Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 7, Problem 47E

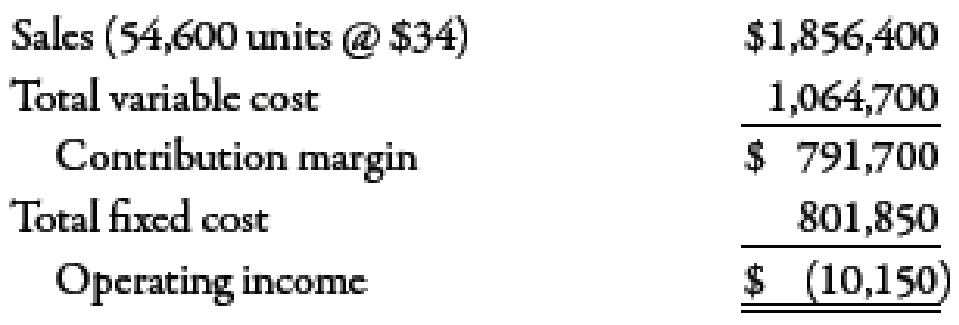

Klamath Company produces a single product. The

Required:

1. Compute the unit contribution margin and the units that must be sold to break even.

2. Suppose 10,000 units are sold above break-even. What is the operating income?

3. Compute the contribution margin ratio. Use the contribution margin ratio to compute the break-even point in sales revenue. (Note: Round the contribution margin ratio to four decimal places, and round the sales revenue to the nearest dollar.) Suppose that revenues are $200,000 more than expected for the coming year. What would the total operating income be?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Klamath Company produces a single product. The projected income statement for the comingyear is as follows:

Required:1. Compute the unit contribution margin and the units that must be sold to break even.2. Suppose 10,000 units are sold above break-even. What is the operating income?3. Compute the contribution margin ratio. Use the contribution margin ratio to computethe break-even point in sales revenue. (Note: Round the contribution margin ratio to fourdecimal places, and round the sales revenue to the nearest dollar.) Suppose that revenuesare $200,000 more than expected for the coming year. What would the total operatingincome be?

Jellico Inc.’s projected operating income (based on sales of 450,000 units) for the coming year is as follows:Required:1. Compute: (a) variable cost per unit, (b) contribution margin per unit, (c)contribution margin ratio, (d) break-even point in units, and (e) break-even point in sales dollars.2. How many units must be sold to earn operating income of $296,400?3. Compute the additional operating income that Jellico would earn if sales were $50,000 more than expected.4. For the projected level of sales, compute the margin of safety in units, and then in sales dollars.5. Compute the degree of operating leverage. (Note: Round answer to two decimal places.)6. Compute the new operating income if sales are 10% higher than expected.

Sooner Industries charges a price of $88 and has fixed cost of $301,000. Next year, Sooner expects to sell 15,600 units and make operating income of $172,000. What is the variable cost per unit? What is the contribution margin ratio? Note: Round your variable cost per unit answer to the nearest cent. Enter the contribution margin ratio as a percentage, rounded to two decimal places.

Chapter 7 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

Ch. 7 - Prob. 1DQCh. 7 - Describe the difference between the units sold...Ch. 7 - Define the term break-even point.Ch. 7 - Prob. 4DQCh. 7 - What is the variable cost ratio? The contribution...Ch. 7 - Prob. 6DQCh. 7 - Define the term sales mix. Give an example to...Ch. 7 - Explain how CVP analysis developed for single...Ch. 7 - Prob. 9DQCh. 7 - How does targeted profit enter into the break-even...

Ch. 7 - Explain how a change in sales mix can change a...Ch. 7 - Define the term margin of safety. Explain how it...Ch. 7 - Explain what is meant by the term operating...Ch. 7 - How can sensitivity analysis be used in...Ch. 7 - Why is a declining margin of safety over a period...Ch. 7 - If the variable cost per unit goes down,Ch. 7 - The amount of revenue required to earn a targeted...Ch. 7 - Prob. 3MCQCh. 7 - Prob. 4MCQCh. 7 - An important assumption of cost-volume-profit...Ch. 7 - The use of fixed costs to extract higher...Ch. 7 - Prob. 7MCQCh. 7 - The contribution margin is the a. amount by which...Ch. 7 - Dartmouth Company produces a single product with a...Ch. 7 - Dartmouth Company produces a single product with a...Ch. 7 - If a companys total fixed cost decreases by...Ch. 7 - Prob. 12MCQCh. 7 - Variable Cost, Fixed Cost, Contribution Margin...Ch. 7 - Prob. 14BEACh. 7 - Variable Cost Ratio, Contribution Margin Ratio...Ch. 7 - Prob. 16BEACh. 7 - Units to Earn Target Income Head-First Company...Ch. 7 - Sales Needed to Earn Target Income Head-First...Ch. 7 - Break-Even Point in Units for a Multiple-Product...Ch. 7 - Prob. 20BEACh. 7 - Margin of Safety Head-First Company plans to sell...Ch. 7 - Degree of Operating Leverage Head-First Company...Ch. 7 - Impact of Increased Sales on Operating Income...Ch. 7 - Variable Cost, Fixed Cost, Contribution Margin...Ch. 7 - Prob. 25BEBCh. 7 - Variable Cost Ratio, Contribution Margin Ratio...Ch. 7 - Prob. 27BEBCh. 7 - Units to Earn Target Income Chillmax Company plans...Ch. 7 - Sales Needed to Earn Target Income Chillmax...Ch. 7 - Prob. 30BEBCh. 7 - Prob. 31BEBCh. 7 - Margin of Safety Chillmax Company plans to sell...Ch. 7 - Prob. 33BEBCh. 7 - Impact of Increased Sales on Operating Income...Ch. 7 - Basic Break-Even Calculations Suppose that Larimer...Ch. 7 - Price, Variable Cost per Unit, Contribution...Ch. 7 - Contribution Margin Ratio, Variable Cost Ratio,...Ch. 7 - Prob. 38ECh. 7 - Prob. 39ECh. 7 - Margin of Safety Comer Company produces and sells...Ch. 7 - Prob. 41ECh. 7 - Sales Revenue Approach, Variable Cost Ratio,...Ch. 7 - Prob. 43ECh. 7 - Cherry Blossom Products Inc. produces and sells...Ch. 7 - Prob. 45ECh. 7 - Lotts Company produces and sells one product. The...Ch. 7 - Klamath Company produces a single product. The...Ch. 7 - Margin of Safety and Operating Leverage Medina...Ch. 7 - Parker Pottery produces a line of vases and a line...Ch. 7 - Jellico Inc.s projected operating income (based on...Ch. 7 - Break-Even Units, Contribution Margin Ratio,...Ch. 7 - Prob. 52PCh. 7 - Aldovar Company produces a variety of chemicals....Ch. 7 - Basu Company produces two types of sleds for...Ch. 7 - Cost-Volume-Profit Equation, Basic Concepts,...Ch. 7 - Contribution Margin Ratio, Break-Even Sales,...Ch. 7 - Prob. 57PCh. 7 - Polaris Inc. manufactures two types of metal...Ch. 7 - Cost-Volume-Profit, Margin of Safety Victoria...Ch. 7 - Abraham Company had revenues of 830,000 last year...Ch. 7 - Prob. 61PCh. 7 - Prob. 62PCh. 7 - Prob. 63PCh. 7 - Suppose that Kicker had the following sales and...Ch. 7 - Danna Lumus, the marketing manager for a division...Ch. 7 - Cost-Volume-Profit Analysis, Single-Product...Ch. 7 - Cost-Volume-Profit Analysis, Single-Product...Ch. 7 - Prob. 3MTCCh. 7 - Prob. 4MTCCh. 7 - Sensitivity Cost-Volume-Profit Analysis and...Ch. 7 - Calculate the hotels margin of safety (both in...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Faldo Company produces a single product. The projected income statement for the coming year, based on sales of 200,000 units, is as follows: Required: 1. Compute the unit contribution margin and the units that must be sold to break even. Suppose that 30,000 units are sold above the break-even point. What is the profit? 2. Compute the contribution margin ratio and the break-even point in dollars. Suppose that revenues are 200,000 greater than expected. What would the total profit be? 3. Compute the margin of safety in sales revenue. 4. Compute the operating leverage. Compute the new profit level if sales are 20 percent higher than expected. 5. How many units must be sold to earn a profit equal to 10 percent of sales? 6. Assume the income tax rate is 40 percent. How many units must be sold to earn an after-tax profit of 180,000?arrow_forwardSuppose a company finds that shipping cost is 3,560 each month plus 6.70 per package shipped. What is the cost formula for monthly shipping cost? Identify the independent variable, the dependent variable, the fixed cost per month, and the variable rate.arrow_forwardEXERCISE 5-11 Break-Even Analysis; Target Profit; Margin of Safety; CM Ratio [LO1, LO3, LO5, LO6, LO7] Pringle Company distributes a single product. The company's sales and expenses for a recent month follow: Total Per Unit Sales ...... $600,000 $40 Variable expenses 420,000 28 Contribution margin . Fixed expenses . Net operating income 180,000 $12 150,000 $ 30,000arrow_forward

- a) Compute the breakeven sales dollars of cach product assuming the same sales mix remains constant. b) Prepare an analysis showing whether Product Z should be eliminated. The amount of change to net income should be computed. c) Assume the current demand of cach product is same as the sales volume the company has for the year. Below is the machine processing time required for cach product. Product Machine processing time in hours i. How many units should the company produce for each product if there is a constraint of only 24.000 hours of machine processing time in the year. ii. Compute the highest possible net income camed by the company. 3 2 An accountant has prepared the folowing product-line income statement for the year: Product Tatal No of mts sokd 5,000 4,000 4,000 Saks Varible enpermes 200,000 S 120,000 100,000 S 60.000 40,000 S 20,000 60,000 40,000 20,000 Cotribution mangin 80,000 40,000 20,000 Fihed expenses Rert Depreciin 10,000 12,000 8,000 5.000 6,000 2,000 2,400 3,000…arrow_forwardKlamath Company produces a single product. The projected income statement for the coming year is as follows: Sales (54,600 units @ $34) $1,856,400 Total variable cost 1,064,700 Contribution margin $ 791,700 Total fixed cost 801,850 Operating income $(10,150) Compute the contribution margin ratio. Use the contribution margin ratio to compute the break-even point in sales revenue. (Note: Round the contribution margin ratio to four decimal places before converting to a percentage (for example, 0.80378 would be rounded to .8038, and entered as 80.38%), and round the sales revenue to the nearest dollar.) Contribution margin ratio _______ % Break-even sales revenue $_______arrow_forwardA firm manufactures a product that sells for $25 per unit. Variable cost per unit is $2 and fixed cost per period is $1840. Capacity per period is 2000 units. (a) Develop an algebraic statement for the revenue function and the cost function. (b) Determine the number of units required to be sold to break even. (c) Compute the break-even point as a percent of capacity. (d) Compute the break-even point in sales dollars.arrow_forward

- ABC Company manufactures the product XE-17. The product is sold at a unit price of $70.Variable expenses are $13.50 per unit and fixed expenses are $220,000 per year.Required :a. What should be the product’s CM ratio? b. Calculate the BEP is sales dollars and in units for ABC Company. c. The manager of ABC company estimates that in the coming year, the company’s sales willincrease by $80,000 (from the current sales). How much should the net profit / loss increase/decrease if the fixed costs remain constant? d. The manager of ABC company predicts that by spending an additional $80,000 per year onadvertising and using higher quality raw material (which will in turn increase the raw materialcost per unit by $3), and increasing selling price per unit by 2% (to compensate for theincreased costs), unit sales will increase by two- thirds of the current sales units. Should thecompany go with the manager’s proposed plan? Explain your answer. (Assume that in thecurrent year, the company sold…arrow_forwardA firm manufactures a product that sells for $16 per unit. Variable cost per unit is $8 and fixed cost per period is $1680. Capacity per period is 2200 units. (a) Develop an algebraic statement for the revenue function and the cost function. (b) Determine the number of units required to be sold to break even. (c) Compute the break-even point as a percent of capacity. (d) Compute the break-even point in sales dollars. (a) The revenue function is TR = (Type an expression using x as the variable. Do not include the $ symbol in your answer.) The cost function is TC = (Type an expression using x as the variable. Do not include the $ symbol in your answer.) (b) The number of units required to be sold to break even is| units. (Round up to the nearest whole number.) (c) The break-even point as a percent of capacity is%. (Round to two decimal places as needed.) (d) The break-even point in sales dollars is $ (Round to the nearest cent as needed.)arrow_forwardKlamath Company produces a single product. The projected income statement for the coming year is as follows: Sales (54,600 units @ $34) $1,856,400 Total variable cost 1,064,700 Contribution margin $ 791,700 Total fixed cost 801,850 Operating income $(10,150) Suppose that revenues are $200,000 more than expected for the coming year. What would the total operating income be?$_________arrow_forward

- White Lake Inc. produces and sells a single product. Data concerning that product appear below: Selling price per unit $ 230.00 Variable expense per unit $ 103.50 Fixed expense per month $ 518,650 Required: a. What is the minimum amount of sales revenues in dollars to break even? b. Assume the company's monthly target profit is $12,650. Determine the number of units that White Lake needs to sell to attain this target profit?arrow_forwardABC Company manufactures the product XE-17. The product is sold at a unit price of $70.Variable expenses are $13.50 per unit and fixed expenses are $220,000 per year.Required :a. What should be the product’s CM ratio? b. Calculate the BEP is sales dollars and in units for ABC Company. c. The manager of ABC company estimates that in the coming year, the company’s sales willincrease by $80,000 (from the current sales). How much should the net profit / loss increase/decrease if the fixed costs remain constant? d. The manager of ABC company predicts that by spending an additional $80,000 per year onadvertising and using higher quality raw material (which will in turn increase the raw materialcost per unit by $3), and increasing selling price per unit by 2% (to compensate for theincreased costs), unit sales will increase by two- thirds of the current sales units. Should thecompany go with the manager’s proposed plan? Explain your answer. (Assume that in thecurrent year, the company sold…arrow_forwardA manufacturer has a monthly fixed cost of $87,500 and a production cost of $15 for each unit produced. The product sells for $20/unit. (a) What is the cost function? CX) (b) What is the revenue function? R(x) - (c) What is the profit function? Px) - (d) Compute the profit (loss) corresponding to production levels of 15,000 and 20,000 units. (Input a negative value to indicate a loss) PL1S,000)- P(20,000) =arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Cost-Volume-Profit (CVP) Analysis and Break-Even Analysis Step-by-Step, by Mike Werner; Author: Accounting Step by Step;https://www.youtube.com/watch?v=D0MOfse9OWk;License: Standard Youtube License