Segmented Income Statement, Management Decision Making

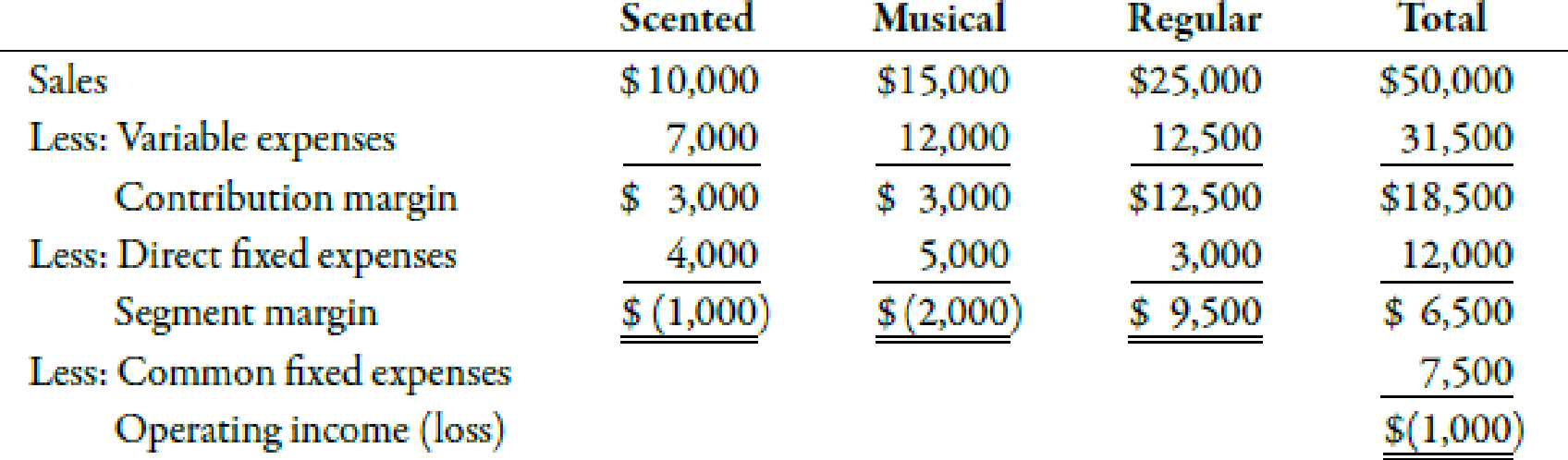

FunTime Company produces three lines of greeting cards: scented, musical, and regular. Segmented income statements for the past year are as follows:

Kathy Bunker, president of FunTime, is concerned about the financial performance of her firm and is seriously considering dropping both the scented and musical product lines. However, before making a final decision, she consults Jim Dorn, FunTime’s vice president of marketing.

Required:

- 1. CONCEPTUAL CONNECTION Jim believes that by increasing advertising by $1,000 ($250 for the scented line and $750 for the musical line), sales of those two lines would increase by 30%. If you were Kathy, how would you react to this information?

- 2. CONCEPTUAL CONNECTION Jim warns Kathy that eliminating the scented and musical lines would lower the sales of the regular line by 20%. Given this information, would it be profitable to eliminate the scented and musical lines?

- 3. CONCEPTUAL CONNECTION Suppose that eliminating either line reduces sales of the regular cards by 10%. Would a combination of increased advertising (the option described in Requirement 1) and eliminating one of the lines be beneficial? Identify the best combination for the firm.

1.

Describe the reaction of Person K on the increase in advertisement expense and sales.

Explanation of Solution

Segmented Income Statement:

Variable costing is used in the preparation of a segmented income statement. In this income statement, the variable expenses are recorded separately from the fixed expenses which are further divided into direct fixed expenses and common expenses.

The following table represents the segmented income statement of Company F:

| Company F | ||||

| Segmented Income Statement | ||||

| For the Previous Year | ||||

| Scented ($) | Musical ($) | Regular ($) | Total ($) | |

| Sales1 | 13,000 | 19,500 | 25,000 | 57,500 |

| Less variable expenses2 | 9,100 | 15,600 | 12,500 | 37,200 |

| Contribution margin | 3,900 | 3,900 | 12,500 | 20,300 |

| Less direct fixed expenses3: | 4,250 | 5,750 | 3,000 | 13,000 |

| Segment margin | (350) | (1,850) | 9,500 | 7,300 |

| Less common fixed expenses: | 7,500 | |||

| Operating income (loss) | (200) | |||

Table (1)

The amount of operating loss is $200. Person K should accept the increase in the direct fixed expense and sales. The overall operating loss before the increase is $1,000 whereas the overall operating loss after the increase is $200. This represents that there is a decrease in the operating loss after an increase in the direct fixed expense and sales.

Working Notes:

1. Calculation of revised sales for scented cards:

Hence, the amount of revised sales for scented cards is $13,000.

Calculation of revised sales for musical cards:

Hence, the amount of revised sales for musical cards is $19,500.

2. Calculation of revised variable expense for scented cards:

Hence, the amount of revised variable expense for scented cards is $9,100.

Calculation of revised variable expense for musical cards:

Hence, the amount of revised variable expense for musical cards is $15,600.

3. Calculation of revised fixed direct expense for scented cards:

Hence, the revised fixed direct expense for scented cards is $4,250.

Calculation of revised fixed direct expense for musical cards:

Hence, the revised fixed direct expense for musical cards is $5,750.

2.

Describe whether it would be beneficial for the company to eliminate the scented and musical lines.

Explanation of Solution

The following table represents the operating income or loss after eliminating scented and musical lines:

| Company F | |

| Segmented Income Statement | |

| For the Previous Year | |

| Regular ($) | |

| Sales1 | 20,000 |

| Less variable expenses2 | 10,000 |

| Contribution margin | 10,000 |

| Less direct fixed expenses: | 3,000 |

| Segment margin | 7,000 |

| Less common fixed expenses: | 7,500 |

| Operating income (loss) | (500) |

Table (2)

The amount of operating loss is $500. If the company eliminates the scented and musical lines, then the sales and variable expenses will get reduced by 20%. The overall operating loss was $1,000 but the revised operating loss after eliminating scented and musical line is $500.

Although the operating loss decreases, still it is not profitable because when the direct fixed expenses of scented and musical lines increase, the operating loss reduces to $200.

Working Notes:

1. Calculation of revised sales:

Hence, the amount of revised sales is $20,000.

2. Calculation of revised variable expense:

Hence, the amount of revised variable expense is $10,000.

3.

Describe whether the combination of an increase in advertising and eliminating either of the lines would be beneficial. Also, identify the best combination.

Explanation of Solution

Since the musical line has the highest segment loss, the line should be eliminated. The following table represents the income statement after eliminating musical lines:

| Company F | |||

| Segmented Income Statement | |||

| For the Previous Year | |||

| Scented ($) | Regular ($) | Total ($) | |

| Sales1 | 13,000 | 22,500 | 35,500 |

| Less variable expenses2 | 9,100 | 11,250 | 20,350 |

| Contribution margin | 3,900 | 11,250 | 15,150 |

| Less direct fixed expenses3: | 4,250 | 3,000 | 7,250 |

| Segment margin | (350) | 8,250 | 7,900 |

| Less common fixed expenses: | 7,500 | ||

| Operating income (loss) | 400 | ||

Table (3)

Therefore, the amount of operating income is $400. The company should consider this type of combination as it is more profitable than any other combination.

Working Notes:

1. Calculation of revised sales for scented cards:

Hence, the amount of revised sales for scented cards is $13,000.

Calculation of revised sales for the regular line:

Hence, the amount of revised sales for the regular line is $22,500.

2. Calculation of revised variable expense for scented cards:

Hence, the amount of revised variable expense for scented cards is $9,100.

Calculation of revised variable expense for the regular line:

Hence, the amount of revised variable expense for the regular line is $11,250.

3. Calculation of revised fixed direct expense for scented cards:

Hence, the revised fixed direct expense for scented cards is $4,250.

Want to see more full solutions like this?

Chapter 8 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

- Explaining why companies use performance evaluation systems Financial performance is measured in many ways. Requirements Explain the difference between lag and lead indicators. The following is a list of financial measures. Indicate whether each is a lag or a lead indicator: An income statement shows net income of $100,000 Listing of next week’s orders of $50,000 The trend showing that average hits on the redesigned Web site are increasing at 5% per week Price sheet from vendor reflecting that cost per pound of sugar for the next month is $2 Contract signed last month with a large retail store that guarantees a minimum shelf space for Grandpa’s Overloaded Chocolate Cookies for the next yeararrow_forwardBreakeven Planning; Profit Planning Connelly Inc., a manufacturer of quality electric ice creammakers, has experienced a steady growth in sales over the past few years. Because her business hasgrown, Jan DeJaney, the president, believes she needs an aggressive advertising campaign next yearto maintain the company’s growth. To prepare for the growth, the accountant prepared the followingdata for the current year:Variable costs per ice cream makerDirect labor $ 13.50Direct materials 14.50Variable overhead 6.00Total variable costs $ 34.00Fixed costsManufacturing $ 82,500Selling 42,000Administrative 356,000Total fixed costs $480,500Selling price per unit $ 67.00Expected sales (units) 30,000Required1. If the costs and sales price remain the same, what is the projected operating profit for the coming year?2. What is the breakeven point in units for the coming year? (Round your answer up to the nearest wholenumber.)3. Jan has set the sales target for 35,000 ice cream makers, which she thinks…arrow_forwardScorecard Measures, Strategy Translation At the end of 20x1, Mejorar Company implemented a low-cost strategy to improve its competitive position. Its objective was to become the low-cost producer in its industry. A Balanced Scorecard was developed to guide the company toward this objective. To lower costs, Mejorar undertook a number of improvement activities such as JIT production, total quality management, and activity-based management. Now, after two years of operation, the president of Mejorar wants some assessment of the achievements. To help provide this assessment, the following information on one product has been gathered: 20x1 20x3 Theoretical annual capacity* 249,600 249,600 Actual production** 208,000 234,000 Market size (in units sold) 1,300,000 1,300,000 Production hours available (40 workers) 104,000 104,000 Very satisfied customers 62,400 117,000 Actual cost per unit $340 $272 Days of inventory 14 7 Number of defective…arrow_forward

- Explaining why companies use performance evaluation systems Financial performance is measured in many ways. Requirements 1. Explain the difference between lag and lead indicators. 2. The following is a list of financial measures. Indicate whether each is a lag or a lead indicator: a. Income statement shows net income of $100,000 b. Listing of next week’s orders of $50,000 c. Trend showing that average hits on the redesigned Web site are increasing at 5% per week d. Price sheet from vendor reflecting that cost per pound of sugar for the next month is $2 e. Contract signed last month with large retail store that guarantees a minimum shelf space for Grandpa’s Overloaded Chocolate Cookies for the next yeararrow_forwardRequired information [The following information applies to the questions displayed below] Nation's Capital Fitness, Inc., operates a chain of fitness centers in the Washington, D.C., area. The firm's controller is accumulating data to be used in preparing its annual profit plan for the coming year. The cost behavior pattern of the firm's equipment maintenance costs must be determined. The accounting staff has suggested the use of the high-low method to develop an equation, in the form of Y=a+bX, for maintenance costs. Data regarding the maintenance hours and costs for last year are as follows: Month January February March April May June July August September October November December Total Average "Rounded Hours of Maintenance Service 530 470 260 470 360 450 330 450 470 380 360 360 4,890 408- Maintenance Costs $ 5,068 4,220 2,800 4,330 2,970 4,140 3,100 3,510 4,010 3,200 3,250 3,040 $43,638 $ 3,637 Required: 1. Using the high-low method of cost estimation, estimate the behavior of the…arrow_forwardRizzo Goal Inc. produces and sells hockey equipment, often custom made for online orders. The company has the following performance metrics on its balanced scorecard: days from ordered to delivered, number of shipping errors, customer retention rate, and market share. A measure map illustrates that the days from ordered to delivered and the number of shipping errors are both expected to directly affect the customer retention rate, which affects market share. Additional internal analysis finds that: Every shipping error over three shipping errors per month reduces the customer retention rate by 1.5%. On average, each day above three days from ordered to delivered yields a reduction in the customer retention rate of 1%. Each day before three days from order to delivery yields an increase in the customer retention rate of 1%, on average. Rizzo Goal Inc.s current customer retention rate is 60%. The company estimates that for every 1% increase or decrease in the customer retention rate, market share changes 0.5% in the same direction. Rizzo Goal Inc.s current market share is 21.4%. Ignoring any other factors, if the company has six shipping errors this month and an average of 3.5 days from ordered to delivered, determine (a) the new customer retention rate and (b) the new market share that Rizzo Goal Inc. expects to have.arrow_forward

- Kanye Achebe just became the operations manager of Weston Transportation. Weston transports large crates for online companies and transports containers overseas. Kanye would like to evaluate each divisional manager on a basis similar to segmental reporting required by generally accepted accounting principles (GAAP) financial statements contained in annual reports. These data include a presentation of net sales, operating profit and loss before and after taxes, total identifiable assets, and depreciation for segment reported. Kanye thinks that evaluating business division managers by the same criteria as the total company is appropriate. A. Explain why you think the chief financial officer (CFO) disagrees and tells Kanye that publicly reporting information might demotivate managers. B. For better evaluation of the managers, what type of information should Kanye propose that the CFO might accept?arrow_forwardMaking sales mix decisions Moore Company sells both designer and moderately priced fashion accessories. Top management is deciding which product line to emphasize. Accountants have provided the following data: The Moore Company store in Grand Junction, Colorado, has 14,000 square feet of Floor space. If Moore Company emphasizes moderately priced goods, it can display 840 items in the store. If Moore Company emphasizes designer wear, it can display only 560 designer items. These numbers are also the average monthly sales in units. Prepare an analysis to show which product the company should emphasize.arrow_forwardManagerial Accounting: An Overview Ethics and the Manager Richmond, Inc., operates a chain of 44 department stores. Two years ago, the board of directors of Richmond approved a large-scale remodelling of its stores to attract a more upscale clientele. Before finalizing these plans, two stores were remodelled as a test. Linda Perlman, assistant controller, was asked to oversee the financial reporting for these test stores, and she and other management personnel were offered bonuses based on the sales growth and profitability of these stores. While completing the financial reports, Perlman discovered a sizable inventory of outdated goods that should have been discounted for sale or returned to the manufacturer. She discussed the situation with her management colleagues; the consensus was to ignore reporting this inventory as obsolete because reporting it would diminish the financial results and their bonuses. Required: 1. According to the IMA’s Statement of Ethical Professional Practice,…arrow_forward

- Restructuring a Segmented Income Statement Millard Corporation is a wholesale distributor of office products. It purchases office products from manufacturers and distributes them in the West, Central, and East regions. Each of these regions is about the same size and each has its own manager and sales staff. The company has been experiencing losses for many months. In an effort to improve performance, management has requested that the monthly income statement be segmented by sales region. The company’s first effort at preparing a segmented income statement for May is given below. The cost of goods sold and shipping expense are both variable. All other costs are fixed. Required: 1. List any weaknesses that you see in the company’s segmented income statement given above. 2. Explain the basis that is apparently being used to allocate the corporate expenses to the regions. Do you agree with these allocations? Explain. 3. Prepare a new contribution format segmented income statement for May.…arrow_forward! Required information Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below.] Hudson Company reports the following contribution margin income statement. Sales (9,700 units at $280 each) Variable costs (9,700 units at $210 each) Contribution margin Fixed costs Income HUDSON COMPANY Contribution Margin Income Statement For Year Ended December 31 Exercise 18-17 (Algo) Evaluating strategies- advertising LO C2 The marketing manager believes that increasing advertising costs by $200,000 will increase the company's sales volume to 11,100 units. Prepare a contribution margin income statement for the next year assuming the company incurs the additional advertising costs. HUDSON COMPANY Contribution Margin Income Statement For Year Ended December 31 Sales Variable costs Contribution margin Fixed costs Income/Loss $ 2,716,000 2,037,000 679,000 441,000 $ 238,000arrow_forwardStrategic Initiatives and CSR Blue Skies Inc. is a retail gardening company that is piloting a new strategic initiative aimed at increasing gross profit. Currently, the company's gross profit is 23% of sales, and its target gross profit percentage is 28%. The company's current monthly sales revenue is $570,000. The new initiative being piloted is to produce goods in-house instead of buying them from wholesale suppliers. Its in-house production process has two procedures. The makeup of the costs of production for Procedure 1 is 40% direct labor, 45% direct materials, and 15% overhead. The makeup of the costs of production for Procedure 2 is 60% direct labor, 30% direct materials, and 10% overhead. Assume that Procedure 1 costs twice as much as Procedure 2. 1. Determine what the cost of labor, materials, and overhead for both Procedures 1 and 2 would need to be for the company to meet its target gross profit. Cost makeup of Procedure 1: Direct Labor Direct Materials Overhead Total Cost…arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College