Reporting for a Variable Interest Entity

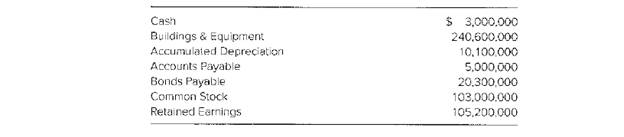

Gamble Company convinced Conservative Corporation that the two Companies should establish Simpletown Corporation to build a new gambling casino in Simpletown Coiner. Although chances for the casino’s success were relatively low, a local bank loaned $140 million to the new corporation, which built, the casino at a cost of $130 million. Conservative purchased 100 percent of the initial capital stock offering for $5.6 million, md Gamble agreed to supply 100 percent of the management which would include directing Simpletown’s day-to-day activities. Gamble also agreed to guarantee the bank loan. Additionally, Gamble guaranteed a 20 percent return to Conservative on its investment for the first 10 years. Gamble will receive all profits in excess of the 20 percent return to Conservative. Immediately after the casino’s construction, Gamble reported the following amounts:

The only disclosure that Gamble currently provides in its financial reports about its relationships to Conservative and Simpletown is a brief footnote indicating that a

Required

Prepare a consolidated

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

Advanced Financial Accounting

- Templeton Extended Care Facilities, Inc. is considering the acquisition of a chain of cemeteries for $400 million. Because the primary asset of this business is real the majority of the money needed to buy the business. The current owners have estate, Templeton's management has determined that they will be able to borrow no debt financing but Templeton plans to borrow $300 million and invest only $100 million in equity ($40 million in Preferred Shared and $60 million in Common Shares) in the acquisition. Templeton is issuing new common stock at a market price of $27. Dividends last year were $1.45 and are expected to grow at an annual rate of 6% forever. • Templeton is issuing a $1000 par value bond that pays 8% annual interest and matures in 15 years. Investors are willing to pay $950 for the bond and Temple faces a tax rate of 35%. The preferred stock of Templeton currently sells for $36 a share and pays $2.50 in dividends annually ● What is the Weighted Average Cost of capital?arrow_forwardBeedles Inc. needed to raise $14 million in an IPO and chose Security Brokers Inc. to underwrite the offering. The agreement stated that Security Brokers would sell 3 million shares to the public and provide $14 million in net proceeds to Beedles. The out-of-pocket expenses incurred by Security Brokers in the design and distribution of the issue were $490,000. What profit or loss would Security Brokers incur if the issue were sold to the public at the following average price? Write out your answer completely. For example, 5 million should be entered as 5,000,000. Round your answers to the nearest dollar. Loss should be indicated by a minus sign. $5 per share? $ $7 per share? $ $4 per share? $arrow_forwardOn January 1, 2020, Ridge Road Company acquired 25 percent of the voting shares of Sauk Trail, Inc., for $3,700,000 in cash. Both companies provide commercial Internet support services but serve markets in different industries. Ridge Road made the investment to gain access to Sauk Trail’s board of directors and thus facilitate future cooperative agreements between the two firms. Ridge Road quickly obtained several seats on Sauk Trail’s board, which gave it the ability to significantly influence Sauk Trail’s operating and investing activities. The January 1, 2020, carrying amounts and corresponding fair values for Sauk Trail’s assets and liabilities follow: Carrying Amount Fair Value Cash and receivables $ 160,000 $ 160,000 Computing equipment 5,450,000 6,500,000 Patented technology 150,000 4,100,000 Trademark 200,000 2,100,000 Liabilities (235,000 ) (235,000 ) Also, as of January 1, 2020, Sauk Trail’s computing equipment had a…arrow_forward

- On January 1, 2023, Ridge Road Company acquired 25 percent of the voting shares of Sauk Trail, Incorporated, for $3,500,000 in cash. Both companies provide commercial Internet support services but serve markets in different Industries. Ridge Road made the Investment to gain access to Sauk Trail's board of directors and thus facilitate future cooperative agreements between the two firms. Ridge Road quickly obtained several seats on Sauk Trail's board, which gave it the ability to significantly influence Sauk Trail's operating and Investing activities. The January 1, 2023, carrying amounts and corresponding fair values for Sauk Trail's assets and liabilities follow: Assets and Liabilities Cash and Receivables Computing Equipment Patented Technology Trademark Carrying Amount $ 150,000 5,360,000 Fair Value $ 150,000 Liabilities Years 2023 2024 Also, as of January 1, 2023, Sauk Trail's computing equipment had a seven-year remaining estimated useful life. The patented technology was…arrow_forwardAn investment bank agrees to underwrite an issue of 15 million shares of stock for Looney Landscaping Corporation. a. The investment bank underwrites the stock on a firm commitment basis, and agrees to pay $10.00 per share to Looney Landscaping Corporation for the 15 million shares of stock. The investment bank then sells those shares to the public for $11.50 per share. How much money does Looney Landscaping Corporation receive? What is the profit to the investment bank? If the investment bank can sell the shares for only $8.50, how much money does Looney Landscaping Corporation receive? What is the profit to the investment bank? b. Suppose, instead, that the investment bank agrees to underwrite the 15 million shares on a best efforts basis. The investment bank is able to sell 13.5 million shares for $10.00 per share, and it charges Looney Landscaping Corporation $0.325 per share sold. How much money does Looney Landscaping Corporation receive? What is the profit to the investment…arrow_forwardKaplan Ltd is contemplating the acquisition of Baron Incorporation. The values of the two companies as separate entities are GH¢ 30 million and GH¢ 10 million, respectively. Kaplan estimates that by combining the two companies, it will reduce marketing and administration cost by GH¢ 700,000 per year in perpetuity. Kaplan can either pay GH¢ 15 million cash for Baron Inc, or offer Baron a 50% holding in the combined firm. The opportunity cost of capital is 10%. What is the gain from merger? What is the cost of the cash offer? What is the cost of the stock offer? What is the NPV of the acquisition under the cash offer? What is the NPV under the stock offer? Discuss five (5) defense mechanisms that target firms should be allowed to put in place to resist possible takeoversarrow_forward

- On January 1, 2023, Ridge Road Company acquired 30 percent of the voting shares of Sauk Trail, Incorporated, for $4,500,000 in cash. Both companies provide commercial Internet support services but serve markets in different industries. Ridge Road made the investment to gain access to Sauk Trail's board of directors and thus facilitate future cooperative agreements between the two firms. Ridge Road quickly obtained several seats on Sauk Trail's board, which gave it the ability to significantly influence Sauk Trail's operating and investing activities. The January 1, 2023, carrying amounts and corresponding fair values for Sauk Trail's assets and liabilities follow: Carrying Amount $ 200,000 5,810,000 Fair Value $ 200,000 7,140,000 4,180,000 2,180,000 (275,000) Assets and Liabilities Cash and Receivables Computing Equipment Patented Technology Trademark Liabilities Also, as of January 1, 2023, Sauk Trail's computing equipment had a seven-year remaining estimated useful life. The patented…arrow_forwardKaplan Ltd is contemplating the acquisition of Baron Incorporation. The values of the two companies as separate entities are GH¢ 30 million and GH¢ 10 million, respectively. Kaplan estimates that by combining the two companies, it will reduce marketing and administration cost by GH¢ 700,000 per year in perpetuity. Kaplan can either pay GH¢ 15 million cash for Baron Inc, or offer Baron a 50% holding in the combined firm. The opportunity cost of capital is 10%. Required: 1. What is the NPV of the acquisition under the cash offer? 2. What is the NPV under the stock offer? 3. Discuss five (5) defense mechanisms that target firms should be allowed to put in place to resist possible takeoversarrow_forwardManny Carson, certified management accountant and controller of Wakeman Enterprises, has been given permission to acquire a new computer and software for the companys accounting system. The capital investment analysis showed an NPV of 100,000. However, the initial estimates of acquisition and installation costs were made on the basis of tentative costs without any formal bids. Manny now has two formal bids, one that would allow the firm to meet or beat the original projected NPV and one that would reduce the projected NPV by 50,000. The second bid involves a system that would increase both the initial cost and the operating cost. Normally, Manny would take the first bid without hesitation. However, Todd Downing, the owner of the firm presenting the second bid, is a close friend. Manny called Todd and explained the situation, offering Todd an opportunity to alter his bid and win the job. Todd thanked Manny and then made a counteroffer. Todd: Listen, Manny, this job at the original price is the key to a successful year for me. The revenues will help me gain approval for the loan I need for renovation and expansion. If I dont get that loan, I see hard times ahead. The financial stats for loan approval are so marginal that reducing the bid price may blow my chances. Manny: Losing the bid altogether would be even worse, dont you think? Todd: True. However, if you award me the job, Ill be able to add personnel. I know that your son is looking for a job, and I can offer him a good salary and a promising future. Additionally, Ill be able to take you and your wife on that vacation to Hawaii that weve been talking about. Manny: Well, you have a point. My son is having an awful time finding a job, and he has a wife and three kids to support. My wife is tired of having them live with us. She and I could use a vacation. I doubt that the other bidder would make any fuss if we turned it down. Its offices are out of state, after all. Todd: Out of state? All the more reason to turn it down. Given the states economy, it seems almost criminal to take business outside. Those are the kind of business decisions that cause problems for people like your son. Required: Evaluate the ethical behavior of Manny. Should Manny have called Todd in the first place? Would there have been any problems if Todd had agreed to meet the lower bid price? Identify the parts of the Statement of Ethical Professional Practice (Chapter 1) that Manny may be violating, if any.arrow_forward

- Parch Inc. and Rees Urch, Parch's former head of R&D, formed Sede Inc., which will perform research and development. Sede issued 10,000 shares of common stock to Urch, who is now Sede's president. Parch lent $800,000 to Sede for initial working capital in return for a note receivable that can be converted at will into 100,000 shares of Sede's common stock. Parch also granted Sede a line of credit of $1,000,000. Is consolidation appropriate for Parch and Sede? Explain and justify your answer. What would Parch accomplish with this arrangement? If consolidation were not appropriate, what serious reporting issue exists regarding Parch's separate financial statements?arrow_forwardIndividuals A and B are planning to form a new corporation: NEWCO. A will contribute to NEWCO several high-end super computers with a combined, fair market value of 80,000. A's adjusted basis in these computers is 10,000. B will contribute to NEWCO 80,000 of cash. NEWCO will issue to each of A and B, 100 shares of voting common stock in exchange for the property and cash contributed. Consequently, there will be 200 common shares outstanding with a total initial value of $160,000? What is A's basis in her shares of NEWCO, assuming the contributions meet all the requirements of IRC 351? a. A’s basis for her stock is 80,000, same as B. b. A’s basis for her stock is 10,000, i.e., a substituted basis. c. A's basis for her stock is zero because the company has not generated E&P A. A’s basis for her stock is 100, which is equal to the number of shares she received.arrow_forwardDark Creek Corporation's CEO is selecting between two mutually exclusive projects. Thecompany needs to make a $3,500 payment to bondholders at the end of the year. To minimize agency costs, the firm's bondholders decide to use a bond covenant to stipulate that the bondholders can demand an additional payment if the company chooses to take on the high- volatility project. How much additional payment to bondholders would make stockholders indifferent between the two projects? Cash flows pertaining to the two projects are shown in the tablearrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningBusiness Its Legal Ethical & Global EnvironmentAccountingISBN:9781305224414Author:JENNINGSPublisher:Cengage

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningBusiness Its Legal Ethical & Global EnvironmentAccountingISBN:9781305224414Author:JENNINGSPublisher:Cengage Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning