Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

15th Edition

ISBN: 9780134476315

Author: Chad J. Zutter, Scott B. Smart

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 3, Problem 3.16P

Learning Goal 4

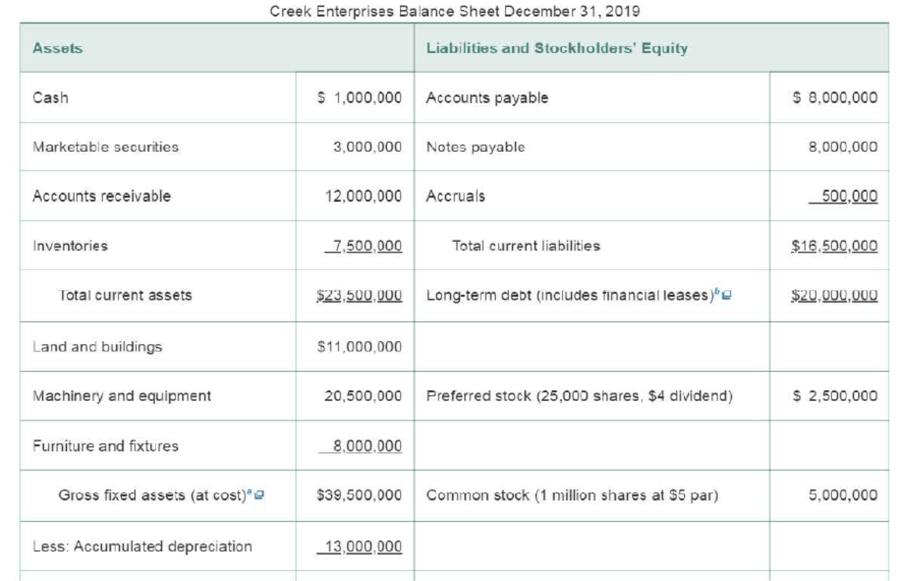

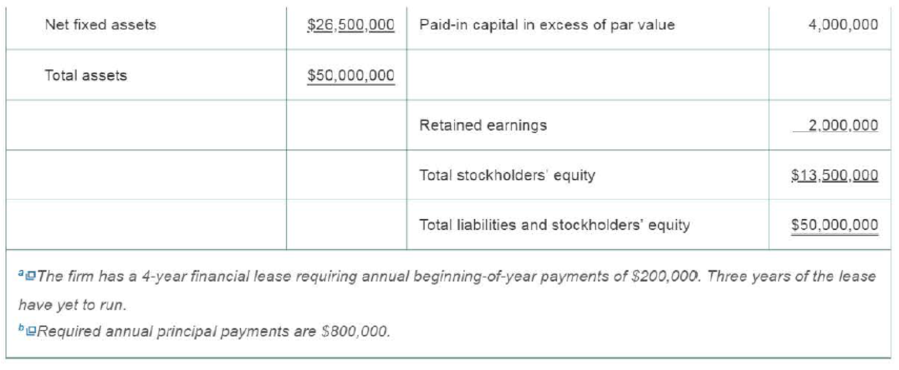

P3-16 Debt analysis Springfield Bank is evaluating Creek Enterprises, which has requested a $4,000,000 loan, to assess the firm’s financial leverage and financial risk. On the basis of the debt ratios for Creek, along with the industry average and Creek’s recent financial statements (following), evaluate and recommend appropriate action on the loan request.

Creek Enterprises Income Statement for the Year Ended December 31 2019

| Sales revenue | $30,000,000 |

| Less: Cos I of goods sold | 21,000,000 |

| Gross profits | $9,000,000 |

| Less: Operating expenses | |

| Selling expense | $3,000,000 |

| General and administrative expenses | 1,800,000 |

| General and administrative expenses | 1,800,000 |

| Lease expense | 200,000 |

| Depreciation expense | 1,000,000 |

| Total operating expense | $2,000,000 |

| Operating profits | $ 3,000.000 |

| Less: Interest expense | 1,000,000 |

| Net profits before taxes | $ 2,000.000 |

| Less: Taxes (rate = 40 %) | 800,000 |

| Net profits after taxes | $1,200,000 |

| Less: |

100,0000 |

| Earnings available for common stockholders | $1,100.000 |

| Industry averages | |

| Debt ratio | 0.51 |

| Times interest earned ratio | 7.30 |

| Fixed-payment coverage ratio | 1.85 |

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

You are considering two possible companies for investment purposes. The following data is available for each company.

Company A

Net credit sales, Dec. 31, 2019 $540,000

Net Accounts receivable, Dec 31, 2018 $120,000

Net accounts receivable, Dec 31, 2019 $180,000

Number of days sales in receivables ratio, 2018 103 days

Net Income, Dec. 31, 2018 $250,000

Company B

Net credit sales, Dec. 31, 2019 $620,000

Net Accounts receivable, Dec 31, 2018 $145,000

Net accounts receivable, Dec 31, 2019 $175,000

Number of days sales in receivables ratio, 2018 110 days

Net Income, Dec. 31, 2018 $350,000

Additional Information:

Company A: Bad debt estimation percentage using the income statement method is 6%, and the balance sheet…

Here are the abbreviated financial statements for Planner's Peanuts:

(b)

(c)

INCOME STATEMENT, 2022

Sales

Cost

Net income

Assets

Total

$ 5,500

4,300

$ 1,200

25%

30%

35%

2021

$ 8,500

IS

S

$8.500

BALANCE SHEET, YEAR-END

2022

$ 9,000

$ 9,000

Debt

Equity

Total

Answer is complete but not entirely correct.

External

Financing Need

2.275.00

2,726.00

3,177.00

Assets are proportional to sales. If the dividend payout ratio is fixed at 50%, calculate the required total external financing

for growth rates in 2023 of (a) 25%, (b) 30%, and (c) 35%.

Note: Do not round intermediate calculations. Round your answers to 2 decimal places.

2021

$ 823

7,677

$ 8.500

2022

$ 1.000

8,000

$ 9.000

I attached in this A company table in which you can see last 5 years Financial Progress Of company

Assume

the unlevered beta of the company is 1.5 for all 5 years

Tax Rate 35%

Assume Total Liabilities shown on balance sheet as Total Debt

Requirements:

Calculate the Levered Beta of assigned company for last 5 years.

Comment in the industry outlook the company is operating.

2021

2020

2019

2018

2017

Property , Plant and Equipment

$ 19,179,617

$ 20,638,354

$ 19,862,302

$ 18,262,610

$ 13,639,451

Right Of use Assets

$ 19,318

$ 49,377

----

----

----

Intangible Assets

$ 885

$ 1,197

$ 2,736

$ 2,565

$ 3,903

Other non Current Assets

$ 100

$ 100

$ 100

$ 100

$ 100

Current Assets

$ 22,519,623

$ 22,172,184

$ 19,896,904

$ 17,327,314

$…

Chapter 3 Solutions

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Ch. 3.1 - Prob. 3.1RQCh. 3.1 - Describe the purpose of each of the four major...Ch. 3.1 - Prob. 3.3RQCh. 3.1 - Prob. 3.4RQCh. 3.2 - With regard to financial ratio analysis, how do...Ch. 3.2 - What is the difference between cross-sectional and...Ch. 3.2 - Prob. 3.7RQCh. 3.2 - Prob. 3.8RQCh. 3.3 - Under what circumstances would the current ratio...Ch. 3.3 - In Table 3.5, most of the specific firms listed...

Ch. 3.4 - To assess the firms average collection period and...Ch. 3.5 - What is financial leverage?Ch. 3.5 - What ratio measures the firms degree of...Ch. 3.6 - What three ratios of profitability appear on a...Ch. 3.6 - Prob. 3.15RQCh. 3.6 - Prob. 3.16RQCh. 3.7 - What do the price/earnings (P/E) ratio and the...Ch. 3.8 - Financial ratio analysis is often divided into...Ch. 3.8 - Prob. 3.19RQCh. 3.8 - What three areas of analysis are combined in the...Ch. 3 - For the quarter ended January 28, 2017, Kroger...Ch. 3 - Learning Goals 3, 4, 5 ST3-1 Ratio formulas and...Ch. 3 - Prob. 3.2STPCh. 3 - Prob. 3.1WUECh. 3 - Learning Goal 1 E3-2 Explain why the income...Ch. 3 - Prob. 3.3WUECh. 3 - Learning Goal 3 E3-4 Bluestone Metals Inc. is a...Ch. 3 - Learning Goal 6 E3-5 If we know that a firm has a...Ch. 3 - Financial statement account identification Mark...Ch. 3 - Learning Goal 1 P3-2 1ncome statement preparation...Ch. 3 - Prob. 3.3PCh. 3 - Learning Goal 1 P3-4 Calculation of EPS and...Ch. 3 - Prob. 3.5PCh. 3 - Prob. 3.6PCh. 3 - Learning Goals 1 P3-7 Initial sale price of common...Ch. 3 - Prob. 3.8PCh. 3 - Learning Goal 1 P3-9 Changes In stockholders...Ch. 3 - Learning Goals 2, 3, 4, 5 P3-10 Ratio comparisons...Ch. 3 - Learning Goal 3 P3-11 Liquidity management Bauman...Ch. 3 - Prob. 3.12PCh. 3 - Inventory management Three companies that compete...Ch. 3 - Accounts receivable management The table below...Ch. 3 - Prob. 3.15PCh. 3 - Learning Goal 4 P3-16 Debt analysis Springfield...Ch. 3 - Prob. 3.17PCh. 3 - Learning Goals 2, 3, 4 P3-18 Using Tables 3.1,...Ch. 3 - Learning Goals 5 P3-19 Common-size statement...Ch. 3 - The relationship between financial leverage and...Ch. 3 - Learning Goal 4 P3-21 Analysis of debt ratios...Ch. 3 - Learning Goal 6 P3-22 Ratio proficiency McDougal...Ch. 3 - Learning Goal 6 P3-23 Cross-sectional ratio...Ch. 3 - Learning Goal 6 P3-24 Financial statement analysis...Ch. 3 - Learning Goals 6 P3- 25 Integrative: Complete...Ch. 3 - Learning Goal 6 P3-26 DuPont system of analysis...Ch. 3 - Learning Goal 6 P3-27 Complete ratio analysis,...Ch. 3 - Spreadsheet Exercise The income statement and...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Ratio Analysis Rising Stars Academy provided the following information on its 2019 balance sheet and state mcnt of cash flows: Long-term debt S 4,400 Interest expense S 398 Total liabilities 8,972 Net income 559 Total assets 38,775 Interest payments 432 Total equity 29,803 Cash flows from operations 1.015 Operating income 1.223 Income tax expenses 266 Income taxes paid 150 Required: Calculate the following ratios for Rising Stars: (a) debt to equity, (b) debt to total assets, (c) long-term debt to equity, (d) times interest earned (accrual basis), and (e) times interest earned (cash basis). (Note: Round answers to three decimal places.) CONCEPTUAL CONNECTION Interpret these results. 3.What does it mean if a bond is callablearrow_forwardI attached in this A company table in which you can see last 5 years Financial Progress Of company Assume the unlevered beta of the company is 1.5 for all 5 years Tax Rate 35% Assume Total Liabilities shown on balance sheet as Total Debt Requirements: Calculate the Levered Beta of assigned company for last 5 years. Comment in the industry outlook the company is operating. YEAR 2021 2020 2019 2018 2017 Property , Plant and Equipment $ 19,179,617 $ 20,638,354 $ 19,862,302 $ 18,262,610 $ 13,639,451 Right Of use Assets $ 19,318 $ 49,377 ---- ---- ---- Intangible Assets $ 885 $ 1,197 $ 2,736 $ 2,565 $ 3,903 Other non Current Assets $ 100 $ 100 $ 100 $ 100 $ 100 Current Assets $ 22,519,623 $ 22,172,184 $ 19,896,904 $ 17,327,314…arrow_forwardFrom the balance sheet prepare a proforma income statement where revenues can increase by 2% and the firm can borrow at 5.5% BALANCE SHEET 2021 Cash and cash equivalents 280 Receivables 2588 Inventory 2516 Other CA 189 TOTAL CA 5573 Fixed assets 5024 TOTAL ASSETS 10597 Accounts payable 4713 Short term debt 78 TOTAL CL 4790 LT debt 921 Shareh. Equity 4886 TOTAL LIAB. AND SHARH. EQUITY 10597 INCOME STATEMENT 2021 Sales 19418 COGS 13136 Depreciations 354 SG&A 4952 EBIT 976 Interest Expenses 52 Tax 268 Net income 656 Pro-forma statement Pro Forma Forecasts Actual Projected Projected Projected Projected Projected 2021 2022 2023 2024 2025 2026 COGS/REVENUES SGA/SALES INVENTORIES/COGS OTHER CA/SALES AR/SALES AP/COGS SALES/FIXED ASSETS DEPR/ FIXED ASSETS EQUITY/INVESTED CAPITAL ST DEBT/INVESTED…arrow_forward

- OBJECTIVE: To enable learners to utilize financial ratios as a mechanism to evaluate the firm's financial performance and identify areas for making decisions for improvement REQUIREMENT: Financial Statement Analysis Question Refer to the following financial statements of Delima Corporation for 2019 and 2020: Delima Corporation Income Statements For the year ended 31 December (in millions) 2020 $13,198 7,750 2019 $12,397 7,108 Net sales Cost of goods sold Gross profit Selling and administrative expenses Income from operations 5,448 5,289 3,472 3,299 1,976 1,990 Interest expense 233 248 Other (income) expense, net 11 1,732 503 1,229 Income before income taxes 1,742 Income tax expense 502 Net income 1,240 Delima Corporation Balance Sheets 31 December (in millions) 2020 2019 Assets Current assets Cash $460 $444 Accounts receivables (net) 1,188 1,132 1,190 1,056 225 2,915 3,128 Inventories Other current assets 247 Total current assets 3,027 3,281 Property (net) 5,593 $11,901 Other assets…arrow_forwardComparative Analysis: Under Armour, Inc., versus Columbia Sportswear Refer to the 10-K reports of Under Armour, Inc., and Columbia Sportswear that are available for download from the companion website at CengageBrain.com. Required: Are debt and equity likely to be available as inflows of cash in the near future?arrow_forwardFinancing Deficit Stevens Textile Corporation’s 2018 financial statements are shown here: Balance Sheet as of December 31, 2018 (Thousands of Dollars) Income Statement for December 31, 2018 (Thousands of Dollars) Suppose 2019 sales are projected to increase by 15% over 2018 sales. Use the forecasted financial statement method to forecast a balance sheet and income statement for December 31, 2019. The interest rate on all debt is 10%, and cash earns no interest income. Assume that all additional debt in the form of a line of credit is added at the end of the year, which means that you should base the forecasted interest expense on the balance of debt at the beginning of the year. Use the forecasted income statement to determine the addition to retained earnings. Assume that the company was operating at full capacity in 2018, that it cannot sell off any of its fixed assets, and that any required financing will be borrowed as notes payable. Also, assume that assets, spontaneous liabilities, and operating costs are expected to increase by the same percentage as sales. Determine the additional funds needed. What is the resulting total forecasted amount of the line of credit? In your answers to parts a and b, you should not have charged any interest on the additional debt added during 2019 because it was assumed that the new debt was added at the end of the year. But now suppose that the new debt is added throughout the year. Don’t do any calculations, but how would this change the answers to parts a and b?arrow_forward

- Baker & Co. has applied for a loan from the Trust Us Bank in order to invest in several potential opportunities. In order to evaluate the firm as a potential debtor, the bank would like to compare Baker & Co. with the industry. Balance Sheet December 31 December 31 Income Statement For the year ended Dec 31, 2021 2020 2021 Assets Sales (100% credit) 1,330 Cash 305 270 Less: Cost of goods sold 760 Accounts receivable 275 290 Gross profit 570 Inventory 600 580 Operating expenses 30 Current assets 1,180 1,140 Depreciation 200 Plant and equipment 1,700 1,940 Net operating income 340 Less: acc depr -500 -600 Less: Interest expense 57 Net plant and equipment 1,200 1,340 Net income before taxes 283 Total assets 2,380 2,480 Less: Taxes 96 Net income 187 Liab. and Owners' Equity Accounts payable 150 200 Notes payable 125 - Current liabilities 275 200 Bonds payable 500 500…arrow_forwardPrepare the statement of retained earnings TPR had one major creditor at the beginning of 2020. One of the major banks loaned TPR $500,000 for ongoing operating costs. The outstanding portion of the loan was $400,000 at the beginning of the vear. The bank requires TPR to maintain a current ratio of 1.8:1 or the loan may become immediately repayable. It also requires TPR to have a debt to total asset ratio of no greater than 55%. Information required for adjusting journal entries: 1. There is no interest accrual required for the mortgage loan on the building because payment was made on December 31. The loan for the balloon machine carries an interest rate of 5% and has been outstanding for 15 days. 2. Depreciation of $800 on the cash register machines and $15,000 on the other equipment has not yet been recorded. 3. A dividend of $2,000 was declared but has not been recorded. It will be paid in March 2021. 4. The monthly electricity bill of $2,000 was received in early January 2021.…arrow_forwardProblem 17-5 (AICPA Adapted) Investment in Hall Company at equity statement of financial position: Accounts receivable, net of allowance Fearsome Company showed the following comparative 2021 2020 Cash and cash equivalents 2,350,000 600,000 1,000,000 2,200,000 2,000,000 5,000,000 1,050,000) ( 800,000) 400,000 350,000 700,000 850,000 2,000,000 1,500,000 4,000,000 Inventory Land Property, plant and equipment. Accumulated depreciation Goodwill 400,000 12,500,000 9,000,000 Accounts payable Note payable - long term Bonds payable Share capital, P100 par Share premium Retained earnings Treasury shares, at cost 600,000 500,000 1,600,000 5,250,000 2,700,000 1,850,000 550,000 2,100,000 4,000,000 1,750,000 1,300,000 700,000) 12,500,000 9,000,000 Additional information for 2021 1. The net income for the current year was P3,050,000. 2. Cash dividend paid amounted to P2,500,000. 3. The entity sold equipment costing P200,000, with carrying amount of P50,000, for P70,000 cash. 4. The entity issued…arrow_forward

- Proforma balance sheet for the upcoming year is given. The estimated net income is $2,621.60. If the company is planning pay $500 dividends, what should be the external financing needs (EFN)? Assets $20,972.80 Debt Equity $20,972.80 Total Total Proforma Balance Sheet Multiple Choice O O -$208.8. $208.8. $500. $291.2. -$500. $11,000.00 $10,181.60 $21,181.60arrow_forwardYears Bank Total Asset 2018 STANBIC 6,205,018 2019. STANBIC. 9,295,682 2020. STANBIC 12,742,132 2018. BARCLAYS 8,994,562 2019. ABSA 11,772,546 2020. ABSA. 12,546,473 Calculate the five-firm concentration ratio in for each year using total assets.arrow_forwardParticulars As on 31.3.2019(Rupees. In Lacs)As on 31.3.2020(Rupees. In Lacs)Investment in FinancialAssets- 100Equity Share Capital 150 160Long term Loans taken 100 200Dividend paid - 26Dividend received - 10Interest received - 15 Calculate the debt-equity ratio & commentarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License