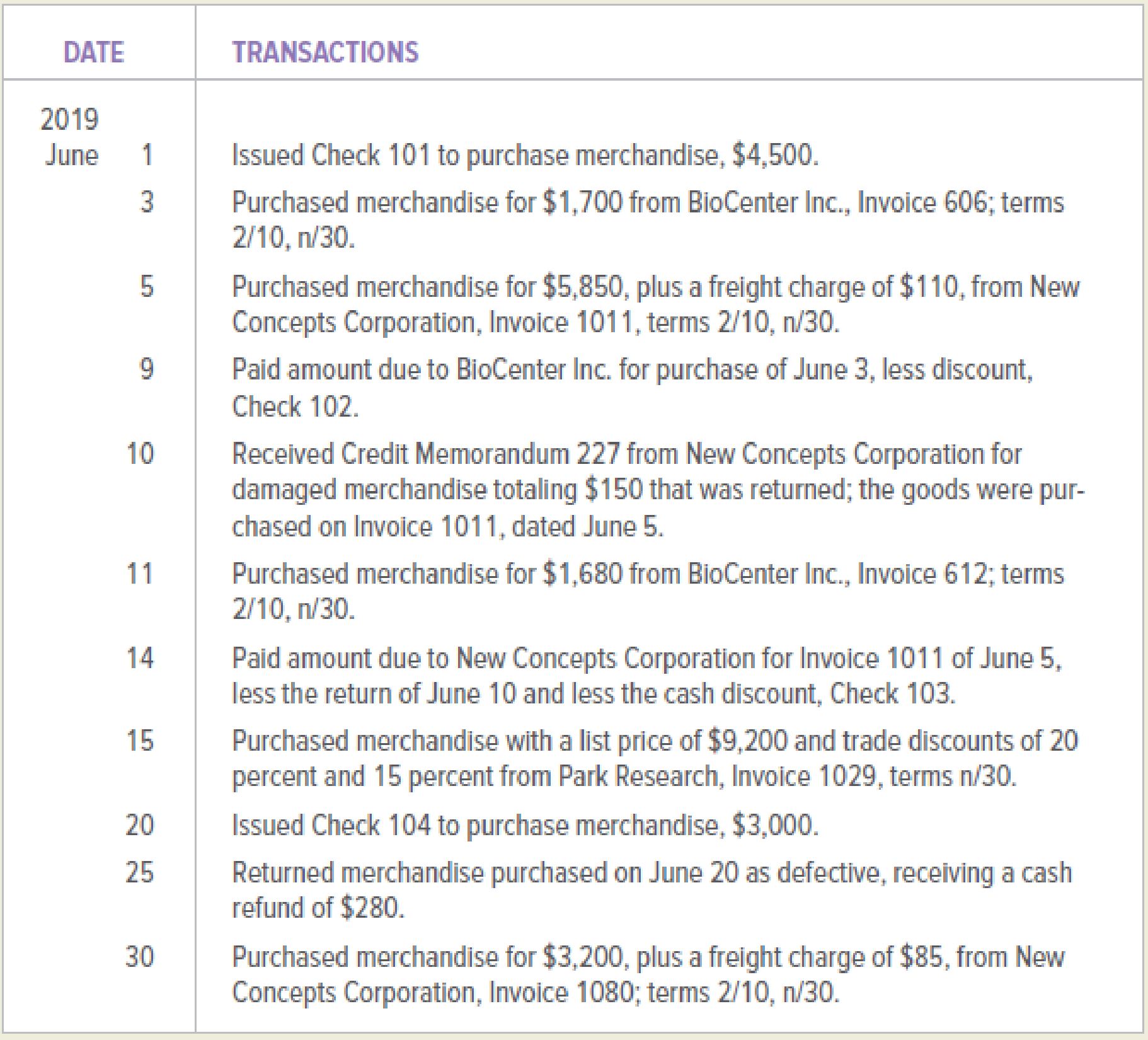

NewTech Medical Devices is a medical devices wholesaler that commenced business on June 1, 2019. NewTech Medical Devices purchases merchandise for cash and on open account. In June 2019, NewTech Medical Devices engaged in the following purchasing and cash payment activities:

INSTRUCTIONS

Journalize the transactions in a general journal. Use 1 as the journal page number.

Analyze: What was the amount of trade discounts received on the June 15 purchase from Park Research?

Record the transaction into general journal.

Explanation of Solution

Journalizing:

Journalizing refers to that process in which the transactions of an organization are recorded in a sequence. Based on the recorded entries, the accounts are posted to the relevant ledger accounts.

The general journal recording the transactions is as follows:

Recording the purchases on cash:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| June 1, 2019 | Purchases | 4,500 | ||

| Cash | 4,500 | |||

| (to record the inventory purchased on cash) | ||||

Table (1)

- • The purchases account is an expense account. The purchases account has normal debit balance and the balance is increasing. Therefore, it is debited.

- • The cash account is an asset account and account balance for cash is decreasing. Therefore, it is credited.

Recording the purchases on credit:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| June 3, 2019 | Purchases | 1,700 | ||

| Accounts payable/Company BC | 1,700 | |||

| (to record the inventory purchased on account with terms2/10, n/30) | ||||

Table (2)

- • The purchases account is an expense account. The purchases account has normal debit balance and the balance is increasing. Therefore, it is debited.

- • Since, the accounts payable is liability and account balance is increasing. Therefore, it is credited.

Recording the purchases on credit including freight charges:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| June 5, 2019 | Purchases | 5,850 | ||

| Freight In | 110 | |||

| Accounts payable/Company NC | 5,960 | |||

| (to record the inventory purchased on account with terms2/10, n/30) | ||||

Table (3)

- • The purchases account is an expense account. The purchases account has normal debit balance and the balance is increasing. Therefore, it is debited.

- • The freight-in account is debited. This is because the freight-in account is an expense account and it has normal debit balance which is increasing.

- • Accounts payable is liability and balance for accounts payable is increasing. Therefore, it is credited.

Recording the payment made:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| June 9, 2019 | Accounts payable/Company BC | 1,700 | ||

| Purchases discounts | 34 | |||

| Cash | 1,666 | |||

| (to record the payment made and receiving purchases discount) | ||||

Table (4)

- • The accounts payable is liability and the account balance is decreasing. Therefore, accounts payable account is debited.

- • The purchases discount account is a contra expense account. The account has the normal credit balance and its increasing. Therefore, it is credited.

- • The cash account is an asset account and the account balance is decreasing. Therefore, it is credited.

Recording the purchases returned and credit memorandum received:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| June 10, 2019 | Accounts payable/Company NC | 150 | ||

| Purchases returns and allowances | 150 | |||

| (to record the inventory returned and credit memorandum received) | ||||

Table (5)

- • The accounts payable account is a liability account. The accounts payable account has the normal credit balance and it is decreasing. Therefore, it is debited.

- • The purchase returns and allowances account is contra expenses account. The account has the normal credit balance and increasing. Therefore, it is credited.

Recording the purchases on credit:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| June 11, 2019 | Purchases | 1,680 | ||

| Accounts payable/Company BC | 1,680 | |||

| (to record the inventory purchased on account with terms2/10, n/30) | ||||

Table (6)

- • The purchases account is debited. This is because the purchase account is an expense account and has normal debit balance which is increasing.

- • Since, the accounts payable is liability and account balance is increasing. Therefore, it is credited.

Recording the payment made:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| June 14, 2019 | Accounts payable/Company NC | 5,810 | ||

| Purchases discounts | 114 | |||

| Cash | 5,696 | |||

| (to record the payment made and receiving purchases discount) | ||||

Table (7)

- • The accounts payable is liability and the account balance is decreasing. Therefore, accounts payable account is debited.

- • The purchases discount account is a contra expense account. The account has the normal credit balance and its increasing. Therefore, it is credited.

- • The cash account is an asset account and the account balance is decreasing. Therefore, it is credited.

Recording the purchases on credit:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| June 15, 2019 | Purchases | 6,256 | ||

| Accounts payable/Company PR | 6,256 | |||

| (to record the inventory purchased on account with terms n/30) | ||||

Table (8)

- • The purchases account is debited. This is because the purchase account is an expense account and has normal debit balance which is increasing.

- • Since, the accounts payable is liability and account balance is increasing. Therefore, it is credited.

Recording the purchases on cash:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| June 20, 2019 | Purchases | 3,000 | ||

| Cash | 3,000 | |||

| (to record the inventory purchased on cash) | ||||

Table (9)

- • The purchases account is an expense account. The purchases account has normal debit balance and the balance is increasing. Therefore, it is debited.

- • The cash account is credited. This is because the cash account is an asset account and account balance is decreasing.

Recording the purchases returned:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| June 25, 2019 | Cash | 280 | ||

| Purchases returns and allowances | 280 | |||

| (to record the inventory returned and cash received) | ||||

Table (10)

- • The cash account is debited. This is because the cash account is asset account and the account balance is increasing.

- • The purchase returns and allowances account is contra expenses account. The account has the normal credit balance and increasing. Therefore, it is credited.

Recording the purchases on credit including freight charges:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| June 30, 2019 | Purchases | 3,200 | ||

| Freight In | 85 | |||

| Accounts payable/Company NC | 3,285 | |||

| (to record the inventory purchased on account with terms2/10, n/30) | ||||

Table (11)

- • The purchases account is an expense account. The purchases account has normal debit balance and the balance is increasing. Therefore, it is debited.

- • The freight In account is debited. This is because the freight In account is an expense account and it has normal debit balance which is increasing.

- • Since, the accounts payable is liability and account balance is increasing. Therefore, it is credited.

Calculation of total trade discount:

The formula to calculate the first trade discount is given below,

Substitute $9,200 for list price and 20 for percentage in the above formula.

The formula to calculate the second trade discount is given below,

Substitute $9,200 for list price, $1,840 for first trade discount and 15 for percentage in the above formula.

The formula to calculate the total trade discount is given below,

Substitute $1,840 for first trade discount and $1,104 for second trade discount in the above formula.

The total trade discount should be of $2,944 amount.

Working Note:

Calculation of purchases discount:

The purchases discounts are received by the buyer from the seller. The purchases discounts are received by the buyer for fulfilling the terms of timely payment to seller for purchases. The terms related to paying on timely basis with the company BC were agreed as 2/10, n/30. The terms 2/10, n/30 means the buyer is entitled to receive two percent of purchase discount on the purchases amount. The buyer will be entitled to the discount only if the payment is paid within ten days after provided invoice.

The amount calculated as purchase discount would be $34.

Calculation of purchases discount:

The purchases discounts are received by the buyer from the seller. The purchases discounts are received by the buyer for fulfilling the terms of timely payment to seller for purchases. The terms related to paying on timely basis with the company BC were agreed as 2/10, n/30. The terms 2/10, n/30 means the buyer is entitled to receive two percent of purchase discount on the purchases amount. The buyer will be entitled to the discount only if the payment is paid within ten days after provided invoice.

The amount calculated as purchase discount would be $114.

Calculations for the purchases amount:

The seller provides the trade discount of twenty percent and the fifteen percent on the list price to the buyer. The purchases amount to be recorded by the buyer would be at the invoice price.

The purchases amount that would be calculated is $6,256.

Want to see more full solutions like this?

Chapter 8 Solutions

COLLEGE ACCOUNTING (LL)W/ACCESS>CUSTOM<

- Blossom Company uses special journals and a general journal. The following transactions occurred during September 2020. Sept. 2 Sold merchandise on account to H. Drew, invoice no. 101, $720, terms n/30. The cost of the merchandise sold was $400. 10 Purchased merchandise on account from A. Pagan $595, terms 2/10, n/30. 12 Purchased office equipment on account from R. Cairo $6,000. 21 Sold merchandise on account to G. Holliday, invoice no. 102 for $765, terms 2/10, n/30. The cost of the merchandise sold was $495. 25 Purchased merchandise on account from D. Downs $855, terms n/30. 27 Sold merchandise to S. Miller for $650 cash. The cost of the merchandise sold was $445.arrow_forwardRead through the information below for selected transactions during the month of December, 2021 and prepare the required jounal entry to record the transaction. Post each of the entries below to the general ledger T-accounts attached . Sold Merchandise for $5,000 to Lee Corp on account on December 9. Cost of the merchandise was $3,390 and the terms of the sale were 1/15, n/30.arrow_forwardNIZWA ELECTRONICS is doing a merchandise business. The business selling all electronics items. The business has made the following purchases and sales during the month of May 2019. The following information was taken from the inventory records during May 2019. The business had Opening inventory of 20 Sar ung Galaxy Mobile at OMR 60 each on 1st May 2019. On May 3, Purchase 25 numbers at OMR 50 each and May 31 Sold 25 numbers at 70 each. What will be the Cost of goods sold at the end of May 31 assumes that business uses LIFO method?arrow_forward

- Presented below are the transactions for Mariano Lerin Bookstore for March 2019. Mar. 2 Purchased merchandise on credit from Digao Publishers, terms 2/10, n/30, P74,000. 3 Sold merchandise on credit to Detoya Book Shop, terms 1/10, n//30, P10,000. 5 Sold merchandise for cash, P7,000. 6 Purchased and received merchandise on credit from Made Easy Bookstore, terms 2/10, n/30, P42,000. 7 Received freight bill from Super Express from shipment received on March 6, P570. 9 Sold merchandise on credit to Recoletos Books, terms 1/10, n/30, P38,000. 10 Purchased merchandise from Digao Publishers, terms 2/10, n/30, P26,500. 11 Received freight bill from Super Express for sale on Mar. 9, P291. 12 Paid Digao Publishers for purchase of Mar. 2. 13 Received payment in full for Detoya Books’ purchase on Mar. 3. 14 Paid Made Easy Bookstore half the amount owed on the Mar. 6 purchase. A discount is allowed for partial…arrow_forwardPresented below are the transactions for Mariano Lerin Bookstore for March 2019. Mar. 2 Purchased merchandise on credit from Digao Publishers, terms 2/10, n/30, P74,000. 3 Sold merchandise on credit to Detoya Book Shop, terms 1/10, n//30, P10,000. 5 Sold merchandise for cash, P7,000. 6 Purchased and received merchandise on credit from Made Easy Bookstore, terms 2/10, n/30, P42,000. 7 Received freight bill from Super Express from shipment received on March 6, P570. 9 Sold merchandise on credit to Recoletos Books, terms 1/10, n/30, P38,000. 10 Purchased merchandise from Digao Publishers, terms 2/10, n/30, P26,500. 11 Received freight bill from Super Express for sale on Mar. 9, P291. 12 Paid Digao Publishers for purchase of Mar. 2. 13 Received payment in full for Detoya Books’ purchase on Mar. 3. 14 Paid Made Easy Bookstore half the amount owed on the Mar. 6 purchase. A discount is allowed for partial…arrow_forwardRecord the following transactions in their respective general and special journals. Presented below are the transactions for Mariano Lerin Bookstore for March 2019 Mar. 2 Purchased merchandise on credit from Digao Publishers, terms 2/10, n/30, P74,000. 3 Sold merchandise on credit to Detoya Book Shop, terms 1/10, n//30, P10,000. 5 Sold merchandise for cash, P7,000. 6 Purchased and received merchandise on credit from Made Easy Bookstore, terms 2/10, n/30, P42,000. 7 Received freight bill from Super Express from shipment received on March 6, P570. 9 Sold merchandise on credit to Recoletos Books, terms 1/10, n/30, P38,000. 10 Purchased merchandise from Digao Publishers, terms 2/10, n/30, P26,500. 11 Received freight bill from Super Express for sale on Mar. 9, P291. 12 Paid Digao Publishers for purchase of Mar. 2. 13 Received payment in full for Detoya Books’ purchase on Mar. 3. 14 Paid Made Easy Bookstore…arrow_forward

- Fiona Sporty uses a purchases journal, a cash payments journal, a sales journal, a cash receipts journal and a general journal. Indicate in which journals the following transactions are most likely to be recorded. Purchased inventories on credit Sales of inventory on credit Received payment of a customer’s account Payment of monthly rent by cheque End of period closing entries Week 7 Below is information about Lisa Ltd’s cash position for the month of June 2019. The general ledger Cash at Bank account had a balance of $21,200 on 31 May. The cash receipts journal showed total cash receipts of $292,704 for June. The cash payments journal showed total cash payments of $265,074 for June. The June bank statement reported a bank balance of $41,184 on 30 June. Outstanding cheques at the end of June were: no. 3456, $1,448; no. 3457, $84; no. 3460, $70 and no. 3462, $410. Cash receipts of $10,090 for 30 June were not included in the June bank statement. Included on the bank…arrow_forwardSandra’s Store purchased merchandise from a manufacturer with an invoice price of$11,000 and credit terms of 3/10, n/60, and paid within the discount period.Requireda. Prepare the journal entries that the purchaser should record for the purchase andpayment.b. Prepare the journal entries that the seller should record for the sale and collection.c. Assume that the buyer borrowed enough cash to pay the balance on the last day ofthe discount period at an annual interest rate of 8% and paid it back on the last dayof the credit period. Calculate how much the buyer saved by following this strategy.(Use a 365-day year.)arrow_forwardBlossom Co. uses the gross method to record sales made on credit. On June 1, 2025, it made sales of $62,000 with terms 3/15, n/45. On June 12, 2025, Blossom received full payment for the June 1 sale. Prepare the required journal entries for Blossom Co. (If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit 10 Creditarrow_forward

- Using the journal entries recorded for the previous worksheet, post the them on their respective general and subsidiary ledgers, and prepare the trial balance for March 2019. Presented below are the transactions for Mariano Lerin Bookstore for March 2019. Mar. 2 Purchased merchandise on credit from Digao Publishers, terms 2/10, n/30, P74,000. 3 Sold merchandise on credit to Detoya Book Shop, terms 1/10, n//30, P10,000. 5 Sold merchandise for cash, P7,000. 6 Purchased and received merchandise on credit from Made Easy Bookstore, terms 2/10, n/30, P42,000. 7 Received freight bill from Super Express from shipment received on March 6, P570. 9 Sold merchandise on credit to Recoletos Books, terms 1/10, n/30, P38,000. 10 Purchased merchandise from Digao Publishers, terms 2/10, n/30, P26,500. 11 Received freight bill from Super Express for sale on Mar. 9, P291. 12 Paid Digao Publishers for purchase of Mar. 2. 13…arrow_forwardThe following are transactions of Mariano Lerin Bookstore for March 2020: March 2 Purchased merchandise on credit from Digao Publishers; terms 2/10, n/30, FOB destination, P74,000 3 Sold merchandise on credit to Detoya Book Shop, terms 1/10, n/30, FOB shipping point, P10,000 5 Sold merchandise for cash, P70,000 6 Purchased and received merchandise on credit from Easy Bookstore, terms 2/10, n/30, FOB shipping point, P42,000 7 Received freight bill from Supper Express from shipment received on March 6, P570 8 Paid Rent for the month, P7,000 9 Sold merchandise on credit to Recoletos Books, terms 1/10, n/30 FOB destination, P38,000 10 Purchased merchandise from Digao Publishers, terms 2/10, n/30, FOB shipping point, P26,500, including freight costs of P500. 11 Received freight bill from Super Express for sale on March 9, P291. 12 Paid Digao Publishers for purchase of March 2. 13 Received payment in full from Detoya Book Shop's purchase of March 3 14 Paid Easy Bookstore half the amount owed…arrow_forwardThe following are transactions of Mariano Lerin Bookstore for March 2020: March 2 Purchased merchandise on credit from Digao Publishers; terms 2/10, n/30, FOB destination, P74,000 3 Sold merchandise on credit to Detoya Book Shop, terms 1/10, n/30, FOB shipping point, P10,000 5 Sold merchandise for cash, P70,000 6 Purchased and received merchandise on credit from Easy Bookstore, terms 2/10, n/30, FOB shipping point, P42,000 7 Received freight bill from Supper Express from shipment received on March 6, P570 8 Paid Rent for the month, P7,000 9 Sold merchandise on credit to Recoletos Books, terms 1/10, n/30 FOB destination, P38,000 10 Purchased merchandise from Digao Publishers, terms 2/10, n/30, FOB shipping point, P26,500, including freight costs of P500. 11 Received freight bill from Super Express for sale on March 9, P291. 12 Paid Digao Publishers for purchase of March 2. 13 Received payment in full from Detoya Book Shop's purchase of March 3 14 Paid Easy Bookstore half the amount owed…arrow_forward

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning