Concept explainers

Variable and Absorption Costing Unit Product Costs and Income Statements; Explanation of Difference in Net Operating Income L07—1, L07—2, L07—3

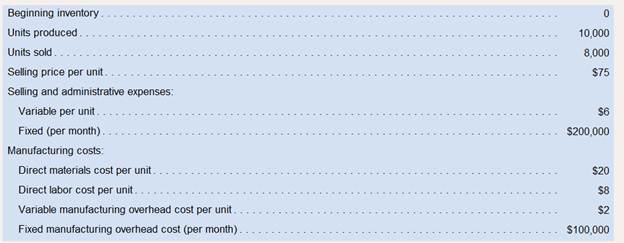

High Country, Inc., produces and sells many recreational products. The company has just opened a new plant to produce a folding camp cotthat will be marketed throughout the United States. The following cost and revenue data relate to May, the first month of the plant’s operation:

Management is anxious to assess the profitability of the new camp cot during the month of May.

Management is anxious to assess the profitability of the new camp cot during the month of May.

Required:

Assume that the company uses absorption costing.

a. Determine the unit product cost.

b. Prepare an income statement for May.

Assume that the company uses variable costing.

a. Determine the unit product cost.

b. Prepare a contribution format income statement for May.

Explain the reason for any difference in the ending inventory balances under the two costing methods and the impact of this differenceon reported net operating income.

Answer 1:

Absorption Costing: is also known as Full costing method. In this method, those costs which vary directly with production are considered in product cost. Also, fixed Manufacturing Expenses are treated as product cost only. Selling Expenses (since they do not vary with production), both variable and fixed, are charged off completely in the period in which the expenses get incurred.

Unit product Cost and Income statement for May.

Answer to Problem 20P

Solution:

| Computation of Unit Product Cost under Absorption Costing | |

| Particulars | Per unit cost |

| Direct Material | $ 20 |

| Direct Labour | $ 8 |

| Variable Manufacturing Overhead | $ 2 |

| Fixed Manufacturing Overhead | $ 27 |

| Total Product Cost | $ 57 |

| Income Statement under Absorption Costing | ||

| May | ||

| A | Sales(Sales Volume X Sales Price) | $ 600,000 |

| B | Less: Cost of Goods Sold | |

|

C | Beginning Inventory

Opening Inventory Quantity X Unit Product Cost of previous year | $ - |

| D | Add: Cost of Goods Manufactured

Production Quantity X Unit Product Cost | 570,000 |

| E | Less: Closing Inventory

Closing Inventory Quantity X Unit Product Cost of current year | $ 114,000 |

| B | Cost of Goods Sold (C+D-E) | $ 456,000 |

| F | Gross Margin (A - B) | $ 144,000 |

| G | Variable Selling & Admin Expenses

(Sales quantity X Variable selling cost per unit) | $ 48,000 |

| H | Fixed Selling Overhead | $ 130,000 |

| I | Net Operating Income (F - G - H) | $ (34,000) |

| Working Notes:

| ||

| May | Remarks | |

| Sales Volume | 8,000 | (as given in question) |

| Production Volume | 10,000 | (as given in question) |

| Opening Stock | - | (Closing Stock of previous period) |

| Closing Stock | 2,000 | (Opening Stock + Production - Sales) |

| Selling Price per unit | $ 75 | (as given in question) |

| Fixed Manufacturing Cost | $ 270,000 | |

| Fixed Manufacturing Cost per unit | $ 27 | (Fixed manufacturing cost / Production Qty) |

| Variable Selling Cost | $ 6 |

Explanation of Solution

- In absorption costing, direct material, direct labour, variable manufacturing expenses and fixed manufacturing cost per unit are considered for unit product cost;

- The income statement under this method requires following computations:

Cost of Goods Sold comprises of variable as well as fixed manufacturing cost

Total selling expenses comprise of variable as well as fixed selling cost

Given:

Sales volume, production volume and selling price per unit are given in the question.

Formulas:

Cost of Goods Sold:

Note: Unit product cost here is unit cost computed as per absorption costing.

Answer 2:

Variable Costing: is also known as Direct costing method. In this method, those costs which vary directly with production are considered in product cost. Fixed Manufacturing Expenses are treated as period cost and not product cost. Selling Expenses (since they do not vary with production), both variable and fixed, are charged off completely in the period in which the expenses get incurred.

Unit product Cost and Income statement May

Answer to Problem 20P

Solution:

| Computation of Unit Product Cost under Variable Costing | |

| Direct Material | $ 20 |

| Direct Labour | $ 8 |

| Variable Manufacturing Overhead | $ 2 |

| Total Product Cost | $ 30 |

| Income Statement under Variable Costing | ||

| May | ||

| A | Sales(Sales Volume X Sales Price) | 600,000 |

| B | Less: Cost of Goods Sold | |

| C | Beginning Inventory

Opening Inventory Quantity X Unit Product Cost of previous year | $ - |

| D | Add: Variable Manufacturing Cost

Production Quantity X Unit Product Cost | 300,000 |

| E | Less: Closing Inventory

Closing Inventory Quantity X Unit Product Cost of current year | $ 60,000 |

| B | Cost of Goods Sold (C+D-E) | $ 240,000 |

| F | Variable Selling & Admin Expenses(Sales quantity X Variable selling cost per unit) | $ 48,000 |

| G | Contribution Margin (A-B-F) | $ 312,000 |

| Sales Value - (Cost of Goods Sold + Variable selling expenses) | ||

| H | Fixed Manufacturing Overhead | $ 270,000 |

| I | Fixed Selling Overhead | $ 130,000 |

| J | Net Operating Income | $ (88,000) |

| Working Notes:

| ||

| May | Remarks | |

| Sales Volume | 8,000 | (as given in question) |

| Production Volume | 10,000 | (as given in question) |

| Opening Stock | - | (as given in question) |

| Closing Stock | 2,000 | (Opening Stock + Production - Sales) |

| Selling Price per unit | $75 | (as given in question) |

| Variable Selling Cost per unit | $6 |

Explanation of Solution

- In variable costing, direct material, direct labour and variable manufacturing expenses are considered for unit product cost;

- The income statement under this method requires following computations:

Variable cost comprises of variable cost of goods sold and variable selling expenses

Fixed cost comprises of fixed manufacturing cost and fixed selling cost

Given:

Sales volume, production volume, opening stock and selling price per unit are given in the question.

Formulas:

Variable Cost of Goods Sold:

Note: Unit product cost here is unit cost computed as per variable costing.

Answer 3

The difference between the ending inventory values under two costing methods would be on account of fixed cost element on inventory.

Under Variable costing, the inventory is valued at Unit product cost as per variable costing method which is direct material plus direct labour plus variable manufacturing expenses.

Whereas

Under Absorption costing, the inventory is valued at Unit product cost as per absorption costing method which is direct material plus direct labour plus variable manufacturing expenses plus fixed cost per unit.

Due to the inclusion of fixed cost in inventory in absorption costing, following is the impact:

- Opening inventory is higher resulting in decrease in profit

- Closing inventory is higher resulting in increase in profit

Reasons for differences in ending inventory

Explanation of Solution

| Ending inventory value under absorption costing | $ 114,000 |

| Ending inventory value under variable costing | $ 60,000 |

| Difference in inventory values | $ 54,000 |

| Closing Stock Quantity | 2,000 units |

| Fixed manufacturing cost per unit

(considered in unit product cost in absorption costing method) | $ 27 |

| Fixed manufacturing cost absorbed on closing stock

(2,000 units X $ 27 per unit) | 54,000 |

| Profit under absorption costing | $ (34,000) |

| Profit under variable costing | $ (88,000) |

| Difference | $ 54,000 |

As clear from above, the amount of Fixed manufacturing cost absorbed on closing stock is equal to the difference between inventory values under two costing methods.

Also, since closing stock is higher under absorption costing, as a result, loss is also less by

$ 54,000 as compared to variable costing.

Want to see more full solutions like this?

Chapter 7 Solutions

Introduction To Managerial Accounting

- Aldovar Company produces a variety of chemicals. One division makes reagents for laboratories. The divisions projected income statement for the coming year is: Required: 1. Compute the contribution margin per unit, and calculate the break-even point in units. (Note: Round answer to the nearest unit.) Calculate the contribution margin ratio and use it to calculate the break-even sales revenue. (Note: Round contribution margin ratio to four decimal places, and round the break-even sales revenue to the nearest dollar.) 2. The divisional manager has decided to increase the advertising budget by 250,000. This will increase sales revenues by 1 million. By how much will operating income increase or decrease as a result of this action? 3. Suppose sales revenues exceed the estimated amount on the income statement by 1,500,000. Without preparing a new income statement, by how much are profits underestimated? 4. Compute the margin of safety based on the original income statement. 5. Compute the degree of operating leverage based on the original income statement. If sales revenues are 8% greater than expected, what is the percentage increase in operating income? (Note: Round operating leverage to two decimal places.)arrow_forwardRequired information [The following information applies to the questions displayed below] Barnes Company reports the following for its product for its first year of operations Direct materials Direct labor s 35 per unit Variable overhead 5 25 per unit $10 per unit Fixed overhead Variable selling and administrative expenses $ 48,000 per year $3 per unit Fixed selling and administrative expenses $ 20,000 per year The company sells its product for $150 per unit. Compute gross profit using absorption costing assuming the company (al produces and sells 2,000 units and (b) produces 2,400 units and sells 2,000 units. Answer is not complete. (a) 2,000 Units Produced and 2.000 Units Sold (0)2,400 Unit Produced and 2,000 Units Sold Gross profit using absorption costing Sales Cost of goods sold Gross profit 00arrow_forwardRequired information Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below.] Hudson Company reports the following contribution margin income statement. Sales (11,400 units at $225 each) Variable costs (11,400 units at $180 each) Contribution margin Fixed costs Income HUDSON COMPANY Contribution Margin Income Statement For Year Ended December 31 1. Amount of sales 2. Margin of safety Exercise 18-12 (Algo) Target income and margin of safety LO C2 1. Assume Hudson has a target income of $150,000. What amount of sales (in dollars) is needed to produce this target income? 2. If Hudson achieves its target income, what is its margin of safety (in percent)? (Round your answer to 1 decimal place.) $ 2,565,000 2,052,000 513,000 360,000 $ 153,000 %arrow_forward

- Trend Reporting for Non-Value-Added Costs Cicleta Manufacturing has four activities: receiving materials, assembly, expediting products, and storing goods. Receiving and assembly are necessary activities; expediting and storing goods are unnecessary. The following data pertain to the four activities for the year ending 20x1 (actual price per unit of the activity driver is assumed to be equal to the standard price): Activity Activity Driver SQ AQ SP Receiving Receiving orders 12,000 24,000 $21 Assembly Labor hours 99,000 120,000 15 Expediting Orders expedited 0 8,000 50 Storing Number of units 0 16,000 7 Assume that at the beginning of 20x2, Cicleta trained the assembly workers in a new approach that had the objective of increasing the efficiency of the assembly process. Cicleta also began moving toward a JIT purchasing and manufacturing system. When JIT is fully implemented, the demand for expediting…arrow_forward! Required information [The following information applies to the questions displayed below.] O'Brien Company manufactures and sells one product. The following information pertains to each of the company's first three years of operations: Variable costs per unit: Manufacturing: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative Fixed costs per year: Fixed manufacturing overhead Fixed selling and administrative expenses $ $ $ a. Compute the unit product cost for Year 1, Year 2, and Year 3. b. Prepare an income statement for Year 1, Year 2, and Year 3. 2562 $590,000 $150,000 During its first year of operations, O'Brien produced 92,000 units and sold 72,000 units. During its second year of operations, it produced 75,000 units and sold 90,000 units. In its third year, O'Brien produced 81,000 units and sold 76,000 units. The selling price of the company's product is $71 per unit. 4. Assume the company uses absorption costing and a LIFO inventory…arrow_forward! Required information Use the following information for the Quick Study below. (Algo) [The following information applies to the questions displayed below.] Ramort Company reports the following for its single product. Ramort produced and sold 20,600 units this year. Direct materials Direct labor Variable overhead Fixed overhead Variable selling and administrative expenses Fixed selling and administrative expenses Sales price Compute gross profit under absorption costing. $ 13 per unit $ 15 per unit $6 per unit $ 41,200 per year $2 per unit QS 19-9 (Algo) Computing gross profit under absorption costing LO P2 RAMORT COMPANY Gross Profit (Absorption Costing) $ 65,800 per year $ 69 per unitarrow_forward

- Relevant Cost Analysis in a Variety of Situations Andretti Company has a single product called a Dak. The company normally produces and sells 60,000 Daks each year at a selling price of $32 per unit. The company’s unit costs at this level of activity are given below: A number of questions relating to the production and sale of Daks follow. Each question is independent. Required: 1. Assume that Andretti Company has sufficient capacity to produce 90,000 Daks each year without any increase in fixed manufacturing overhead costs. The company could increase its unit sales by 25% above the present 60,000 units each year if it were willing to increase the fixed selling expenses by $80,000. What is the financial advantage (disadvantage) of investing an additional $80,000 in fixed selling expenses? Would the additional investment be justified? 2. Assume again that Andretti Company has sufficient capacity to produce 90,000 Daks each year. A customer in a foreign market wants to purchase 20,000…arrow_forwardRequired information [The following information applies to the questions displayed below.] Hudson Company reports the following contribution margin income statement. HUDSON COMPANY Contribution Margin Income Statement For Year Ended December 31 Sales (10,900 units at $225 each) Variable costs (10,900 units at $180 each) Contribution margin Fixed costs Income HUDSON COMPANY Contribution Margin Income Statement For Year Ended December 31 2,452,500 1,962,000 The company is considering buying a new machine that will increase its fixed costs by $39,000 per year and decrease its variable costs by $10 per unit. Prepare a contribution margin income statement for the next year assuming the company purchases this machine. Sales Variable costs Contribution margin Fixed costs Income/Loss 490, 500 387,000 $ 103,500arrow_forwardRequired information [The following information applies to the questions displayed below.] Barnes Company reports the following for its product for its first year of operations. $30 per unit $20 per unit $ 11 per unit 60,000 per year $3 per unit $ 22,000 per year $ Direct materials Direct labor Variable overhead Fixed overhead Variable selling and administrative expenses Fixed selling and administrative expenses The company sells its product for $150 per unit. Compute contribution margin using variable costing assuming the company (a) produces and sells 2,400 units and (b) produces 3,000 units and sells 2,400 units. X Answer is complete but not entirely correct. Contribution margin using variable costing Sales Variable expenses Direct materials Direct labor Variable overhead Contribution margin (a) 2,400 Units Produced and 2,400 Units Sold ✔ $ X X X 360,000 $ 72,000 48,000 X 26,400 X 213,600 $ (b) 3,000 Units Produced and 2,400 Units Sold 360,000✔ 90,000 X 60,000 X 33,000 X 147,000arrow_forward

- Required information [The following information applies to the questions displayed below.] Diego Company manufactures one product that is sold for $78 per unit in two geographic regions-East and West. The following information pertains to the company's first year of operations in which it produced 60,000 units and sold 57,000 units. Variable costs per unit: Manufacturing: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative $ 28 $ 12 $ 2 $ 3 Fixed manufacturing overhead Fixed selling and administrative expense $ 1,260,000 $ 654,000 Fixed costs per year: The company sold 42,000 units in the East region and 15,000 units in the West region. It determined $340,000 of its fixed selling and administrative expense is traceable to the West region, $290,000 is traceable to the East region, and the remaining $24,000 is a common fixed expense. The company will continue to incur the total amount of its fixed manufacturing overhead costs as long as it…arrow_forwardRequired information Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below.] Hudson Company reports the following contribution margin income statement. HUDSON COMPANY Contribution Margin Income Statement For Year Ended December 31 Sales (9,900 units at $225 each) Variable costs (9,900 units at $180 each) Contribution margin Fixed costs Income Exercise 18-11 (Algo) Computing break-even units and sales LO P2 1. Compute break-even point in units. 2. Compute break-even point in sales dollars. 1. Break-even units 2. Break-even sales dollars $ 2,227,500 1,782,000 445,500 342,000 $ 103,500 unitsarrow_forwardReconciliation of Absorption and Variable Costing Net Operating Incomes Jorgansen Lighting, Inc., manufactures heavy-duty street lighting systems for municipalities. The company uses variable costing for internal management reports and absorption costing for external reports to shareholders, creditors, and the government. The company has provided the following data: The company’s fixed manufacturing overhead per unit was constant at $560 for all three years. Required: 1. Calculate each year’s absorption costing net operating income. Present your answer in the form of a reconciliation report. 2. Assume in Year 4 that the company’s variable costing net operating income was $984,400 and its absorption costing net operating income was $1,012,400. a. Did inventories increase or decrease during Year 4? b. How much fixed manufacturing overhead cost was deferred or released from inventory during Year 4?arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,