Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

thumb_up100%

Chapter 2, Problem 34P

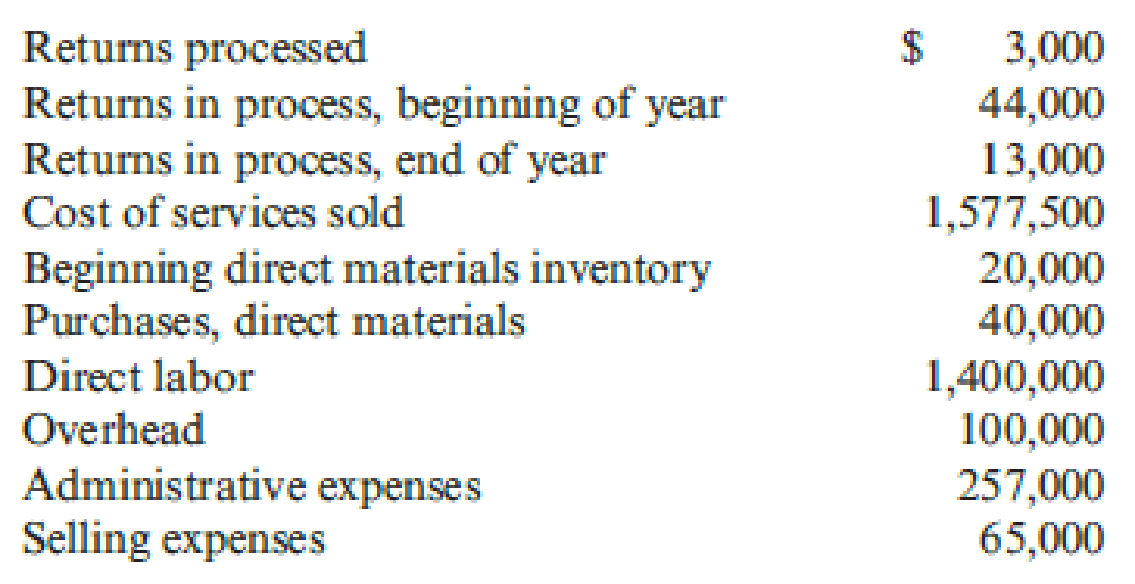

Mason, Durant, and Westbrook (MDW) is a tax services firm. The firm is located in Oklahoma City and employs 15 professionals and eight staff. The firm does tax work for small businesses and well-to-do individuals. The following data are provided for the last fiscal year. (The Mason, Durant, and Westbrook fiscal year runs from July 1 through June 30.)

Required:

- 1. Prepare a statement of cost of services sold.

- 2. Refer to the statement prepared in Requirement 1. What is the dominant cost? Will this always be true of service organizations? If not, provide an example of an exception.

- 3. Assuming that the average fee for processing a return is $850, prepare an income statement for Mason, Durant, and Westbrook.

- 4. Discuss three differences between services and tangible products. Calculate the average cost of preparing a tax return for last year. How do the differences between services and tangible products affect the ability of MDW to use the last year’s average cost of preparing a tax return in budgeting the cost of tax return services to be offered next year?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Trombone deducts employment taxes from its employees' wages on a monthly basis and pays these to the local taxation authorities in the following month. At the year-end the financial statements will contain an accrual for income tax payable on employment income. You will be in charge of auditing this accrual.

Question: Describe the audit procedures required in respect of the year-end accrual for tax payable on employment income.

GV is a small accounting firm supporting wealthy individuals in their preparation ofannual income tax statements. Every December, GV sends out a short survey to itscustomers, asking for the information required for preparing the tax statements. Basedon 50 years of experience, GV categorizes its cases into the following two groups:• Group 1 (new customers): 20 percent of cases• Group 2 (repeat customers): 80 percent of casesThis year, there are 50 income tax statements arriving each week.In order to prepare the income tax statement, GV has three resources.The activities are carried out by the following three persons:• An administrative support person who processes every tax statement.• A senior accountant (who is also the owner) who processes only tax statements fornew customers.• A junior accountant who only processes tax statements for repeat customers.What is the total demand rate for each of the three resources?

A CPA prepares tax returns for clients and bills them after the work is completed. It usually takes two weeks of work to prepare the tax returns. It takes 30 days on

average to receive payment from the clients. The CPA uses cash-basis accounting. The revenue should be recorded when the CPA:

O A. receives payments from the clients

O B. bills the clients.

OC. starts working on the tax returns

O D. completes working on the tax returns.

Click to select your answer.

11-50nm

99+

Chapter 2 Solutions

Cornerstones of Cost Management (Cornerstones Series)

Ch. 2 - What is an accounting information system?Ch. 2 - What is the difference between a financial...Ch. 2 - What are the objectives of a cost management...Ch. 2 - Define and explain the two major subsystems of the...Ch. 2 - What is a cost object? Give some examples.Ch. 2 - Prob. 6DQCh. 2 - What is a direct cost? An indirect cost?Ch. 2 - Prob. 8DQCh. 2 - What is allocation?Ch. 2 - Explain how driver tracing works.

Ch. 2 - What is a tangible product?Ch. 2 - Prob. 12DQCh. 2 - Give three examples of product cost definitions....Ch. 2 - Prob. 14DQCh. 2 - Prob. 15DQCh. 2 - Pietro Frozen Foods, Inc., produces frozen pizzas....Ch. 2 - For next year, Pietro predicts that 50,000 units...Ch. 2 - Pietro expects to produce 50,000 units and sell...Ch. 2 - Refer to Cornerstone Exercises 2.2 and 2.3. Next...Ch. 2 - Jean and Tom Perritz own and manage Happy Home...Ch. 2 - Jean and Tom Perritz own and manage Happy Home...Ch. 2 - Jean and Tom Perritz own and manage Happy Home...Ch. 2 - Jean and Tom Perritz own and manage Happy Home...Ch. 2 - Prob. 9ECh. 2 - The following items are associated with a cost...Ch. 2 - Nizam Company produces speaker cabinets. Recently,...Ch. 2 - Three possible product cost definitions were...Ch. 2 - Wyandotte Company provided the following...Ch. 2 - For each of the following independent situations,...Ch. 2 - LeMans Company produces specialty papers at its...Ch. 2 - Kildeer Company makes easels for artists. During...Ch. 2 - Anglin Company, a manufacturing firm, has supplied...Ch. 2 - Lakeesha Barnett owns and operates a package...Ch. 2 - Millennium Pharmaceuticals, Inc. (MPI), designs...Ch. 2 - Jazon Manufacturing produces two different models...Ch. 2 - Ellerson Company provided the following...Ch. 2 - Ellerson Company provided the following...Ch. 2 - Orinder Company provided the following information...Ch. 2 - Last year, Orsen Company produced 25,000 juicers...Ch. 2 - Last year, Orsen Company produced 25,000 juicers...Ch. 2 - The ability to assign a cost directly to a cost...Ch. 2 - Selected information concerning the operations of...Ch. 2 - Brody Company makes industrial cleaning solvents....Ch. 2 - Wright Plastic Products is a small company that...Ch. 2 - The following items are associated with a...Ch. 2 - The actions listed next are associated with either...Ch. 2 - Spencer Company produced 200,000 cases of sports...Ch. 2 - Prob. 33PCh. 2 - Mason, Durant, and Westbrook (MDW) is a tax...Ch. 2 - Orman Company produces neon-colored covers for...Ch. 2 - High drug costs are often in the news. Consumer...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Sanchez & Vukmin, LLP, is a full-service accounting firm located near Chicago, Illinois. Last year, Sanchez provided tax preparation services to 500 clients. Total fixed costs were $265,000 with total variable costs of $180,000. Based on this information, complete this chart.arrow_forwardGrotto Ltd has already sent $19,600 to the ATO in respect to PAYG, and this figure shown as a debit in the Income Tax Expense account. The Profit and Loss account is then prepared and the Net Profit (before tax) is found to be $75,000. The current company tax rate is 30%. Required: Prepare general journal entries for the following Correct the Income Tax Expense account Close the Income Tax Expense account Transfer Net Profit (after tax) to Retained Earningsarrow_forwardCongratulations on your appointment as a Tax Trainee at a recognized audit firm in Jamaica. On your first assignment your supervisor asked you to assist him with the income tax computation of a small business in the tourism sector. The company provided the following information: Allen’s Rest Well Resort is a resort cottage located incorporated in Jamaica. The company is a registered tourism operator under the Tourist Board Act. The hotelcommenced operations on the 1 January 2019. Fixed Assets Cost (J$) TWDV (J$)Building (hotel) 100,000,000 72,000,000Furnitures 8,000,000 6,000,000Computers (laptops and CPUs)…arrow_forward

- Congratulations on your appointment as a Tax Trainee at a recognized audit firm in Jamaica. On your first assignment your supervisor asked you to assist him with the income tax computation of a small business in the tourism sector. The company provided the following information: Allen's Rest Well Resort is a resort cottage located incorporated in Jamaica. The company is a registered tourism operator under the Tourist Board Act. The hotel commenced operations on the 1 January 2019. Fixed Assets Cost (J$) TWDV (J$) Building (hotel) Furnitures Computers (laptops and CPUS) Computers (printers and monitors) 100,000,000 8,000,000 1,000,000 500,000 72,000,000 6,000,000 500,000 375,000 Motor Cars # 1 purchased in July 2019 3,000,000 2,437,500 # 2 purchased January 2019 Bus and Vans (purchased 1 January 2019) 2,500,000 8,00,0000 1,875,000 480,000 The following acquisitions and disposal occurred in 2021: 1. A Corolla motor car purchased for $3,000,000. Acquired 1 April 2021. 2. A BMW for…arrow_forwardThe WongGroup (WG) provides tax advice to multinational firms. WG charges clients for (a) direct professional time (at an hourly rate) and (b) support services (at 30% of the direct professional costs billed). The three professionals in WG and their rates per professional hour are as follows: WG has just prepared the May 2017bills for two clients. The hours of professional time spent on each client are as follows: Read the requirements3. Requirement 1. What amounts did WG bill to South Beach Dominion and London Enterprises for May 2017? Determine the formula needed to calculate the total cost per professional for each client when WG allocates support costs at 30% of direct professional costs. (1) + ( (2) × (3) ) = Cost per professional Complete the table below to determine the amounts that WG billed to South Beach Dominion and London Enterprises for May 2017. Begin with South Beach Dominion. South Beach…arrow_forwardTo have all regular tax associates attend at least 15 CPD units sponsored by the accounting firm during the current year. Determine whether A. FinancialB. Nonfinancialarrow_forward

- For the purpose of process analysis, which of the following measures would be considered an appropriate flow unit for analyzing the main operation of a local accountingfirm? Instructions: You may select more than one answer.a. Number of accountants working each weekb. Number of tax returns completed each weekc. Number of customers with past-due invoicesd. Number of reams of paper received from suppliersarrow_forwardEaton Enterprises uses the wage-bracket method to determine federal income tax withholding on its employees. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. Open spreadsheet Find the amount to withhold from the wages paid each employee. Enter all amounts as positive numbers. If an amount is zero, enter "0". Round interim calculations to two decimals and use in subsequent computations. Round final answer to two decimal places. As we go to press, the federal income tax rates for 2022 are being determined by budget talks in Washington and not available for publication. For this edition, the 2021 federal income tax tables for Manual Systems with Forms W-4 from 2020 or later with Standard Withholding and 2020 FICA rates have been used. Click here to access the Wage-Bracket Method Tables. Employee FilingStatus No. ofWithholdingAllowances Payroll…arrow_forwardCongratulations on your appointment as a Tax Trainee at a recognized audit firm in Jamaica. On your first assignment your supervisor asked you to assist him with the income tax computation of a small business in the tourism sector. The company provided the following information Allen’s Rest Well Resort is a resort cottage located incorporated in Jamaica. The company is a registered tourism operator under the Tourist Board Act. The hotelcommenced operations on the 1 January 2019. Fixed Assets Cost (J$) TWDV (J$) Building (hotel) 100,000,000 Furnitures 8,000,000 Computers (laptops and CPUs) 1,000,000 Computers (printers and monitors) 500,000 Motor Cars # 1 purchased in July 2019 # 2 purchased January 2019 3,000,000 2,500,000 2,437,500 1,875,000 Bus and Vans (purchased 1 January 2019) 8,00,0000 480,000 The following acquisitions and disposal occurred in 2021: 1. A Corolla motor car purchased for $3,000,000. Acquired 1 April 2021. 2. A BMW for…arrow_forward

- As a tax consultant, you receive tax forms and financial reports from various companies. Following are independent cases in which you have to check the given numbers and decide whether it is correct or not. If it is wrong, then you have to provide (a) the correct answer with detailed calculations and (b) explanations of your answers including the appropriate accounting treatment of the various transactions. A. National Tourism Company reported on 31 December, 2018 a pretax financial income of $900,000 which is subject to 40% tax rate. At the beginning of that year, the company had a deferred tax liability of $18,000 and a deferred tax asset of $12,000. During the year, National recorded warranty costs of $156,000 to be paid in 2019 and prepaid advertising expense that will be used in 2019 of $36,000. Also, the company in 2018 received an interest on governmental bonds of $72,000. National reported $114,000 operating losses carryforward and $78,000 of installment sales revenue to be…arrow_forwardAs a tax consultant, you receive tax forms and financial reports from various companies. Following are independent cases in which you have to check the given numbers and decide whether it is correct or not. If it is wrong, then you have to provide (a) the correct answer with detailed calculations and (b) explanations of your answers including the appropriate accounting treatment of the various transactions. A. National Tourism Company reported on 31 December, 2018 a pretax financial income of $900,000 which is subject to 40% tax rate. At the beginning of that year, the company had a deferred tax liability of $18,000 and a deferred tax asset of $12,000. During the year, National recorded warranty costs of $156,000 to be paid in 2019 and prepaid advertising expense that will be used in 2019 of $36,000. Also, the company in 2018 received an interest on governmental bonds of $72,000. National reported $114,000 operating losses carryforward and $78,000 of installment sales revenue to be…arrow_forwardElitz and Van Aken, CPAs, offer three types of services to clients: auditing, tax, and small business accounting. Based on experience and projected growth, the following billable hours have been estimated for the year ending December 31, 2020: Service Billable Hours Audit Department: Staff 22,400 Partners 7,900 Tax Department: Staff 13,200 Partners 5,500 Small Business Accounting Department: Staff 3,000 Partners 600 The average billing rate for staff is $160 per hour, and the average billing rate for partners is $350 per hour. Prepare a professional fees earned budget for Elitz and Van Aken, CPAs, for the year ending December 31, 2020, using the following column headings and showing the estimated professional fees by type of service rendered and add additional rows in the table as needed:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY