Concept explainers

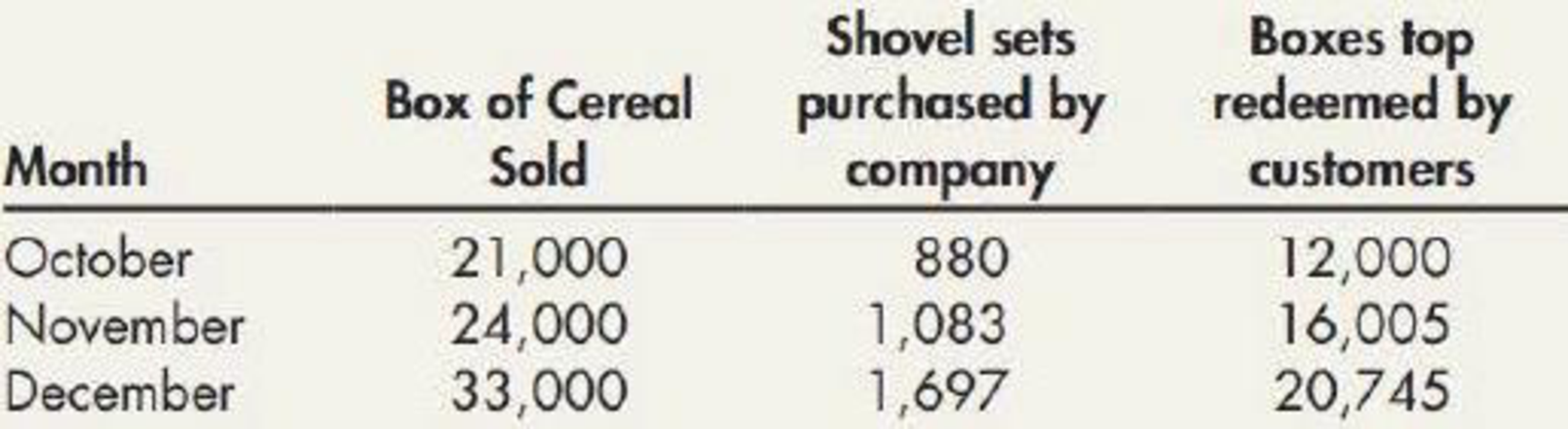

Premium Obligation Yummy Cereal Company is offering one toy shovel set for 15 box tops of its cereal. Year-to-date sales have been off, and it is hoped that this offer will stimulate demand. Each shovel set costs the company $3. The following data are available for the last 3 months of 2019:

It is estimated that only 70% of the box tops will be redeemed. The cereal sells for $2.80 per box.

Required:

- 1. Prepare

journal entries for each month to record sales, shovel set purchases, and redemptions. - 2. Assuming Yummy prepares monthly financial statements, indicate how the inventory of premiums and the estimated liability would be disclosed on Yummy’s ending balance sheets for October, November, and December.

1.

Prepare the journal entry to record the sales, shovel set purchases and redemption for each month in the books of Company YC.

Explanation of Solution

Prepare the journal entry to record the sales made during October:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| October | Cash or Accounts receivable | 58,800 | |

| Sales | 58,800 | ||

| (To record the sale of 21,000 cereal boxes) |

Table (1)

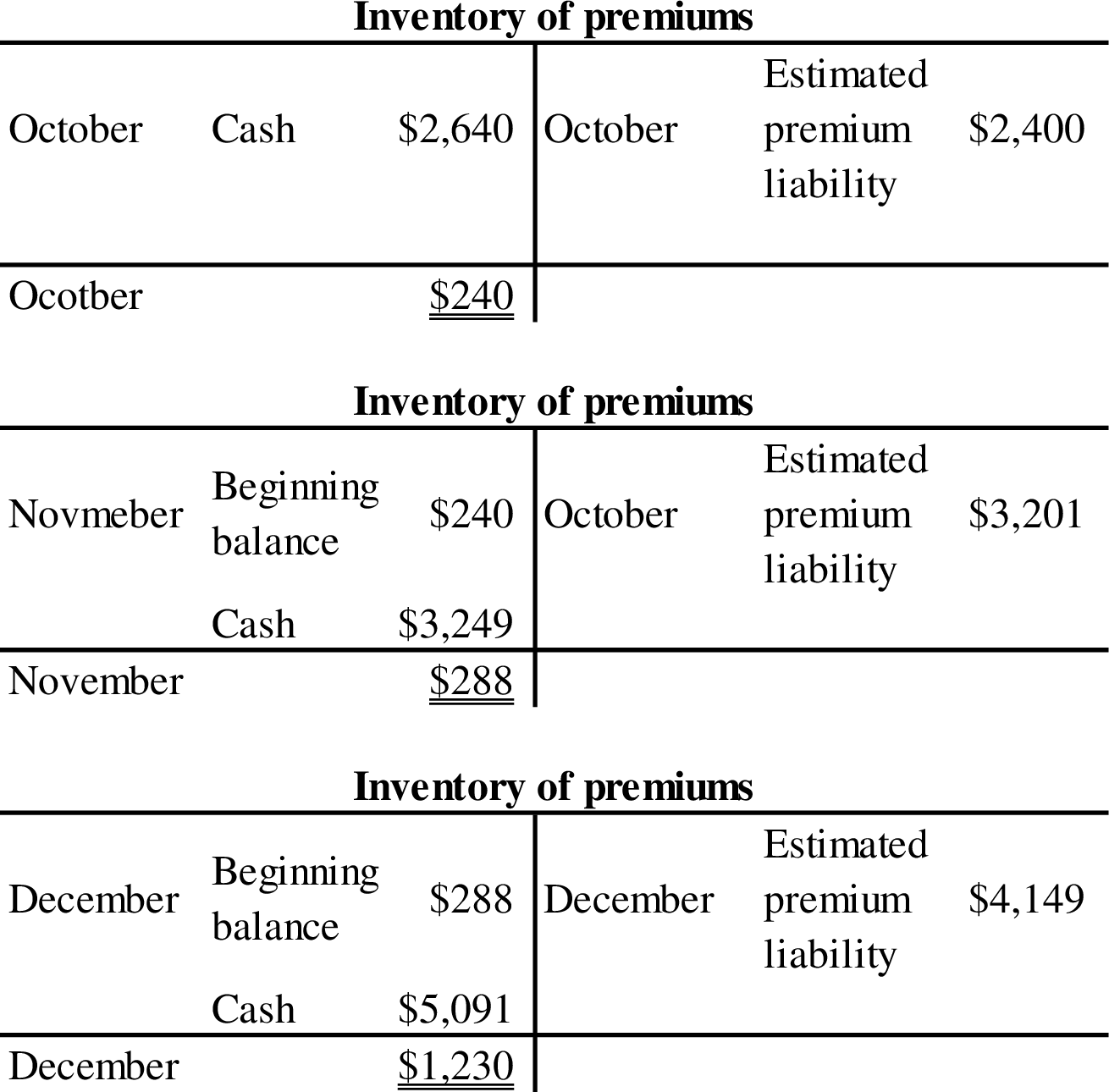

Prepare the journal entry to record the purchase of shovel set:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| October | Inventory of premiums | 2,640 | |

| Cash | 2,640 | ||

| (To record the purchase of toy shovel sets) |

Table (2)

Prepare the journal entry to record the estimated total premium liability:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| October | Premium expenses (2) | 2,940 | |

| Estimated premium liability | 2,940 | ||

| (To record the recognition of estimated premium liability) |

Table (3)

Working note (1):

Calculate the total box tops estimated for redemption:

| Particulars | Amount ($) | Amount ($) |

| Total box tops outstanding in October 2019 (A) | 21,000 | |

| Estimated percent redeemed (B) | 70% | |

| Total box tops estimated for redemption (C) | 14,700 |

Table (4)

Working note (2):

Calculate the amount of premium expenses:

Prepare the journal entry to record the redemption of 12,000 top boxes in October:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| October | Estimated premium liability (3) | 2,400 | |

| Inventory of premiums | 2,400 | ||

| (To record the redemption of 12,000 top boxes of cereals) |

Table (5)

Working note (3):

Calculate the amount of estimated premium liability:

Prepare the journal entry to record the sales made during November:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| November | Cash or Accounts receivable | 67,200 | |

| Sales | 67,200 | ||

| (To record the sale of 24,000 cereal boxes) |

Table (6)

Prepare the journal entry to record the purchase of shovel set:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| November | Inventory of premiums | 3,249 | |

| Cash | 3,249 | ||

| (To record the purchase of toy shovel sets) |

Table (7)

Prepare the journal entry to record the estimated total premium liability:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| November | Premium expenses (4) | 3,360 | |

| Estimated premium liability | 3,360 | ||

| (To record the recognition of estimated premium liability) |

Table (8)

Working note (3):

Calculate the total box tops estimated for redemption:

| Particulars | Amount ($) | Amount ($) |

| Total box tops outstanding in November 2019 (A) | 24,000 | |

| Estimated percent redeemed (B) | 70% | |

| Total box tops estimated for redemption (C) | $16,800 |

Table (9)

Working note (4):

Calculate the amount of premium expenses:

Prepare the journal entry to record the redemption of 16,005 top boxes in October:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| October | Estimated premium liability (5) | 3,201 | |

| Inventory of premiums | 3,201 | ||

| (To record the redemption of 16,005 top boxes of cereals) |

Table (10)

Working note (5):

Calculate the amount of estimated premium liability:

Prepare the journal entry to record the sales made during December:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| December | Cash or Accounts receivable | 92,400 | |

| Sales | 92,400 | ||

| (To record the sale of 33,000 cereal boxes) |

Table (11)

Prepare the journal entry to record the purchase of shovel set:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| December | Inventory of premiums | 5,091 | |

| Cash | 5,091 | ||

| (To record the purchase of toy shovel sets) |

Table (12)

Prepare the journal entry to record the estimated total premium liability:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| November | Premium expenses (7) | 4,620 | |

| Estimated premium liability | 4,620 | ||

| (To record the recognition of estimated premium liability) |

Table (13)

Working note (6):

Calculate the total box tops estimated for redemption:

| Particulars | Amount ($) | Amount ($) |

| Total box tops outstanding in December 2019 (A) | 33,000 | |

| Estimated percent redeemed (B) | 70% | |

| Total box tops estimated for redemption (C) | $23,100 |

Table (14)

Working note (7):

Calculate the amount of premium expenses:

Prepare the journal entry to record the redemption of 20,475top boxes in October:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| October | Estimated premium liability (8) | 4,149 | |

| Inventory of premiums | 4,149 | ||

| (To record the redemption of 20,475 top boxes of cereals) |

Table (15)

Working note (8):

Calculate the amount of estimated premium liability:

2.

Indicate the way in which the inventory of premiums and the estimated liability would be disclosed in the ending balance sheets of Company YC for the months October, November and December.

Explanation of Solution

Balance sheet: Balance Sheet is one of the financial statements that summarize the assets, the liabilities, and the Shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

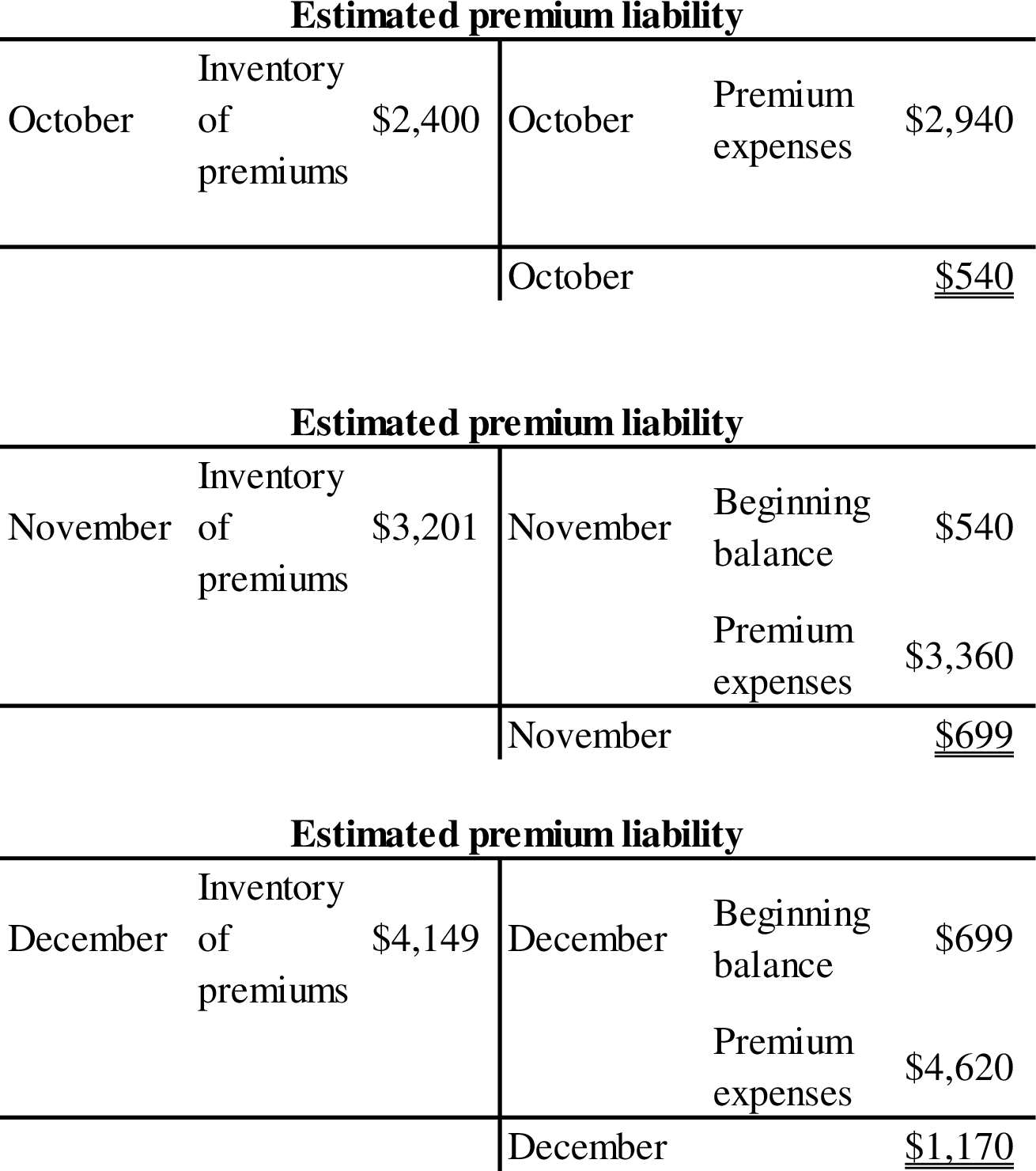

Prepare the partial balance sheet to record the inventory of premiums and the estimated liability:

| Company YC | |||

| Balance Sheet Statement (Partial) | |||

| At The End of | |||

| Assets | October | November | December |

| Current assets: | |||

| Inventory of premiums | $240 | $288 | $1,230 |

| Liabilities | October | November | December |

| Current liabilities: | |||

| Estimated premium liability | $540 | $699 | $1,170 |

Table (16)

Prepare the T-accounts to determine the estimated premium liability and inventory of premiums:

Want to see more full solutions like this?

Chapter 9 Solutions

Intermediate Accounting: Reporting And Analysis

- Carla Vista Choice sells natural supplements to customers with an unconditional sales return if they are not satisfied. The sales returns extends 60 days. On February 10, 2021, a customer purchases on account $3500 of products (cost $1750). Assuming that based on prior experience, estimated returns are 20%. The journal entry to record the expected sales return includes a debit to Cash and a credit to Sales Revenue of $3500. debit to Sales Returns and Allowance of $700 and a credit to Allowance for Sales Returns and Allowances of $700. credit to Estimated Inventory Returns of $350. debit to Cost of Goods Sold and credit to Inventory for $1750.arrow_forward- please answer in excel and show work please The manager of Steve's Audio has approved Daisy's application for 24 months of credit with maximum monthly payments of $65. If the annual percentage rate (APR) is 15.8 percent, what is the maximum initial purchase that Daisy can buy on credit? Multiple Choice $1538.25 $1,330.12 $ 890.99 $980.99 $1, 434.67arrow_forwardSunland Candy Company offers a coffee mug as a premium for every ten $1 candy bar wrappers presented by customers together with $2. The purchase price of each mug to the company is $2.40; in addition it costs $1.60 to mail each mug. The results of the premium plan for the years 2020 and 2021 are as follows (assume all purchases and sales are for cash): 2020 2021 Coffee mugs purchased 750,000 820,000 Candy bars sold 5,600,000 6,760,000 Wrappers redeemed 2,700,000 4,250,000 2020 wrappers expected to be redeemed in 2021 1,900,000 2021 wrappers expected to be redeemed in 2022 2,680,000 Part 1 Partially correct answer icon Your answer is partially correct. Prepare the general journal entries that should be made in 2020 and 2021 related to the above plan by Sunland Candy. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit…arrow_forward

- Sunland Candy Company offers a coffee mug as a premium for every ten $1 candy bar wrappers presented by customers together with $2. The purchase price of each mug to the company is $2.40; in addition it costs $1.60 to mail each mug. The results of the premium plan for the years 2020 and 2021 are as follows (assume all purchases and sales are for cash): 2020 2021 Coffee mugs purchased 750,000 820,000 Candy bars sold 5,600,000 6,760,000 Wrappers redeemed 2,700,000 4,250,000 2020 wrappers expected to be redeemed in 2021 1,900,000 2021 wrappers expected to be redeemed in 2022 2,680,000 Part 1 Prepare the general journal entries that should be made in 2020 and 2021 related to the above plan by Sunland Candy. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit 2020 (To record…arrow_forwardFlint Taco Palace sells 280 gift cards at $50 per gift card and 140 of the gift cards are redeemed by year-end. Flint estimates that it wi have 10% breakage on its gift cards. Prepare the entry for the gift card redemption and the expected breakage for the gift cards in the current year. (Ignore Cost of Goods Sold.) (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. List all debit entries before credit entries. Round intermediate calculations to 4 decimal places, eg. 0.2456 and final answers to 0 decimal places, e.g. 5,125.) Account Titles and Explanation Cash Unearned Gift Card Revenue Subscriptions Revenue. Debit 14000 Credit 7000 7000arrow_forwardCrane Frosted Flakes Company offers its customers a pottery cereal bowl if they send in 3 proof of purchase seals from Crane Frosted Flakes boxes and $1. The company estimates that 60% of the proof of purchase seals will be redeemed. In 2026, the company sold 1404000 boxes of Frosted Flakes, and customers redeemed 686400 proof of purchase seals receiving 228800 bowls. If the bowls cost Crane Company $3 each, how much liability for outstanding premiums should be recorded at the end of 2026? $104000 O $156000 $287040 O $561600arrow_forward

- Palmer Frosted Flakes Company offers its customers a pottery cereal bowl if they send in 3 boxtops from Palmer Frosted Flakesboxes and P2. The company estimates that 60% of the boxtops will be redeemed. In 2020, the company sold 675,000 boxesof Frosted Flakes and customers redeemed 330,000 boxtops receiving 110,000 bowls. If the bowls cost Palmer Company P6each, how much liability for outstanding premiums should be recorded at the end of 2020?a. P540,000 c. P150,000b. P100,000 d. P276,000arrow_forwardProblem 2: JIN Corporation started a promotional program. A towel is offered as a premium to customers who send in 10 box tops of facial soap returned and a remittance of P25. Distribution cost is P10 per towel. The entity estimated that only 60% of the box tops reaching the market will be redeemed. The entity provided the following information: 2020 2021 Facial soap sales, P50 per unit Towel purchases, P90 per unit Number of box tops returned 2,500,000 2,875,000 337,500 360,000 22,500 38,550 Requirements: How much net cash did the entity receive (give) with regards to the premium transactions for the year given below? (if net cash outflow, put a negative (-) sign before the numerical figure. A. December 31, 2020 B. December 31, 2021 7.arrow_forwardDetermining Transaction Price and Refund Liability In January 2020, a retailer sells 200 paper shredders to customers for $100 each. The terms of the sales include a right for the customer to return a shredder within 180 days of the sale date. Based on historical trends, the retailer uses the expected value method and estimates a 40% probability that 16 paper shredders will be returned, a 45% probability that 18 paper shredders will be returned, and a 15% probability that 24 paper shredders will be returned. The retailer also concludes it is highly probable that there will not be a significant reversal of revenue recognized based on this return estimate. Thus, the agreement is a valid contract. Assume no actual returns in January 2020. Determine (1) the transaction price for the sale of shredders for January 2020, and (2) the refund liability balance on January 31, 2020. Round expected returns to the nearest whole unit in your calculations. 1. Transaction price $Answer 2. Refund…arrow_forward

- Problem 2: JIN Corporation started a promotional program. A towel is offered as a premium to customers who send in 10 box tops of facial soap returned and a remittance of P25. Distribution cost is P10 per towel. The entity estimated that only 60% of the box tops reaching the market will be redeemed. The entity provided the following information: 2020 2021 Facial soap sales, P50 per unit Towel purchases, P90 per unit Number of box tops returned 2,500,000 2,875,000 337,500 360,000 38,550 22,500 Requirements: 4. Compute for the premiums (as an asset) amount for the year ended: A. December 31, 2020 B. December 31, 2021 2 AE211: Intermediate Acctg. 2 Prepared by: Bernadette Adelaida M. Cope 5. Compute for the premiums expense for the year ended: A. December 31, 2020 B. December 31, 2021 6. Compute for the premium liability for the year ended: A. December 31, 2020 B. December 31, 2021 7. How much net cash did the entity receive (give) with regards to the premium transactions for the year…arrow_forwardProblem 2: JIN Corporation started a promotional program. A towel is offered as a premium to customers who send in 10 box tops of facial soap returned and a remittance of P25. Distribution cost is P10 per towel. The entity estimated that only 60% of the box tops reaching the market will be redeemed. The entity provided the following information: 2020 2021 Facial soap sales, P50 per unit Towel purchases, P90 per unit Number of box tops returned 2,500,000 2,875,000 337,500 360,000 22,500 38,550 Requirements: 5. Compute for the premiums expense for the year ended: A. December 31, 2020 B. December 31, 2021arrow_forwardKane Candy Company sells candy bars for $1 each. In addition, Kane offers its customers a coffee mug in exchange for $2 and 10 candy wrappers. A coffee mug costs Kane $2.40, and the company estimates that customers will redeem 60 percent of the candy wrappers. During 2020, Kane purchased 720,000 mugs, sold 5,600,000 candy bars, and redeemed 2,800,000 candy wrappers. Instructions: 1. Prepare the journal entry to record the purchase of the coffee mugs. 2. Prepare the entry to record the sale of the candy bars. 3. Prepare the entry to record the redemption of candy wrappers, the receipt of $2 per 10 wrappers, and the delivery of the coffee mugs. 4. Prepare the adjusting entry to record additional premium expense and the estimated premium liability at Dec. 31, 2020. Larrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning