a)

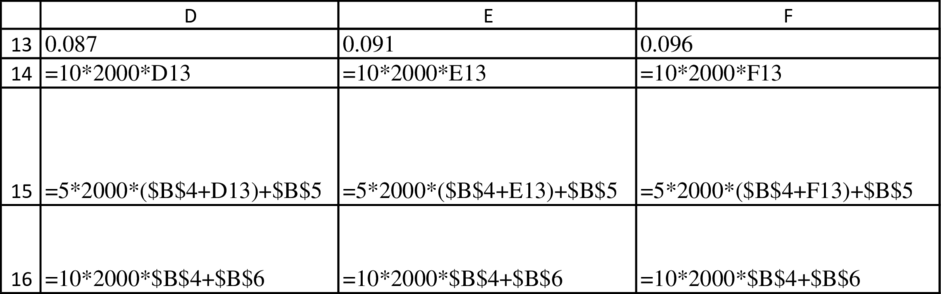

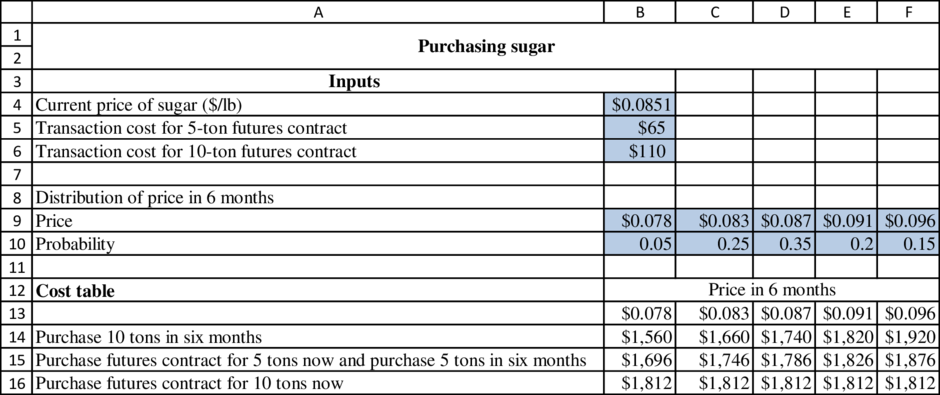

To identify: The decision that would minimize the expected cost using precision tree.

Introduction: Simulation model is the digital prototype of the physical model that helps to

a)

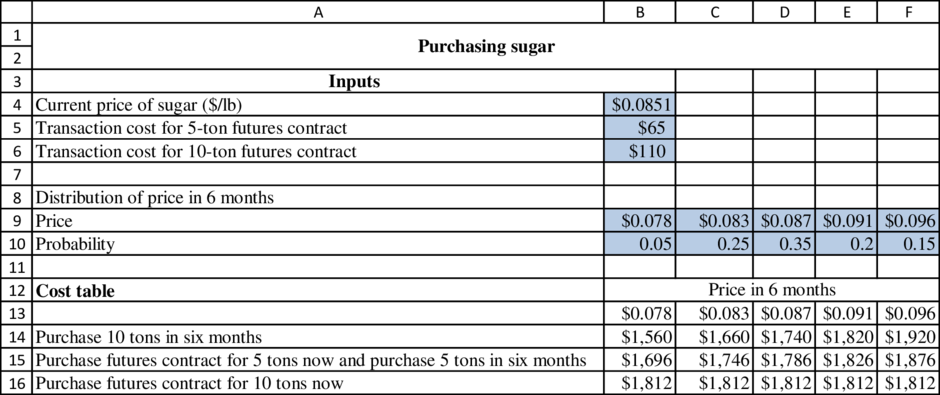

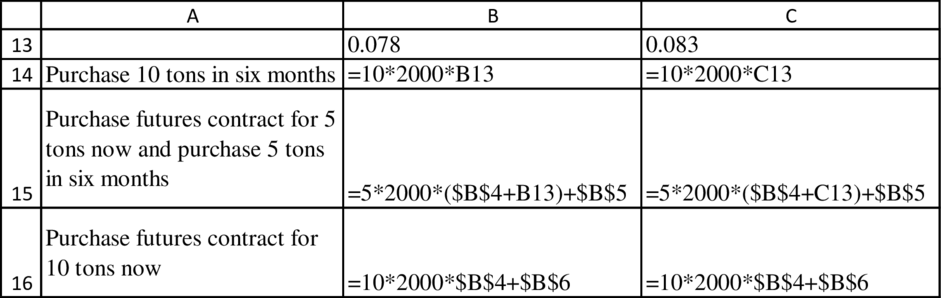

Explanation of Solution

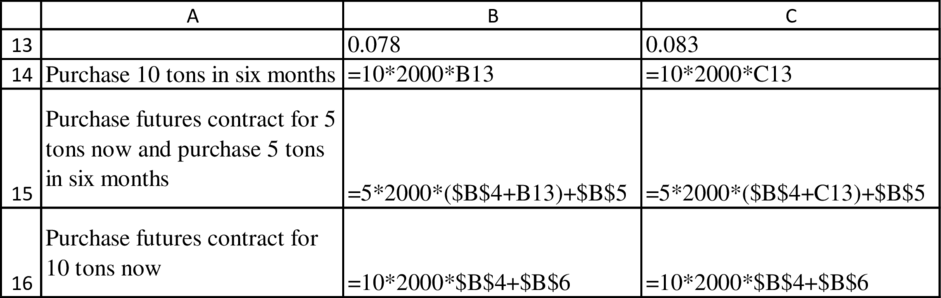

Formulae to determine the above table:

b)

To determine: The input that have the largest effect on the best.

Introduction: Simulation model is the digital prototype of the physical model that helps to forecast the performance of the system or model in the real world.

b)

Explanation of Solution

Formulae to determine the above table:

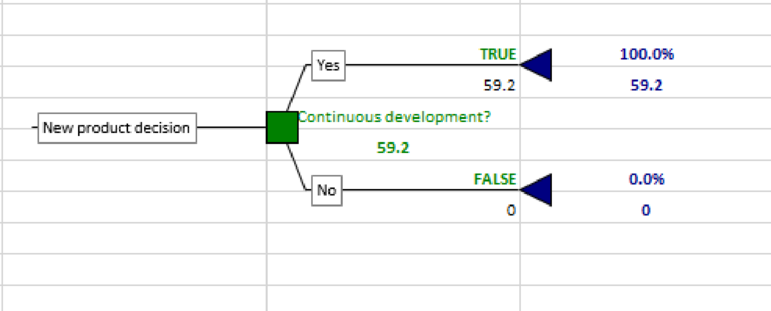

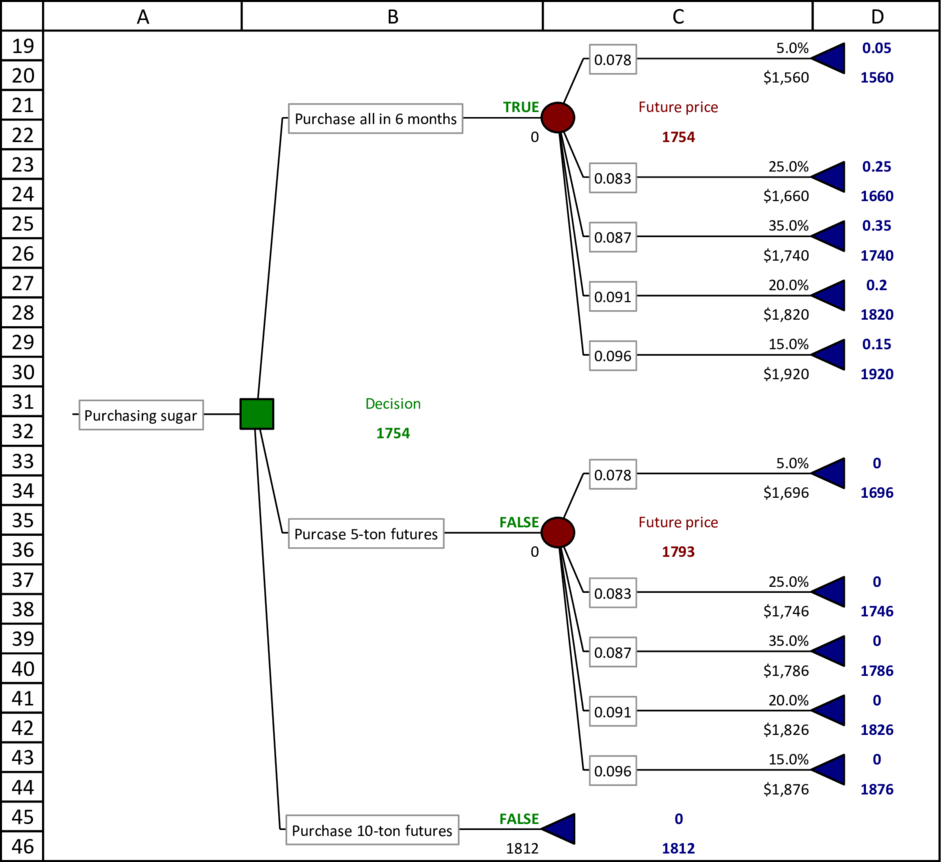

Decision tree developed by precision tree software:

Decision tree should be developed using precision tree software.

Place the cursor at any blank cell and click decision tree under precision tree icon. The following window will appear:

Press ok and the below image (Model image) will appear:

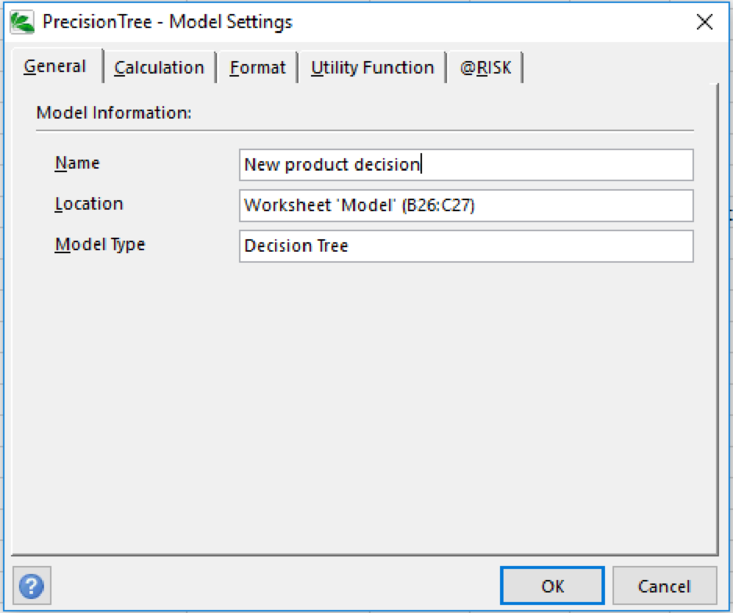

Click in the triangle:

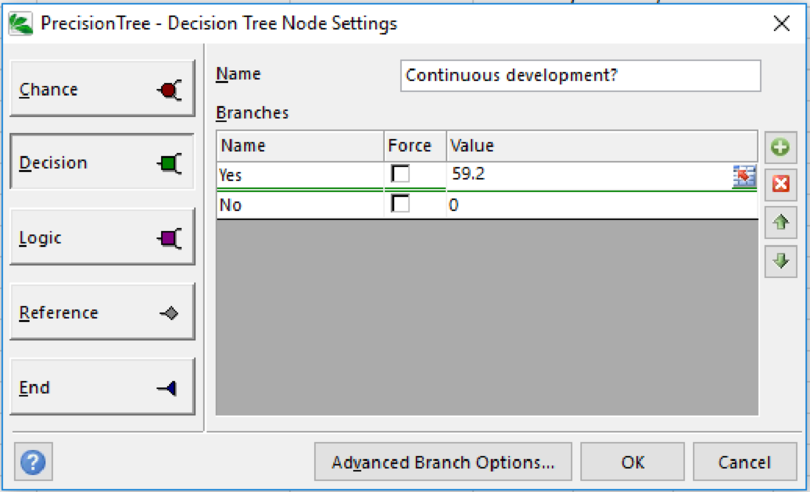

Select decision (The below image is model):

Click ok and the below image (Model image) will appear:

Click in the triangle:

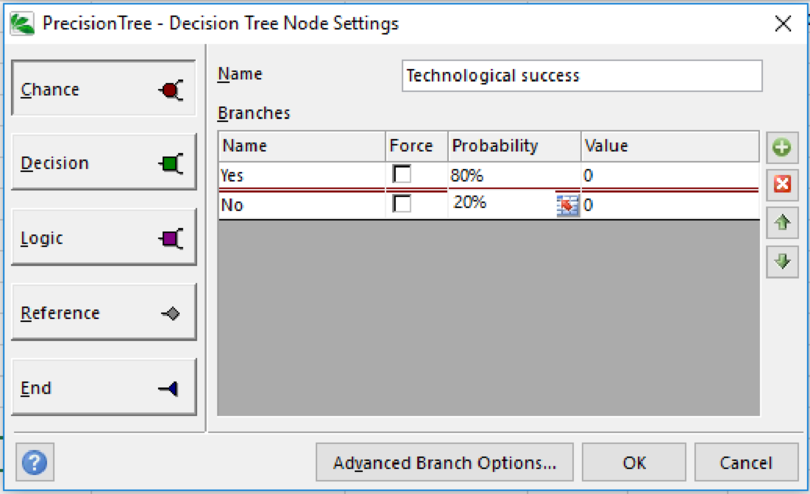

Select chance (The below image is model):

The process should be continued till end.

The following image shows the complete decision tree:

According to decision tree, it is better to wait and purchase the sugar in six months.

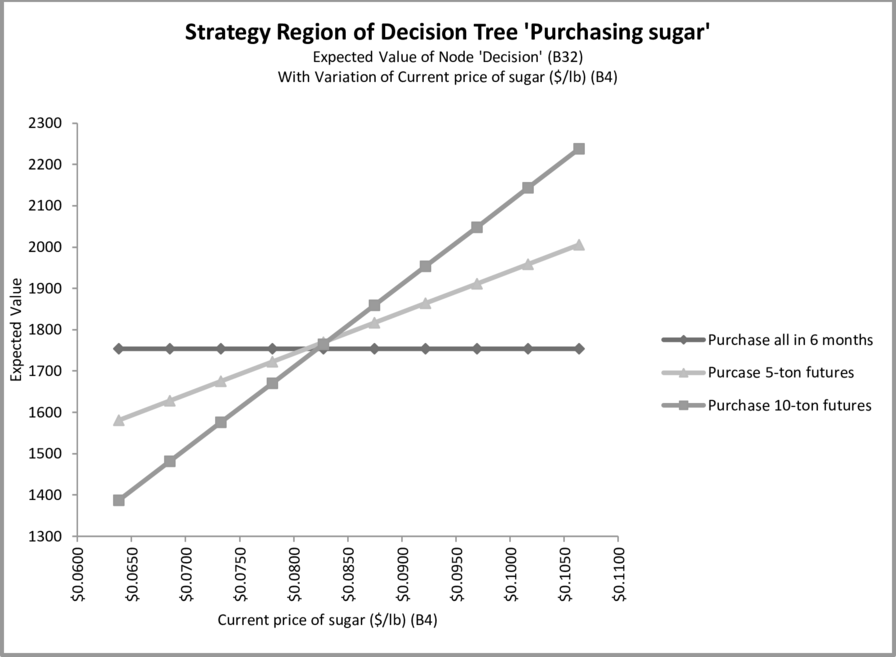

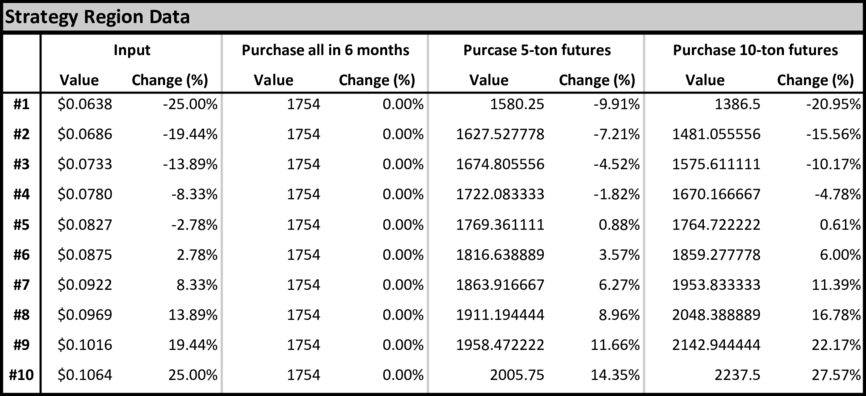

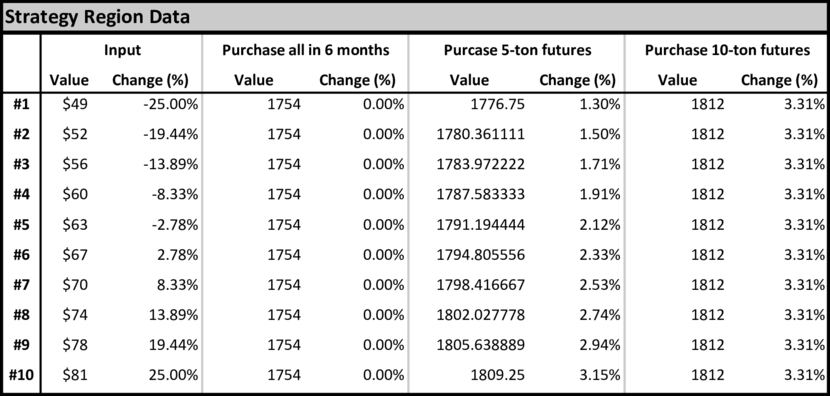

Strategy B4:

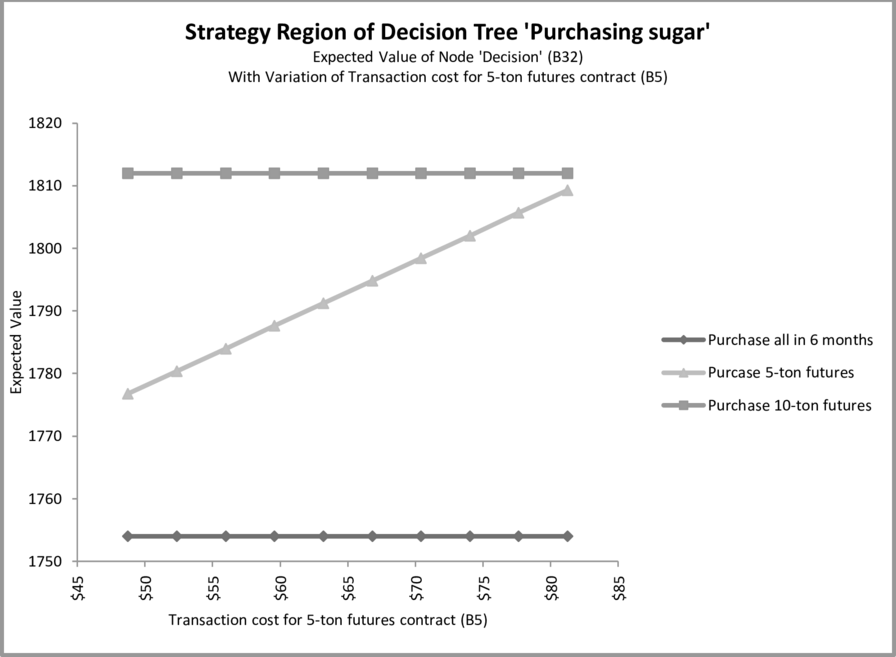

Strategy B5:

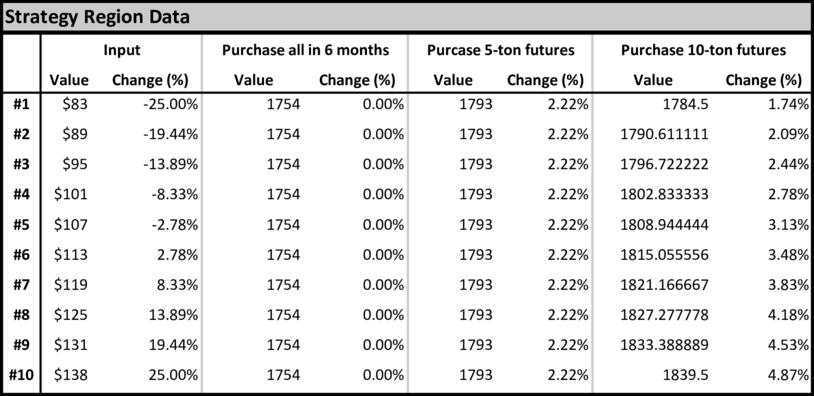

Strategy B6:

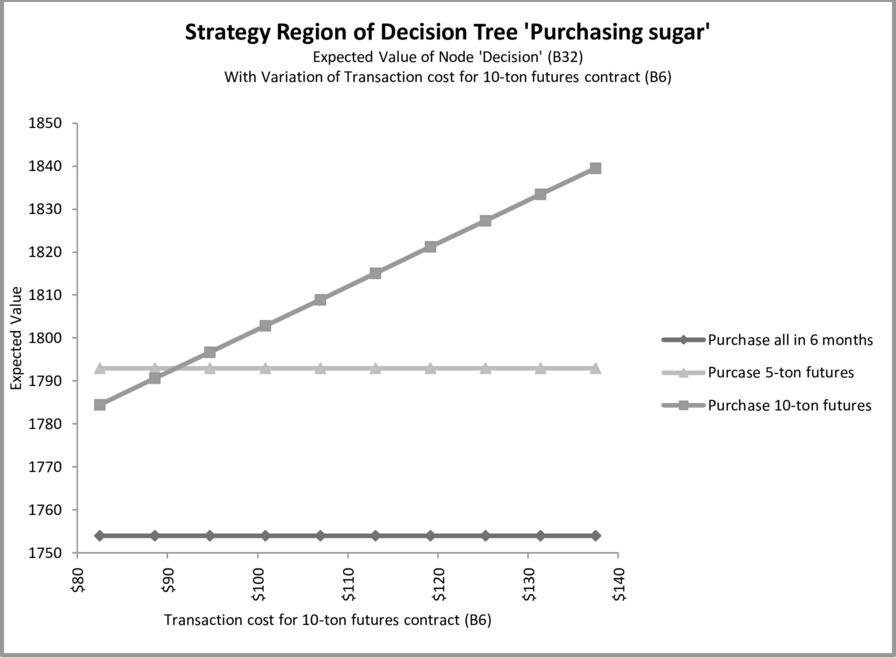

The sensitivity analysis was done for the cells B4, B5, and B6. It is optimal to purchase a 10-ton futures contract.

Want to see more full solutions like this?

Chapter 9 Solutions

Practical Management Science

- The Tinkan Company produces one-pound cans for the Canadian salmon industry. Each year the salmon spawn during a 24-hour period and must be canned immediately. Tinkan has the following agreement with the salmon industry. The company can deliver as many cans as it chooses. Then the salmon are caught. For each can by which Tinkan falls short of the salmon industrys needs, the company pays the industry a 2 penalty. Cans cost Tinkan 1 to produce and are sold by Tinkan for 2 per can. If any cans are left over, they are returned to Tinkan and the company reimburses the industry 2 for each extra can. These extra cans are put in storage for next year. Each year a can is held in storage, a carrying cost equal to 20% of the cans production cost is incurred. It is well known that the number of salmon harvested during a year is strongly related to the number of salmon harvested the previous year. In fact, using past data, Tinkan estimates that the harvest size in year t, Ht (measured in the number of cans required), is related to the harvest size in the previous year, Ht1, by the equation Ht = Ht1et where et is normally distributed with mean 1.02 and standard deviation 0.10. Tinkan plans to use the following production strategy. For some value of x, it produces enough cans at the beginning of year t to bring its inventory up to x+Ht, where Ht is the predicted harvest size in year t. Then it delivers these cans to the salmon industry. For example, if it uses x = 100,000, the predicted harvest size is 500,000 cans, and 80,000 cans are already in inventory, then Tinkan produces and delivers 520,000 cans. Given that the harvest size for the previous year was 550,000 cans, use simulation to help Tinkan develop a production strategy that maximizes its expected profit over the next 20 years. Assume that the company begins year 1 with an initial inventory of 300,000 cans.arrow_forwardAssume the demand for a companys drug Wozac during the current year is 50,000, and assume demand will grow at 5% a year. If the company builds a plant that can produce x units of Wozac per year, it will cost 16x. Each unit of Wozac is sold for 3. Each unit of Wozac produced incurs a variable production cost of 0.20. It costs 0.40 per year to operate a unit of capacity. Determine how large a Wozac plant the company should build to maximize its expected profit over the next 10 years.arrow_forwardScenario 3 Ben Gibson, the purchasing manager at Coastal Products, was reviewing purchasing expenditures for packaging materials with Jeff Joyner. Ben was particularly disturbed about the amount spent on corrugated boxes purchased from Southeastern Corrugated. Ben said, I dont like the salesman from that company. He comes around here acting like he owns the place. He loves to tell us about his fancy car, house, and vacations. It seems to me he must be making too much money off of us! Jeff responded that he heard Southeastern Corrugated was going to ask for a price increase to cover the rising costs of raw material paper stock. Jeff further stated that Southeastern would probably ask for more than what was justified simply from rising paper stock costs. After the meeting, Ben decided he had heard enough. After all, he prided himself on being a results-oriented manager. There was no way he was going to allow that salesman to keep taking advantage of Coastal Products. Ben called Jeff and told him it was time to rebid the corrugated contract before Southeastern came in with a price increase request. Who did Jeff know that might be interested in the business? Jeff replied he had several companies in mind to include in the bidding process. These companies would surely come in at a lower price, partly because they used lower-grade boxes that would probably work well enough in Coastal Products process. Jeff also explained that these suppliers were not serious contenders for the business. Their purpose was to create competition with the bids. Ben told Jeff to make sure that Southeastern was well aware that these new suppliers were bidding on the contract. He also said to make sure the suppliers knew that price was going to be the determining factor in this quote, because he considered corrugated boxes to be a standard industry item. Is Ben Gibson acting legally? Is he acting ethically? Why or why not?arrow_forward

- Scenario 3 Ben Gibson, the purchasing manager at Coastal Products, was reviewing purchasing expenditures for packaging materials with Jeff Joyner. Ben was particularly disturbed about the amount spent on corrugated boxes purchased from Southeastern Corrugated. Ben said, I dont like the salesman from that company. He comes around here acting like he owns the place. He loves to tell us about his fancy car, house, and vacations. It seems to me he must be making too much money off of us! Jeff responded that he heard Southeastern Corrugated was going to ask for a price increase to cover the rising costs of raw material paper stock. Jeff further stated that Southeastern would probably ask for more than what was justified simply from rising paper stock costs. After the meeting, Ben decided he had heard enough. After all, he prided himself on being a results-oriented manager. There was no way he was going to allow that salesman to keep taking advantage of Coastal Products. Ben called Jeff and told him it was time to rebid the corrugated contract before Southeastern came in with a price increase request. Who did Jeff know that might be interested in the business? Jeff replied he had several companies in mind to include in the bidding process. These companies would surely come in at a lower price, partly because they used lower-grade boxes that would probably work well enough in Coastal Products process. Jeff also explained that these suppliers were not serious contenders for the business. Their purpose was to create competition with the bids. Ben told Jeff to make sure that Southeastern was well aware that these new suppliers were bidding on the contract. He also said to make sure the suppliers knew that price was going to be the determining factor in this quote, because he considered corrugated boxes to be a standard industry item. As the Marketing Manager for Southeastern Corrugated, what would you do upon receiving the request for quotation from Coastal Products?arrow_forwardcompany wants to issue a 15-year Bond with $1,000 face value and an 8% Annual coupon. the bond can be sold to investors for $1,010 per Bond but will incur transaction cost of $15 per Bond if the company tax rate is 21%. what is the after-tax cost of debt financing to the firm?arrow_forwardCompany XYZ, Inc. purchases widgets from a supplier at a cost of $20 per unit and sells the widgets for $30 per unit. By the end of Spring, demand for these widgets subsided considerably and all widgets that weren't sold during the Spring can be sold at a discounted price of $18 per unit. The company estimates demand during quarter two (Q2) to be normally distributed with mu = ? = 10,000 and sigma = ? =1525 boxes What is the optimal stockout probability for company XYZ, Inc.?arrow_forward

- Global Logistics needs to rent space for storing product for the next three years. The following information regarding the demand and spot price is available. Current demand for the product is 150,000. Historically, Global Logistics has required 1500 square feet to store 1500 units of the product. Demand for the product can go up by 20% with a probability of 0.7 or down by 20% with a probability of 0.3. Global Logistics can sign a three-year fixed lease to rent 150,000 square feet of space at $1.00 per square foot per year. The firm may also choose to obtain warehousing space on the spot market. The current spot market price is $1.20 per square foot per year. The spot price can go up by 10% with a probability of 0.8 and can decrease by 10% with a probability of 0.2. The firm receives a revenue of $1.22 for each unit of demand. a) Create a decision tree showing period 0, 1 and 2 for the scenario described above. b) Calculate the NPV for the option when the firm decides to sign a…arrow_forwardRefer to the slides on buy-back contracts to answer this question. A publisher sells books to Borders at $12 each. The marginal production cost for the publisher is $1 per book. Borders prices the book to its customers at $24 and expects demand over the next two months to be normally distributed, with a mean of $20,000 and a standard deviation of $5000. Borders places a single order with the publisher for delivery at the beginning of the two-month period. Currently, Borders discounts any unsold books at the end of the two months down to $3, and any books that did not sell at full price sell at this price. How many books should Borders order? What is the expected profit? How many books does it expect to sell at a discount? What is the profit that the publisher makes given Borders’ actions? A plan under discussion is for the publisher to refund Borders $5 per book that does not sell during the two-month period. As before, Borders will discount them to $3 and sell any that remain.…arrow_forwardSaving Plan Options An insurance company offers a saving plan that has two options for the insured to withdraw money after maturity. Option A consists of a guaranteed payment of £1500 at the end of each month for 15 years. Alternatively, under option B, the insured receives a lump-sum payment equal to the present value of the payments described under option A. (a) Find the sum of the payments under option A. (b) Find the lump-sum payment under option B if it is determined by using an interest rate of 2.25% compounded monthly. Round the answer to the nearest pound. C. Which option is better? Why?arrow_forward

- An industrial property’s first year annual NOI is projected to be $777,000, the property’s acquisition cap rate is 7.0%, and the lender’s maximum LTV is 70% of the purchase price. What is the maximum loan amount that can be borrowed against the property? Group of answer choices $11,100,000 $7,770,000 $3,330,000 $15,857,143arrow_forwardAdriana Alvarado has decided to purchase a personal computer. She has narrowed the choices to two: Drantex and Confiar. Both brands have the same processing speed, 6.4 gigabytes of hard-disk capacity, two USB ports, and a DVDRW drive, and each comes with the same basic software support package. Both come from mail-order companies with good reputations. The selling price for each is identical. After some review, Adriana discovers that the cost of operating and maintaining Drantex over a 3-year period is estimated to be $300. For Confiar, the operating and maintenance cost is $600. The sales agent for Drantex emphasized the lower operating and maintenance costs. The agent for Confiar, however, emphasized the service reputation of the product and the faster delivery time (Confiar can be purchased and delivered 1 week sooner than Drantex). Based on all the information, Adriana has decided to buy Confiar. What is the total product purchased by Adriana?arrow_forwardConsider a two-tier supply chain with one manufacturer and one retailer whointeract in a single selling season. The manufacturer sells a product to the retailer, who in turn sells in the market. Demand E is uncertain with cumulative distribution function F (·)and probability density function f (·). Since the production lead time is much longer thanthe selling season, the retailer must place a single order before demand is realized and cannotreplenish her inventory during the season. The retailer sells the product at an exogenousand fixed retail price r. The manufacturer produces the product at a unit cost of c. Themanufacturer uses a linear sales rebate contract and determines the following contract terms:For each unit ordered, he charges the retailer a wholesale price w, and for each unit sold, hepays the retailer a rebate s. Assume that the product has zero salvage value at the end ofthe season, and the inventory holding cost during the season is…arrow_forward

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage, Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning