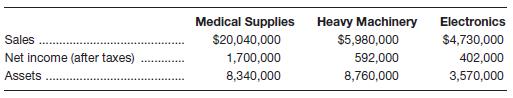

The Global Products Corporation has three subsidiaries.

a. Which division has the lowest return on sales?

b. Which division has the highest

c. Compute the return on assets for the entire corporation.

d. If the

a.

To calculate: The division with the lowest return on sales.

Introduction:

Return on sales:

It is used to compute the ratio which shows the degree to which a company makes money from its business activities. It is calculated by dividing the net income by sales.

Answer to Problem 29P

The medical supply division is the one with the lowest return on sales, that is, 8.48%. Whereas, the return on sales of heavy machinery division is 9.90% and that of electronics is 8.50%.

Explanation of Solution

Calculation of the return on sales of medical supplies:

Calculation of the return on sales of heavy machinery:

Calculation of the return on sales of electronics:

b.

To determine: The division with the highest ROA.

Introduction:

Return on assets (ROA):

It is used to compute the ratio which shows the degree to which a company makes money from its business activities. It is computed by dividing the net income of a company by its sales.

Answer to Problem 29P

The medical supply division is the one with the highest ROA, that is, 20.38%. Whereas, the ROA of heavy machinery division is 6.76% and that of electronics is 11.26%.

Explanation of Solution

The calculation of the ROA of medical supplies:

The calculation of the ROA of heavy machinery:

The calculation of the ROA of electronics:

c.

To calculate: The ROA for the entire corporation.

Introduction:

Return on assets (ROA):

It is used to compute the ratio which shows the degree to which a company makes money from its business activities. It is computed by dividing the net income of a company by its sales.

Answer to Problem 29P

The ROA for entire corporation is 13.03%.

Explanation of Solution

Calculation of the ROA for the entire corporation:

Working Notes:

Calculation of the corporate net income:

Calculation of the corporate total assets:

d.

To calculate: For the whole corporation, the new ROA.

Introduction:

Return on assets (ROA):

It is used to compute the ratio which shows the degree to which a company makes money from its business activities. It is computed by dividing the net income of a company by its sales.

Answer to Problem 29P

The new return on assets for the corporation as a whole is 18.81%.

Explanation of Solution

Calculation of new return on assets for the entire corporation:

Working Notes:

Calculation of the return on redeployed assets of heavy machinery:

Calculation of the corporate net income:

Calculation of the corporate total assets:

Want to see more full solutions like this?

Chapter 3 Solutions

Loose Leaf for Foundations of Financial Management Format: Loose-leaf

- The Global Products Corporation has three subsidiaries. Medical Supplies Heavy Machinery Electronics Sales $20,040,000 $5,980,000 $4,730,000 Net Income (after taxes) 1,700,000 592,000 402,000 Assets 8,340,000 8,760,000 3,570,000 Which division has the lowest return on sales? Which division has the highest return on assets? Compute the return on assets for the entire corporation? If the $8,760,000 investment in the heavy machinery division is sold off and redeployed in the medical supplies subsidiary at the same rate of return on assets currently achieved in the medical supplies division, what will be the new return on assets for the entire corporation?arrow_forwardFar Sight is a division of a major corporation. The following data are for the latest year of operations: Required: a. What is the division's return on investment (ROI)?b. What is the division's residual income? Sales 24,480,000 Net operating income 1.738.000 average operating assets 6,000 rate of return 16%arrow_forwardNavarre Energy Research specializes in developing and commercializing new products. It is organized into two divisions, which are based on the products they produce. Canal Division is smaller, and the lives of the products it produces tend to be shorter than those produced by the larger Lake Division. Selected financial data for the past year are shown in the following table. Divisional investment is as of the beginning of the year. Navarre uses a(n) 8 percent cost of capital and beginning-of- the-year investment when computing ROI and residual income. Ignore income taxes. Allocated corporate overhead Cost of goods sold Divisional investment R&D Sales Selling, general and administrative. (excluding R&D) Division Canal ($000) $4,900 28,000 60,900 12,800 66,008 5,300 Lake (5000) $ 10,000 38,800 400,000 72,000 180,000 7,600 R&D is assumed to have a three-year life in Canal Division and an eight-year life in Lake Division. All R&D expenditures are spent at the beginning of the year. Assume…arrow_forward

- Last Resort Industries Inc. is a privately held diversified company with five separate divisions organized as investment centers. A condensed income statement for the Specialty Products Division for the past year, assuming no support department allocations, along with asset information is as follows: The manager of the Specialty Products Division was recently presented with the opportunity to add an additional product line, which would require invested assets of 14,400,000. A projected income statement for the new product line is as follows: The Specialty Products Division currently has 27,000,000 in invested assets, and Last Resort Industries Inc.s overall return on investment, including all divisions, is 10%. Each division manager is evaluated on the basis of divisional return on investment. A bonus is paid, in 8,000 increments, for each whole percentage point that the divisions return on investment exceeds the company average. The president is concerned that the manager of the Specialty Products Division rejected the addition of the new product line, even though all estimates indicated that the product line would be profitable and would increase overall company income. You have been asked to analyze the possible reasons the Specialty Products Division manager rejected the new product line. a. Determine the return on investment for the Specialty Products Division for the past year. b. Determine the Specialty Products Division managers bonus for the past year. c. Determine the estimated return on investment for the new product line. Round percentages to one decimal place and the investment turnover to two decimal places. d. Why might the manager of the Specialty Products Division decide to reject the new product line? Support your answer by determining the projected return on investment for 20Y6, assuming that the new product line was launched in the Specialty Products Division and 20Y6 actual operating results were similar to those of 20Y5. e. Suggest an alternative performance measure for motivating division managers to accept new investment opportunities that would increase the overall company income and return on investment.arrow_forwardThe condensed income statement for the Consumer Products Division of Tri-State Industries Inc. is as follows (assuming no support department allocations): The manager of the Consumer Products Division is considering ways to increase the return on investment. a. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment of the Consumer Products Division, assuming that 143,750,000 of assets have been invested in the Consumer Products Division. b. If expenses could be reduced by 3,450,000 without decreasing sales, what would be the impact on the profit margin, investment turnover, and return on investment for the Consumer Products Division?arrow_forwardThe three divisions of Yummy Foods are Snack Goods, Cereal, and Frozen Foods. The divisions are structured as investment centers. The following responsibility reports were prepared for the three divisions for the prior year: a. Which division is making the best use of invested assets and should be given priority for future capital investments? b. b. Assuming that the minimum acceptable return on new projects is 19%, would all investments that produce a return in excess of 19% be accepted by the divisions? Explain. c. c. Identify opportunities for improving the companys financial performance.arrow_forward

- Use the following information for Exercises 11-31 and 11-32: Washington Company has two divisions: the Adams Division and the Jefferson Division. The following information pertains to last years results: Washingtons actual cost of capital was 12%. Exercise 11-31 Economic Value Added Refer to the information for Washington Company above. Required: 1. Calculate the EVA for the Adams Division. 2. Calculate the EVA for the Jefferson Division. 3. CONCEPTUAL CONNECTION Is each division creating or destroying wealth? 4. CONCEPTUAL CONNECTION Describe generally the types of actions that Washingtons management team could take to increase Jefferson Divisions EVA?arrow_forwardBisbee Health Products invests heavily in research and development (R&D), although it must currently treat its R&D expenditures as expenses for financial accounting purposes. To encourage investment in R&D, Bisbee evaluates its division managers using EVA. The company adjusts accounting income for R&D expenditures by assuming these expenditures create assets with a two-year life. That is, the R&D expenditures are capitalized and then amortized over two years. Western Division of Bisbee shows after-tax income of $8.4 million for year 2. R&D expenditures in year 1 amounted to $3.8 million and in year 2, R&D expenditures were $4.9 million. For purposes of computing EVA, Bisbee assumes all R&D expenditures are made at the beginning of the year. Before adjusting for R&D, Western Division shows assets of $30.6 million at the beginning of year 2 and current liabilities of $680,000. Bisbee computes EVA using divisional investment at the beginning of the year and a 14 percent cost of capital.…arrow_forwardMacon Mills is a division of Bolin Products, Inc. During the most recent year, Macon had a net income of $40 million. Total assets were $470 million, non-interest-bearing current liabilities were $72,000,000. What are the invested capital and ROI for Macon? Solution What is the invested capital (Total Assets – Non-Interest-Bearing Current Liabilities)? What is the ROI (Net Income/Invested Capital)?arrow_forward

- The Maxim Corporation reported the following operating results for its three divisions: South, West, and East. West Division $1,700,000 50,000 East Division $2,000,000 $ $ 100,000 $ 625,000 $ 800,000 Sales. After-tax income Divisional assets. Which division has the largest asset turnover? Multiple Choice O South. West. South Division $ 380,000 $ 20,000 $ 200,000 East All three divisions have the same asset turnover.arrow_forward. The sales, income from operations, and invested assets for each division of Grosbeak Company are as follows: Sales Income from Operations Invested Assets Division E $5,000,000 $550,000 $2,400,000 Division F 4,800,000 860,000 2,500,000 Division G 7,000,000 860,000 2,900,000 (a) Using the expanded expression, determine the profit margin, investment turnover, and rate of return on investment for each division. Round to one decimal place. (b) Which is (are) the most profitable per dollar invested?arrow_forwardMesopotamian Materials Inc. (MMI) has two decentralized divisions (Ur and Babylon) that have decision making responsibility over the amount of resources invested in their divisions. Recent financial extracts for both divisions are presented below: Ur Babylon Fixed assets, gross $2,500 $4,000 Accumulated depreciation $1,500 $1,200 Other assets $500 $750 Liabilities $500 $1,000 Sales $6,750 $7,200 Net income after tax* $743 $1,008 Average age of fixed assets (years) 15 5 *Net income is after tax but before interest MMI's weighted average cost of capital (WACC) is 11.5%. The MMI measures division performance based on the book value of net assets. The producer price index 15 years ago was 100, 116 five years ago, and currently is 125. Which is true, when fixed asset costs are adjusted upward for inflation? Babylon's RONA is 35.8% Babylon's RONA is 26.3% Ur's depreciation expense increases by $19 more than…arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,