College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

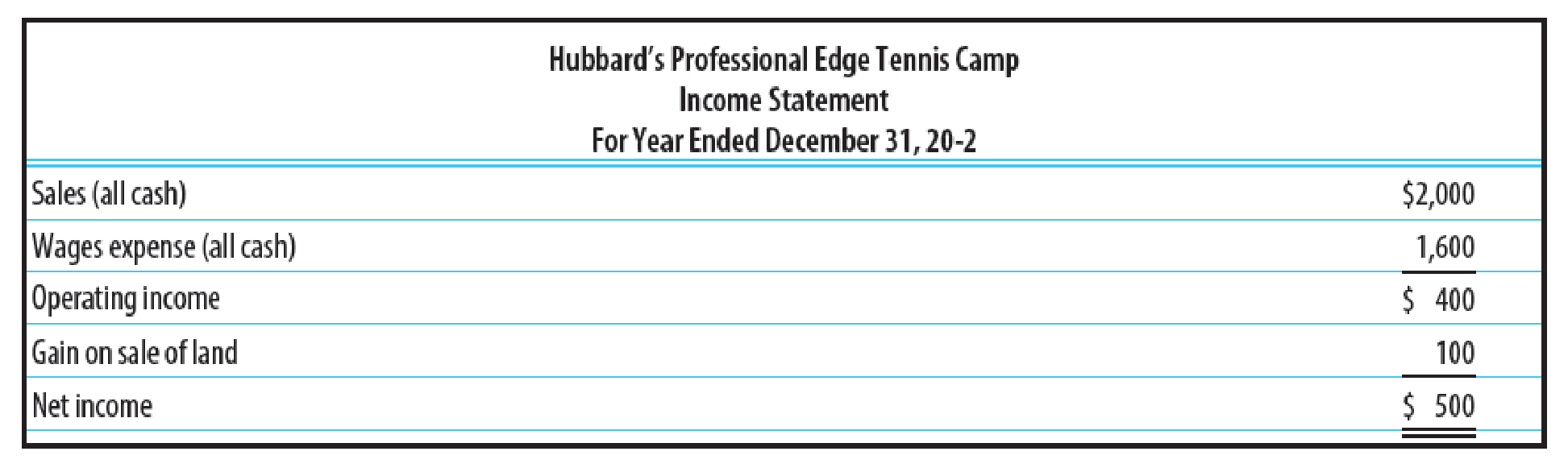

Chapter 23, Problem 5SEA

GAINS AND LOSSES ON THE SALE OF LONG-TERM ASSETS The income statement for Hubbard’s Professional Edge Tennis Camp follows. Assume that all revenues and expenses were for cash and that land was sold for $500. There were no other investing or financing activities during the year. The Cash balances at the beginning and end of the year were $100 and $1,000, respectively. Prepare a statement of

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Use the following excerpts from Nutmeg Company's financial records to determine net cash flows from operating activities and net cash flows from investing

activities.

Net income this year

Purchased land this year

Sold investments this year

Original cost of investments that were sold

$83,700

20,000

31,500

33,000

PLEASE NOTE: All whole dollar amounts will be with "$" and commas as needed (i.e. $12,345).

Net cash flows from operating activities

Net cash flows from investing activities

Shown below are totals of the three sections from the SCF for the Sivad Motel for the year just ended. Analyze this information and prepare a report indicating your opinion regarding its sources and uses of cash and their impact on the future of the company. Your conclusions and recommendations should be supported with proper explanations and assumptions.

Statement of Cash Flows

Net cash provided by operating activities $10,000

Net cash used by investing activities (15,000)

Net cash used by financing activities (5,000)

Decrease in cash for the year (10,000)

Cash at beginning of year 15,000

Cash at end of…

The income statement for Captree Landscaping is shown below. Assume that all revenues and expenses were for cash and that land was sold for $40,000. There were no other investing or financing activities during the year. The cash balances at the beginning and end of the year were $53,000 and $140,000. Prepare a statement of cash flows.

Captree LandscapingIncome StatementFor the Year Ended December 31, 20--

Sales (all cash)

$115,000

Wages expense (all cash)

(68,000)

Operating income

$ 47,000

Gain on sale of land

3,000

Net income

$ 50,000

Chapter 23 Solutions

College Accounting, Chapters 1-27

Ch. 23 - True/False The purpose of the statement of cash...Ch. 23 - Investing activities are those transactions...Ch. 23 - An increase in accounts receivable is deducted...Ch. 23 - Prob. 4TFCh. 23 - Prob. 5TFCh. 23 - Prob. 1MCCh. 23 - Prob. 2MCCh. 23 - Prob. 3MCCh. 23 - Prob. 4MCCh. 23 - Prob. 5MC

Ch. 23 - Prob. 1CECh. 23 - Prob. 2CECh. 23 - Prob. 3CECh. 23 - Prob. 4CECh. 23 - Prob. 5CECh. 23 - Prob. 6CECh. 23 - Prob. 7CECh. 23 - Prob. 8CECh. 23 - Prob. 1RQCh. 23 - Prob. 2RQCh. 23 - Prob. 3RQCh. 23 - Prob. 4RQCh. 23 - Prob. 5RQCh. 23 - Prob. 6RQCh. 23 - Prob. 7RQCh. 23 - Prob. 8RQCh. 23 - Prob. 9RQCh. 23 - Prob. 10RQCh. 23 - Prob. 11RQCh. 23 - Prob. 12RQCh. 23 - Prob. 13RQCh. 23 - Prob. 14RQCh. 23 - Prob. 15RQCh. 23 - Prob. 16RQCh. 23 - Prob. 17RQCh. 23 - Prob. 18RQCh. 23 - Prob. 19RQCh. 23 - Prob. 20RQCh. 23 - Prob. 21RQCh. 23 - SERIES A EXERCISES IDENTIFICATION OF OPERATING,...Ch. 23 - CHANGE IN CASH AND CASH EQUIVALENTS Olsen Companys...Ch. 23 - Prob. 3SEACh. 23 - Prob. 4SEACh. 23 - GAINS AND LOSSES ON THE SALE OF LONG-TERM ASSETS...Ch. 23 - Prob. 6SEACh. 23 - Prob. 7SEACh. 23 - CASH PAID FOR INTEREST Ball Companys income...Ch. 23 - Prob. 9SPACh. 23 - Prob. 10SPACh. 23 - COMPUTE CASH PROVIDED BY OPERATING ACTIVITIES Horn...Ch. 23 - EXPANDED STATE MENT OF CASH FLOWS Financial...Ch. 23 - Prob. 1SEBCh. 23 - Prob. 2SEBCh. 23 - Prob. 3SEBCh. 23 - Prob. 4SEBCh. 23 - Prob. 5SEBCh. 23 - Prob. 6SEBCh. 23 - Prob. 7SEBCh. 23 - Prob. 8SEBCh. 23 - Prob. 9SPBCh. 23 - Prob. 10SPBCh. 23 - COMPUTE CASH PROVIDED BY OPERATING ACTIVITIES...Ch. 23 - EXPANDED STATEMENT OF CASH FLOWS Financial...Ch. 23 - MANAGING YOUR WRITING Direct Method A friend of...Ch. 23 - MASTERY PROBLEM Financial statements for...Ch. 23 - CHALLENGE PROBLEM The long-term liabilities...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Shown below are totals of the three sections from the SCF for the Nanood Motel for the year just ended. Analyze this information and prepare a report indicating your opinion regarding its sources and uses of cash and their impact on the future of the company. Your conclusions and recommendations should be supported with proper explanations and assumptions. Statement of Cash Flows Net cash provided by operating activities $5,000 Net cash used by investing activities (50,000) Net cash provided by financing activities. $100,000 Increase in cash for the year 55,000 Cash at beginning of year…arrow_forwardThe land was purchased during the year for RO 60,000 and sold during the year for RO 25000 . The income statement reported a loss on sale of land in the amount of RO 2,000. All transactions related to land account was cash transactions. These transactions would be shown in the statement of cash flows as: Select one: a. RO 27,000 cash received by investing activities, and RO 60,000 cash paid for investing activities b. RO 25,000 cash received by investing activities, and RO 60,000 cash paid for investing activities c. RO 23,000 cash received by investing activities, and RO 60,000 cash paid for investing activities d. RO 60,000 cash received by investing activities, and RO 25,000 cash paid for investing activitiesarrow_forwardShown below are totals of the three sections from the SCF for the Nanged Motel for the year just ended. Analyze this information and prepare a report indicating your opinion regarding its sources and uses of cash and their impact on the future of the company. Your conclusions and recommendations should be supported with proper explanations and assumptions. Statement of Cash Flows Net cash provided by operating activities $505,000 Net cash provided by investing activities 150,000 Net cash used by financing activities (50,000) Increase in cash for the year 605,000 Cash at beginning of year…arrow_forward

- State the section(s) of the statement of cash flows prepared by the indirect method (operating activities, investing activities, financing activities, or not reported) and the amount that would be reported for each of the following transactions: Note: Only consider the cash component of each transaction. Note: If an item should not be reported, select "Not reported" and leave amount cell blank or enter "0". a. Received $120,000 from the sale of land costing $70,000. operatin financing investing not reported $fill in the blank 2 fill in blank $fill in the blank 4 b. Purchased investments for $75,000. fill in blank $fill in the blank 6 c. Declared $35,000 cash dividends on stock. Dividends of $5,000 were payable at the beginning of the year, and $6,000 were payable at the end of the year. fill in blank $fill in the blank 8 d. Acquired equipment for $64,000 cash. fill in blank $fill in the blank 10 e. Declared and issued 100 shares of $20 par common stock as…arrow_forwardState the section(s) of the statement of cash flows prepared by the indirect method (operating activities, investing activities, financing activities, or not reported) and the amount that would be reported for each of the following transactions: Note: Only consider the cash component of each transaction. Note: If an item should not be reported, select "Not reported" and leave amount cell blank or enter "0". a. Received $120,000 from the sale of land costing $70,000. $fill in the blank 2 $fill in the blank 4 b. Purchased investments for $75,000. $fill in the blank 6 c. Declared $35,000 cash dividends on stock. $5,000 dividends were payable at the beginning of the year, and $6,000 were payable at the end of the year. $fill in the blank 8 d. Acquired equipment for $64,000 cash. $fill in the blank 10 e. Declared and issued 100 shares of $20 par common stock as a stock dividend, when the market price of the stock was $32 a share. $fill in the blank 12…arrow_forwardJennifer’s Wedding Shops earned net income of $27,000, which included depreciation of $16,000. Jennifer’s acquired a $119,000 building by borrowing $119,000 on a long-term note payable. Requirements How much did Jennifer’s cash balance increase or decrease during the year? Were there any non-cash transactions for the company? If so, show how they would be reported in the statement of cash flows.arrow_forward

- Shim Company presents its statement of cash flows using the indirect method. The following accounts and corresponding balances were drawn from Shim’s Year 2 and Year 1 year-end balance sheets. (see below). The income statement reported a $2,280 gain on the sale of equipment, an $810 loss on the sale of land, and $4,200 of depreciation expense. Net income for the period was $45,800. Requirements: Prepare the operating activities section of the statement of cash flows. Account Year 2 Year 1 Accounts Receivable 31,200.00 35,000.00 Prepaid Rent 1,453.00 1,100.00 Interest Receivable 650.00 600.00 Accounts Payable 9,876.00 12,200.00 Salaries Payable 2,625.00 2,000.00 Unearned Revenue 3,237.00 4,470.00 Shim Company Cash from Operating Activitiesarrow_forwardThe following accounts and corresponding balances were drawn from Drea Company’s Year 2 and Year 1 year-end balance sheets. (See below). Other information drawn from the accounting records: Drea incurred a $1,500 loss on the sale of investment securities during Year 2. The only transaction related to land was a purchase of land in Year 2. Requirements: Calculate the amount of cash inflow or (outflow) related to the investments account for Drea, Year 2. Calculate the amount of cash inflow or (outflow) related to the Land account for Year 2. Based on the above, what is Drea's cash flow from investing activities for Year 2?arrow_forwardJaup Nonprofit has a beginning balance in notes payable of $42,000 and an ending balance of $68,000. During the year, $4,000 of principal payments on notes payable were made. Identify any activity that should be reflected in the statement of cash flows using the indirect method. You must report which section(s) of the statement of cash flows would be affected, as well as the direction and amount for each transaction.arrow_forward

- using the image attached , please prepare the cash flow statement for the year. Also alongside the given image the following additional infromation should be noted for the account as well : 1. The building was revalued during the year.2. Equipment costing 25,000 for which there a provision for depreciation of 5,500was sold for a profit of 6,000.3. Dividends paid and proposed for the year amounted to 27,000arrow_forwardThree Gray Ladies, Inc. had the following activities during the year. What would be reported on the Statement of Cash Flows as the net cash flow from investing activities? • Sold equipment with a $50,000 book value for a gain of $12,000. • Paid $34,000 on a long-term note payable. • Received $100,000 from common stock issuance. • Purchased land. Paid a down payment of $10,000. The balance of $90,000 will be paid via a five-year promissory note with quarterly payments. • Purchased an investment of IBM Stock for $5,000. • Paid $17,000 cash for purchase of merchandise inventory.arrow_forward) Provide an accurate, full and complete explanation and implication of the information presented in (mathematical forms) by explaining the significance of the cash flow statement The net income reported on the income statement for the current year was $128,000. Depreciation recorded on store equipment for the year amounted to $21,100. Balances of the current asset and current liability accounts at the beginning and end of the year are as follows: End of Year Beginning of Year Cash $51,200 $47,100 Accounts receivable (net) 36,710 34,810 Merchandise inventory 50,120 52,990 Prepaid expenses 5,630 4,470 Accounts payable (merchandise creditors) 47,970 44,560 Wages payable 26,210 29,110arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License