Concept explainers

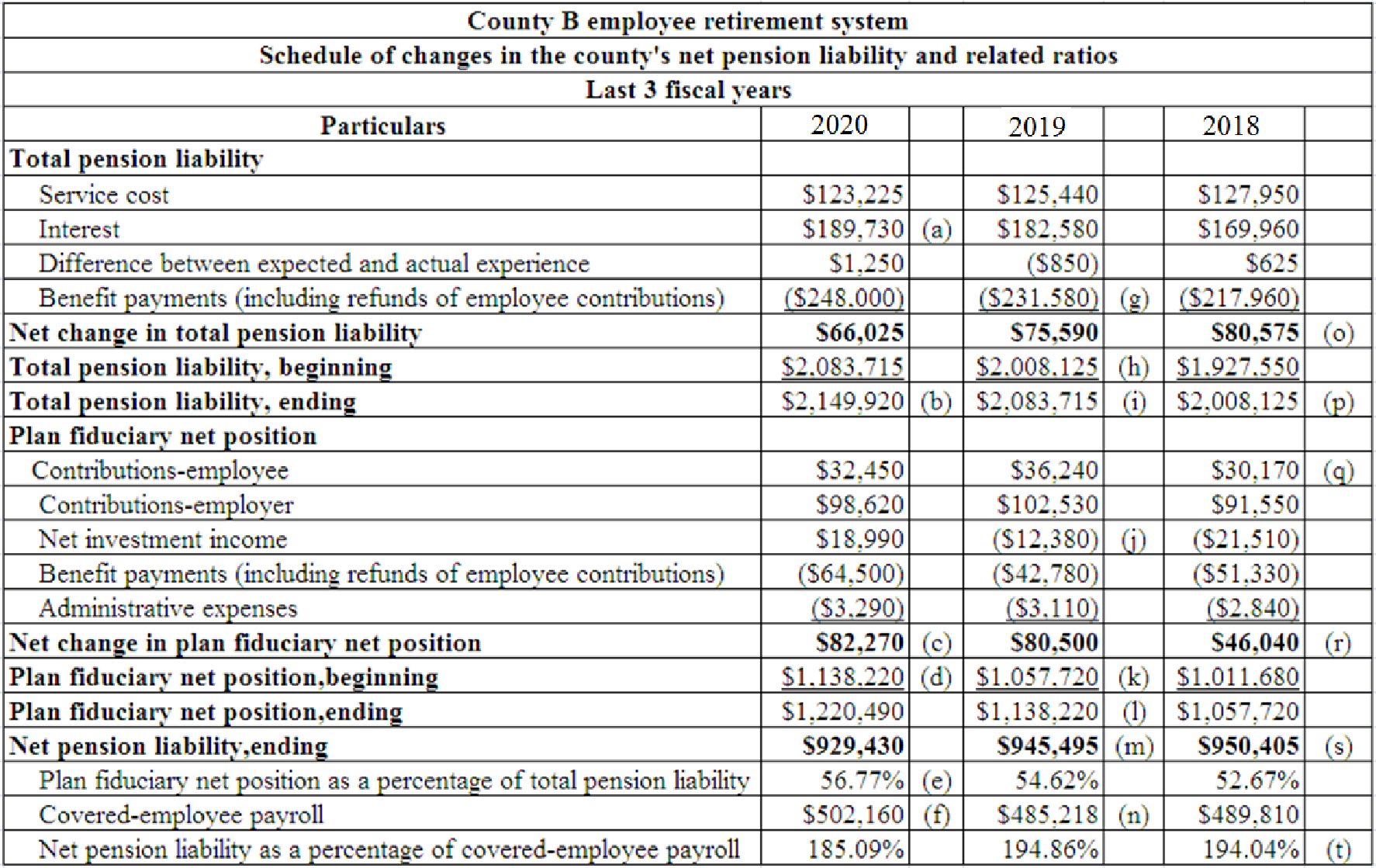

Compute the missing amount of “schedule of changes in the County’s Net pension liability and related ratios”.

Explanation of Solution

Fiduciary activities: Fiduciary activities are those activities done by persons or organizations to another parties with utmost good faith and trust. A fiduciary activity may involve managing funds, assets and other valuables of a person or a group of people.

The person or organization involved in fiduciary activities need to act ethically in the best interest of others. Government also involve in fiduciary activities by holding the assets of individuals or organization to benefit them.

Prepare the financial statement of County B:

Table (1)

Working note (a): Calculate interest during the year 2020:

Interest amount is calculated by deducting all other pension liabilities from net change in total pension liability. Total pension liabilities except interest includes service costs, difference between expected and experience, and benefit payments. The amount of service cost is $123,225, difference between expected and experience is $1,250, and benefit payment is -$248,000. The net change in total pension liability is $66,205.

Calculation of interest is as follows:

Hence, the interest amount is $189,730.

Working note (b): Calculate net change in plan fiduciary net position:

Net change in plan fiduciary net position is the difference between plan fiduciary net position at the end of the year and plan fiduciary net position at the beginning of the year. Plan fiduciary net position at the ending is $1,057,720. Plan fiduciary net position at the beginning is $1,011,680.

Calculation of net change in plan fiduciary net position is as follows:

Hence, the net change in plan fiduciary net position is $46,040.

Working note (c): Calculate net change in plan fiduciary net position:

Net change in plan fiduciary net position is the difference between plan fiduciary net position incomes and plan fiduciary net position expenses. Plan fiduciary net position income includes contribution from employee $32,450, contribution from employers $98,620, and net investment income $18,990. Plan fiduciary net position expenses include benefit payments of $64,500 and administrative expenses of $3,290.

Calculation of net change in plan fiduciary net position is as follows:

Hence, the net change in plan fiduciary net position is $82,270.

Working note (d): Calculate plan fiduciary net position at the beginning of the year 2020:

Plan fiduciary net position at the beginning is computed as the difference between plan fiduciary net position at the end of the year and net change in plan fiduciary net position. Plan fiduciary net position at the end of the year is $1,220,490.

Calculation of plan fiduciary net position at the beginning is as given below:

Hence, the plan fiduciary net position at the beginning of the year 2020 is $1,138,220.

Working note (e): Calculate plan fiduciary net position as the percentage of total pension liability:

Plan fiduciary net position as a percentage of total pension liability is calculated by dividing plan fiduciary net position at the end of the year by total pension liability at the end of the year. Plan fiduciary net position at the end of the year is given as $1,220,490 and total pension liability at the end of the year is calculated as $2,149,920.

Calculate plan fiduciary net position as the percentage of total pension liability:

Hence, the plan fiduciary net position as percentage of total pension liability is 56.77%.

Working note (f): Calculate covered-employee payroll:

The calculation of covered-employee payroll is by dividing net pension liability at the ending by net pension liability as a percentage of covered-employee payrolls. Net pension liability at the ending is given as $929,430 and net pension liability as a percentage of covered-employee payrolls is 185.09%.

Calculate covered-employee payroll:

Hence, the covered-employee payroll is $502,150.

Working note (g): Calculate benefit payment for the year 2019:

Benefit payment is calculated by deducting all other pension liabilities from net change in total pension liability. Total pension liabilities except benefit payment includes service costs, interest, and difference between expected and experience. The amount of service cost is $125,440, interest amount is $182,580, and difference between expected and experience is -$850, and benefit payment is -$248,000. The net change in total pension liability is $75,590.

Calculate benefit payment for the year 2019:

Hence, the benefit payment for the year 2019 is ($231,580).

Working note (h): Calculate total pension liability at the beginning of the year 2019:

Total pension liability at the beginning of the year is computed as the difference between total pension liability at the end of the year and net change in total pension liability. The total pension liability at the ending is $2,083,715. The calculation is as follows:

Calculate total pension liability at the beginning of the year 2019:

Hence, the total pension liability at the beginning of the year is $2,008,125.

Working note (i): Calculate total pension liability at the end of the year 2019:

The total pension liability at the end of the year 2019 will be the same as the total pension liability at the beginning of the year 2020. The total pension liability at the beginning of the year 2020 is $2,083,715. Hence, the total pension liability at the end of the year 2019 is also $2,083,175.

Working note (j): Calculate net investment income for 2019:

Net investment income is the difference between net change in plan fiduciary net position and the difference between plan fiduciary net position incomes and plan fiduciary net position expenses. Plan fiduciary net position income includes contribution from employee $36,240, contribution from employers $102,530. Plan fiduciary net position expenses include benefit payments of -$42,780 and administrative expenses of -$3,110. The net change in plan fiduciary net position is given as $80,500.

Calculate net investment income for 2019:

Hence, the net investment income for 2019 is ($12,380).

Working note (k): Calculate plan fiduciary net position at the beginning of 2019:

The plan fiduciary net position at the beginning of the year 2019 will be the same as the plan fiduciary net position at the end of the year 2018. The plan fiduciary net position at the end of the year 2018 is $1,057,720. Hence, the plan fiduciary net position at the beginning of the year 2019 is also $1,057,720.

Working note (l): Calculate plan fiduciary net position at the end of the year 2019:

Plan fiduciary net position at the ending is computed as the sum of plan fiduciary net position at the beginning of the year and net change in plan fiduciary net position. Plan fiduciary net position at the beginning of the year is $1,057,720.

Calculation of plan fiduciary net position at the beginning is as given below:

Hence, the plan fiduciary net position at the end of the year 2019 is $1,138,220.

Working note (m): Calculate net pension liability at the end of the year 2019:

Net pension liability at the end of the year 2019 is calculated as the difference between total pension liability at the ending of 2019 and plan fiduciary net position at the ending. Total pension liability at the ending of 2019 is calculated as $2,083,715 and plan fiduciary net position at the ending of 2019 is $1,138,220.

Calculate net pension liability at the end of the year 2019:

Hence, the net pension liability at the end of the year 2019 is $945,495.

Working note (n): Calculate covered-employee payroll:

The calculation of covered-employee payroll is by dividing net pension liability at the ending by net pension liability as a percentage of covered-employee payrolls. Net pension liability at the ending is given as $945,495 and net pension liability as a percentage of covered-employee payrolls is 194.86%.

Calculate covered-employee payroll:

Hence, the covered-employee payroll is $485,218.

Working note (o): Calculate net change in total pension liability for the year 2018:

Net change in total pension liability is calculated by deducting benefit payment from all other pension liabilities. Total pension liabilities except benefit payment includes service costs, interest, and difference between expected and experience. The amount of service cost is $127,950, interest amount is $169,960, and difference between expected and experience is $625. The benefit payment is given as -$217,960.

Calculate net change in total pension liability for the year 2018:

Hence, the net change in total pension liability for the year 2018 is $80,575.

Working note (p): Calculate total pension liability at the end of the year 2018:

The total pension liability at the end of the year 2018 will be the same as the total pension liability at the beginning of the year 2019. The total pension liability at the beginning of the year 2019 is $2,008,125. Hence, the total pension liability at the end of the year 2018 is also $2,008,125.

Working note (q): Calculate contribution from employees for 2018:

Contribution from employees is calculated as the difference between net change in plan fiduciary net position and the difference between plan fiduciary net position incomes and plan fiduciary net position expenses. Plan fiduciary net position income includes contribution from employers $91,550 and net investment income is -$21,510. Plan fiduciary net position expenses include benefit payments of -$51,330 and administrative expenses of -$2,840. The net change in plan fiduciary net position is calculated as $46,040.

Calculate contribution from employees for 2018:

Hence, the contribution from employee for 2018 is $30,170.

Working note (r): Calculate net change in plan fiduciary net position:

Net change in plan fiduciary net position is the difference between plan fiduciary net position at the end of the year and plan fiduciary net position at the beginning of the year. Plan fiduciary net position at the ending is $1,057,720. Plan fiduciary net position at the beginning is $1,011,680.

Calculation of net change in plan fiduciary net position is as follows:

Hence, the net change in plan fiduciary net position is $46,040.

Working note (s): Calculate net pension liability at the end of the year 2018:

Net pension liability at the end of the year 2018 is calculated as the difference between total pension liability at the ending of 2018 and plan fiduciary net position at the ending. Total pension liability at the ending of 2018 is calculated as $2,008,125 and plan fiduciary net position at the ending of 2018 is $1,057,720.

Calculation of net pension liability at the end of the year 2018 is as given below:

Hence, the net pension liability at the end of the year 2018 is $950,405.

Working note (t): Calculate net pension liability as a percentage of covered-employee payrolls:

The calculation of net pension liability as a percentage of covered-employee payroll is by dividing net pension liability at the ending by covered-employee payroll. Net pension liability at the ending is given as $950,405 and covered-employee payroll is $489,810. The calculation of covered-employee payroll is as follows:

Hence, the net pension liability as a percentage of covered-employee payrolls is 194.04%.

Want to see more full solutions like this?

Chapter 8 Solutions

Accounting For Governmental & Nonprofit Entities

- The following incomplete (columns have missing amounts) pension spreadsheet is for Old Tucson Corporation (OTC). ($ in millions) debit (credit) PBO Plan assets Prior service cost Net (Gain) loss Pension Expenses Cash Net Pension (Liability)/ Asset Beginning Balance (540 ) 70 Service cost 74 Interest cost Expected return on assets (27 ) Gain/loss on assets (4 ) Amortization of: Prior service cost (10 ) Net gain loss Loss on PBO (29 ) 29 Contribution to funds…arrow_forwardThe following Incomplete (columns have missing amounts) pension spreadsheet is for the current year for First Republic Corporation (FRC). ($ in millions) Debit (Credit) Beginning balance Service cost Interest cost Expected return on assets Gain/loss on assets Amortization of: Prior service cost Net gain/loss Loss on PBO Contributions to fund Retiree benefits paid Ending balance What was the actuary's Interest (discount) rate? Multiple Choice O 17% PBO (300) (12) Prior Plan Service Net Pension Net Pension Assets Cost (Gain)/Loss Expense Cash (Liability)/Asset 43 (185) 83 (88) 866 (11) (5) 6 (96) 77 51 (60)arrow_forwardThe City of Huble has a defined benefit pension plan for a number of its employees. Which of thefollowing is not included immediately in the determination of pension expense that this government should recognize in its government-wide financial statements?a. Service cost.b. Interest on total pension liability.c. Changes in pension liability as a result of a change in benefit terms.d. Changes in pension liability as a result of a change in economic or demographic assumptions.arrow_forward

- The following incomplete (columns have missing amounts) pension spreadsheet is for Old Tucson Corporation (OTC). A) Net pension asset of $323.50 million B) Net pension liability of $519.00 million C) Net pension liability of $323.50 million D) Net pension asset of $519.00 millionarrow_forwardThe following incomplete (columns have missing amounts) pension spreadsheet is for the current year for First Republic Corporation (FRC). Prior ($ in millions) Debit(Credit) Plan Service Net Pension Net Pension PBO Assets Cost (Gain)/Loss Expense Cash (Liability)/Asset Beginning balance Service cost (700) 28 (90) 62 Interest cost 49 Expected return on assets Gain/loss on assets 68 (2) Amortization of: Prior service cost Net gain/loss (7) Loss on PBO (8) Contributions to fund (45) Retiree benefits paid (65) 730 (81) Ending balance What was FRC's pension expense for the year? Multiple Choice $44 million. Next > < Prev 20 of 39 Show Question no....pages Question no....pagesi -pdf MacBook Airarrow_forward(Computation of Actual Return, Gains and Losses, Corridor Test, and Pension Expense) Erickson Company sponsors a defined benefit pension plan. The corporation’s actuary provides the following information about the plan. Check the below image for the information. Instructions(a) Compute the actual return on the plan assets in 2017.(b) Compute the amount of the other comprehensive income (G/L) as of December 31, 2017. (Assume the January 1, 2017, balance was zero.)(c) Compute the amount of net gain or loss amortization for 2017 (corridor approach).(d) Compute pension expense for 2017.arrow_forward

- I only need the answer to b part. I cannot find it anywhere. b. How would the Carol County Pension Trust Fund be reported on the county's financial statarrow_forwardLuciana Fashions calculated pension expense for its underfunded pension plan as follows: Service cost Interest cost Expected return on the plan assets ($100 actual, less $10 gain). Amortization of prior service cost Amortization of net loss Pension expense by by ($ in millions) $ 224 ($ in millions) 150 (90) Required: Which elements of Luciana's balance sheet are affected by the components of pension expense? What are the specific changes in these accounts? Note: Enter your answers in millions. 8 2 $ 294arrow_forwardAssume that actual returns and expected returns to plan assets in a defined benefit pension plan are +$10 and +$12, respectively. What is the effect in the current period on pension expense? Select One: a.Pension expense is increased by $10 b.Pension expense is reduced by $10 c.Pension expense is reduced by $12 d.None of the listed answersarrow_forward

- The following refers to the pension spreadsheet (columns have missing amounts) for the current year for Ng Enterprises. ($ in millions) Debit(Credit) PBO Plan Assets Prior Service Cost Net (Gain)/Loss Pension Expense Cash Net Pension (Liability)/Asset Beginning balance 450 60 55 50 Service cost (85) Interest cost (25) Expected return on assets 55 Gain/loss on assets 3 Amortization of: Prior service cost Net gain/loss (1) Loss on PBO (65) Contributions to fund 40 Retiree benefits paid Ending balance (530) 54 122 What were the retiree benefits paid?arrow_forwardE5 (Pension Entries) Assume that the actuarially required pension plan contribution for a county for its general government employees is $8,000,000. Compute the pension expenditures to be reported in each of the following situations: The county contributed $5,000,000 to the pension plan. Its unfunded pension liability increased by $3,000,000 (all classified as unmatured). The county contributed $4,500,000 to the pension plan. Its unfunded pension liability increased by $3,500,000 (all classified as unmatured). The county contributed $4,200,000 to the pension plan. The matured portion of its unfunded pension liability increased $150,000. The county contributed $9,000,000 to the pension plan. The matured portion of its unfunded pension liability decreased $200,000.arrow_forwardThe City of Huble has a defined benefit pension plan for a number of its employees. Which of the following is not included immediately in the determination of pension expense that this government should recognize in its government-wide financial statements? Service cost. Interest on total pension liability. Changes in pension liability as a result of a change in benefit terms. Changes in pension liability as a result of a change in economic or demographic assumptions.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education