Excel Applications for Accounting Principles

4th Edition

ISBN: 9781111581565

Author: Gaylord N. Smith

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 2, Problem 4R

The

Information for the

- a. Cleaning supplies on hand on December 31, 2012, $18,750.

- b. Insurance premiums expired during the year, $1,800.

- c. Depreciation on equipment during the year, $21,600.

- d. Wages accrued but not paid at December 31, 2012, $1,830.

Suppose you discover that an assistant in your department had misunderstood your instructions and had provided you with the wrong information on two of the adjusting entries. Cleaning supplies consumed during the year should have been $18,750, and insurance premiums unexpired at year-end were $1,800. Make the corrections on your worksheet and save the corrected file as F1WORK4. Reprint the worksheet.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The information necessary for preparing the 2021 year-end adjusting entries for Bearcat Personal Training Academy appears below. Bearcat’s fiscal year-end is December 31. 1. Depreciation on the equipment for the year is $7,000. 2. Salaries earned (but not paid) from December 16 through December 31, 2021, are $4,000. 3. On March 1, 2021, Bearcat lends an employee $20,000. The employee signs a note requiring principal and interest at 9% to be paid on February 28, 2022. 4. On April 1, 2021, Bearcat pays an insurance company $13,200 for a two-year fire insurance policy. The entire $13,200 is debited to Prepaid Insurance at the time of the purchase. 5. Bearcat uses $1,700 of supplies in 2021. 6. A customer pays Bearcat $2,700 on October 31, 2021, for three months of personal training to begin November 1, 2021. Bearcat credits Deferred Revenue at the time of cash receipt.7. On December 1, 2021, Bearcat pays $6,000 rent to the owner of the building. The payment represents rent for December…

The balance in the prepaid insurance account, before adjustment at the end of the year, is $18,565.

Journalize the March 31 adjusting entry required under each of the following alternatives for determining the amount of the adjustment: (a) the amount of insurance expired during the year is $14,135; (b) the amount of unexpired insurance applicable to future periods is $4,430. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered.

The prepaid insurance account had a balance of $7,155 at the beginning of the year. The account was debited for $22,025 for premiums on policies

purchased during the year, ending on March 31.

Journalize the adjusting entry required under each of the following alternatives for determining the amount of the adjustment: (a) the amount of unexpired

insurance applicable to future periods is $8,765; (b) the amount of insurance expired during the year is $20,415. Refer to the Chart of Accounts for exact

wording of account titles.

Chapter 2 Solutions

Excel Applications for Accounting Principles

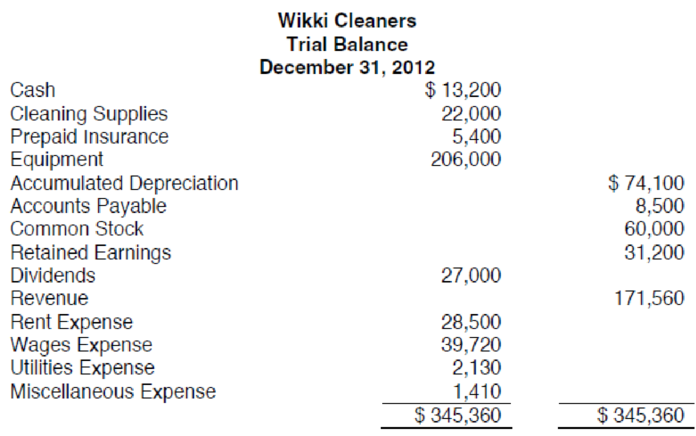

Ch. 2 - The trial balance of Wikki Cleaners at December...Ch. 2 - The trial balance of Wikki Cleaners at December...Ch. 2 - The trial balance of Wikki Cleaners at December...Ch. 2 - The trial balance of Wikki Cleaners at December...Ch. 2 - The trial balance of Wikki Cleaners at December...Ch. 2 - The trial balance of Wikki Cleaners at December...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The information necessary for preparing the 2021 year-end adjusting entries for Winter Storage appears below. Winter's fiscal year-end is December 31.Depreciation on the equipment for the year is $7,000.Salaries earned by employees (but not paid to them) from December 16 through December 31, 2021, are $3,400.On March 1, 2021, Winter lends an employee $12,000 and a note is signed requiring principal and interest at 6% to be paid on February 28, 2022.On April 1, 2021, Winter pays an insurance company $15,000 for a one-year fire insurance policy. The entire $15,000 is debited to prepaid insurance at the time of the purchase.$1,500 of supplies are used in 2021.A customer pays Winter $4,200 on October 31, 2021, for six months of storage to begin November 1, 2021. Winter credits deferred revenue at the time of cash receipt.On December 1, 2021, $4,000 rent is paid to a local storage facility. The payment represents storage for December 2021 through March 2022, at $1,000 per month. Prepaid…arrow_forwardThe information necessary for preparing the 2021 year-end adjusting entries for Gamecock Advertising Agency appears below. Gamecock’s fiscal year-end is December 31. 1. On July 1, 2021, Gamecock receives $6,000 from a customer for advertising services to be given evenly over the next 10 months. Gamecock credits Deferred Revenue. 2. At the beginning of the year, Gamecock’s depreciable equipment has a cost of $28,000, a four-year life, and no salvage value. The equipment is depreciated evenly (straight-line depreciation method) over the four years. 3. On May 1, 2021, the company pays $4,800 for a two-year fire and liability insurance policy and debits Prepaid Insurance. 4. On September 1, 2021, the company borrows $20,000 from a local bank and signs a note. Principal and interest at 12% will be paid on August 31, 2022. 5. At year-end there is a $2,700 debit balance in the Supplies (asset) account. Only $1,000 of supplies remains on hand.Required: Record the necessary adjusting entries on…arrow_forwardAt December 31, the unadjusted trial balance of H&R Tacks reports Equipment of $25,500 and zero balances in Accumulated Depreciation and Depreciation Expense. Depreciation for the period is estimated to be $5,100. Required: 1. Prepare the adjusting journal entry on December 31. 2. Post the beginning balances and adjusting entries to the following T-accounts. Complete this question by entering your answers in the tabs below. Required 11 Required 2 Post the beginning balances and adjusting entries to the following T-accounts. Accumulated Depreciation Beginning Balance Debit Ending Balance Credit Answer is not complete. 5,100 5,100 Beginning Balance Debit Ending Balance Creditarrow_forward

- At December 31, the unadjusted trial balance of H&R Tacks reports Equipment of $25,500 and zero balances in Accumulated Depreciation and Depreciation Expense. Depreciation for the period is estimated to be $5,100. Required: 1. Prepare the adjusting journal entry on December 31. 2. Post the beginning balances and adjusting entries to the following T-accounts. Complete this question by entering your answers in the tabs below. Required 11 Required 2 Post the beginning balances and adjusting entries to the following T-accounts. Accumulated Depreciation Beginning Balance Debit Ending Balance Credit Answer is not complete. 5,100 5,100 Beginning Balance Debit Ending Balance Creditarrow_forwardSafety First Company completed all of its October 31,2020 adjustments in preparation for preparing its financial statements which resulted in the following trial balance Other information: All accounts have normal balances $26,400 of the Notes payable balance is due by October 31, 2021 The final task in the year end process was to access the assets for impairment, which resulted in the following schedule Required: Prepare the entries to record any impairment losses at October 31, 2020. Assume the company recorded no impairment losses in the previous years Prepare a classified balance sheet at October 31, 2020 What is the impact on the financial statements of an impairment loss?arrow_forwardPrepare the adjusting journal entries as of Dec 31, 2019 for the following information gathered from the ledger of Flag Company : a.) Unexpired of the Prepaid Insurance account balance of P 42,500 was P 24,500. b.) Accrued Interest on Notes issued P 1,270. c.) Equipment acquired on March 31, 2019 at P 120,000, has a scrap value of P4,000 with estimated life of 10 years. d) Unrecorded unpaid taxes P 18,500. e.) Unpaid salaries P22,500. £.) Interest received and credited to Unearned Interest Income account was P 14,000 of which only P 12,000 was eamed. g.) Office supplies has a balance of P 8,000, Consumed as of Dec 31, 2019 was P 6,800. h.) Unearned Rent Income account has a balance of P 24,000 of which P 20,000 was rent earned. i.) Office Supplies balance was P5,600 of which P1,600 was consumed. Account Title Debit Credit a.) b.) e.) (P) e.) f.) g.) h.) i)arrow_forward

- Cedar Valley is a national restoration contractor licensed in roofing, siding, gutters and windows. Cedar Valley's balance of Allowance for Uncollectible Accounts is $2,300 (debit before adjustment at the end of the year. The company estimates future uncollectible accounts to be $11,500. What is the adjustment Cedar Valley would record for Allowance for Uncollectible Accounts? (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 1 Record the adjusting entry for Allowance for Uncollectible Accounts. Note: Enter debits before credits. Transaction General Jounal Debit Credit Record entry Clear entry View general journalarrow_forwardAt December 31, the unadjusted trial balance of H&R Tacks reports Equipment of $30,000 andzero balances in Accumulated Depreciation—Equipment and Depreciation Expense. Depreciationfor the period is estimated to be $6,000. Prepare the adjusting journal entry on December 31. Inseparate T-accounts for each account, enter the unadjusted balances, post the adjusting journalentry, and report the adjusted balancearrow_forwardThe balance in the unearned rent account for Jones Co. as of December 31 is $1,200. If Jones Co. failed to record the adjusting entry for $600 of rent earned during December, the effect on the balance sheet and income statement for December would be: A. Assets understated by $600; net income overstated by $600. B. Liabilities understated by $600; net income understated by $600. C. Liabilities overstated by $600; net income understated by $600. D. Liabilities overstated by $600; net income overstated by $600.arrow_forward

- Prepare adjusting journal entries, as needed, considering the account balances excerpted from the unadjusted trial balance and the adjustment data. A. supplies actual count at year end, $6,500 B. remaining unexpired insurance, $6,000 C. remaining unearned service revenue, $1,200 D. salaries owed to employees, $2,400 E. depreciation on property plant and equipment, $18,000arrow_forwardRequired 1. Prepare and complete a 10-column work sheet for fiscal year 2019, starting with the unadjusted trial balance and including adjustments based on these additional facts. a. The supplies available at the end of fiscal year 2019 had a cost of $7,900. b. The cost of expired insurance for the fiscal year is $10,600. c. Annual depreciation on equipment is $7,000. d. The April utilities expense of $800 is not included in the unadjusted trial balance because the bill arrived after the trial balance was prepared. The $800 amount owed needs to be recorded. e. The company’s employees have earned $2,000 of accrued and unpaid wages at fiscal year-end. f. The rent expense incurred and not yet paid or recorded at fiscal year-end is $3,000. g. Additional property taxes of $550 have been assessed for this fiscal year but have not been paid or recorded in the accounts. h. The $300 accrued interest for April on the long-term notes payable has not yet been paid or recorded. 2. Using information…arrow_forwardFrom the following given data, prepare adjusting journal entries for the year ended December 31, 2021: Purchase of supplies for P3,000. At the end of the year, P1,000 cost of supplies were actually used. Expense method was used in payment of supplies. A P48,000 6%, 120-day note was received from a client dated November 1, 2021. The interest was not yet collected at the end of the accounting period. Before adjustments, the balance of laundry supplies inventory was P35,000. Physical count of supplies inventory was P15,000. An office equipment was acquired on May 31, 2021 for P150,000. The office equipment has an estimated life of 5 years without scrap value. A copying machine was rented on November 30, 2021 at P1.00/copy of production. It reported to have produced 300 copies as of December 31, 2021. No payment was made as of this date. Signed an advertising contract on December 1, 2021 with a radio station for P3,500. The contract will commence upon payment on December 15. 2021 and will…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY