Concept explainers

To calculate: The investment of cash flow that gives the higher present value @6% and 22% rate of discount.

Introduction:

The present value of future cash flows that is discounted at a particular rate of discount is called the present value.

Answer to Problem 2QP

The cash flow X at 6% and 22% is $23,125.75 and $12,873.37 respectively and the cash flow Y at 6% and 22% is $21,904.29 and $14,890.93 respectively. Note that the present value cash flow is greater than at 6% in both the investment. At 6% rate of interest, Investment X is more valuable since it has the highest present value and at 22% interest, Investment Y has the highest present value.

Explanation of Solution

Given information:

Investment X provides Person X $3,400 in a year for nine years, whereas Investment Y provides $5,200 in a year for five years. The rate of discount is given.

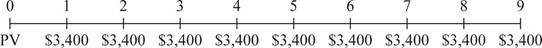

Time line for Investment X:

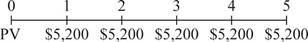

Time line for Investment Y:

Formula to calculate the present value annuity:

Note: C denotes the annuity payment or annual cash flow, r denotes the rate of exchange, and t denotes the period.

Compute the present value annuity for Investment X at 6%:

Hence, the present value annuity for Investment X at 6% is $23,125.75.

Compute the present value annuity for Investment Y at 6%:

Hence, the present value annuity for Investment Y at 6% is $21,904.29.

Compute the present value annuity for Investment X at 22%:

Hence, the present value annuity for Investment X at 22% is $12,873.37.

Compute the present value annuity for Investment Y at 22%:

Hence, the present value annuity for Investment Y at 22% is $14,890.93.

Want to see more full solutions like this?

Chapter 5 Solutions

Essentials of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

- Investment X offers to pay you $7,500 per year for 9 years, whereas Investment Y offers to pay you $10, 200 per year for 5 years. a. If the discount rate is 6 percent, what is the present value of these cash flows? Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. b. If the discount rate is 22 percent, what is the present value of these cash flows? Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. a. Present value of Investment X at 6 percent Present value of Investment Y at 6 percent b. Present value of Investment X at 22 percent Present value of Investment Y at 22 percentarrow_forwardInvestment X offers to pay you $4,800 per year for 9 years, whereas Investment Y offers to pay you $7,100 per year for 5 years. If the discount rate is 6 percent, what is the present value of these cash flows? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Investment X Investment Y If the discount rate is 16 percent, what is the present value of these cash flows? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Investment X Investment Yarrow_forwardInvestment X offers to pay you $5,300 per year for eight years, wheras Investmeny Y offers to pay you $7,300 per year for five years. Which of these cash flows streams has the higher present value if the discount rate if 5%? If the discount rate is 15%?arrow_forward

- Investment X offers to pay you $4,700 per year for 9 years, whereas Investment Y offers to pay you $6,400 per year for 5 years. a. If the discount rate is 8 percent, what is the present value of these cash flows? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) b. If the discount rate is 20 percent, what is the present value of these cash flows?arrow_forwardInvestment X offers to pay you $3,423 per year for 11 years, whereas Investment Y offers to pay you $6,380 per year for 5 years. What is the dollar difference (higher minus lower) in the present values of these two cash flow streams if the discount rate is 7.28 percent? Answer to two decimals.arrow_forwardInvestment x offers to pay you 5,300 per year for 8 years, whereas investment y offers to pay you 7300 per year for 5 years. Which of these cash flow streams has the present value if the discount rate is 5 percent? If the discount was 15?arrow_forward

- Investment X offers to pay you $9,125 per year for 2 years at a discount rate of 4.5%, Investment Y offers to pay you $5,951 per year for 3 years at a discount rate of 3%. Investment Z offers to pay you $4,310 per year for 4 years at a discount rate of 2%. Which of these cash flow streams has the higher present value? Select one: a. They're all the same b.Investment Y c.Investment Z O d.Investment Xarrow_forwardInvestment X offers to pay you $6,100 per year for 9 years, whereas Investment Y offers to pay you $8,400 per year for 5 years. If the discount rate is 7 percent, what is the present value of these cash flows? Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. If the discount rate is 23 percent, what is the present value of these cash flows? Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.arrow_forwardInvestment X offers to pay you $5,400 per year for 9 years, whereas Investment Y offers to pay you $7,500 per year for 5 years. If the discount rate is 6 percent, what is the present value of these cash flows? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) If the discount rate is 21 percent, what is the present value of these cash flows? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.)arrow_forward

- Consider two streams of cash flows, A and B. Stream A’s first cash flow is $9,800 and is received three years from today. Future cash flows in Stream A grow by 3 percent in perpetuity. Stream B’s first cash flow is −$9,100, is received two years from today, and will continue in perpetuity. Assume that the appropriate discount rate is 11 percent. a. What is the present value of each stream? b. Suppose that the two streams are combined into one project, called C. What is the IRR of Project C?arrow_forwardConsider two streams of cash flows, A and B. Stream A's first cash flow is $10,800 and is received three years from today. Future cash flows in stream A grow by 3 percent in perpetuity. Stream B's first cash flow is -$9,800, occurs two years from today, and will continue in perpetuity. Assume that the appropriate discount rate is 11 percent. a. What is the present value of each stream? (Negative amounts should be indicated by a minus sign. Do not round intermediate calculations. Round the answers to 2 decimal places. Omit $ sign in your response.) Present value Stream A Stream B b. Suppose that the two streams are combined into one project, called C. What is the IRR of project C? (Do not round intermediate calculations. Round the answer to 2 decimal places.) IRR 7% c. What is the correct IRR rule for Project C? Accept the project if the discount rate is above the IRR. Accept the project if the discount rate is below the IRR. Accept the project if the discount rate is equal the IRR.arrow_forward2. Present Value and Multiple Cash Flows Investment X offers to pay you $5,300 per year for eight years, whereas Investment Y offers to pay you $7,300 per year for five years. Which of these cash flow streams has the higher present value if the discount rate is 5 percent? If the discount rate is 15 percent? 6. Calculating Annuity Values For each of the following annuities, calculate the present value. Annuity Payment Years Interest Rate $ 1,750 7 1,390 9 17,500 18 50,000 28 5% 10 8 14arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education