Concept explainers

Problem 2-37A Effect of

CHECK FIGURES

d. Adjustment amount: $4,000

Required

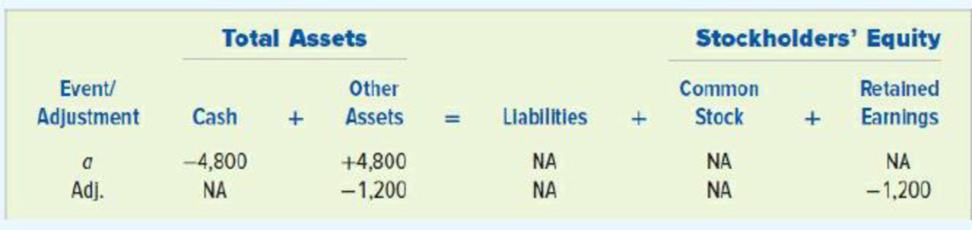

Each of the following independent events requires a year-end adjusting entry. Show how each event and its related adjusting entry affect the accounting equation. Assume a December 31 closing date. The first event is shown as an example.

- a. Paid $4,800 cash in advance on October 1 for a one-year insurance policy.

- b. Received a $3,600 cash advance for a contract to provide services in the future. The contract required a one-year commitment, starting April 1.

- c. Purchased $1,200 of supplies on account. At year’s end, $175 of supplies remained on hand.

- d. Paid $9,600 cash in advance on August 1 for a one-year lease on office space.

Show the manner in which the events and its related adjusting entries would affect the accounting equation.

Answer to Problem 33P

Prepare a table exhibiting the events and the adjusting entries that would affect the accounting equation are as follows:

| Company | ||||||||

| Accounting equation | ||||||||

| Event / Adjustment | Total Assets | = | Liabilities | + | Stockholder's Equity | |||

| Cash | Other assets | Common Stock | Retained Earnings | |||||

| a. (Given) | ($4,800) | + | $4,800 | = | NA | + | NA | NA |

| Adjustment (1) | NA | + | ($1,200) | = | NA | + | NA | ($1,200) |

| b. | $3,600 | + | NA | = | $3,600 | + | NA | NA |

| Adjustment (2) | NA | + | NA | = | ($2,700) | + | NA | $2,700 |

| c. | NA | + | $1,200 | = | $1,200 | + | NA | NA |

| Adjustment (3) | NA | + | ($1,025) | = | NA | + | NA | ($1,025) |

| d. | ($9,600) | + | $9,600 | = | NA | + | NA | NA |

| Adjustment (4) | NA | + | ($4,000) | = | NA | + | NA | ($4,000) |

Table (1)

Explanation of Solution

Accounting equation: Accounting equation is an accounting tool expressed in the form of equation, by creating a relationship between the resources or assets of a company, and claims on the resources by the creditors and the owners. Accounting equation is expressed as shown below.

The effects of the events and adjustments can be explained as follows:

a. Paid $4,800 cash in advance on October 1 for a one-year insurance policy.

The cash account (asset) is decreased by $4,800 and the prepaid insurance (asset) account is increased by $4,800. When the insurance expense is recognized for 3 months at the end of the year, the prepaid insurance (asset) account is decreased by $1,200 (1) and amount of insurance expense (expense account) is increased by $1,200. Increase in insurance expense account decreases the retained earnings by the same amount.

b. Received a $3,600 cash advance for a contract to provide services in the future. The contract required a one-year commitment, starting April 1.

The cash account (asset) is increased by $3,600 and the unearned revenue account (liability) is increased by $3,600. The revenue would be recognized when the services are provided to the client. After providing the service for 9 months from April 1 to December 31, revenue should be recognized for 9 months at the end of the year. While recognizing the earned unearned revenue, the unearned revenue (liability) is decreased by $2,700 (2) and the revenue account is increased by $2,700. Increase in revenue account increases the retained earnings by the same amount.

c. Purchased $1,200 of supplies on account. At year’s end, $175 of supplies remained on hand.

The supplies account (asset) is increased by $1,200 and the accounts payable (liability) account is increased by $1,200. When the supplies expenses are recognized, the supplies account (asset) is decreased by $1,025 (3) and the expense account is increased by $1,025. Increase in the expense account decreases the retained earnings by the same amount.

d. Paid $9,600 cash in advance on August 1 for a one-year lease on office space.

The cash account (asset) is decreased by $9,600 and the prepaid rent (asset) account is increased by $9,600. When the rent expense is recognized at the end of the year for 3 months, the prepaid rent (asset) account is decreased by $4,000 (4) and amount of insurance expense (expense account) is increased by $4,000. Increase in insurance expense account decreases the retained earnings by the same amount.

Working Note:

Determine the amount of prepaid insurance recognized at the end of year.

Determine the amount of revenue recognized at the end of year.

Determine the amount of supplies used at the end of year.

Determine the amount of prepaid rent recognized at the end of year.

Want to see more full solutions like this?

Chapter 2 Solutions

Survey Of Accounting

- JOURNAL ENTRIES (ACCRUED INTEREST RECEIVABLE) At the end of the year, the following interest is earned, but not yet received. Record the adjusting entry in a general journal. Interest on 6,000, 60-day, 5.5% note (for 24 days) 22.00 Interest on 9,000, 90-day, 6% note (for 12 days) 18.00 40.00arrow_forwardUNCOLLECTIBLE ACCOUNTSALLOWANCE METHOD Lewis Warehouse used the allowance method to record the following transactions, adjusting entries, and closing entries during the year ended December 31, 20--: Selected accounts and beginning balances on January 1, 20--, are as follows: REQUIRED 1. Open the three selected general ledger accounts. 2. Enter the transactions and the adjusting and closing entries in a general journal (page 6). After each entry, post to the appropriate selected accounts. 3. Determine the net realizable value as of December 31, 20--.arrow_forwardSALES RETURNS AND ALLOWANCES ADJUSTMENT At the end of year 1, MCs estimates that 2,400 of the current years sales will be returned in year 2. Prepare the adjusting entry at the end of year 1 to record the estimated sales returns and allowances and customer refunds payable for this 2,400. Use accounts as illustrated in the chapter.arrow_forward

- UNCOLLECTIBLE ACCOUNTSALLOWANCE METHOD Pyle Nurseries used the allowance method to record the following transactions, adjusting entries, and closing entries during the year ended December 31, 20--. REQUIRED 1. Open the three selected general ledger accounts. 2. Enter the transactions and the adjusting and closing entries in a general journal (page 6). After each entry, post to the appropriate selected accounts. 3. Determine the net realizable value as of December 31.arrow_forwardPrepaid Rent—Quarterly Adjustments On September 1, Northhampton Industries signed a six-month lease for office space, which is effective September 1. Northhampton agreed to prepay the rent and mailed a check for $12,000 to the landlord on September 1. Assume that Northhampton prepares adjusting entries only four times a year: on March 31, June 30, September 30, and December 31. Required Compute the rental cost for each full month. Prepare the journal entry to record the payment of rent on September 1. Prepare the adjusting entry on September 30. Assume that the accountant prepares the adjusting entry on September 30 but forgets to record an adjusting entry on December 31. Will net income for the year be understated or overstated? by what amount?arrow_forwardInterest Payable—Quarterly Adjustments Glendive takes out a 12%, 90-day, $100,000 loan with Second State Bank on March 1, 2016. Assume that Glendive prepares adjusting entries only four times a year: on March 31, June 30, September 30, and December 31. Required Prepare the journal entry on March 1, 2016. Prepare the adjusting entry on March 31, 2016. Prepare the entry on May 30, 2016, when Glendive repays the principal and interest to Second State Bank.arrow_forward

- Question Content Area Allowance for Doubtful Accounts has a debit balance of $570 at the end of the year (before adjustment), and Bad Debt Expense is estimated at 2% of credit sales. If credit sales are $950,400, the amount of the adjusting entry for uncollectible accounts is a. $19,008 b. $18,438 c. cannot determine without more information d. $19,578arrow_forwardQuestion Content Area After the accounts are adjusted and closed at the end of the fiscal year, Accounts Receivable has a balance of $702,763 and Allowance for Doubtful Accounts has a balance of $22,123. What is the net realizable value of the accounts receivable? a. $702,763 b. $680,640 c. $724,886 d. $22,123arrow_forwardRepayment Schedule End of Month Monthly Payment Interest Portion Principal Outstanding Principal Balance January $266.55 $30.00 $236.55 $2,763.45 February 266.55 27.63 238.92 2,524.53 March 266.55 25.25 241.30 2,283.23 April 266.55 22.83 243.72 2,039.51 Мay 266.55 20.40 246.15 1,793.36 June 266.55 17.93 248.62 1,544.74 July 266.55 15.45 251.10 1,293.64 August 266.55 12.94 253.61 1,040.03 September 266.55 10.40 256.15 783.88 October 266.55 7.84 258.71 525.17 November 266.55 5.25 261.30 263.87 December 266.51 2.64 263.87 0.00 Total $3,198.56 $198.56 $3,000.00 Effective interest rate: Monthly rate = 1% Annual percentage rate (APR) = 12% Monthly payment = $3,000/ f(1.01) Calculate the effective annual rate on each of the following loans: a. A $5,000 loan for two years, 10 percent simple annual interest, with principal repayment at the end of the second year b. A $5,000 loan for two years, 10 percent add-on interest, paid in 24 equal monthly installments c. A $5,000 loan to be repaid at the…arrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage