On January 1, Sweet Pleasures, Inc., begins business. The company has $14,000 cash on hand and is attempting to project cash receipts and disbursements through April 30. On May 1, a note payable of $10,000 will be due. This amount was borrowed on January 1 to carry the company through its first four months of operation.

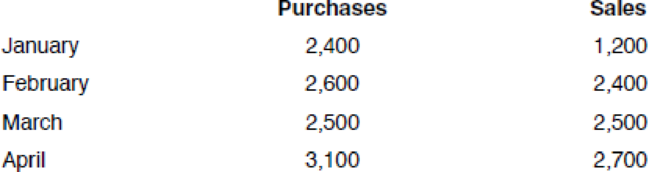

The unit purchase cost of the company’s single product, a box of Sweet Pleasures chocolates, is $12. The unit sales price is $28. Projected purchases and sales in units for the first four months are:

Sales terms call for a 5% discount if paid within the same month that the sale occurred. It is expected that 50% of the billings will be collected within the discount period, 25% by the end of the month after purchase, 19% in the following month, and 6% will be uncollectible.

Approximately 60% of the purchases are paid for in the month purchased. The rest are due and payable in the next month.

Total fixed marketing and administrative expenses for each month include cash expenses of $5,000 and depreciation on equipment of $2,000. Variable marketing and administrative expenses total $6 per unit sold. All marketing and administrative expenses are paid as incurred.

REQUIREMENT

You have been asked to prepare a

Prepare a cash budget for the four months.

Explanation of Solution

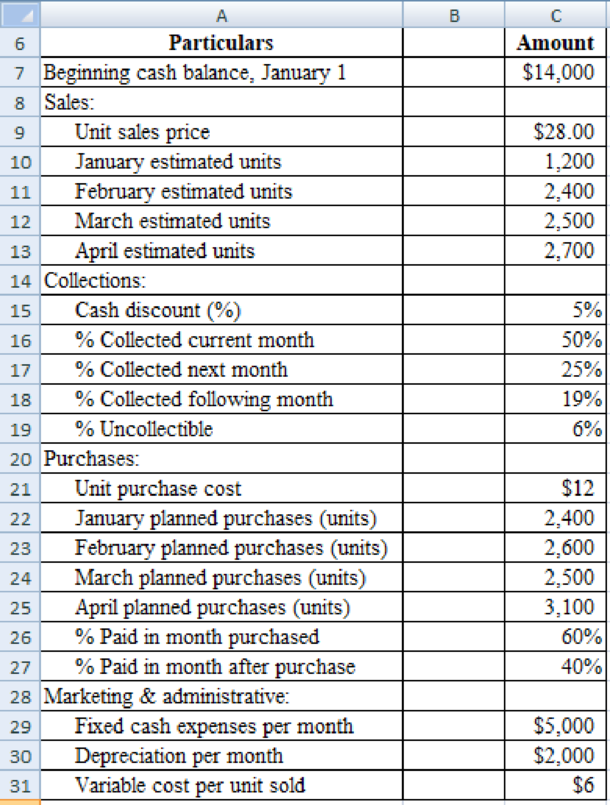

Given data,

Figure (1)

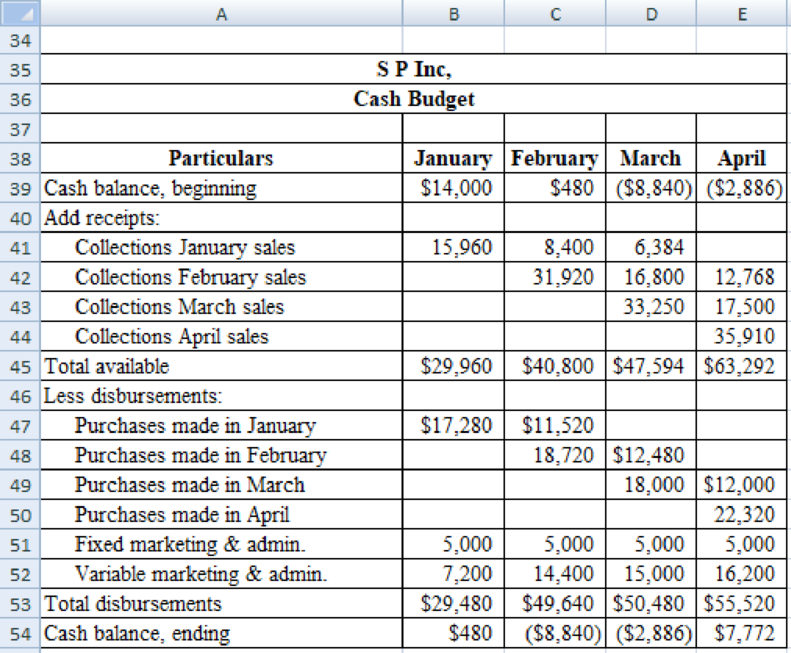

Prepare a cash budget:

Figure (2)

Want to see more full solutions like this?

Chapter 21 Solutions

Excel Applications for Accounting Principles

- Halifax Shoes has 30% of its sales in cash and the remainder on credit. Of the credit sales, 65% is collected in the month of sale, 25% is collected the month after the sale, and 5% is collected the second month after the sale. How much cash will be collected in August if sales are estimated as $75,000 in June, $65,000 in July, and $90,000 in August?arrow_forwardMy Aunts Closet Store collects 60% of its accounts receivable in the month of sale and 35% in the month after the sale. Given the following sales, how much cash will be collected in March?arrow_forwardNonnas Re-Appliance Store collects 55% of its accounts receivable in the month of sale and 40% in the month after the sale. Given the following sales, how much cash will be collected in February?arrow_forward

- Earthies Shoes has 55% of its sales in cash and the remainder on credit. Of the credit sales, 70% is collected in the month of sale, 15% is collected the month after the sale, and 10% is collected the second month after the sale. How much cash will be collected in June if sales are estimated as $75,000 in April, $65,000 in May, and $90,000 in June?arrow_forwardBaird Pointers Corporation expects to begin operations on January 1, Year 1; it will operate as a specialty sales company that sells laser pointers over the Internet. Baird expects sales in January Year 1 to total $340,000 and to increase 20 percent per month in February and March. All sales are on account. Baird expects to collect 66 percent of accounts receivable in the month of sale, 24 percent in the month following the sale, and 10 percent in the second month following the sale. Required Prepare a sales budget for the first quarter of Year 1. Determine the amount of sales revenue Baird will report on the Year 1 first quarterly pro forma income statement. Prepare a cash receipts schedule for the first quarter of Year 1. Determine the amount of accounts receivable as of March 31, Year 1.arrow_forwardAdams Pointers Corporation expects to begin operations on January 1, year 1; it will operate as a specialty sales company that sells laser pointers over the Internet. Adams expects sales in January year 1 to total $350,000 and to increase 15 percent per month in February and March. All sales are on account. Adams expects to collect 66 percent of accounts receivable in the month of sale, 25 percent in the month following the sale, and 9 percent in the second month following the sale. Required a. Prepare a sales budget for the first quarter of year 1. b. Determine the amount of sales revenue Adams will report on the year 1 first quarterly pro forma income statement. c. Prepare a cash receipts schedule for the first quarter of year 1. d. Determine the amount of accounts receivable as of March 31, year 1. Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Prepare a cash receipts schedule for the first quarter of year 1. Note: Do…arrow_forward

- Campbell Pointers Corporation expects to begin operations on January 1, year 1; it will operate as a specialty sales company that sells laser pointers over the Internet. Campbell expects sales in January year 1 to total $360,000 and to increase 10 percent per month in February and March. All sales are on account. Campbell expects to collect 66 percent of accounts receivable in the month of sale, 22 percent in the month following the sale, and 12 percent in the second month following the sale. Required a. Prepare a sales budget for the first quarter of year 1. b. Determine the amount of sales revenue Campbell will report on the year 1 first quarterly pro forma income statement. c. Prepare a cash receipts schedule for the first quarter of year 1. d. Determine the amount of accounts receivable as of March 31, year 1.arrow_forwardMunoz Pointers Corporation expects to begin operations on January 1, year 1; it will operate as a specialty sales company that sells laser pointers over the Internet. Munoz expects sales in January year 1 to total $270,000 and to increase 15 percent per month in February and March. All sales are on account. Munoz expects to collect 69 percent of accounts receivable in the month of sale, 24 percent in the month following the sale, and 7 percent in the second month following the sale. Required a. Prepare a sales budget for the first quarter of year 1. b. Determine the amount of sales revenue Munoz will report on the year 1 first quarterly pro forma income statement. c. Prepare a cash receipts schedule for the first quarter of year 1. d. Determine the amount of accounts receivable as of March 31, year 1. Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Determine the amount of accounts receivable as of March 31, year 1. (Do not…arrow_forwardCampbell Pointers Corporation expects to begin operations on January 1, year 1; it will operate as a specialty sales company that sells laser pointers over the Internet. Campbell expects sales in January year 1 to total $330,000 and to increase 20 percent per month in February and March. All sales are on account. Campbell expects to collect 66 percent of accounts receivable in the month of sale, 21 percent in the month following the sale, and 13 percent in the second month following the sale. Required a. Prepare a sales budget for the first quarter of year 1. b. Determine the amount of sales revenue Campbell will report on the year 1 first quarterly pro forma income statement. c. Prepare a cash receipts schedule for the first quarter of year 1. d. Determine the amount of accounts receivable as of March 31, year 1. Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Prepare a sales budget for the first quarter of year 1. January…arrow_forward

- Thornton Pointers Corporation expects to begin operations on January 1, year 1; it will operate as a specialty sales company that sells laser pointers over the Internet. Thornton expects sales in January year 1 to total $300,000 and to Increase 15 percent per month in February and March. All sales are on account. Thornton expects to collect 66 percent of accounts receivable in the month of sale, 24 percent in the month following the sale, and 10 percent in the second month following the sale. Required a. Prepare a sales budget for the first quarter of year 1. b. Determine the amount of sales revenue Thornton will report on the year 1 first quarterly pro forma Income statement. c. Prepare a cash receipts schedule for the first quarter of year 1. d. Determine the amount of accounts receivable as of March 31, year 1. Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Prepare a sales budget for the first quarter of year 1. Sales…arrow_forwardGibson Pointers Corporation expects to begin operations on January 1, year 1; it will operate as a specialty sales company that sells laser pointers over the Internet. Gibson expects sales in January year 1 to total $240,000 and to increase 20 percent per month in February and March. All sales are on account. Gibson expects to collect 65 percent of accounts receivable in the month of sale, 21 percent in the month following the sale, and 14 percent in the second month following the sale. Required Prepare a sales budget for the first quarter of year 1. Determine the amount of sales revenue Gibson will report on the year 1 first quarterly pro forma income statement. Prepare a cash receipts schedule for the first quarter of year 1. Determine the amount of accounts receivable as of March 31, year 1.arrow_forwardFanning Pointers Corporation expects to begin operations on January 1, year 1; it will operate as a specialty sales company that sells laser pointers over the Internet. Fanning expects sales in January year 1 to total $350,000 and to increase 10 percent per month in February and March. All sales are on account. Fanning expects to collect 69 percent of accounts receivable in the month of sale, 21 percent in the month following the sale, and 10 percent in the second month following the sale. Required a. Prepare a sales budget for the first quarter of year 1. b. Determine the amount of sales revenue Fanning will report on the year 1 first quarterly pro forma income statement. c. Prepare a cash receipts schedule for the first quarter of year 1. d. Determine the amount of accounts receivable as of March 31, year 1. Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Prepare a sales budget for the first quarter of year 1. Sales…arrow_forward

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College