.Prepare a statement of stockholders equity. Additional common stock of 7.500 was issued during the year ended June 30. 20Y7. 3.Prepare a balance sheet, assuming that the current portion of the note payable is 7,000. 4.Prepare closing entries as of June 30, 20Y7.arrow_forward

- Transactions Interstate Delivery Service is owned and operated by Katie Wyer. The following selected transactions were completed by Interstate Delivery during May: 1. Received cash in exchange for common stock, 18,000. 2. Paid advertising expense, 4,850. 3. Purchased supplies on account, 2,100. 4. Billed customers for delivery services on account, 14,700. 5. Received cash from customers on account, 8,200. Indicate the effect of each transaction on the following accounting equation elements: Assets, Liabilities, Common Stock, Dividends, Revenue, and Expense. To illustrate, the answer to (1) follows: (1) Asset (Cash) increases by 18,000; Common Stock increases by 18,000.arrow_forwardMultiple-step income statement and balance sheet The following selected accounts and their current balances appear in the ledger of Kanpur Co. for the fiscal year ended June 30, 20Y7: Instructions 1. Prepare a multiple-step income statement. 2. Prepare a statement of stockholders equity. Additional common stock of 7,500 was issued during the year ended June 30, 20Y7. 3. Prepare a balance sheet, assuming that the current portion of the note payable is 7,000. 4. Briefly explain how multiple and single-step income statements differ.arrow_forwardSales transactions Using transactions listed in P4-2, indicate the effects of each transaction on the liquidity metric working capital and profitability metric gross profit percent. Indicate the gross profit percent for each sale (rounding to one decimal place) in parentheses next to the effect of the sale on the company’s ability to attain an overall gross profit percent of 30%.arrow_forward

- Discuss how each of the following transactions for Watson, International, will affect assets, liabilities, and stockholders equity, and prove the companys accounts will still be in balance. A. An investor invests an additional $25,000 into a company receiving stock in exchange. B. Services are performed for customers for a total of $4,500. Sixty percent was paid in cash, and the remaining customers asked to be billed. C. An electric bill was received for $35. Payment is due in thirty days. D. Part-time workers earned $750 and were paid. E. The electric bill in C is paid.arrow_forwardGiven the ledger accounts of Devrij Company as of January 31, 2020: Cash $26,400 Accounts Payable $9,000 Supplies Share Capital-Ordinary 15,600 6,600 Rent Expense 16,800 Accounts Receivable 13,200 Notes Payable 7,200 Service Revenue 31,200 Required: 1. Compute the total of the debit side of the trial balance. (show your computation). 2. Compute the total of the credit side of the trial balance. (show your computation)arrow_forwardView Policies Current Attempt in Progress Sheridan Ltd. has the following selected transactions: 1. 2. 3. 4. 5. 6. 7. 8. Issued common shares to shareholders in exchange for $6,800. Paid rent in advance for two months, $2,800. Paid administrative assistant $700 salary. Billed clients $1,600 for services provided. Received $1,200 in partial payment from clients for services provided in item 4 above. Purchased $700 of supplies on account. Paid supplier amount owing on account, $700. Borrowed $1,400 cash from the bank to purchase equipment. 1. Journalize the transactions for Sheridan Ltd. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) No Account Titles and Explanation 2. 3. Asset Debit Cash 5 Credit !!arrow_forward

- FIN ANCIAL RATIO S Based on the financial statements for Jackson Enterprises (income statement, statement of owner’s equity, and balance sheet) shown on pages 596–597, prepare the following financial ratios. All sales are credit sales. The Accounts Receivable balance on January 1, 20--, was $21,600.1. Working capital2. Current ratio3. Quick ratio4. Return on owner’s equity5. Accounts receivable turnover and average number of days required to collect receivables6. Inventory turnover and average number of days required to sell inventoryarrow_forwardStudy the following balance sheet to help you prepare for your upcoming interview for an entry-level analyst position at Galaxy Corporation. Galaxy Corporation Balance Sheet Cash $656,250 Accounts payable $1,575,000 Accounts receivable $2,296,875 Accruals $984,375 Inventory $3,609,375 Notes payable $1,378,125 Total current assets $6,562,500 Total current liabilities $3,937,500 Long-term debt $6,562,500 Total debt $10,500,000 Common equity $2,100,000 Net plant and equipment $10,937,500 Retained earnings $4,900,000 Total equity $7,000,000 Total assets $17,500,000 Total liabilities and equity $17,500,000 During your interview for an introductory-level analyst position at Galaxy Corporation, the interviewer asks you to complete the following table using the information provided in the preceding balance sheet. Net Working Capital $__________________________ Current Ratio…arrow_forwardThe following is a trial balance of Barnhart Company as December 31, Year 1: Account Title: Cash Accounts Receivable Accounts Payable Common Stock Retained Earnings Service Revenue Operating Expenses Dividends Totals Multiple Choice 5,700 560 22,910 22,910 What is the total amount of assets that will be reported on the balance sheet prepared as of December 31, Year 1? $16,650. $22,910. $13,100. Debit Credit 13,100 3,550 $24,700. 3,100 7,200 4,560 8,050arrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,