Construction Accounting And Financial Management (4th Edition)

4th Edition

ISBN: 9780135232873

Author: Steven J. Peterson MBA PE

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 6, Problem 20P

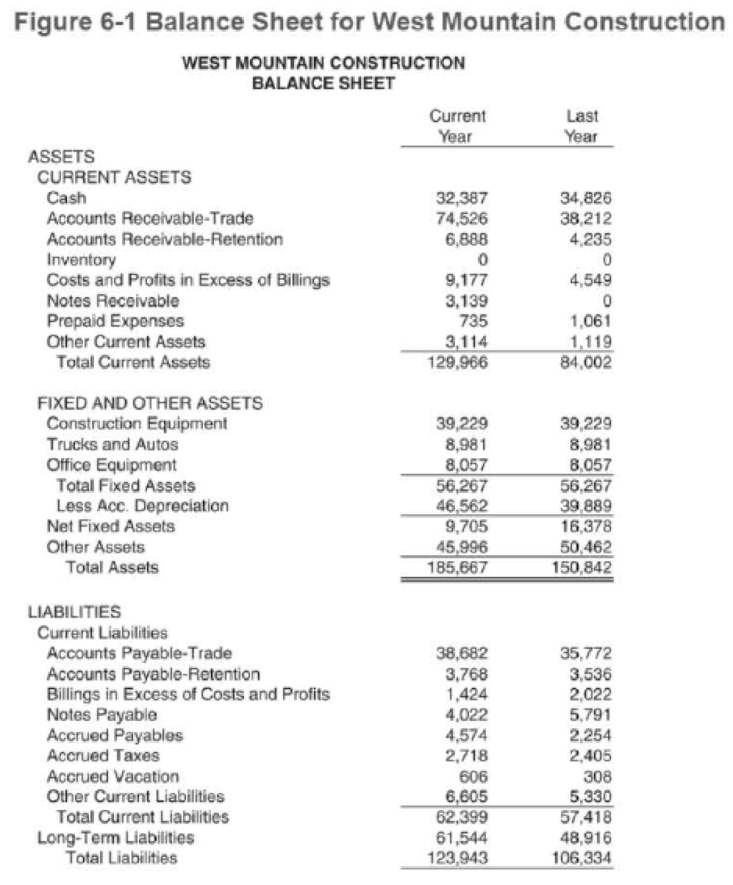

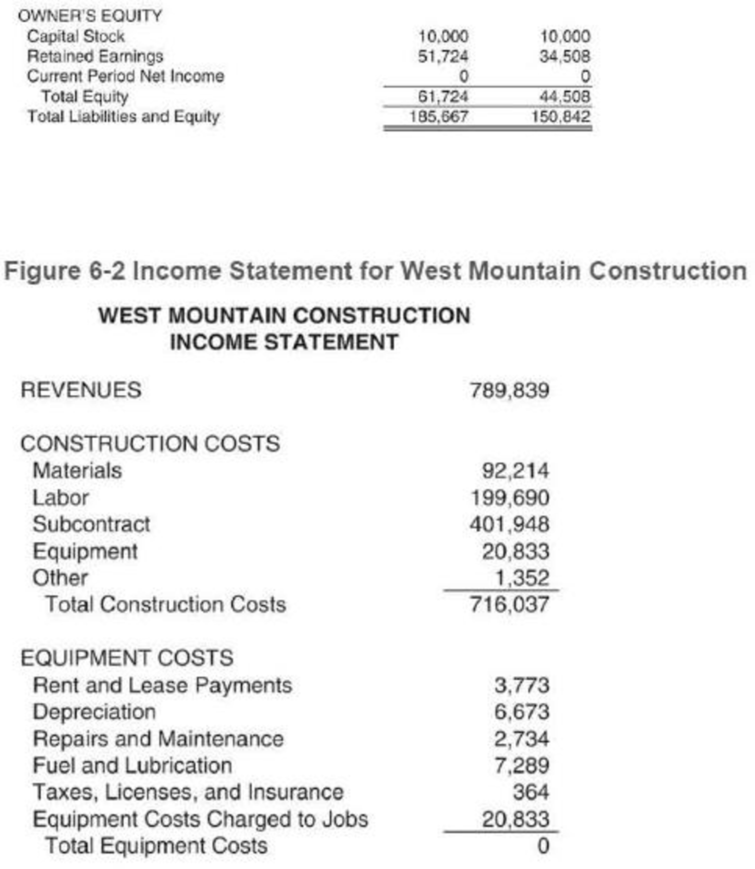

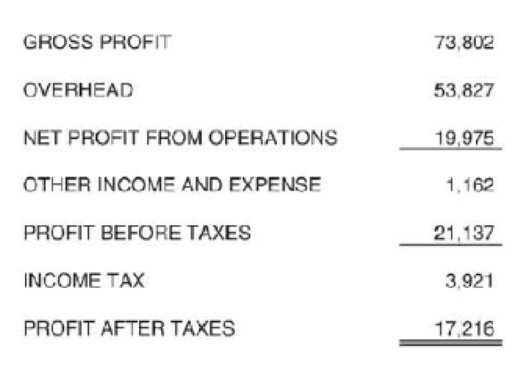

Determine the degree of fixed asset newness for the commercial construction company in Figures 6-1 and 6-2. What insight does this give you into the company’s financial operations?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Instructions: Kindly make an analysis about the asset management ratio (Receivable Turnover, Fixed Asset Turnover, and Total Asset turnover) of SM Investment Corporation.

What is the role of financial intermediaries in asset transformation? Briefly explain along with the types of asset transformation undertaken by the financial intermediaries.

in horizontal analysis explain the results of total current asset and non current assets and what its impact of the results to the company

Chapter 6 Solutions

Construction Accounting And Financial Management (4th Edition)

Ch. 6 - When calculating a ratio with numbers from the...Ch. 6 - How does the method of depreciation affect...Ch. 6 - How does retention affect the financial ratios?...Ch. 6 - Prob. 4PCh. 6 - Prob. 5PCh. 6 - Determine the current liabilities to net worth...Ch. 6 - Determine the debt to equity ratio for the...Ch. 6 - Prob. 8PCh. 6 - Determine the current assets to total assets ratio...Ch. 6 - Prob. 10P

Ch. 6 - Determine the average age of accounts payable and...Ch. 6 - Determine the assets to revenues ratio for the...Ch. 6 - Prob. 13PCh. 6 - Prob. 14PCh. 6 - Determine the gross profit margin for the...Ch. 6 - Determine the general overhead ratio for the...Ch. 6 - Prob. 17PCh. 6 - Prob. 18PCh. 6 - Determine the pretax return on equity and...Ch. 6 - Determine the degree of fixed asset newness for...Ch. 6 - Prob. 21PCh. 6 - Prob. 22PCh. 6 - Prob. 23PCh. 6 - Prob. 24PCh. 6 - Prob. 25PCh. 6 - Prob. 26PCh. 6 - Prob. 27PCh. 6 - Determine the average age of accounts payable and...Ch. 6 - Prob. 29PCh. 6 - Prob. 30PCh. 6 - Determine the accounts payable to revenues ratio...Ch. 6 - Determine the gross profit margin for the...Ch. 6 - Determine the general overhead ratio for the...Ch. 6 - Prob. 34PCh. 6 - Determine the pretax return on assets and...Ch. 6 - Determine the pretax return on equity and...Ch. 6 - Prob. 37PCh. 6 - Determine the months in backlog using the work on...Ch. 6 - Determine the months in backlog using the work on...Ch. 6 - The construction company in Figures 2-2 and 2-3...Ch. 6 - Prob. 43CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Which one of the following statements are related to working capital of a company ? Deals with receipts and disbursements of funds To purchase fixed assets Purpose of purchase of raw materialarrow_forwardWarner Borg Is a leading global supplier of highly engineered automotive systems and components primarily for powertrain applications. The following note was contained in its recent annual report: NOTE 3.INVENTORIES, NET aN of December 31 (in millionsm) Current Year $ 321.7 Prior Year $ 282.0 Raw materials and supplies Work in progess Finished goods FIFO inventories 90.2 79.2 117.6 116.8 528.7 478.8 (16.5) $ 462.3 LIFO reserve (18.4) $ 510.3 Total inventories, net Required: 1. What amount of ending inventory would have been reported in the current year if Warner Borg had used only FIFO? (Enter your answer in millions rounded to 1 decimal place.) 2. The cost of goods sold reported by Warner Borg for the current year was $6,598.9 million. Determine the cost of goods sold that would have been reported if Warner Borg had used only FIFO for both years. (Enter your answer in millions rounded to 1 decimal place.) 3. To lower the cash outflows for taxes, which of the following should the…arrow_forwardDiscuss when a company in the extractive industries needs to start accounting for its restoration costs? Explain the measurement requirement for potential restoration provisions.arrow_forward

- What provides the framework for conducting return on assets (ROA) analysis by incorporating revenues and expenses to generate net profit margin, as well as inclusion of assets to measure asset turnover?arrow_forwardWhich of the following is an essential step in the case of cost/income equivalents for comparing machinery investments: O a. Calculating the liquidation value of the assets O b. Calculating the amortization of the equipment O c. Taking into account the warranty offered on the machinery O d. Calculating the NPV of the investmentarrow_forwardWhat are the advantages of using the Dupont System to analyze the Return on Assets?arrow_forward

- Property, Plant, and Equipment (PPE) Assessment: Describe the company’s Property, Plant and Equipment section in the balance sheet relative to the total fixed assets of the company’s industry (use quantitative and qualitative summaries to support your description. Analyze the accounting treatment of Property, Plant and Equipment, including depreciation methods employed and any impairments recognized, and include a brief summary of the accounting standards and principles included in the decision (reference the Notes that inform your summary). Discuss the significance of Property, Plant And Equipment in the company’s operations and its impact on financial performance and reporting.arrow_forwardWhat costs are included in determining the total cost of an asset? Why would a company include more than just the purchase price of an asset?arrow_forwardExplain how the DuPont system of analysis breaks down return on assets?arrow_forward

- What do you know about PPE ( property, plant and equipment ? • What range of measures is used to determine amounts for these items in the reports of the individual companies? • Do you think it is valid to add the items, given the measures used? • How would you interpret the total amount for property, plant and equipment in the financial statements? • Compare the measures used by the different companies for similar items. Are there any inconsistencies in how similar items are measured by the different companies? Answer above by seeing 2020 annual report of Coles & WoolWorths AU and evaluate the PPE disclosure of WOW and COL.arrow_forwardHow does separating current assets from property, plant,and equipment in the balance sheet help analysts?arrow_forward1. What are the two main characteristics of intangible assets? 2. Why does the accounting profession make a distinction between internally created intangibles and purchased intangibles? 3. What are the factors to be considered in estimating the useful life of an intangible asset? 4. What is the nature of research and development cost? 5. Indicate the proper accounting form the following items. Organization Cost Advertising Cost Operating Lossesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Relevant Costing Explained; Author: Kaplan UK;https://www.youtube.com/watch?v=hnsh3hlJAkI;License: Standard Youtube License