PRIN.OF CORPORATE FINANCE

13th Edition

ISBN: 9781260013900

Author: BREALEY

Publisher: RENT MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 5, Problem 8PS

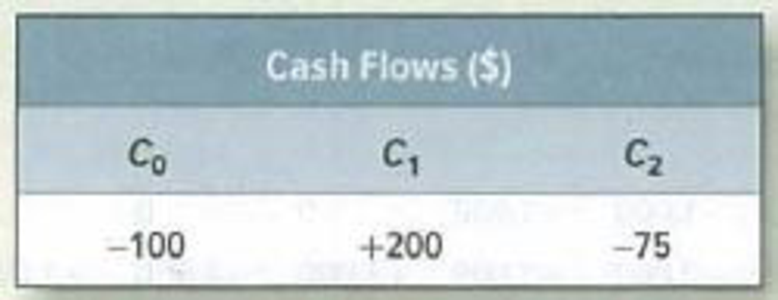

IRR rule* Consider a project with the following cash flows:

- a. How many internal rates of return does this project have?

- b. Which of the following numbers is the project IRR: (i) −50%; (ii) −12%; (iii) +5%; (iv) +50%?

- c. The

opportunity cost of capital is 20%. Is this an attractive project? Briefly explain.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

If the cash flows for Project M are C0 = -1,000; C1 = +800; C2 = +700 and C3= -200. Calculate the IRR for the project. For what range of discount rates does the project have a positive NPV?

Consider the cash flows for the investment projects given in Table. Assume that the

MARR = 10%.

(a) Suppose A, B, and C are mutually exclusive projects. Which project would be selected

on the basis of the IRR criterion?

(b) Assume that projects C and E are mutually exclusive. Using the IRR criterion, which

Project would you select?.

Net Cash Flow

B

D.

E

-4,850

2,100

2,100

2,500

4,250

3,200

2,850

800

300

4,250

4,250

2,850

2,900

1,050

500

-835

-835

-835

-835

1,500

3.250

1,600

1,200

2,100

2,100

Internal rate of return For the project shown in the following table, , calculate the internal rate of return (IRR). Then indicate, for the project, the maximum cost of capital that the firm could have and still find the IRR acceptable.

.....

The project's IRR is

%. (Round to two decimal places.)

Data table

(Click on the icon located on the top-right corner of the data table below in order to

copy its contents into a spreadsheet.)

Initial investment (CF,)

$150,000

Year (t)

Cash inflows

(CF;)

$35,000

$30,000

$35,000

$40,000

$50,000

1

2

3

4

5

Print

Done

Chapter 5 Solutions

PRIN.OF CORPORATE FINANCE

Ch. 5 - (IRR) Check the IRRs for project F in Section 5-3.Ch. 5 - (IRR) What is the IRR of a project with the...Ch. 5 - (XIRR) What is the IRR of a project with the...Ch. 5 - Payback a. What is the payback period on each of...Ch. 5 - Payback Consider the following projects: a. If the...Ch. 5 - Prob. 3PSCh. 5 - IRR Write down the equation defining a projects...Ch. 5 - Prob. 5PSCh. 5 - IRR Calculate the IRR (or IRRs) for the following...Ch. 5 - IRR rule You have the chance to participate in a...

Ch. 5 - IRR rule Consider a project with the following...Ch. 5 - IRR rule Consider projects Alpha and Beta: The...Ch. 5 - IRR rule Consider the following two mutually...Ch. 5 - IRR rule Mr. Cyrus Clops, the president of Giant...Ch. 5 - Prob. 12PSCh. 5 - Investment criteria Consider the following two...Ch. 5 - Profitability index Look again at projects D and E...Ch. 5 - Capital rationing Suppose you have the following...Ch. 5 - Prob. 17PSCh. 5 - Prob. 18PS

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 1] Payback and Internal Rate of Return: A project has perpetual cash flows of C per period, a cost of I, and a required return of r. What is the relationship between the project’s payback and its IRR? What implications does your answer have for long-lived projects with relatively constant cash flows? 2] WHAT ARE THE PROBLEMS WITH IRR APPROACH TO CAPITAL BUDGETING? 3] COMPARE IRR WITH MIRR METHOD.arrow_forwardConsider the following cash flow profile and assume MARR is 10%/yr. Solve, a. What does Descartes’ rule of signs tell us about the IRR(s) of this project? b. What does Norstrom’s criterion tell us about the IRR(s) of this project? c. Determine the IRR(s) for this project. d. Is this project economically attractive?arrow_forward6.Calculate the project's Modified Internal Rate of Return (MIRR). What critical assumption does the MIRR make that differentiates it from the IRR? TIP : look for the definition of Modified Internal Rate of Return, and then do it in excel, easy !!! Year Net Cash flow Future Value of Net Cash flow 0 -$20.8 example 1 $4.5 $7.97 (n=6, i=10%)=fv(.1,6,,4.5) 2 $6.3 (n=5, i=10%) 3 $5.2 (n=4, i=10%) 4 $3.9 (n=3, i=10%) 5 $2.1 (n=2, i=10%) 6 $1.3 (n=1, i=10%) 7 $0.5 (n=0, i=10%) Sum = $XX.XX MIRR = ( in excel ) Rate ( 7,-20.8, xx.xx) 7.Where does the value of MIRR fall relative to the discount rate and IRR?arrow_forward

- Consider the following cash flows: C0= -22, C1= 20, C2= 20, C3=20, C4= -40 a) Calculate both the internal rates of return on this project out of which one is (a shade above) 7% and that the other is (a shade below) 34%. b) is the project attractive if the discount rate is 5%? What is the NPV? c) Is the project attractive is the discount rate is 20%? What is the NPV? d) Is the project attractive is the discount rate is 40%? What is the NPV?arrow_forwardA project's IRR: A) All of these answers are correct. B is the average rate of return necessary to pay back the project's capital providers. C is equal to the discounted cash flows divided by the number of cash flows if the cash flows are a perpetuity. D will change with the cost of capital.arrow_forwardConsider the cash flows for the investment projects given in Table. Assume that the MARR = 10%. (a) Suppose A, B, and C are mutually exclusive projects. Which project would be selected on the basis of the IRR criterion (b) Assume that projects C and È are mutually exclusive. Using the IRR criterion, which Project would you select? Net Cash Flow A В C D E -4,250 3,200 2,850 -4,250 1,500 3,250 1,600 1,200 -4,250 2,850 -4,850 2,100 2,100 2,100 2,100 2,500 1 -835 2,900 1,050 500 2 -835 3 800 -835 4 300 -835arrow_forward

- Internal rate of return For the project shown in the following table, calculate the internal rate of return (IRR). Then indicate, for the project, the maximum cost of capital that the firm could have and still find the IRR acceptable.arrow_forwardwhich of the following do you need to know to calculate the IRR of a project?. 1. project's estimated cash flows 2. project's level of risk 3. project's required rate of return 4. project's NPV a. 1 and 2 b. 4 only c. 1,2 and 3 d. 1 only e. 2 onlyarrow_forwardNet Present Value Suppose a project has conventional cash flows and a positive NPV. What do you know about its payback? Its discounted payback? Its profitability index? Its IRR? Explain.arrow_forward

- K Internal rate of return and modified internal rate of return For the project shown in the following table,, calculate the internal rate of return (IRR) and modified internal rate of return (MIRR). If the cost of capital is 13.04%, indicate whether the project is acceptable according to IRR and MIRR. The project's IRR is %. (Round to two decimal places.) Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Initial investment (CFO) Year (t) $80,000 Cash inflows (CF₂) 1 $10,000 2345 $25,000 $10,000 $15,000 $45,000 Print Done -arrow_forwardProject Y has following cash flows: C0 = -800, C1 = +6,000, and C2 = -6,000. Calculate the IRRs for the project: For what range of discount rates does the project have positive NPV (Plot a graph with NPV on the vertical axis and discount rate on the horizontal axis).arrow_forwardWhich of the following comes closest to the net present value (NPV) of a project whose initial investment is $5 and which produces two cash flows: the first at the end of year 2 of $3 and the second at the end of year 4 of $7? The required rate of return is 13%? Select one: a. $1.84 b. $0 c. $1.64 d. $2.05 e. $2.26arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License