Extensions of the CVP Analysis—Taxes

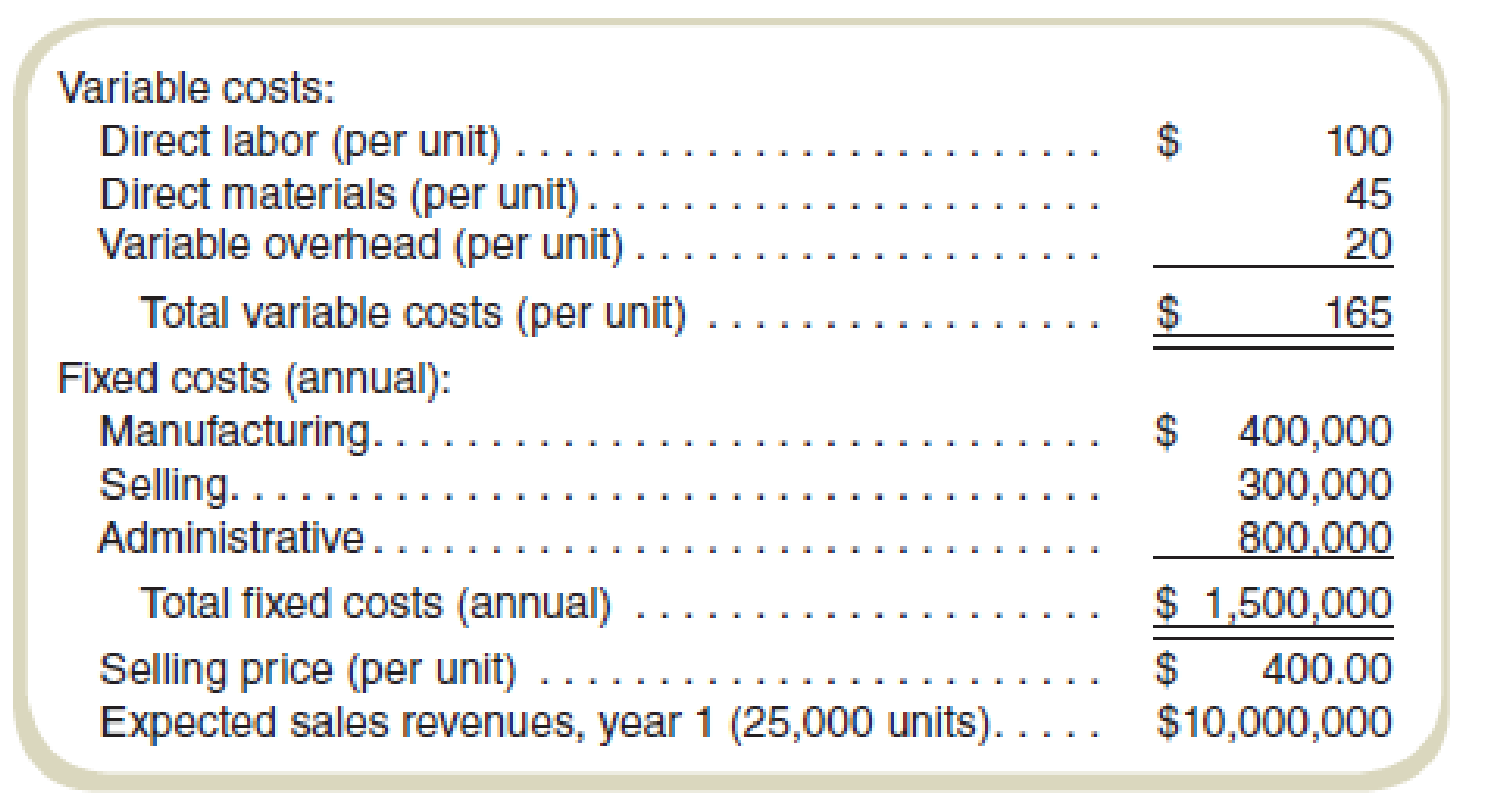

Eagle Company makes the MusicFinder, a sophisticated satellite radio. Eagle has experienced a steady growth in sales for the past five years. However, Ms. Luray, Eagle’s CEO, believes that to maintain the company’s present growth will require an aggressive advertising campaign next year. To prepare for the campaign, the company’s accountant, Mr. Bednarik, has prepared and presented to Ms. Luray the following data for the current year, year 1:

Eagle has an income tax rate of 35 percent.

Ms. Luray has set the sales target for year 2 at a level of $11,200,000 (or 28,000 radios).

Required

- a. What is the projected after-tax operating profit for year 1?

- b. What is the break-even point in units for year 1?

- c. Ms. Luray believes that to attain the sales target (28,000 radios) will require additional selling expenses of $300,000 for advertising in year 2, with all other costs remaining constant. What will be the after-tax operating profit for year 2 if the firm spends the additional $300,000?

- d. What will be the break-even point in sales dollars for year 2 if the firm spends the additional $300,000 for advertising?

- e. If the firm spends the additional $300,000 for advertising in year 2, what is the sales level in dollars required to equal the year 1 after-tax operating profit?

- f. At a sales level of 28,000 units, what is the maximum amount the firm can spend on advertising to earn an after-tax operating profit of $750,000?

a.

Calculate the projected after-tax operating profit for year 1.

Answer to Problem 62P

The projected after-tax operating profit for year 1 is $2,843,750.

Explanation of Solution

Target volume: the level of sales which need to be achieved during a particular period of time is termed as target volume.

Target profit: the amount of profit which needs to be achieved during a particular period of time on a particular level of sales is termed as target profit.

Total fixed costs and variable costs:

| Particulars | Amount |

| Variable cost (per unit): | |

| Direct labor | $100 |

| Direct material | $45 |

| Variable overhead | $20 |

| Total variable cost: | $165 |

| Fixed cost: | |

| Manufacturing | $400,000 |

| Selling | $300,000 |

| Administration | $800,000 |

| Total fixed costs (annual) | $1,500,000 |

| Selling price | $400 |

| Expected sales revenue, year 1 (25,000 units) | $10,000,000 |

Table: (1)

Compute the projected after-tax operating profit for year 1:

Compute the after-tax profit, when the tax rate is 35%:

Thus, the projected after-tax operating profit for year 1 is $2,843,750

Working note 1:

Compute the profit:

b.

Calculate the break-even point in units for year 1.

Answer to Problem 62P

The break-even point in units for year 1 is $6,383.

Explanation of Solution

Breakeven point (BEP): The breakeven point or BEP is that level of output at which the total revenue is equal to the total cost. The BEP means there are no operating income and no operating losses. The management keeps an eye on the breakeven point in order to avoid the operating losses in order to avoid losses.

Compute the break-even point in units for year 1:

Thus, the break-even point for the drones is 6,383 units.

Working note 2:

Compute the contribution margin:

c.

Calculate after-tax operating profit for year 2 if the firm spends the additional $300,000.

Answer to Problem 62P

After tax operating profit for year 2 will be $3,107,000,

Explanation of Solution

Target volume: the level of sales which need to be achieved during a particular period of time is termed as target volume.

Target profit: the amount of profit which needs to be achieved during a particular period of time on a particular level of sales is termed as target profit.

Compute the projected after-tax operating profit for year 1:

Compute the after-tax profit:

Thus, the projected after-tax operating profit for year 1 is $3,107,000.

Working note 3:

Compute the profit:

Working note 4:

Compute the revised fixed cost:

d.

Calculate the break-even point if the firm spends the additional $300,000 for advertising.

Answer to Problem 62P

If a firm spends the additional $300,000 for advertising, the break-even point will be $3,063,000.

Explanation of Solution

Breakeven point (BEP): The breakeven point or BEP is that level of output at which the total revenue is equal to the total cost. The BEP means there are no operating income and no operating losses. The management keeps an eye on the breakeven point in order to avoid the operating losses in order to avoid losses.

Compute the break-even point in sales dollar for year 1:

Thus, if a firm spends the additional $300,000 for advertising, the break-even point will be $3,063,000.

Working note 5:

Compute the break-even point in units for year 1:

Thus, the break-even point for the drones is 7,659 units.

e.

Calculate the dollar sales to maintain the year 1 after-tax operating profit if the firm spends the additional $300,000 for advertising.

Answer to Problem 62P

The dollar sales to maintain the year 1 after-tax operating profit if the firm spends the additional $300,000 for advertising is $10,510,638.

Explanation of Solution

Breakeven point (BEP): The breakeven point or BEP is that level of output at which the total revenue is equal to the total cost. The BEP means there are no operating income and no operating losses. The management keeps an eye on the breakeven point in order to avoid the operating losses in order to avoid losses.

Dollars sales to maintain the year 1 level of profit:

Working note 6:

Compute the dollar sales to maintain the year 1 after-tax operating profit if the firm spends the additional $300,000 for advertising:

f.

Calculate the maximum amount the firm can spend on advertising to earn the after-tax operating profit of $750,000 at a sales level of 28,000 units.

Answer to Problem 62P

The maximum amount the firm can spend on advertising to earn the after-tax operating profit of $750,000 at a sales level of 28,000 units is $4,226,154.

Explanation of Solution

Compute the the maximum amount the firm can spend on advertising to earn the after-tax operating profit of $750,000 at a sales level of 28,000 units is $4,226,154:

Thus, the maximum amount the firm can spend on advertising to earn the after-tax operating profit of $750,000 at a sales level of 28,000 units is $4,226,154.

Working note 7:

Compute the operating profit before tax:

Working note 8:

Compute the contribution margin in dollar sales:

Working note 9:

Compute the total fixed cost:

Working note 10:

Compute the maximum amount the firm can spend on advertising:

Total fixed cost other than advertising:

| Particulars | Amount |

| Fixed cost: | |

| Manufacturing | $400,000 |

| Administration | $800,000 |

| Total fixed costs (annual) | $1,200,000 |

Table: (7)

Want to see more full solutions like this?

Chapter 3 Solutions

Fundamentals Of Cost Accounting (6th Edition)

- Allegience Insurance Company’s management is considering an advertising program that would require an initial expenditure of $177,085 and bring in additional sales over the next five years. The projected additional sales revenue in year 1 is $82,000, with associated expenses of $28,500. The additional sales revenue and expenses from the advertising program are projected to increase by 10 percent each year. Allegience’s tax rate is 30 percent. (Hint: The $177,085 advertising cost is an expense.)Required:1. Compute the payback period for the advertising program.2. Calculate the advertising program’s net present value, assuming an after-tax hurdle rate of 10 percent. (Round your intermediate calculations and final answer to the nearest whole dollar.)arrow_forwardA stationery company plans to launch a new type of indelible ink pen. Advertising for the new product will be heavy and will cost the company $11 million, although the company expects general revenues of $280 million next year from sources other than sales of the new pen. If the company has a corporate tax-rate of 40% on its pretax income, what effect will the advertising for the new pen have on its taxes? O It will have no effect on taxes. O Increase taxes by $4.40 million O Increase taxes by $11 million O Reduce taxes by $4.40 millionarrow_forwardA company is planning to move to a larger office and is trying to decide if the new office should be owned or leased. Cash flows for owning versus leasing are estimated as follows. Assume that the cash flows from operations will remain level over a 10-year holding period. If purchased, the company will make an equity investment and finance the remainder with an interest-only loan that has a balloon payment due in year 10. The company’s marginal income tax rate is 30% and the after-tax cash flow from sale of the property at the end of year 10 is expected to be $800,000. What would the initial equity investment have to be to generate a 15% incremental rate of return on equity with owning instead of leasing?arrow_forward

- Pleasant Place Plc is contemplating as to whether to invest in the Hotel or Tourism business. The Chairman of the Company has approached you this morning for assistance on the tax implications with respect to the two businesses for his final decision.The projected results of the two companies are likely to be the same in the first year. The companies’ projected income and expenditure for year 1 is as follows:ABS LTD (HOTEL) GHCGross Profit 1,000,000Expenditure 670,000Additional Relevant Information:CDS LTD (TOURISM) GHC1,000,000670,000A building to be bought on 1 March of Year 1 for GHC 400,000 has been granted full year’s depreciation at the rate of 20% and same amount has been added to the projected cost above.Required:As a postgraduate student in taxation at the Accra Business School, write a briefing note to advice the Chairman on what business to invest in, with the necessary appendix.arrow_forwardIncome Statement: A small food stall owned by Ms. Lopez is located at San Fernando Pampanga. She earns P 285,000 at the present and is expected to increase by 10% yearly. Prepare her 5-year income statement. Financial Assumptions: 1. 10% of the projected sales is cost of sales 2. The operating expenses is amounting to 35,000 for year 2018 and it's expected to increase by 5% per year. 3. Income tax is assumed to be 20%. 2018 2019 2020 2021 2022 Sales Less: Cost of Sales Gross Profit Less: Operating Expenses Net income before tax Less: Income tax Net revenue after taxarrow_forwardIn conducting an EVA analysis for year two for a newly introduced product line, Bethune, Inc., which manufactures pre-assembled blower packages and other water treatment components, determined the EVA to be $28,000. Bethune’s CEO knew that the gross income was $700,000, but he asked you to find out how much expense was associated with the new product line for year 2. The company uses an after-tax interest rate of 14% and a Te of 35%. The initial investment capital required for the new product was $550,000 and all equipment is 3-year MACRS depreciated.arrow_forward

- Data on Wentz Inc. for last year are shown below, along with the payables deferral period (PDP) for the firms against which it benchmarks. The firm's new CFO believes that the company could delay payments enough to increase its PDP to the benchmarks' average. If this were done, by how much would payables increase? Use a 365-day year. Cost of goods sold = $74,000 Payables = $5,000 Payables Deferral Period (PDP) = 24.66 Benchmark Payables Deferral Period = 34.00 Please explain process and show calculations.arrow_forwardCollin Wilkes is the marketing manager at Darby Company. Last year, Collin recommended the company approve a capital investment project for the addition of a new product line. Collin’s recommendation included predicted cash inflows for five years from the sales of the new product line. Darby Company has been selling the new products for almost one year. The company has a policy of conducting annual post-audits on capital investments, and Collin is concerned about the one-year post-audit because sales in the first year have been lower than he estimated. However, sales have been increasing for the last couple of months, and Collin expects that by the end of the second year, actual sales will exceed his estimates for the first two years combined. Collin wants to shift some sales from the second year of the project into the first year. Doing so will make it appear that his cash flow predictions were accurate. With accurate estimates, he will be able to avoid a poor performance evaluation.…arrow_forwardCollin Wilkes is the marketing manager at Darby Company. Last year, Collin recommended the company approve a capital investment project for the addition of a new product line. Collin’s recommendation included predicted cash inflows for five years from the sales of the new product line. Darby Company has been selling the new products for almost one year. The company has a policy of conducting annual post-audits on capital investments, and Collin is concerned about the one-year post-audit because sales in the first year have been lower than he estimated. However, sales have been increasing for the last couple of months, and Collin expects that by the end of the second year, actual sales will exceed his estimates for the first two years combined. Collin wants to shift some sales from the second year of the project into the first year. Doing so will make it appear that his cash flow predictions were accurate. With accurate estimates, he will be able to avoid a poor performance evaluation.…arrow_forward

- Spencer Wilkes is the marketing manager at Darby Company. Last year, Spencer recommended the company approve a capital investment project for the addition of a new product line. Spencer’s recommendation included predicted cash inflows for five years from the sales of the new product line. Darby Company has been selling new products for almost one year. The company has a policy of conducting annual post audits on capital investments, and Spencer is concerned about the one-year post-audit because sales in the first year have been lower than he estimated. However, sales have been increasing for the last couple of months, and Spencer expects that by the end of the second year, actual sales will exceed his estimates for the first two years combined. Spencer wants to shift some sales from the second year of the project into the first year. Doing so will make it appear that his cash flow predictions were accurate. With accurate estimates, he will be able to avoid a poor performance…arrow_forwardPleasant Place Plc is contemplating as to whether to invest in the Hotel or Tourism business. TheChairman of the Company has approached you this morning for assistance on the tax implicationswith respect to the two businesses for his final decision.The projected results of the two companies are likely to be the same in the first year.The companies’ projected income and expenditure for year 1 is as follows: ABS LTD (HOTEL) CDS LTD (TOURISM) Dollar DollarGross Profit 1,000,000 1,000,000Expenditure 670,000 670,000 Additional Relevant Information:A building to be bought on 1 March of Year 1 for GHC 400,000 has been granted full year’sdepreciation at the rate of 20% and same amount has been added to the projected cost above.Required:As a postgraduate student in…arrow_forwardSpencer Wilkes is the marketing manager at Darby Company. Last year, Spencer recommended the company approve a capital investment project for the addition of a new product line. Spencer’s recommendation included predicted cash inflows for five years from the sales of the new product line. Darby Company has been selling the new products for almost one year. The company has a policy of conducting annual postaudits on capital investments, and Spencer is concerned about the one-year post-audit because sales in the first year have been lower than he estimated. However, sales have been increasing for the last couple of months, and Spencer expects that by the end of the second year, actual sales will exceed his estimates for the first two years combined. Spencer wants to shift some sales from the second year of the project into the first year. Doing so will make it appear that his cash flow predictions were accurate. With accurate estimates, he will be able to avoid a poor performance…arrow_forward

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning