College Accounting (Book Only): A Career Approach

13th Edition

ISBN: 9781337280570

Author: Scott, Cathy J.

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter C, Problem 2P

Use the information presented in Problem C-1 to solve this problem.

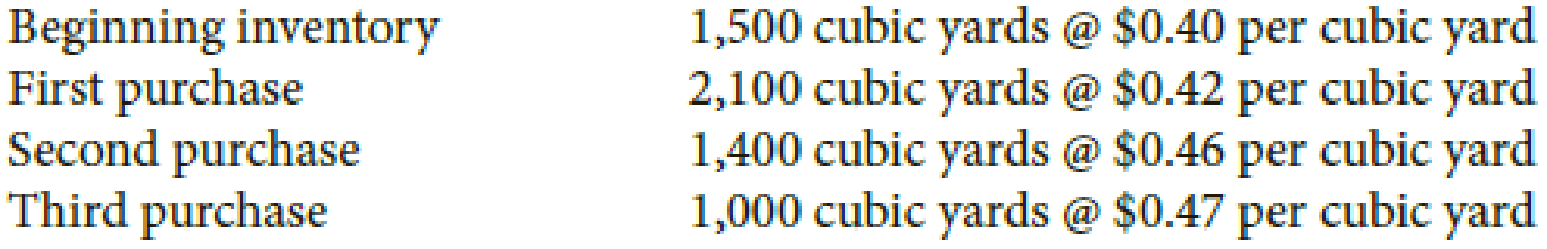

Bean Nursery sells bark to its customers at retail. Bean buys bark from a plywood mill in bulk and transports the bark in its own trucks. Information relating to the beginning inventory and purchases of bark is as follows:

Required

Find the cost of the ending inventory by the first-in, first-out method.

Check Figure

Cost of ending inventory, $562

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Assume that Whitewall Tire Store completed the following perpetual inventory transactions for a line of tires:

i (Click the icon to view the transactions.)

Read the requirements.

Requirement 1. Compute cost of goods sold and gross profit using the FIFO inventory costing method.

Begin by computing the cost of goods sold and cost of ending merchandise inventory using the FIFO inventory costing method. Enter the transactions in chronological order, calculating new inventory on hand balances after each transaction. Once all of the transactions have

been entered into the perpetual record, calculate the quantity and total cost of merchandise inventory purchased, sold, and on hand at the end of the period. (Enter the oldest inventory layers first.)

Date Quantity

Dec. 1

11

23

261

29

Totals

Purchases

Unit

Cost

Cost of Goods Sold

Total

Unit

Cost Quantity Cost

Total

Cost

Inventory on Hand

Unit

Quantity Cost

C

Total

Cost

More info

Dec. 1 Beginning merchandise inventory

Dec. 11 Purchase

Dec. 23…

Assume that Whitewall Tire Store completed the following perpetual inventory transactions for a line of tires:

(Click the icon to view the transactions.)

Requirement 1. Compute cost of goods sold and gross profit using the FIFO inventory costing method.

Begin by computing the cost of goods sold and cost of ending merchandise inventory using the FIFO inventory costing method. Enter the transactions in chronological order, calculating new inventory on hand balances after each transaction. Once all of the transactions have

been entered into the perpetual record, calculate the quantity and total cost of merchandise inventory purchased, sold, and on hand at the end of the period. (Enter the oldest inventory layers first.)

Cost of Goods Sold

Date Quantity

Dec. 1

11

23

26

29

Totals

Purchases

Unit

Cost

Total

Unit

Cost Quantity Cost

Total

Cost

Inventory on Hand

Unit

Cost

Quantity

C

Total

Cost

1.

Requirements

More info

Dec. 1

Beginning merchandise inventory

Dec. 11 Purchase

Dec. 23 Sale

Dec. 26…

Interior Wholesale uses a perpetual inventory system. Journalize the following

sales transactions for Interior Wholesale. Explanations are not required.

Jan. 4: Sold $12,000 of furniture on account, credit terms are 1/15, n/30, to

Amesbury Furniture Store. Cost of goods is $6,000. Begin by preparing the

entry to journalize the sale portion of the transaction. Do not record the

expense related to the sale. We will do that in the following step.

Date

Jan. 4

Transactions

Jan. 4

Jan. 8

Jan. 13

Jan. 20

Accounts

Debit

Sold $12,000 of furniture on account, credit terms are 1/15, n/30, to

Amesbury Furniture Store. Cost of goods is $6,000.

Received a $300 sales return on damaged goods from

Amesbury Furniture Store. Cost of goods damaged is $150.

Interior Wholesale received payment from Amesbury Furniture Store on

the amount due from Jan. 4, less the return and discount.

Sold $4,400 of furniture on account, credit terms are 1/10, n/45,

FOB destination, to Springfield Furniture. Cost of goods is…

Chapter C Solutions

College Accounting (Book Only): A Career Approach

Additional Business Textbook Solutions

Find more solutions based on key concepts

List five asset accounts, three liability accounts, and five expense accounts included in the acquisition and p...

Auditing And Assurance Services

Based on your answers to the above questions, should Lockwood invest in the machinery?

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

Bank loan; accrued interest LO132 On October 1, Eder Fabrication borrowed 60 million and issued a nine-month, ...

Intermediate Accounting

How would the decision to dispose of a segment of operations using a split-off rather than a spin-off impact th...

Advanced Financial Accounting

Disposal of assets. Answer the following questions. 1. A company has an inventory of 1,300 assorted parts for a...

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Place the letter of the appropriate accounting cost in Column 2 in the blank next to each decision category in ...

Fundamentals Of Cost Accounting (6th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Bean Nursery sells bark to its customers at retail. Bean buys bark from a plywood mill in bulk and transports the bark in its own trucks. Information relating to the beginning inventory and purchases of bark is as follows: Required Find the cost of 1,200 cubic yards in the ending inventory by the weighted-average-cost method. Carry average cost per cubic yard to four decimals. Check Figure Cost of ending inventory, 519.24arrow_forwardAssume that AB Tire Store completed the following perpetual inventory transactions for a line of tires: (Click the icon to view the transactions.) Requirements 1. 2. 3. 4. Compute cost of goods sold and gross profit using the FIFO inventory costing method. Compute cost of goods sold and gross profit using the LIFO inventory costing method. Compute cost of goods sold and gross profit using the weighted-average inventory costing method. (Round weighted-average cost per unit to the nearest cent and all other amounts to the nearest dollar.) Which method results in the largest gross profit, and why? X More info 4 Dec. 1 Beginning merchandise inventory Dec. 11 Purchase Dec. 23 Sale Dec. 26 Purchase Dec. 29 Sale 24 tires @ $61 each 6 tires @ $76 each 16 tires @ $83 each 14 tires @ $86 each 17 tires @ $83 eacharrow_forwardMusicMagic specializes in sound equipment. Company records indicate the following data for a line of speakers: (Click the icon to view the data.) Read the requirements. Co Requirement 1. Determine the amounts that MusicMagic should report for cost of goods sold and ending inventory two ways: a. FIFO and b. LIFO. (MusicMagic uses a perpetual inventory system.) Start by determining the amounts that MusicMagic should report for cost of goods sold and ending inventory under a. FIFO. FIFO method cost of goods sold = FIFO method ending inventory = Data table Date Mar 1 Mar 2 Mar 7 Mar 13 Item Balance Purchase Sale Sale Print Quantity 14 5 7 6 Unit Cost $ Done 41 48 Sale Price $ 109 102 Xarrow_forward

- MusicPlace specializes in sound equipment. Company records indicate the following data for a line of speakers (Click the icon to view the data) Read the requirements Requirement 1. Determine the amounts that MusicPlace should report for cost of goods sold and ending inventory two ways: a. FIFO and b. LIFO (MusicPlace uses a perpetual inventory system.) Start by determining the amounts that MusicPlace should report for cost of goods sold and ending inventory under a FIFO FIFO method cost of goods sold FIFO method ending inventory Determinie the amounts that MusicPlace should report for cost of goods sold and ending inventory under b. LIFO. LIFO method cost of goods sold LIFO method ending inventory Requirement 2. MusicPlace uses the FIFO method. Prepare the company's income statement for the month ended March 31, 2021, reporting gross profit. Operating expenses totaled $280, and the income tax rate was 40%. (Round answers to the nearest dollar) MusicPlace Income Statement Month Ended…arrow_forwardCem's Company sells custom-order paintings made with watercolor pastels and recycled canvases. Cem's company is located in Nashville, TN. Following is partial information for the income statement of Cem's Company under three different inventory costing methods, assuming the use of a periodic inventory system Required: 1. Compute cost of goods sold under the FIFO, LIFO, and average cost inventory costing methods. 2. Prepare an income statement through pretax income for each method. Sales, 150 units; unit sales price, $50, Expenses, $1,500 3. Rank the three methods in order of preference based on income taxes paid (favorable cash flow) Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute cost of goods sold under the FIFO, LIFO, and average cost inventory costing methods. Average Cost Cost of goods sald Beginning inventory O50 units @530) Purchases (150 units @129) Goods available for sale Ending inventory (560 units) Cost of goods…arrow_forwardhelp me The following information is taken from the records of Wildlife Florist. The company usesthe perpetual inventory system.Date Description Units Unit Cost (RM)Dec1 Opening inventory 200 20Dec 5 Sale 108Dec 6 Purchase 200 18Dec 12 Purchase 125 17Dec 13 Sale 300Dec 19 Purchase 350 21Dec 29 Purchase 150 18Dec 30 Sale 4005Required:-a. Calculate cost of goods sold and the cost of ending inventory under each of thefollowing inventory cost flow assumptions:i. FIFO.ii. Weighted average.arrow_forward

- The following information is taken from the records of Wildlife Florist. The company uses the perpetual inventory system. Date Description Units Unit Cost(RM) Dec 1 Opening inventory 200 20 Dec 5 Sale 108 Dec 6 Purchase 200 18 Dec 12 Purchase 125 17 Dec 13 Sale 300 Dec 19 Purchase 350 21 Dec 29 Purchase 150 18 Dec 30 Sale 400 a) Calculate each unit of goods sold and the cost of ending inventory under each of the following inventory cost flow assumptions: i. FIFO ii. Weighted average b) Assume each unit was sold for RM25. Complete the following partial income statements: FIFO Weighted Average Sales Less: Cost of Sales Gross Profitarrow_forwardThe following information is taken from the records of Wildlife Florist. The company usesthe perpetual inventory system.Date Description Units Unit Cost (RM)Dec1 Opening inventory 200 20Dec 5 Sale 108Dec 6 Purchase 200 18Dec 12 Purchase 125 17Dec 13 Sale 300Dec 19 Purchase 350 21Dec 29 Purchase 150 18Dec 30 Sale 4005Required:-a. Calculate cost of goods sold and the cost of ending inventory under each of thefollowing inventory cost flow assumptions:i. FIFO.ii. Weighted average. b. Assume each unit was sold for RM25. Complete the following partial income statements: FIFO Weighted Average Sales Less: Cost of Sales Gross Profitarrow_forwardGolf Haven Superstore carries an inventory of putters and other golf clubs. The sales price of each putter is $144. Company records indicate the following for a particular line of Golf Haven Superstore's putters View the records. Read the requirements. Requirement 1. Prepare Golf Haven Superstore's perpetual inventory record for the putters assuming Golf Haven Supersto Round weighted average cost per unit to the nearest cent and all other amounts to the nearest dollar. Then identify the cost Start by entering the beginning inventory balances. Enter the transactions in chronological order, calculating new inventory been entered into the perpetual record, calculate the quantity and total cost of inventory purchased, sold, and on hand at the Date Jun. 1 Jun 6 Jun 8 Quantity 12 Purchases Unit Cost 75 Total Cost 900 Cost of Goods Sold Unit Cost Quantity Total Cost 2 $ 72 $ 144 Inventory on Hand Unit Quantity Cost 8 $ 65 6 72 S 72 S Total Cost 576 432 450 Records Date Jun. 1 Jun. 6 Jun. 8…arrow_forward

- Sport Box sells a wide variety of sporting equipment. The following is information on the purchases and sales of their top selling hockey stick. The hockey stick sells for $130. Description Units Unit Cost Mar. 1 Beginning Inventory 19 $ 44 Mar. 3 Purchase 64 $ 49 Mar. 6 Purchase 114 $ 54 Mar. 17 Sale 59 Mar. 23 Purchase 58 $ 54 Mar. 31 Sale 148 Required: Calculate the cost of goods sold and ending inventory under the perpetual inventory system using the following methods. (Do not round your "Unit Cost" answers. Round all other intermediate and final answers to nearest whole dollar.)arrow_forwardI need help calculating the ending inventory and cost of goods sold using the LIFO method (Please Show Calculations) Note: I also attached an example of what the LIFO chart should look like, please follow that example to answer this question. Jensen Company had the following transactions regarding their inventory, They use a perpetual inventory system. Beginning Inventory: 100 units @ $6.00 per unit First Purchase: 100 units @ $7.00 per unit Sale: 150 units @ $15.00 per unit Second Purchase: 150 units @ $8.00 per unit Sale: 150 units @ $15.00 per unitarrow_forwardUncle Butchs Hunting Supply Shop reports the following information related to inventory: Calculate Uncle Butchs ending inventory using the retail inventory method under the FIFO cost flow assumption. Round the cost-to-retail ratio to 3 decimal places.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Chapter 6 Merchandise Inventory; Author: Vicki Stewart;https://www.youtube.com/watch?v=DnrcQLD2yKU;License: Standard YouTube License, CC-BY

Accounting for Merchandising Operations Recording Purchases of Merchandise; Author: Socrat Ghadban;https://www.youtube.com/watch?v=iQp5UoYpG20;License: Standard Youtube License