Concept explainers

Prepare comparative income statement and comparative schedule of cost of goods sold for each month under (1) absorption costing method and (2) variable costing method.

Explanation of Solution

Absorption costing: It refers to the method of product costing in which the price of the product is calculated considering all fixed as well as the variable or direct costs. The

Variable costing: It refers to the method of product costing in which the price of the product is calculated considering only the variable or direct costs or the cost that happened to occurred due to the product only. It also called as marginal costing as it takes marginal costs while calculating the product cost.

Prepare comparative income statement and comparative schedule of cost of goods sold for each month under (1) absorption costing method and (2) variable costing method as follows:

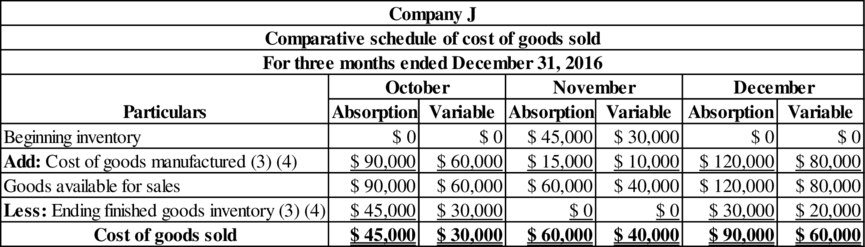

Comparative schedule of cost of goods sold for each month:

Table (1)

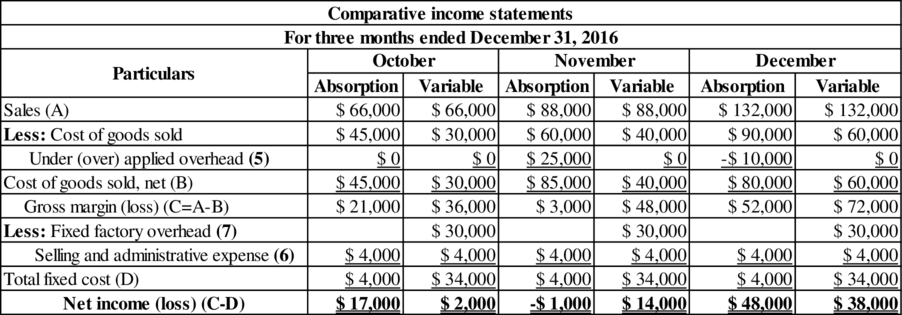

Comparative income statement for each month:

Table (2)

Working note (1):

Calculate the absorption costing per unit.

Working note (2):

Calculate the ending inventory units for each month.

| Particulars | October | November | December |

| Beginning inventory | 0 | 3,000 | 0 |

| Add: Number of units produced | 6,000 | 1,000 | 8,000 |

| Less: Number of units sold | 3,000 | 4,000 | 6,000 |

| Ending inventory | 3,000 | 0 | 2,000 |

Table (3)

Working note (3):

Calculate the cost of goods sold and ending inventory under absorption costing for each month.

| Particulars | October | November | December |

| Number of units produced (A) | 6,000 | 1,000 | 8,000 |

| Absorption cost per unit (B) (1) | $ 15 | $ 15 | $ 15 |

| Cost of goods manufactured | $ 90,000 | $ 15,000 | $ 120,000 |

| Ending inventories units (C) (2) | 3000 | 0 | 2000 |

| Absorption cost per unit (D) | $ 15 | $ 15 | $ 15 |

| Ending inventory | $ 45,000 | $ 0 | $ 30,000 |

| Beginning inventory units (E) (2) | 0 | 3,000 | 0 |

| Absorption cost per unit (F) | $ 15 | $ 15 | $ 15 |

| Beginning inventory | $ 0 | $ 45,000 | $ 0 |

Table (4)

Working note (4):

Calculate the cost of goods sold and ending inventory under variable costing for each month.

| Particulars | October | November | December |

| Number of units produced (A) | 6,000 | 1,000 | 8,000 |

| Variable cost per unit (B) | $ 10 | $ 10 | $ 10 |

| Cost of goods sold | $ 60,000 | $ 10,000 | $ 80,000 |

| Ending inventories units (C) (2) | 3000 | 0 | 2000 |

| Variable cost per unit (D) | $ 10 | $ 10 | $ 10 |

| Ending inventory | $ 30,000 | $ 0 | $ 20,000 |

| Beginning inventory units (E) (2) | 0 | 3,000 | 0 |

| Variable cost per unit (F) | $ 10 | $ 10 | $ 10 |

| Beginning inventory | $ 0 | $ 30,000 | $ 0 |

Table (5)

Working note (5):

Calculate the under or over applied fixed overhead.

October:

November:

December:

Working note (6):

Calculate the fixed selling and administrative expense per month.

Working note (7):

Calculate the fixed factory overhead per month.

Want to see more full solutions like this?

Chapter 10 Solutions

Principles of Cost Accounting

- Plummer Corporation has provided the following data for its two most recent years f operation: Selling price per unit Manufacturing costs: Variable manufacturing cost per unit produced: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead per year. Selling and administrative expenses: Variable selling and administrative expense per unit sold Fixed selling and administrative expense per year. Units in beginning inventory Units produced during the year Units sold during the year. Units in ending inventory The unit product cost under absorption costing in Year 2 is closest to: Multiple Choice O 000 $9.00 $19.00 $28.00 Year 1 Year 2 0 $33.00 9,000 7,000 2,000 2,000 7,000 8,000 1,000 $ 44 $9 $ 6 $4 $ 63,000 $5 $ 66,000arrow_forwardWolsey Industries Inc. expects to maintain the same inventories at the end of 20Y3 as at the beginning of the year. The total of all production costs for the year is therefore assumed to be equal to the cost of goods sold. With this in mind, the various department heads were asked to submit estimates of the costs for their departments during the year. A summary report of these estimates is as follows: 1 Estimated Fixed Cost Estimated Variable Cost (per unit sold) 2 Production costs: 3 Direct materials — $66.00 4 Direct labor — 32.00 5 Factory overhead $190,000.00 20.00 6 Selling expenses: 7 Sales salaries and commissions 102,000.00 6.00 8 Advertising 37,000.00 — 9 Travel 10,000.00 — 10 Miscellaneous selling expense 7,800.00 1.00 11 Administrative expenses: 12 Office and officers’ salaries 138,400.00 — 13 Supplies 12,000.00 2.00 14…arrow_forwardWolsey Industries Inc. expects to maintain the same inventories at the end of 20Y3 as at the beginning of the year. The total of all production costs for the year is therefore assumed to be equal to the cost of goods sold. With this in mind, the various department heads were asked to submit estimates of the costs for their departments during the year. A summary report of these estimates is as follows: 1 Estimated Fixed Cost Estimated Variable Cost (per unit sold) 2 Production costs: 3 Direct materials — $66.00 4 Direct labor — 32.00 5 Factory overhead $190,000.00 20.00 6 Selling expenses: 7 Sales salaries and commissions 102,000.00 6.00 8 Advertising 37,000.00 — 9 Travel 10,000.00 — 10 Miscellaneous selling expense 7,800.00 1.00 11 Administrative expenses: 12 Office and officers’ salaries 138,400.00 — 13 Supplies 12,000.00 2.00 14…arrow_forward

- Variable and absorption costing, explaining operating-income differences. EntertainMe Corporation manufactures and sells 50-inch television sets and uses standard costing. Actual data relating to January, February, and March 2017 are as follows:arrow_forwardCircetrax, Inc. has provided the following financial information for the year: Finished Goods Inventory: Beginning balance, in units Units produced Units sold Ending balance, in units Production costs: Variable manufacturing costs per unit Total fixed manufacturing costs What is the unit product cost for the year using absorption costing? OA. $117 630 1,400 1,500 530 $50 $42,000 Warrow_forwardA company prepares income statements using both absorption and variable costing methods. Factory overhead cost applied per unit produced in 2020 was the same in 2019. The 2020 variable costing statement reported a profit whereas 2020 absorption costing statement reported a loss. The difference in income could be explained by units produced in 2020 being: a. Less than units sold in 2020 b. Less than the activity level used for allocating overhead to the product c. In excess of activity level used for allocating overhead to the product d. In excess of units sold in 2020arrow_forward

- Baughn Corporation, which has only one product, has provided the following data concerning its most recent month of operations: Selling price Units in beginning inventory Units produced Units sold Units in ending inventory Variable costs per unit: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative expense Multiple Choice Fixed costs: Fixed manufacturing overhead Fixed selling and administrative expense What is the unit product cost for the month under variable costing? $104 per unit $79 per unit $ 115 0 $88 per unit 6,600 6,400 200 $95 per unit $26 $46 $ 7 $9 $ 105,600 51,200arrow_forward(b) For 2018, SQU Company had sales of 150,000 units and production of 200,000 units. There was no beginning inventory. Other information for the year included: Direct manufacturing labor Direct materials Fixed administrative expenses 100,000 Fixed manufacturing overhead 187,500 Variable manufacturing overhead 100,000 100,000 200,000 150,000 Variable selling expenses You are required to calculate under both the variable and absorption costing methoda the: inventoriable cost per unit, (i) Ending inventory, and (m) Cost of goods sold.arrow_forwardWolsey Industries Inc. expects to maintain the same inventories at the end of 20Y8 as at the beginning of the year. The total of all production costs for the year is therefore assumed to be equal to the cost of goods sold. With this in mind, the various department heads were asked to submit estimates of the costs for their departments during the year. A summary report of these estimates is as follows: 1 Estimated Fixed Cost Estimated Variable Cost (per unit sold) 2 Production costs: 3 Direct materials — $46.00 4 Direct labor — 40.00 5 Factory overhead $200,000.00 20.00 6 Selling expenses: 7 Sales salaries and commissions 110,000.00 8.00 8 Advertising 40,000.00 — 9 Travel 12,000.00 — 10 Miscellaneous selling expense 7,600.00 1.00 11 Administrative expenses: 12 Office and officers’ salaries 132,000.00 — 13 Supplies 10,000.00 4.00 14…arrow_forward

- Wolsey Industries Inc. expects to maintain the same inventories at the end of 20Y8 as at the beginning of the year. The total of all production costs for the year is therefore assumed to be equal to the cost of goods sold. With this in mind, the various department heads were asked to submit estimates of the costs for their departments during the year. A summary report of these estimates is as follows: 1 Estimated Fixed Cost Estimated Variable Cost (per unit sold)2 Production costs:3 Direct materials — $50.004 Direct labor — 32.005 Factory overhead $190,000.00 20.006 Selling expenses:7 Sales salaries and commissions 101,000.00 12.008 Advertising 36,000.00 —9 Travel 14,000.00…arrow_forwardWolsey Industries Inc. expects to maintain the same inventories at the end of 20Y8 as at the beginning of the year. The total of all production costs for the year is therefore assumed to be equal to the cost of goods sold. With this in mind, the various department heads were asked to submit estimates of the costs for their departments during the year A summary report of these estimates is as follows: Estimated Fixed Cost Estimated Variable Cost (per unit sold) 2 Production costs: 3 Direct materials 4 Direct labor 5 Factory overhead $56.00 36.00 $194,000.00 20.00 6 Selling expenses: 7 Sales salaries and commissions 110,000.00 8.00 8 Advertising 42,000.00 9 Travel 13,000.00 10 Miscellaneous selling expense 7,000.00 1.00 11 Administrative expenses: 12 Office and officers' salaries 13 Supplies 124,600.00 8,000.00 6.00arrow_forwardVariable and absorption costing, explaining operating-income differences.EntertainMe Corporation manufactures and sells 50-inch television sets and uses standard costing.Actual data relating to January, February, and March 2017 are as follows: January February March Unit data: Beginning inventory 0 150 150 Production 1,500 1,400 1,520 Sales 1,350 1,400 1,530Variable costs: Manufacturing cost per unit produced $1,000$ 1,000 $1,000 Operating (marketing) cost per unitsold $800$ 800 $800 Fixed costs: Manufacturing costs $525,000 $525,000 $525,000 Operating (marketing) costs $130,000 $130,000 $130,000The selling price per unit is $3,300. The budgeted level of production used to calculate thebudgeted fixed manufacturing cost per unit is 1,500 units. There are no price, efficiency, orspending variances. Any production-volume variance is written off to cost of goods sold in themonth in which it occurs.1. Prepare income statements for EntertainMe in January, February, and March 2017 under…arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College