Backflush costing and JIT production. Grand Devices Corporation assembles handheld computers that have scaled-down capabilities of laptop computers. Each handheld computer takes 6 hours to assemble. Grand Devices uses a JIT production system and a backflush costing system with three trigger points:

- Purchase of direct materials

- Completion of good finished units of product

- Sale of finished goods

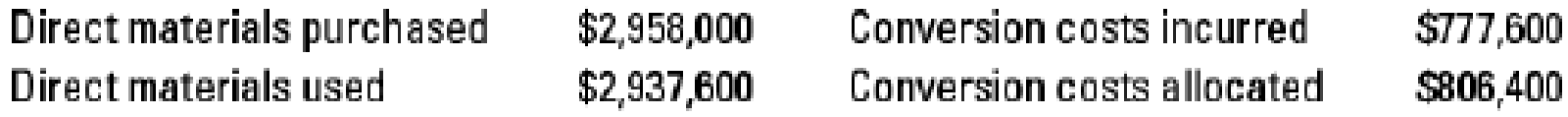

There are no beginning inventories of materials or finished goods and no beginning or ending work-in-process inventories. The following data are for August 2017:

Grand Devices records direct materials purchased and conversion costs incurred at actual costs. It has no direct materials variances. When finished goods are sold, the backflush costing system “pulls through” standard direct materials cost ($102 per unit) and

- 1. Prepare summary

journal entries for August 2017 (without disposing of under- or overallocated conversion costs).

Required

- 2.

Post the entries in requirement 1 to T-accounts for applicable Materials and In-Process Inventory Control, Finished Goods Control, Conversion Costs Control, Conversion Costs Allocated, and Cost of Goods Sold. - 3. Under an ideal JIT production system, how would the amounts in your journal entries differ from those in requirement 1?

Learn your wayIncludes step-by-step video

Chapter 20 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Additional Business Textbook Solutions

Financial Accounting

Horngren's Accounting (12th Edition)

Construction Accounting And Financial Management (4th Edition)

Financial Accounting (12th Edition) (What's New in Accounting)

Principles of Accounting Volume 1

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

- Backush costing and JIT production. Grand Devices Corporation assembles handheld computers that have scaled-down capabilities of laptop computers. Each handheld computer takes 6 hours to assemble. Grand Devices uses a JITproduction system and a backush costing system with three trigger points:arrow_forwardGibson Manufacturing produces two keyboards, one for laptop computers and the other for desktop computers. The production process is automated, and the company has found activity-based costing useful in assigning overhead costs to its products. The company has identified five major activities involved in producing the keyboards. Activity Materials receiving & handling Production setup Assembly Quality inspection Packing and shipping Activity measures for the two kinds of keyboards follow: Laptops Desktops Required Allocation Base Cost of material Number of setups Number of parts Inspection time Number of orders Labor Cost $ 1,190 1,080 Material Number of Number of Cost $ 5,600 7,500 Setups 31 11 Parts 47 28 Allocation Rate 2% of material cost $ 113.00 per setup $ 5.00 per part $ 1.30 per minute $ 12.00 per order Number of Inspection Time Orders 6,800 minutes 5,200 minutes 67 22 a. Compute the cost per unit of laptop and desktop keyboards, assuming that Gibson made 210 units of each…arrow_forwardPlease help with the question number 4,5, and 6. Thank you Gigabyte, Inc. manufactures three products for the computer industry: Gismos (product G): annual sales, 8,000 units Thingamajigs (product T): annual sales, 15,000 units Whatchamacallits (product W): annual sales, 4,000 units The company uses a traditional, volume-based product-costing system with manufacturing over-head applied on the basis of direct-labor dollars. The product costs have been computed as follows: Product G Product T Product W Raw material ..........................$ 35.00 $52.50 $17.50 Direct labor 16(.8 hr.at $20) 12(.6 hr at $20) 8(.4 hr at $20) Manufacturing overhead* ......140.00 105.00 70.00 Total product cost ..................$191.00 $169.50 $95.50 *Calculation of predetermined overhead rate: Manufacturing overhead budget: Machine…arrow_forward

- Central Perk, LLC, a manufacturer of coffee beans, is considering switching its operations to an Activity Based Costing system. The following manufacturing overhead activities and cost drivers have been identified: Activity. Machine setup Machine assembly Product inspection Product movement General factory Cost Driver Number of machine setups Machine hours logged Inspection hours logged Number of moves Machine hours logged Based on the above descriptions, which of the following correctly pairs the activity with its appropriate cost level? O A. Product Inspection... batch level cost OB. Product Movement... facility level cost O C. Machine Assembly... unit level cost O D. General Factory... batch level cost O E. Machine Setup... unit level costarrow_forwardAbsorption costing is a widely used accounting method for costing and reporting on the total production cost of goods or services within an organization. It involves allocating both variable and fixed manufacturing costs to the cost of products. With that in mind, consider the following scenario: ABC Manufacturing Company produces electronic gadgets. In a given accounting period, the company manufactured and sold 10,000 units of their flagship gadget. The following data is available: Direct materials cost per unit: $50 Direct labor cost per unit: $30 Variable manufacturing overhead cost per unit: $20 Fixed manufacturing overhead cost for the period: $50,000 Selling and administrative expenses (all fixed): $30,000 Selling price per gadget: $200 Using absorption costing, calculate the following: A. The total manufacturing cost per unit of the electronic gadget. B. The total cost of goods manufactured during the accounting period. C. The ending inventory value of the manufactured gadgets.…arrow_forwardCompute It uses activity-based costing. Two of Compute It's production activities are kitting (assembling the raw materials needed for each computer in one kit) and boxing the completed products for shipment to customers. Assume that Compute It spends $960,000 per month on kitting and $32,000 per month on boxing. Compute It allocates the following: • Kitting costs based on the number of parts used in the computer • Boxing costs based on the cubic feet of space the computer requires Suppose Compute It estimates it will use 400,000 parts per month and ship products with a total volume of 6,400 cubic feet per month. Assume that each desktop computer requires 125 parts and has a volume of 2 cubic feet. The predetermined overhead allocation rate for kitting is $2.40 per part and the predetermined overhead allocation rate for boxing is $5.00 per cubic foot. What are the kitting and boxing costs assigned to one desktop computer? (Round all calculations to the nearest cent.) O A. O B. O C. O…arrow_forward

- LogicCO is a fast-growing manufacturer of computer chips. Direct materials are added at the start of the production process. Conversion costs are added evenly during the process. Some units of this product are spoiled as a result of defects not detectable before inspection of finished goods. Spoiled units are disposed of at zero net disposal value. uses the FIFO method of process costing. Summary data and weighted-average data for are as follows: Requirements : 1. For each cost category, compute equivalent units. Show physical units in the first column. 2. Summarize total costs to account for; calculate cost per equivalent unit for each cost category; and assign costs to units completed and transferred out (including normal spoilage), to abnormal spoilage, and to units in ending work in process. 3. Should 's managers choose the weighted-average method or the FIFO method? Explain.arrow_forwardUse the following information for questions 2-4. Compute It uses activity-based costing. Two of Compute It’s production activities are Kitting (assembling the raw materials needed for each computer in one kit) and boxing the completed products for shipment to customers. Assume that Compute It spends $960,000 per month on kitting and $32,000 per month on boxing. Compute It allocates the following: • Kitting costs based on the number of parts used in the computer • Boxing costs based on the cubic feet of space the computer requires Suppose Compute It estimates it will use 400,000 parts per month and ship products with a total volume of 6,400 cubic feet per month. Assume that each desktop computer requires 125 parts and has a volume of 2 cubic feet. Compute It contracts with its suppliers to pre-kit certain component parts before delivering them to Compute It. Assume this saves $210,000 of the kitting cost and reduces the total number of parts by 100,000 (because Compute It considers each…arrow_forwardUse the following information for questions 2-4. Compute It uses activity-based costing. Two of Compute It’s production activities are kitting(assembling the raw materials needed for each computer in one kit) and boxing the completed products for shipment to customers. Assume that Compute It spends $960,000 per month on kitting and $32,000 per month on boxing. Compute it allocates the following: • Kitting costs based on the number of parts used in the computer • Boxing costs based on the cubic feet of space the computer requires Suppose Compute It estimates it will use 400,000 parts per month and ship products with a total volume of 6,400 cubic feet per month. What are the predetermined overhead allocation rates?arrow_forward

- Computing product costs in an ABC system The Alright Manufacturing Company in Rochester, Minnesota, assembles and tests electronic components used in smartphones. Consider the following data regarding component T24 (amounts are per unit): Requirements Complete the missing items for the two tables. Why might managers favor this ABC system instead of Alright’s older system, which allocated all manufacturing overhead costs on the basis of direct labor hours?arrow_forwardTime Clock Shop manufactures clocks on an automated assembly line. It utilizes two cost categories: direct materials and conversion costs. Each product must pass through the Assembly Department and the Testing Department. Direct materials are added at the beginning of production, while conversion costs are allocated evenly throughout production. The company uses weighted-average costing. Data for the Assembly Department are given in the table. (Click the icon to view the table.) What is the total amount debited to the work-in-process account during the month of June at Time Clock Shop? A. $450,000 B. $2,270,000 C. $3,250,000 D. $2,000,000 E. $2,450,000 Table Work in process, beginning inventory Direct materials (100% complete) Conversion costs (50% complete) Units started during June Work in process, ending inventory Direct materials (100% complete) Conversion costs (75% complete) Work in process, beginning inventory Direct materials Conversion costs Direct materials costs added during…arrow_forwardGigabyte, Inc. manufactures three products for the computer industry: Gismos (product G): annual sales, 8,000 units Thingamajigs (product T): annual sales, 15,000 units Whatchamacallits (product W): annual sales, 4,000 units The company uses a traditional, volume-based product-costing system with manufacturing over-head applied on the basis of direct-labor dollars. The product costs have been computed as follows: Product G Product T Product W Raw material ..........................$ 35.00 $52.50 $17.50 Direct labor 16(.8 hr.at $20) 12(.6 hr at $20) 8(.4 hr at $20) Manufacturing overhead* ......140.00 105.00 70.00 Total product cost ..................$191.00 $169.50 $95.50 *Calculation of predetermined overhead rate: Manufacturing overhead budget: Machine setup...................................................................................$…arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning