Concept explainers

| Year | Cash Flow (A) | Cash Flow (B) |

| 0 | $43,500 | $43,500 |

| 1 | 21,400 | 6,400 |

| 2 | 18,500 | 14,700 |

| 3 | 13,800 | 22,800 |

| 4 | 7,600 | 25,200 |

a. What is the IRR for each of these projects? Using the IRR decision rule, which project should the company accept? Is this decision necessarily correct?

b. If the required return is 11 percent, what is the NPV for each of these projects? Which project will the company choose if it applies the NPV decision rule?

c. Over what range of discount rates would the company choose project A? Project B? At what discount rate would the company be indifferent between these two projects? Explain.

a)

To calculate: The IRR (Internal rate of return) for the proposed projects of Company G, the project that the company must accept and discuss whether the decision made is appropriate.

Introduction:

The IRR (Internal rate of return) is a rate of discount, which makes the predictable investment’s NPV equal to zero.

The NPV (Net present value) is a capital budgeting technique, which is used to assess the investment, and it is utilized to identify the profitability in a proposed investment.

Answer to Problem 12QP

As IRR is higher in Project A when compared to Project B, then Project A can be accepted. However, it is not the appropriate decision because the criterion of IRR has a problem in ranking of mutually exclusive projects.

Explanation of Solution

Given information:

Company G has identified two mutually exclusive projects where the cash flows of Project A are $21,400, $18,500, $13,800, and $7,600 for the years 1, 2, 3, and 4, respectively. The cash flows of Project B are $6,400, $14,700, $22,800, and $25,200 for the years 1, 2, 3, and 4, respectively. The initial costs for both the project are $43,500, respectively.

Note:

- NPV is the difference between the present values of the cash inflows from the present value of cash outflows.

- The IRR is the rate of interest, which makes the project’s NPV equal to zero. Hence, using the available information, assume that the NPV is equal to zero and form an equation to compute the IRR.

Equation of NPV to compute IRR assuming that NPV is equal to zero:

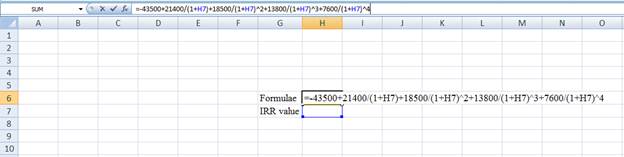

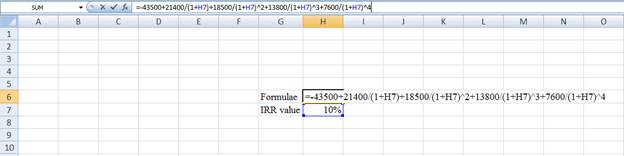

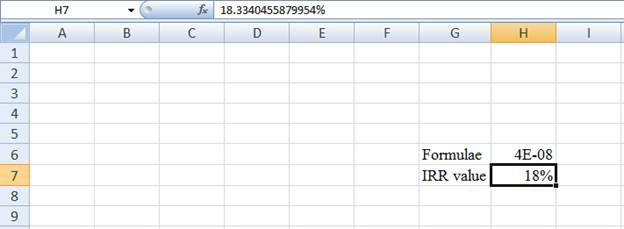

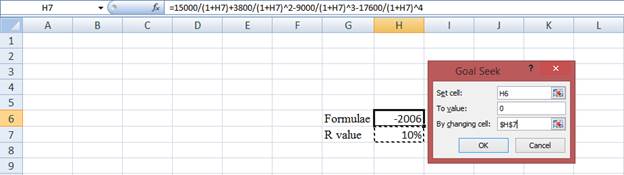

Compute IRR for Project A using a spreadsheet:

Step 1:

- Type the equation of NPV in H6 in the spreadsheet and consider the IRR value as H7.

Step 2:

- Assume the IRR value as 0.10%.

Step 3:

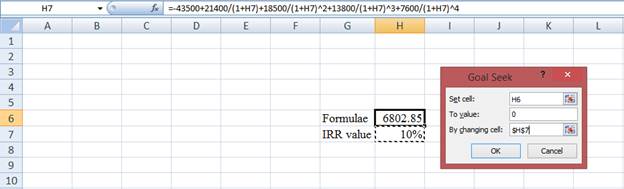

- In the spreadsheet, go to the data and select the what-if analysis.

- In what-if analysis, select goal seek.

- In “Set cell”, select H6 (the formula).

- The “To value” is considered as 0 (the assumption value for NPV).

- The H7 cell is selected for the “By changing cell”.

Step 4:

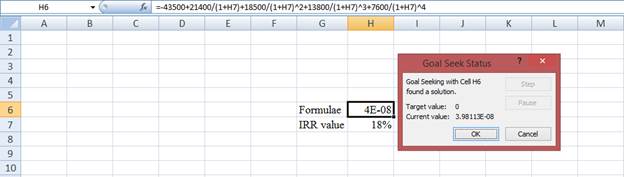

- Following the previous step, click OK in the goal seek. The goal seek status appears with the IRR value.

Step 5:

- The value appears to be 18.3340455879954%.

Hence, the IRR value is 18.33%.

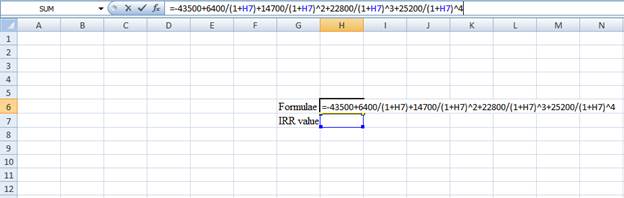

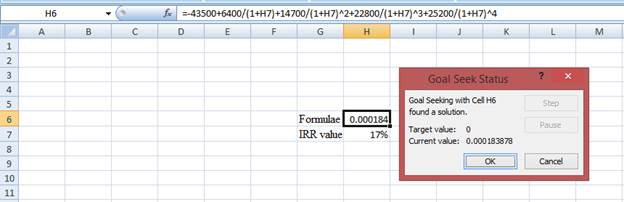

Compute IRR for Project B using a spreadsheet:

Step 1:

- Type the equation of NPV in H6 in the spreadsheet and consider the IRR value as H7.

Step 2:

- Assume the IRR value as 0.10%.

Step 3:

- In the spreadsheet, go to the data and select the what-if analysis.

- In what-if analysis, select goal seek.

- In “Set cell”, select H6 (the formula).

- The “To value” is considered as 0 (the assumption value for NPV).

- The H7 cell is selected for the “By changing cell”.

Step 4:

- Following the previous step, click OK in the goal seek. The goal seek status appears with the IRR value.

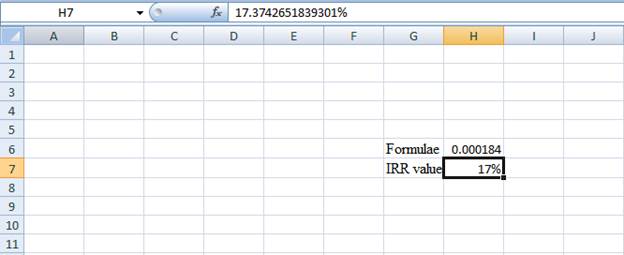

Step 5:

- The value appears to be 17.3742651839301%.

Hence, the IRR value is 17.37%.

b)

To calculate: The NPV for the projects to choose the best project for the company.

Introduction:

The IRR (Internal rate of return) is a rate of discount, which makes the predictable investment’s NPV equal to zero.

The NPV (Net present value) is a capital budgeting technique, which is used to assess the investment, and it is utilized to identify the profitability in a proposed investment.

Answer to Problem 12QP

As NPV is greater in Project B, the company must accept Project B.

Explanation of Solution

Given information:

Company G has identified two mutually exclusive projects where the cash flows of Project A are $21,400, $18,500, $13,800, and $7,600 for the years 1, 2, 3, and 4, respectively. The cash flows of Project B are $6,400, $14,700, $22,800, and $25,200 for the years 1, 2, 3, and 4, respectively. The initial costs for both the project are $43,500, respectively.

Note:

- NPV is the difference between the present values of the cash inflows from the present value of cash outflows.

- The IRR is the rate of interest, which makes the project’s NPV equal to zero. Hence, using the available information, assume that the NPV is equal to zero and form an equation to compute the IRR.

Formula to calculate the NPV:

Compute NPV for Project A:

Hence, the NPV for Project A is $5,891.09.

Compute NPV for Project B:

Note: The rate is given at 11%.

Hence, the NPV for project B is $7,467.80.

c)

To calculate: The rates of discount at which the company will select Project A and Project B, and the discount rate in which the company will be indifferent in selecting between the two projects.

Introduction:

The IRR (Internal rate of return) is a rate of discount, which makes the predictable investment’s NPV equal to zero.

The NPV (Net present value) is a capital budgeting technique, which is used to assess the investment, and it is utilized to identify the profitability in a proposed investment.

Answer to Problem 12QP

At the rate of discount above 15.19%, the company must choose Project A and for the rate below 15.19%, the company should choose Project B. Hence, it is indifferent at the discount rate of 15.19%.

Explanation of Solution

Given information: Company G has identified two mutually exclusive projects where the cash flows of Project A are $21,400, $18,500, $13,800, and $7,600 for the years 1, 2, 3, and 4, respectively. The cash flows of Project B are $6,400, $14,700, $22,800, and $25,200 for the years 1, 2, 3, and 4, respectively. The initial costs for both the project are $43,500, respectively.

Note:

- NPV is the difference between the present values of the cash inflows from the present value of cash outflows.

- The IRR is the rate of interest, which makes the project’s NPV equal to zero. Hence, using the available information, assume that the NPV is equal to zero and form an equation to compute the IRR.

Equation to calculate the crossover rates:

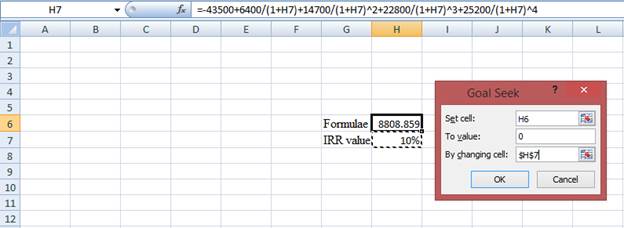

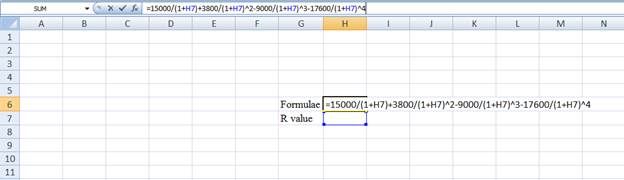

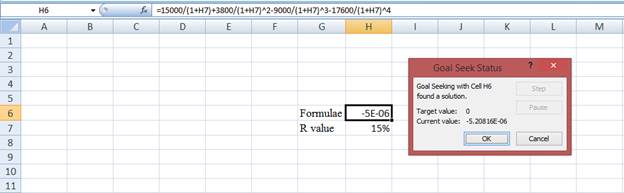

Compute the discount rate using spreadsheet:

Step 1:

- Type the equation of NPV in H6 in the spreadsheet and consider the R value as H7.

Step 2:

- Assume the R value as 10%.

Step 3:

- In the spreadsheet, go to the data and select the what-if analysis.

- In what-if analysis, select goal seek.

- In “Set cell”, select H6 (the formula).

- The “To value” is considered as 0 (the assumption value for NPV).

- The H7 cell is selected for the “By changing cell”.

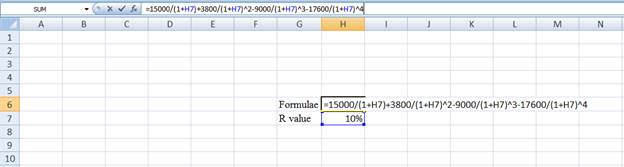

Step 4:

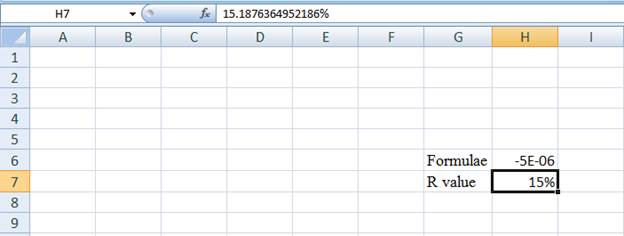

- Following the previous step, click OK in the goal seek. The goal seek status appears with the R value.

Step 5:

- The value appears to be 15.1876364952186%.

Hence, the R value is 15.19%.

Want to see more full solutions like this?

Chapter 9 Solutions

Fundamentals of Corporate Finance

- Bruin, Inc. has identified the following mutually exclusive projects. 0 1 2 3 4 Cash Flows Project A ($37,500) $17,300 $16,200 $13,800 $7,600 Project B ($37,500) $5,700 $12,900 $16,300 $27,500 a. What is the IRR for each of these projects? b. Which project should be selected under the IRR rule? c. If the required return for each project were 11%, what is the NPV of each project. d. Which project should be selected under the NPV rule? e. How would you reconcile this conflict in project selection?arrow_forward17. Consider the following two mutually exclusive projects: Year Cash Flow (A) Cash Flow (B)0 −$291,000 −$41,6001 37,000 20,0002 55,000 17,6003 55,000 17,2004 366,000 14,000 a) What is the Internal Rate of Return (IRR) for each of these projects? b) Using the IRR decision rule, which project should the company accept? c) If the required return is 11 percent, what is the Net Present Value (NV) for each of these projects? d) Using the NPV decision rule, which project should the company accept? e) Why do you think the NPV and IRR rules do not agree on same project approval/rejection direction?arrow_forwardConsider the following two mutually exclusive projects: Year Cash Flow (A) Cash Flow (B) 0 −$29,000 −$29000 1 14,400 4,300 2 12,300 9,800 3 9,200 15,200 4 5,100 16,800 a) What is the Internal Rate of Return (IRR) for each of these projects? b) Using the IRR decision rule, which project should the company accept? c) If the required return is 11 percent, what is the Net Present Value (NV) for each of these projects? d) Using the NPV decision rule, which project should the company accept? e) Why do you think the NPV and IRR rules do not agree on same project approval/rejection direction?arrow_forward

- Question 2: Boisjoly Product Company is considering two mutually exclusive investment projects. The projects' annual expected cash flows are as follows: Estimated Net Cash Flows (million $) Year Project X Project Y 0 (405) (300) 1 134 (387) 2 134 (193) 134 (100) 4 134 600 5 134 600 6 134 850 7 0 (180) (note: numbers in brackets are costs) Compute IRR for each project. If you were told that the company's cost of capital (and also MARR) was 15% per year, which project the company should select?arrow_forwardUse the following information for problems 1 to 5. Assume that the projects are mutually exclusive. Year Cash Flow (A) Cash Flow (B) 0 ($525,600) ($425,600) 1 $323,100 $235,900 2 $180,200 $163,900 3 $145,000 $135,000 4 $88,220 $79,000 What is the IRR for each of these projects? Using the IRR decision rule, which project should the company accept? Is this decision necessarily correct? If the required return is 13 percent, what is the NPV for each of these projects? Which project will the company choose if it applies the NPV decision rule? Over what range of discount rates would the company choose Project A? Project B? At what discount rate would the company be indifferent between these two projects? Explain. Compute the payback period for each project. Compute the profitability index for each project.arrow_forwardIRR: Mutually exclusive projects Nile Inc. wants to choose the better of two mutually exclusive projects that expand warehouse capacity. The projects' cash flows are shown in the following table: . The cost of capital is 18%. a. The internal rate of return (IRR) of project X is %. (Round to two decimal places.) Data table Is project X acceptable on the basis of IRR? (Select the best answer below.) (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Yes O No Project X $500,000 Project Y $310,000 The internal rate of return (IRR) of project Y is %. (Round to two decimal places.) Initial investment (CF) Is project Y acceptable on the basis of IRR? (Select the best answer below.) Year (t) Cash inflows (CF,) $120,000 $140,000 $105,000 $60,000 1 $100,000 O Yes $160,000 O No $170,000 $190,000 b. Which project is preferred? (Select the best answer below.) $250,000 $30,000 OA. Project X N 34 5arrow_forward

- A financial analyst is evaluating the following projects, which are mutually exclusive, meaning that only one of them can be chosen. Based on financial theory and the NPV criterion, which one of these projects should be chosen over the other three? Time A C D -26,000 -7,200 -14,500 -19,600 8,100 11,900 8,100 2,360 8.600 1,150 10,000 2,120 5,700 800 11,100 11,00O0 4,200 850 1,130 9,800 12,480 9,700 830 11,600 Discount 13.9% 13.9% 13.9% 13.9% Rate O Project A O Project B O Project C O Project D O12 345arrow_forwardYour company is considering two mutually exclusive projects, X and Y, whose costs and cash flows are shown here: \table[[Year,x,Yarrow_forwardNPV and IRR Analysis Cummings Products Company is considering two mutually exclusive investments whose expected net cash flows are as follows: EXPECTED NET CASH FLOWS Year Project A Project B 0 -$290 -$400 1 -387 134 2 -193 134 3 -100 134 4 600 134 5 600 134 6 850 134 7 -180 134 Construct NPV profiles for Projects A and B. Select the correct graph. (see image) 2. What is each project's IRR? Do not round intermediate calculations. Round your answers to two decimal places. Project A % Project B % 3. Calculate the two projects' NPVs, if you were told that each project's cost of capital was 14%. Do not round intermediate calculations. Round your answers to the nearest cent.Project A $ Project B $ Which project, if either, should be selected? Calculate the two projects' NPVs, if the cost of capital was 17%. Do not round intermediate calculations. Round your answers to the nearest cent.Project A $ Project B $ Which project would be the proper…arrow_forward

- Consider two mutually exclusive projects A and B: Cash Flows (dollars) Project Co A -39,500 B -59,500 C₁ 28,600 42,500 C₂ NPV at 11% 28,600 +$ 9,478 42,500 +13,282 a. Calculate IRRS for A and B. Note: Do not round intermediate calculations. Enter your answers as a perc Project A B IRR % % b. Which project does the IRR rule suggest is best? Project A Project B c. Which project is really best? Project A Project B Parrow_forwardQ6-1 The Hetman Group Inc. has identified the following two mutually exclusive projects: The Hetman Group Cash flow L 0 1 2 3 4 Year -10,000 200 500 8,200 4,800 Cash flow S -10,000 5,000 6,000 500 500 A. What is the IRR for each of these projects? If you apply the IRR decision rule, which project should the company accepts? Is this decision necessarily correct? B. If the required return is 9%, what is the NPV for each of these projects? Which project will you choose if you apply the NPV decision rule?arrow_forwardCRAYON corporation has identified the following two mutually exclusive projects: YEAR Cash flow ( A) Cash flow ( B) 0 -$300,000 -$300,000 1 68,950 135,000 2 83,900 105,500 3 93,200 75,000 4 105,600 55,600 5 115,600 45,600 What is the IRR for each of this project (range: 10-16%)? Using the IRR decision rule, which project should the company accept? How do you interpret IRR of a project? If the required return is 15%, what is the NPV of these projects? Which project will the company choose if it applies the NPV decision rule? How do you interpret NPV of a project? Calculate the Payback period and discounted pay back period of these projects! Which project should the company accept? What are the differences of payback period and discounted payback…arrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning