Concept explainers

a.

Introduction:

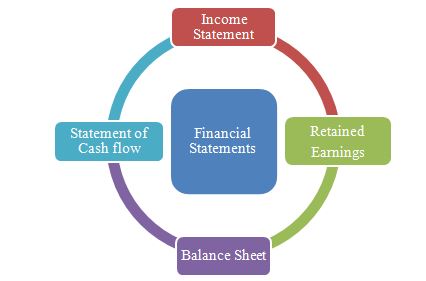

Financial statements are a complete record of the financial transactions that takes place in a company at a particular point of time. It provides important financial information like assets, liabilities, revenues and expenses of the company to its internal and external users. It helps them to know the exact financial position of the company. There are four basic financial statements as shown in the figure below:

Basic Financial Statements

Figure (1)

To Compute: Net income for the year ended December 31, 2017.

a.

Introduction:

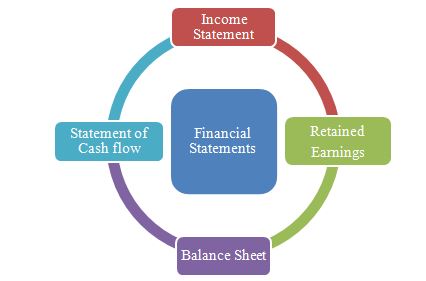

Financial statements are a complete record of the financial transactions that takes place in a company at a particular point of time. It provides important financial information like assets, liabilities, revenues and expenses of the company to its internal and external users. It helps them to know the exact financial position of the company. There are four basic financial statements as shown in the figure below:

Basic Financial Statements

Figure (1)

Answer to Problem 1.10E

Determine net income for the year 2017.

Introduction:

Income statement is a financial statement that shows the net income earned or net loss suffered by a company through reporting all the revenues earned and expenses incurred by the company over a specific period of time.

Income statement is also known as operations statement, earnings statement, revenue statement, or

Prepare the income statement of the company for the year ended December 31st , 2017 as below.

|

O Park Income Statement For the year ended December 31 st, 2017. | ||

| Particulars | Amount ($) | Amount ($) |

| Revenues | 132,000 | |

| Service Revenue | 25,000 | 157,000 |

| Less: Expenses | 126,000 | |

| Net income | 31,000 | |

Table (1)

Explanation of Solution

Income statement is used to determine the net income / net loss of the company. It is calculated by finding out the difference between the net revenues and expenses. Net income for the year ended December 31 st, 2017 is $31,000.

Thus, the net income for the year ended December 31st, 2017 is $31,000.

b.

i.

Introduction:

Retained earnings is a financial statement that shows the amount of the net income retained by a company at a particular point of time for reinvestment and pays its debts and obligations. It shows the amount of retained earnings that is not paid as dividends to the shareholders.

Use the following formula to determine the retained earnings for the year ending December 31, 2017.

Prepare retained earnings statement for the year ending December 31, 2017.

b.

i.

Answer to Problem 1.10E

Prepare the retained earnings statement of O Park for the year ended December 31st, 2017 as below.

|

O Park Retained Earnings Statement For the year ended December 31 st, 2017. | |

| Particulars | Amount ($) |

| Retained earnings, January 1 | 5,000 |

| Add: Net income (From requirement a) | 31,000 |

| 36,000 | |

| Less: Dividends | 9,000 |

| Retained earnings, December 31 | 27,000 |

Table (2)

Explanation of Solution

Ending retained earnings is determined by adding the net income and deducting the dividends to beginning retained earnings. Thus, above table shows the determination of the retained earnings, December 31.

Thus, the ending retained earnings is $27,000.

ii.

Introduction:

Balance sheet is a financial statement that shows the available assets (owner’s equity and outsider’s equity) and owed liabilities from investing and financial activities of a company. This statement reveals the financial health of company. So, this statement is also called as

Use the formula to prepare balance sheet.

Prepare balance sheet for O Park as of December 31, 2017.

ii.

Answer to Problem 1.10E

Prepare the balance sheet for O Park as of December 31, 2017 as below.

|

O Park Balance Sheet December 31, 2017 | ||

| Particulars | Amount ($) | Amount ($) |

| Assets | ||

| Cash | 8,500 | |

| Supplies | 5,500 | |

| Equipment | 114,000 | |

| Total assets | 128,000 | |

| Liabilities and Stockholders’ equity | ||

| Notes payable | 50,000 | |

| Accounts payable | 11,000 | |

| Total liabilities | 61,000 | |

| Stockholders’ equity | ||

| Common stock | 40,000 | |

| Retained earnings | 27,000 | 67,000 |

| Total liabilities and stockholders’ equity | 128,000 | |

Table (3)

Explanation of Solution

Balance sheet includes the items of assets, liabilities, and stockholders’ equity. The total assets of the company are the sum of cash, supplies, and equipment. The total liabilities are the sum of notes payable and accounts payable. The stockholders’ equity is the sum of common stock and retained earnings.

Thus, assets are equal to liabilities and stockholders’ equity.

c.

To Comment: On the company’s growth.

c.

Explanation of Solution

The income statement is prepared to determine the net income. The revenues from the G store are only 16% out of total revenues. In order to know whether the company is in more trouble than worth, it is necessary to know the expenses that are attributable to the G store.

In this income statement, expenses amount is shown in the single category instead of showing it separately for both the companies. Thus, when there is a breakdown of categories, it helps the company to generate profit or loss for the company.

Thus, there should be breakdown of the categories with respect to two companies.

Want to see more full solutions like this?

Chapter 1 Solutions

Financial Accounting: Tools for Business Decision Making, 8th Edition

- Alaga Mo Patabain Ko Cooperative was established on November 2, 2016. Below are the balances financial position accounts on the beginning of December, 2016 and the transactions for December, 2016Total Liabilities is 40% of Total Members’ EquityTotal Non-Current Assets is 60% of Total AssetsCash and Cash Equivalents is P2,400,000 which is 40% of Total Current AssetsNet Surplus/(Net Loss) is (P650,500) based on the result of operation of November, 2016December, 2016 TransactionsInterest Income from Loans – P250,000Service of Income – P150,000Cost of Service – P85,000Membership Fees – P45,000Commission Income – P25,000Miscellaneous Income – P5,000Interest Expense from Deposits – P25,000Administrative Expense – P150,000Gains in Sale of Investment – P35,000Cooperative acquired a delivery truck by issuing a promissory notes worth P350,000 on December 1 with 10 years depreciation. This transaction was omitted in the book. The correct balance of Non-Current Assets as of December 31, 2016.…arrow_forwardSeveral accounts that appeared on Spring's 2017 balance sheet are as follows: Accounts Payable $78,000 Equipment $950,000 Marketable Securities 40,000 Taxes Payable 15,000 Accounts Receivable 143,600 Retained Earnings 250,000 Notes Payable, 12%, due in 60 days 20,000 Inventory 165,000 Capital Stock 1,150,000 Allowance for Doubtful Accounts 20,000 Salaries Payable 10,000 Land 600,000 Cash 65,000 Required: 1. Prepare the Current Liabilities section of Spring's 2017 balance sheet. Spring Partial Balance Sheet As Of December 31, 2017 Current liabilities: Accounts payable $ Notes payable, 12%, due in 60 days Taxes payable Salaries payable Total current liabilities $ 2. Compute Spring's working capital. $ 3. Compute Spring's current ratio. Round your answer to one decimal place. fill in the blank: 1 What does this ratio indicate about Spring’s condition? It seems that Spring has…arrow_forwardOn January 1, 2021, the general ledger of ACME Fireworks includes the following account balances: Accounts Debit Credit Cash $ 25,700 Accounts Receivable 47,400 Allowance for Uncollectible Accounts $ 4,800 Inventory 20,600 Land 52,000 Equipment 18,000 Accumulated Depreciation 2,100 Accounts Payable 29,100 Notes Payable (6%, due April 1, 2022) 56,000 Common Stock 41,000 Retained Earnings 30,700 Totals $ 163,700 $ 163,700 During January 2021, the following transactions occur: January 2 Sold gift cards totaling $9,200. The cards are redeemable for merchandise within one year of the purchase date. January 6 Purchase additional inventory on account, $153,000. January 15 Firework sales for the first half of the month total $141,000. All of these sales are on account. The…arrow_forward

- Consider the following financial data for Terry Enterprises: Balance Sheet as of December 31, 2018 Cash $ 86,000 Accounts payable $ 15,500 Accts. receivable 91,500 Notes payable 93,500 Inventories 65,500 Accruals 19,500 Total current assets $ 243,000 Total current liabilities $ 128,500 Long-term debt 162,500 Net plant & equip. 419,500 Common equity 371,500 Total assets $ 662,500 Total liab. & equity $ 662,500 Statement of Earnings for 2018 Industry Average Ratios Net sales $ 642,500 Current ratio 2.2× Cost of goods sold 482,000 Quick ratio 1.7× Gross profit $ 160,500 Days sales outstanding 44 days Operating expenses 119,500 Inventory turnover 6.7× EBIT $ 41,000 Total asset turnover 0.6× Interest expense 14,500 Net profit margin 7.2% Pre-tax earnings $ 26,500…arrow_forwardAdobe Incorporated reported the following accounts and amounts (in millions) in its financial statements for the year ended November 30, 2018. Accounts Payable Accounts Receivable Accumulated Amortization Accumulated Depreciation $ 1,350 1,330 650 1,400 Allowance for Doubtful Accounts 15 Cash and Cash Equivalents 1,640 Common Stock 450 Deferred Revenue 2,915 Equipment 13,060 Income Taxes Payable 35 Notes Payable (long-term) 5,105 Notes Receivable (long-term) 185 Prepaid Rent 310 Retained Earnings 8,915 Service Revenue 485 Short-Term Investments 1,590 2,720 Software Required: Prepare a classified balance sheet. The Allowance for Doubtful Accounts relates entirely to Accounts Receivable. (One of the accounts does not belong on the balance sheet.) (Enter your answers in millions (i.e., 10,000,000 should be entered as 10).) Answer is not complete. ADOBE INCORPORATED Balance Sheet As of November 30, 2018 (in millions of dollars) Assets Current Assets Cash and Cash Equivalents Accounts…arrow_forwardThe Butler-Huron Company’s balance sheet and income statement for last year are as follows: Balance Sheet (in Millions of Dollars) Assets Liabilities and Equity Cash and marketable securities $139 Accounts payable*** $1,077 Accounts receivable* 976 Accrued liabilities Inventories** 1,920 (salaries and benefits) 636 Other current assets 39 Other current liabilities 501 Total current assets $3,074 Total current liabilities $2,214 Plant and equipment (net) 3,503 Long-term debt and other Other assets 6,625 liabilities 2,510 Total assets $6,625 Common stock 151 Retained earnings 1,750 Total stockholders’ equity $1,901 Total liabilities and equity $6,625 *Assume that all sales are credit sales and that average accounts receivable are the same as ending accounts receivable. **Assume that average inventory over the year was the same as ending inventory. ***Assume that average…arrow_forward

- On January 1, 2021, the general ledger of Tripley Company included the following account balances: Accounts Debit Credit Cash $ 94,000 Accounts receivable 44,000 Allowance for uncollectible accounts $ 9,400 Inventory 30,400 Building 90,400 Accumulated depreciation 14,000 Land 208,000 Accounts payable 40,000 Notes payable (8%, due in 3 years) 60,000 Common stock 104,000 Retained earnings 239,400 Totals $ 466,800 $ 466,800 The $30,400 beginning balance of inventory consists of 304 units, each costing $100. During January 2021, the company had the following transactions: January 2 Lent $24,000 to an employee by accepting a 6% note due in six months. 5 Purchased 3,700 units of inventory on account for $407,000 ($110 each) with terms 1/10, n/30. 8 Returned 100 defective units of inventory purchased on January 5. 15 Sold…arrow_forwardWolfe Inc. Wolfe Inc. reports these account balances at January 1, 2016: Retained Earnings $ 49,000 Accounts Receivable 20,000 Accounts Payable 24,000 Capital Stock 185,000 Land 153,000 Cash 13,000 Equipment 20,000 Notes Payable 28,000 Buildings 80,000 See the account balances for Wolfe Inc. On January 31, Wolfe collected $12,000 of its accounts receivable and paid $11,000 on its note payable. In Wolfe’s trial balance prepared on January 31, 2016, the total of the credit column is: a. $297,000 $287,000 $286,000 $275,000arrow_forwardOn January 1, 2021, the general ledger of Freedom Fireworks includes the following account balances: Accounts Debit Credit Cash $ 12,700 Accounts Receivable 37,000 Inventory 153,500 Land 82,300 Buildings 135,000 Allowance for Uncollectible Accounts $ 3,300 Accumulated Depreciation 11,100 Accounts Payable 34,200 Common Stock 215,000 Retained Earnings 156,900 Totals $ 420,500 $ 420,500 During January 2021, the following transactions occur: January 1 Borrow $115,000 from Captive Credit Corporation. The installment note bears interest at 6% annually and matures in 5 years. Payments of $2,223 are required at the end of each month for 60 months. January 4 Receive $32,500 from customers on accounts receivable. January 10 Pay cash on accounts payable, $26,000. January 15 Pay cash for salaries, $30,400. January 30…arrow_forward

- Presented below are the ending balances of accounts for the Kansas Instruments Corporation at December 31, 2024. Account Title Debits Credits Cash $ 38,000 Accounts receivable 166,000 Raw materials 42,000 Notes receivable 118,000 Interest receivable 21,000 Interest payable $ 23,000 Investment in debt securities 50,000 Land 68,000 Buildings 1,660,000 Accumulated depreciation—buildings 638,000 Work in process 60,000 Finished goods 107,000 Equipment 336,000 Accumulated depreciation—equipment 148,000 Patent (net) 138,000 Prepaid rent (for the next two years) 78,000 Deferred revenue 54,000 Accounts payable 198,000 Notes payable 580,000 Restricted cash (for payment of notes payable) 98,000 Allowance for uncollectible accounts 31,000 Sales revenue 1,160,000 Cost of goods sold 468,000 Rent expense 46,000 Additional Information: The notes receivable, along with any interest receivable, are…arrow_forwardPresented below is the trial balance of Muscat Corporation on December 31, 2019 Accounts Debit Credit Cash OMR 197,000 Sales Revenue OMR 8,100,000 Trading securities 153,000 Cost of Goods Sold 5,132,000 Debt Investments (long-term) 299,000 Equity Investments (long-term) 277,000 Notes Payable (short-term) 90,000 Accounts Payable 455,000 Selling Expenses 2,000,000 Investment Revenue 63,000 Land 260,000 Buildings 1,040,000 Dividends Payable 136,000 Accrued Liabilities 96,000 Accounts Receivable 435,000 Accumulated Depreciation—Buildings 352,000 Allowance for Doubtful Accounts 25,000 Administrative Expenses 900,000 Interest Expense 211,000 Raw Materials 97,000 Work In process 250,000 Finished Goods 250,000 Gain (extraordinary) 80,000 Notes Payable…arrow_forwardPresented below is the trial balance of Muscat Corporation on December 31, 2019 Accounts Debit Credit Cash OMR 197,000 Sales Revenue OMR 8,100,000 Trading securities 153,000 Cost of Goods Sold 5,132,000 Debt Investments (long-term) 299,000 Equity Investments (long-term) 277,000 Notes Payable (short-term) 90,000 Accounts Payable 455,000 Selling Expenses 2,000,000 Investment Revenue 63,000 Land 260,000 Buildings 1,040,000 Dividends Payable 136,000 Accrued Liabilities 96,000 Accounts Receivable 435,000 Accumulated Depreciation—Buildings 352,000 Allowance for Doubtful Accounts 25,000 Administrative Expenses 900,000 Interest Expense 211,000 Raw Materials 97,000 Work In process 250,000 Finished Goods 250,000 Gain (extraordinary) 80,000 Notes Payable…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education