Sub part (a):

Effects of higher interest rate on households and firm behavior.

Sub part (a):

Explanation of Solution

If the Federal Reserve System rises the interest rates, then the borrowing of items become more costly. Therefore, households will reduce the purchase of durable goods such as auto mobiles and houses. So when the rate of interest rises, consumers spending on durable goods reduce.

In the case of firms, when the rate of interest rises, cost of capital becomes higher. Therefore firms will reduce the spending on investment. So when the rate of interest rises, investment will reduce.

Concept introduction:

Rate of interest: The rate of interest: The rate of interest refers to that percentage at which the money is borrowed or is taken as a loan. The amount to be paid as interest is calculated on this given percentage.

Sub part (b):

Effects of higher interest rate on bonds.

Sub part (b):

Explanation of Solution

When the rate of interest rises by the Federal Reserve, it will fall the existing values of fixed rate bonds. Because, in the case of fixed rate bonds, if the holder paying 7% for the next 10 years is become simply worth less if the potential buyers can now earn 8% by buying a new bond. That’s why, the higher interest rate would decrease the value of existing fixed rate bonds held by the public.

Concept introduction:

Bonds: Bond refers to the securities, which are traded in the public to raise the capital when needed. It is an investment with a fixed income, where an investor gives money to an entity or individual for a specified period of time at a fixed rate.

Sub part (c):

Wealth effect of higher interest rate on consumption.

Sub part (c):

Explanation of Solution

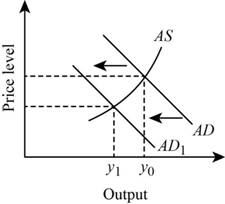

Figure 1 illustrates the changes in aggregative demand

In figure-1, vertical axis shows the output and the horizontal axis shows the price level. When the consumption falls the AD curve will shift from AD to AD1. As a result, price level falls and the quantity reduces from Y0 to Y1.

When the rate of interest rises, the cost of borrowing become higher. And also, the investment rate reduces because of the higher rate of capitals. These factors will reduce the wealth of an economy. When wealth reduces, consumers will spend less and they become worse off. In short, higher interest rate will reduce the spending of consumers. Therefore, the aggregative demand curve will shift the left wards. This is higher than the direct effect on investment.

Concept introduction:

Wealth effect: Wealth effect refers to the effect of a change in the price that has on the wealth of the individual.

Want to see more full solutions like this?

Chapter 30 Solutions

Principles of Economics (12th Edition)

- How the following events affect interest rates? Be clear in your answer. 1. An earthquake destroys bridges and roads in Turkey, leading to increased investment spending for rebuilding the infrastructure. 2. Future taxes of businesses are expected to be increased. 3. Corona pandemic is forcing people to stay home to protect themselves and spend less money than usual. 4. The government proposes a new tax on savings.arrow_forwardIf the government wants to increase the amount of savings in the economy, how should it alter government spending? What effect will this action have on the interest rate in the economy?arrow_forwardExplain how government borrowing affect interest rate in the market. What impact such change in interest rate could have on the economy?arrow_forward

- Predict how each of the following economic changes will affect the equilibrium price and quantity in the financial market for home loans. Which curve will shift: supply or demand? In which direction will the curve shift: right or left? (It may help to use a demand and supply diagram to conduct your analysis.) a. The number of people at the most common ages for home-buying decreases. b. Rents rise extremely rapidly. c. Banks that have made home loans find that a larger number of people than they expected are not repaying those loans. d. Because of a threat of a war, people become uncertain about their economic future.The overall level of saving in the economy diminishes. e. The federal government changes its bank regulations in a way that makes it cheaper and easier for banks to make home loans.arrow_forwardChairman Latrobe, the Supreme Leader of Rolling Rock decided to increase the personal tax rate to fund the defense force. 8) How may this affect the loanable funds market? Explain by describing the change in the demand for, or the supply of, loanable funds. 9) Because of the change decreed by President Thug and your answer to question 8, what is likely to happen to the interest rate and the quantity of funds in the loanable funds market? 10) How will each of these Rolling Rockers feel about President Thug’s decision? (A) Investor Confidence (B) The President of Rolling Rock National Bankarrow_forwardStock prices fell throughout much of 2007 and 2008 and many investors decided to switch their funds into the bond market. What only about 30 percent of surveyed investors knew was that as bond prices rise, interest rates a. fall in reaction to the decreased demand for bonds. b. rise in reaction to the increased demand for bonds. c. fall in reaction to the increased demand for bonds. d. rise in reaction to the decreased demand for bonds.arrow_forward

- Predict how each of the following economic changes will affect the equilibrium price and quantity in the financial market for home loans. Sketch a demand and supply diagram to support your answers. Because of a threat of war, people become uncertain about their economic future. The overall level of saving in the economy diminishes. The federal government changes its bank regulations in a way that makes it cheaper and easier for banks to make home loans.arrow_forwardon a supply and demand diagram for funds, show what happens to interest rates and explain what happens to savings and investment when household decreases their consumptionarrow_forwardSuppose the government borrows $20 million more next year than this year. What happens to investment? To private savings? To public savings? To national savings? How does the elasticity of the supply of loanable funds affect the size of these changes? How does the elasticity of the demand of loanable funds affect the size of these changes?arrow_forward

- Why does longer-term bonds fluctuate more when interest rate change, than does shorter-term bondsarrow_forwardManipulate the graph to show what will happen to supply and demand in the market for loanable funds when the government budget deficit increases, changing the equilibrium quantity of loanable funds by 3 percentage points. Ceteris paribus, what is the new interest rate? interest rate: 6 Ceteris paribus, private investment would decrease. not change. increase. % Interest rate (%) 10 9 8 7 6 4 3 2 1 0 0 Supply 6 Demand 2 4 6 8 10 12 14 16 18 20 22 24 26 28 Quantity of loanable funds (% of GDP)arrow_forwardWhat will happen in the bond market if the government imposes a limit on the amount of daily transactions? Which characteristic of an asset would be affected? How might it affect the interest rates. Explain with a graph.arrow_forward

Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning Macroeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506756Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Macroeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506756Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning