Horngren's Accounting (12th Edition)

12th Edition

ISBN: 9780134486444

Author: Tracie L. Miller-Nobles, Brenda L. Mattison, Ella Mae Matsumura

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

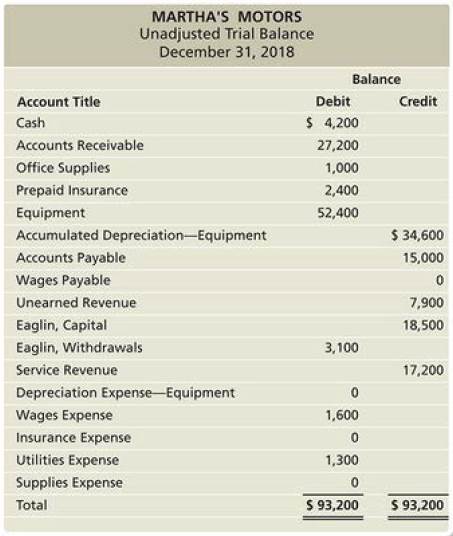

Chapter 4, Problem P4A.34APGA

Preparing

Learning Objectives 7 Appendix 4

The unadjusted

Adjustment data at December 31,2018:

Depreciation on equipment, $2,100.- Accrued Wages Expense. $1,100.

- Office Supplies cm hand, $500.

- Prepaid Insurance expired during December,$600.

- Unearned Revenue earned during December,$4,800

- Accrued Service Revenue, 51,300.

2019 transactions:

- On January 4, Martha's Motors paid wages of $1,900. Of this, $1,100 related to the accrued wages recorded on December 31.

- On January 10, Martha’s Motors received $1,500 for Service Revenue. Of this, $1,300 is related to the accrued Service Revenue recorded on December 31

Requirements

- Journalize adjusting entries.

- Journalize reversing entries for the appropriate adjusting entries.

- Refer to the 2019 data. Journalize the cash payment and the cash receipt that occurred in 2019.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Please answer Requirements 7 & 8

Purchasing Supplies and the Monthly Supplies Adjusting EntryOn July 1, 2021, Martha Jones started Martha’s Auto Repair Shop, Inc. On that same day, Marthapurchased the following supplies for use in the repair shop:Item Unit ofMeasureQuantityPurchasedPrice perUnitExtendedTotal CostShop Towels Rolls 120 $4 $480Degreasing Fluid Quarts 75 $9 $675Gasket Sealer Tubes 40 $6 $240Total $1,395On July 1, Martha paid cash for the supplies and set the accounting policy that all supplies wouldinitially be recorded in the Supplies asset account.At the end of July, Martha counted the supplies that were left and prepared the following listing:Item Unit ofMeasureQuantityRemainingShop Towels Rolls 80Degreasing Fluid Quarts 65Gasket Sealer Tubes 32At the end of August, Martha counted the supplies that were left and prepared the following listing:Item Unit ofMeasureQuantityRemainingShop Towels Rolls 55Degreasing Fluid Quarts 48Gasket Sealer Tubes 22The following is a…

Problem 8: From the following receipt and payment account of Edhi Centre, prepare an

income and expenditure account for the year ended 31-12-2023 and a Balance sheet as

on that date.

Particulars

Balance b/d

Entrance fee

Subscription

2022

2023

2024

Locker rent

Miscellaneous

Adjustments:

Receipt and payment account

For the year ended 31-12-2023

Dr.(AED)

Particulars

Cr.

(AED)

130 Rates

2,500

210 Stationery

340

General expenses

3,610

70 Building (Purchased on 1-

2,500

7-2023)

10,520 Repairs

300

420 Mortgage interest

1,600

300 Balance c/d

2,460

1,660

13,310

13,310

1. Locker rent AED 20 referred to the previous year and AED 30 is still owing.

2. Rates AED 20 referred to the previous year and AED 500 is still owing.

3. Subscription unpaid for the current year AED 200.

4. Depreciate building by 5% p.a.

||

Preparing the Adjusting Entries at Year-End

On Nov. 30, 2019, the end of fiscal year, the following information is available to enable

Chapter 6: Adjusting the Accounts 6-39

NAME:

SCORE:

SECTION:

PROFESSOR:

Problem #4

you

to prepare Edgar Detoya Research and Development adjusting entries:

The Supplies account showed a beginning balance of P21,740. Purchases during the

tear were P45,260. The ending inventory revealed supplies on hand of P 13,970.

The Prepaid Insurance account showed the following on November 30:

Beginning balance

July 1

P35,800

42,000

72,720

October 1

The beginning balance represented .the unexpired portion of a one-year policy

nurchased in September 2018. The July 1 entry represented a new one-year policy, and

the Oct. 1 entry is additional coverage in the form of a three-year policy.

C The following table contains the cost and annual depreciation for buildings and

equipment, all of which the entity purchased before the current year:

Account

Cost

Annual Depreciation…

Chapter 4 Solutions

Horngren's Accounting (12th Edition)

Ch. 4 - Assets are listed on the balance sheet in the...Ch. 4 - Which of the following accounts would be included...Ch. 4 - Which situation indicates a net loss within the...Ch. 4 - Which of the following accounts is not closed?...Ch. 4 - What do closing entries accomplish? Learning...Ch. 4 - Which of the following is not a closing entry?...Ch. 4 - Which of the following accounts may appear on a...Ch. 4 - 8. Which of the following steps of the accounting...Ch. 4 - Clean Water Softener Systems has Cash of $600,...Ch. 4 - Which of the following statements concerning...

Ch. 4 - What document are financial statements prepared...Ch. 4 - What does the income statement report?Ch. 4 - Prob. 3RQCh. 4 - Prob. 4RQCh. 4 - Why are financial statements prepared in a...Ch. 4 - Prob. 6RQCh. 4 - Prob. 7RQCh. 4 - Prob. 8RQCh. 4 - Prob. 9RQCh. 4 - How could a worksheet help in preparing financial...Ch. 4 - If a business had a net loss for the year, where...Ch. 4 - Prob. 12RQCh. 4 - What are temporary accounts? Are temporary...Ch. 4 - What are permanent accounts? Are permanent...Ch. 4 - How is the Income Summary account used? Is it a...Ch. 4 - Prob. 16RQCh. 4 - If a business had a net loss for the year, what...Ch. 4 - What types of accounts are listed on the...Ch. 4 - Prob. 19RQCh. 4 - What is the current ratio, and how is it...Ch. 4 - Prob. 21ARQCh. 4 - Preparing an income statement Learning Objective 1Ch. 4 - Preparing a statement of owner’s equity. Learning...Ch. 4 - Preparing a balance sheet (unclassified, account...Ch. 4 - Preparing a balance sheet (classified, report...Ch. 4 - Classifying balance sheet accounts Learning...Ch. 4 - Prob. S4.6SECh. 4 - Prob. S4.7SECh. 4 - Determine net loss using a worksheet Learning...Ch. 4 - Identifying temporary and permanent accounts...Ch. 4 - Prob. S4.10SECh. 4 - Posting closing entries directly to Taccounts...Ch. 4 - S412 Identifying accounts included on a...Ch. 4 - Identifying steps in the accounting cycle Learning...Ch. 4 - Calculating the current ratio Learning Objective 6...Ch. 4 - Journalizing reversing entries Learning Objective...Ch. 4 - E416 Preparing the financial statements The...Ch. 4 - Classifying balance sheet accounts Learning...Ch. 4 - Preparing a classified balance sheet and...Ch. 4 - Preparing a worksheet Learning Objective 2: Title...Ch. 4 - Preparing financial statements from the completed...Ch. 4 - Preparing closing entries from an adjusted trial...Ch. 4 - Preparing closing entries from T-accounts Learning...Ch. 4 - Determining the effects of closing entries on the...Ch. 4 - Preparing a worksheet and closing entries Learning...Ch. 4 - Preparing closing entries from an adjusted trial...Ch. 4 - Preparing a worksheet, closing entries, and a...Ch. 4 - Journalizing reversing entries. Learning Objective...Ch. 4 - Journalizing reversing entries Leaning Objectives...Ch. 4 - Preparing financial statements including a...Ch. 4 - Preparing financial statements including a...Ch. 4 - Preparing a worksheet, financial statements, and...Ch. 4 - Completing the accounting cycle from adjusting...Ch. 4 - Completing the accounting cycle from journal...Ch. 4 - Preparing adjusting entries and reversing entries...Ch. 4 - Preparing financial statements including a...Ch. 4 - Preparing financial statements including a...Ch. 4 - Preparing a worksheet financial statements, and...Ch. 4 - Completing the accounting cycle from adjusting...Ch. 4 - Completing the accounting cycle from journal...Ch. 4 - Preparing adjusting entries and reversing entries...Ch. 4 - Using Excel to prepare financial statements,...Ch. 4 - Completing the accounting cycle from adjusted...Ch. 4 - Completing the accounting cycle from adjusted...Ch. 4 - COMPREHENSIVE PROBLEMS Comprehensive Problem 1 for...Ch. 4 - COMPREHENSIVE PROBLEMS Comprehensive Problem 1 for...Ch. 4 - COMPREHENSIVE PROBLEMS Comprehensive Problem 1 for...Ch. 4 - COMPREHENSIVE PROBLEMS Comprehensive Problem 1 for...Ch. 4 - COMPREHENSIVE PROBLEMS Comprehensive Problem 1 for...Ch. 4 - COMPREHENSIVE PROBLEMS Comprehensive Problem 1 for...Ch. 4 - COMPREHENSIVE PROBLEMS Comprehensive Problem 1 for...Ch. 4 - COMPREHENSIVE PROBLEMS Comprehensive Problem 1 for...Ch. 4 - COMPREHENSIVE PROBLEMS Comprehensive Problem 1 for...Ch. 4 - Comprehensive Problem 2 for Chapters 1 —4 This...Ch. 4 - Comprehensive Problem 2 for Chapters 1 —4 This...Ch. 4 - Comprehensive Problem 2 for Chapters 1 4 This...Ch. 4 - Comprehensive Problem 2 for Chapters 1 4 This...Ch. 4 - Comprehensive Problem 2 for Chapters 1 4 This...Ch. 4 - Comprehensive Problem 2 for Chapters 1 4 This...Ch. 4 - Comprehensive Problem 2 for Chapters 1 4 This...Ch. 4 - Comprehensive Problem 2 for Chapters 1 4 This...Ch. 4 - Prob. 4.1TIATCCh. 4 - Prob. 4.1EICh. 4 - Prob. 4.1FSC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Name: Time: Queen City Vidadape Trial Balance December 31, 2019 Accaunt Titles Debit Credit Cashin Bank 125,000 30,000 Accounts Receivable Allowance for Uhcollectibe Accaurts Unused Supplies Videdtape Inventory Fumiture and Fixtures 10,000 105,000 80,000 Accumlated Depreciation-Fumiture and Fixtures Notes Payable Accaunts Payabe 50,000 35,000 Accrued Interest Edgar Datbya, Captal Edgar Detoya, Withdrawels Rental Income 162,000 180,000 18000 Other Income Uncallectible Accounts Depreciation Expense InterestExpeanse Damaged Videctape Suplies Used Salaries Expense 95,000 445,000 Tdal 445,000 The following errors and omissions were discovered at year-end prior to closing of the books: a. Uncollectible accounts should be provided at 1% of the outstanding receivable balance. b. Actual cost of supplies used amounted to P6,000. Physical inventory conducted on December 31, 2019 were found to have P15,000 cost of videotapes to have been damaged. Furniture was acquired on October 1, 2019 with an…arrow_forwardWindow Help A education.wi am 1 WP NWP Assessment Player UI Application Question 28 of 42 View Policies Current Attempt in Progress In a service-type business, revenue is considered recognized when the service is performed. at the end of the year. at the end of the month. when cash is received. Save for Laterarrow_forwardR. Burke Trial Balance as at 31 December 2019 Gross profit Accumulated depreciation on office equipment Capital Accounts payable Cash at bank Accounts receivable Drawings Insurance Commission received Motor repairs Closing inventory Office equipment at cost DR$ 100 8350 5500 6300 750 3000 12500 36500 CR$ 19500 7500 4200 5000 300 36500 i. Insurance prepaid $20 ii. Motor repairs owing $60 iii. Depreciate office equipment at 20% using the reducing balance method Required: (i) Prepare R Burke's Income Statement for the year ended 31 December 2019.arrow_forward

- SALES RETURNS AND ALLOWANCES ADJUSTMENT At the end of year 1, MCs estimates that 2,400 of the current years sales will be returned in year 2. Prepare the adjusting entry at the end of year 1 to record the estimated sales returns and allowances and customer refunds payable for this 2,400. Use accounts as illustrated in the chapter.arrow_forwardComplete the accounting cycle using the adjusted trial balance below. JM PHOTOCOPYING CENTER Adjusted Trial Balance December 31, 2019 Account Title Debit Credit Cash P 16.500.00 Accounts Receivable 7.500.00 Allowance for doubtful accounts P 150.00 Note Receivable 5,527.50 3.000.00 Unused Supplies Prepaid rent 5.000.00 Photocopying Equipment 30,000.00 450.00 Accumulated Depreciation - Photocopying Equipment Furniture and Fixtures 5.000.00 Accumulated Depreciation - Furniture & Fixtures 75.00 Accounts payable 2.500.00 Loan payable 50,000.00 Notes payable 5.000.00 Salaries Payable 816.67 Unearned Photocopying Revenues 1,800.00 Mercado, Capital 10,000.00 Mercado, Drawing 500.00 Photocopying Revenues 24,227.50 Taxes and Licenses Expense 2,000.00 Salaries expense 4.800.00 Supplies expense 7,000.00 Utilities expense 2,500.00 Rent expense 5,000.00 525.00 Depreciation Expense Bad debts expense 166.67 P 95,019.17 P 95,019.17 Totals Requirements: 1. Prepare Financial Statements: Profit and loss…arrow_forwardRequirements 1. Journalize the adjusting entries needed on July 31, 2018. ** Suppose the adjustments made in Requirement 1 were not made. Compute the Overall overstatement or understatement of net income as a result of the omission of these adjustments. E3-29 Using the worksheet to record the adjusting journal entries Learning Objective 6 The worksheet of Best Jobs Employment Service follows but is incomplete. 1. Adjustments $3,700 total D. B. BEST JOBS EMPLOYMENT SERVICE Worksheet April 30, 2018 Adjustments Unadjusted Trial Balance Adjusted Trial Balance Account Names Credit Debit Credit Debit Debit Credit 7 Cash $ 1,100 8 Accounts Receivable 9 Office Supplies 10 Equipment 11 Accumulated Depreciation-Equipment 12 Salaries Payable 13 Kubota, Capital 4,100 1,200 32,700 $ 13,900 25,200 14 Kubota, Withdrawals 5,300 15 Service Revenue 9,000 16 Salaries Expense 2,200 17 Rent Expense 1,500 18 Depreciation Expense-Equipment 19 Supplies Expense 20 Total $ 48,100 $ 48,100 21 The following data…arrow_forward

- Phoebe Company Adjusted Trial Balance July 31,2020 No. Account Titles Debit Credit 101 Cash 9,840 112 Accounts Receivable 8,780 157 Equipment 15,900 158 Accumulated Depreciation—Equip. 7,400 201 Accounts Payable 4,220 208 Unearned Rent Revenue 1,800 301 Owner's Capital 45,200 306 Owner's Drawings 16,000 400 Service Revenue 64,000 429 Rent Revenue 6,500 711 Depreciation Expense 8,000 726 Salaries and Wages Expense 55,700 732 Utilities Expense 14,900 $129,120 $129,120 a. Prepare an income statement and an owner's equity statement for the year. Phoebe did not make any capital investments during the year. b. Prepare a classified balance sheet at July 31.arrow_forward7-3 Purchasing Supplies and the Monthly Supplies Adjusting Entry On July 1, 2021, Martha Jones started Martha’s Auto Repair Shop, Inc. On that same day, Martha purchased the following supplies for use in the repair shop: Item Unit of MeasureQuantity PurchasedPrice per UnitExtended Total CostShop Towels Rolls 120 $4 $480Degreasing Fluid Quarts 75 $9 $675Gasket Sealer Tubes 40 $6 $240Total $1,395On July 1, Martha paid cash for the supplies and set the accounting policy that all supplies would initially be recorded in the Supplies asset account. At the end of July, Martha counted the supplies that were left and prepared the following listing: Item Unit of MeasureQuantity RemainingShop Towels Rolls 80 Degreasing Fluid Quarts 65 Gasket Sealer Tubes 32 At the end of August, Martha counted the supplies that were left and prepared the following listing: Item Unit of MeasureQuantity RemainingShop Towels Rolls 55 Degreasing Fluid Quarts 48 Gasket Sealer Tubes 22 The following is a partial list…arrow_forwardQuestion Content Area The journal entry to close the Fees Earned, $128, and Rent Revenue, $29, accounts during the year-end closing process would involve: a.a credit to a general revenue account b.a debit to a general revenue account c.credits to the two revenue accounts d.debits to the two revenue accountsarrow_forward

- Accounting Cycle Journal Entries which are involved to the Business Adjusting Journal Entries Adjusting Journal Entry Date Particulars Ref Debit Credit Jan 30 2020 Supplies Expenses 408 18000 Supplies 105 18000 Jan 30 2020 Depreciation Expenses - Equipment (25000/10)*1/12 409 208 Accumulated Depreciation - Equipment 310 208 Jan 30 2020 Depreciation Expenses - Furniture and Fixtures (35000/5)*1/12 410 583 Accumulated Depreciation - Furniture and Fixtures 311 583 Jan 30 2020 Salaries Expenses 406 25000 Salary Payable 407 25000 Jan 30 2020 Insurance Expenses (20000/3*1) 408 6667 Prepaid Insurance 104 6667 Jan 30 2020 Unearned Sales Revenue 307 25000 Sales 305 25000 Jan 30 2020 Bad Debt Expenses (80000*5%) 412 4000 To Allowance for Doubtful Account 420 4000…arrow_forwardCurrent Attempt in Progress You are asked to prepare the following adjusting entries for Sandra's Sewing at December 31, 2024: 1. 2. 3. Annual depreciation on equipment is $2,750. Journalise the transactions. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Supplies of $715, originally recorded as supplies, were used during the year. Prepaid insurance of $880 expired during the year. No. Date Account Titles and Explanation 1. 2. 3. Dec. 31 Dec. 31 Dec. 31 eTextbook and Media Debit Creditarrow_forwardEnd of year records for April's Florist show: $ Inventory 100 Electricity payable 20 Rent expense 55 Sales 250 Discount allowed 15 Purchases returns and allowances 8 Interest income 33 Discount received 11 Selling expenses 42 During the closing process the credit to the Profit or Loss Summary account would be: a. $112 b. $250 C. $261 d. $302 e.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning  College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY