Adequate information:

Opening value of saving 1,48,000

Closing value of saving 1,98,000

To compute: Dollar weighted average return.

Introduction: Dollar weighted average return is a way to measure an investment’s performance.

Explanation of Solution

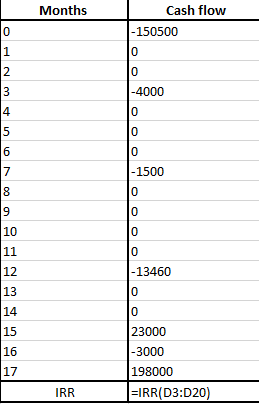

Assuming that an investment was made for $148,000.

Thus, all the values in addition and investment in account are considered as outflow of cash flow and all the values of withdrawal and final value are considered as inflow of cash.

PV of inflow = PV of outflow

IRR can be computed using the following formula in excel:

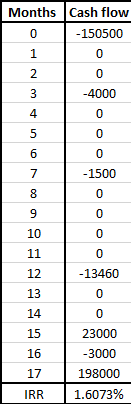

Following is the calculated answer using the above mentioned formula:

The above return has been calculated on monthly basis.

So, as per the question the dollar weighted average return between first and last date can be calculated by multiplying it by 17 (1/1/2016-5/3/2017)

Dollar weight average return is 27.32%

Want to see more full solutions like this?

Chapter 24 Solutions

EBK INVESTMENTS

- a. Show me the stages of preparing a monthly projection for the income statement, balance sheet, and cash flow by using a chart. Provide an explanation for each of these stages along with the data required to prepare monthly financial report projections.arrow_forward1. What are the estimated accounts receivable collections for May?arrow_forwardDevelop a flowchart for revenue cycle of 7-Eleven retail store containing their cash disbursement, payroll and fixed assetarrow_forward

- You have a checking account and a savings account at a credit union. Your checking account has a constant balance of $500. The table shows the total balance of the accounts over time. Total Year, t balance $2500 1 $2540 2 $2580.80 $2622.42 4 $2664.86 $2708.16 a. Write a function m that represents the balance of your savings account after t years. m(t) b. Write a function B that represents the total balance of the two accounts after t years. B(t) =arrow_forwardCompute the amount of revenue from Monthly clients.arrow_forwardWhich of the following transactions will be recorded in cash payment journal? a. Receipt of income b. Purchase of goods on credit c. Sale of goods for cash d. Payment of monthly expensesarrow_forward

- Which of the following is considered cash? a. Thirty-day certificate of deposits b. Customer’s post-dated checks c. Six-month money market savings certificates d. Money market checking accountsarrow_forwardWhen using the Spreadsheet (work sheet) method to analyze noncash accounts, it is best to start with Group of answer choices cash net income retained earnings revenuearrow_forwardHow to calculate the account receivable turnover ratio in a balance Sheet and income statement (explain it with the items on the income statement and balance Sheet eg.inventory, current receivable, current liability..and so on.arrow_forward

- Compute for the following RED 1. Accounts receivable turnover 2. Average collection periodarrow_forwardHow do you calculate Accounts Receivable (AR) Turnover and the Number of Days' Sales in Receivables? How is the amount of change method Calculated in horizontal financial statement Analysis?arrow_forwardFor VAT and Percentage transactions, state when will be the deadline for the remittances?arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub