Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 12, Problem 11MC

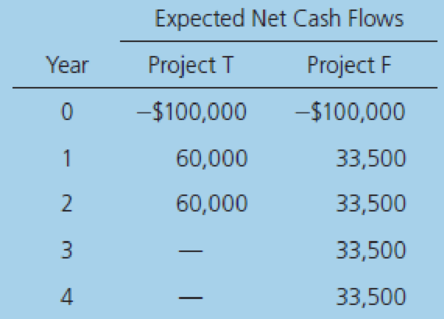

In an unrelated analysis, you have the opportunity to choose between the following two mutually exclusive projects, Project T (which lasts for 2 years) and Project F (which lasts for 4 years):

The projects provide a necessary service, so whichever one is selected is expected to be repeated into the foreseeable future. Both projects have a 10% cost of capital.

- (1) What is each project’s initial

NPV without replication? - (2) What is each project’s equivalent annual

annuity ? - (3) Apply the replacement chain approach to determine the projects’ extended NPVs. Which project should be chosen?

- (4) Assume that the cost to replicate Project T in 2 years will increase to $105,000 due to inflation. How should the analysis be handled now, and which project should be chosen?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Consider the following two mutually exclusive projects (W and Z).

-The table-

Whichever project you choose, if any, you require a 12 percent return on your investment.(a) Calculate the payback period for each project.(b) Calculate the net present value (NPV) of each project(c) Based on your answers in (a) and (b), which project will you finally choose? Explain.

Please help me with this question (picture below)

1. Calculate the payback period, accounting rate of return, net present value of each project. Based on your calculations, discuss whether the projects should go ahead. Assume that the target value for payback is 3 years for project A and 2 years for project B.2. List advantages and disadvantages of payback period, accounting rate of return, net present value of each project.

Project S requires an initial outlay at t = 0 of $16,000, and its expected cash flows would be $5,000 per year for 5

years. Mutually exclusive Project L requires an initial outlay at t = 0 of $30,500, and its expected cash flows would be

$9,450 per year for 5 years. If both projects have a WACC of 16%, which project would you recommend?

Select the correct answer.

O a. Project S, because the NPVS > NPVL.

O b. Both Projects S and L, because both projects have NPV's > 0.

c. Both Projects S and L, because both projects have IRR's > 0.

O d. Project L, because the NPVL > NPVS.

O e. Neither Project S nor L, because each project's NPV < 0.

Chapter 12 Solutions

Intermediate Financial Management (MindTap Course List)

Ch. 12 - What types of projects require the least detailed...Ch. 12 - Prob. 3QCh. 12 - Prob. 4QCh. 12 - Prob. 5QCh. 12 - A project has an initial cost of 40,000, expected...Ch. 12 - IRR Refer to Problem 12-1. What is the projects...Ch. 12 - Prob. 3PCh. 12 - Prob. 4PCh. 12 - Prob. 5PCh. 12 - Prob. 6P

Ch. 12 - Your division is considering two investment...Ch. 12 - Edelman Engineering is considering including two...Ch. 12 - Prob. 9PCh. 12 - Project S has a cost of $10,000 and is expected to...Ch. 12 - Prob. 11PCh. 12 - After discovering a new gold vein in the Colorado...Ch. 12 - Prob. 13PCh. 12 - Prob. 14PCh. 12 - The Pinkerton Publishing Company is considering...Ch. 12 - Shao Airlines is considering the purchase of two...Ch. 12 - The Perez Company has the opportunity to invest in...Ch. 12 - Filkins Fabric Company is considering the...Ch. 12 - The Ulmer Uranium Company is deciding whether or...Ch. 12 - The Aubey Coffee Company is evaluating the...Ch. 12 - Your division is considering two investment...Ch. 12 - The Scampini Supplies Company recently purchased a...Ch. 12 - You have just graduated from the MBA program of a...Ch. 12 - Prob. 2MCCh. 12 - Define the term “net present value (NPV).” What is...Ch. 12 - Prob. 4MCCh. 12 - Prob. 5MCCh. 12 - What is the underlying cause of ranking conflicts...Ch. 12 - Prob. 7MCCh. 12 - Prob. 8MCCh. 12 - Prob. 9MCCh. 12 - Prob. 10MCCh. 12 - In an unrelated analysis, you have the opportunity...Ch. 12 - Prob. 12MC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Answer the following: 1 What is the payback period on each of the above projects? 2 Given that you wish to use the payback rule with a cutoff period of two years, which projects would you accept? Why? 3 If you use a cutoff period of three years, which projects would you accept? Why?arrow_forwardPlease answer the following questions in detail, provide examples whenever applicable, provide in-text citations. (TABLE IMAGE ATTACHED) What is the payback period on each of the above projects? Given that you wish to use the payback rule with a cutoff period of two years, which projects would you accept? If you use a cutoff period of three years, which projects would you accept? If the opportunity cost of capital is 10%, which projects have positive NPVs? If a firm uses a single cutoff period for all projects, it is likely to accept too many short-lived projects.” True or false? If the firm uses the discounted-payback rule, will it accept any negative-NPV projects? Will it turn down any positive NPV projects?arrow_forwardGive typing answer with explanation and conclusion Project S requires an initial outlay at t = 0 of $13,000, and its expected cash flows would be $5,000 per year for 5 years. Mutually exclusive Project L requires an initial outlay at t = 0 of $28,000, and its expected cash flows would be $13,850 per year for 5 years. If both projects have a WACC of 15%, which project would you recommend? Select the correct answer. a. Neither Project S nor L, because each project's NPV < 0. b. Both Projects S and L, because both projects have NPV's > 0. c. Project S, because the NPVS > NPVL. d. Both Projects S and L, because both projects have IRR's > 0. e. Project L, because the NPVL > NPVS.arrow_forward

- 4. You have to select only one of the following projects (ie. They are mutually exclusive.) Project #1 is 4 years long and has an NPV of $140,000. Project #2 is 6 years long and has an NPV of $180,000. The required rate of return is 10%. Which project should you take using the EAA approach?arrow_forwardYou are considering the following two projects which are mutually exclusive. The required return on each project is 14%. Which project should you accept and what is the best reason for that decision? Year Project A Project B 0 $-46,000 $-46,000 1 $25,000 $11,000 2 $18,000 $19,000 3 $16,000 $32,000 a) Both Project A and B since they both have positive NPV b) Project A, because it has the higher profitability index c) Project A, because it has the higher net present value d) Project B, because it has the higher net present valuearrow_forwardProject S has a cost of $10,000 and is expected to produce benefits (cash flows) of $3,000 per year for 5 years. Project L costs $25,000 and is expected to produce cash flows of $7,400 per year for 5 years. Calculate the two projects’ NPVs, IRRs, MIRRs, and PIs, assuming a cost of capital of 12%. Which project would be selected, assuming they are mutually exclusive, using each ranking method? Which should actually be selected?arrow_forward

- The following information is available on two mutually exclusive projects. All numbers are in ‘000s. Project Year 0 Year 1 Year 2 Year 3 Year 4 A $700 $300 $300 $400 $400 B $700 $600 $300 $200 $100 a: If the minimum acceptable rate of return is 10%, which project should be selected using the Net Present Value (NPV) method? Which project should be selected if the Internal Rate of Return (IRR) method is used? b: At what cross‐over rate would the firm be indifferent between the two projects? What is the NPV for both projects at the crossover rate? c: How much should cash flow in year 3 for project B increase or decrease in order for NPV(B) to be equal to NPV(A)?arrow_forwardProject S requires an initial outlay at t = 0 of $19,000, and its expected cash flows would be $5,500 per year for 5 years. Mutually exclusive Project L requires an initial outlay at t = 0 of $37,000, and its expected cash flows would be $10,800 per year for 5 years. If both projects have a WACC of 13%, which project would you recommend? Select the correct answer. a. Project L, because the NPVL > NPVS. b. Neither Project S nor L, because each project's NPV < 0. c. Both Projects S and L, because both projects have NPV's > 0. d. Both Projects S and L, because both projects have IRR's > 0. e. Project S, because the NPVS > NPVL.arrow_forwardProject S requires an initial outlay at t=0 of $12,000, and its expected cash flows would be $4,000 per year for 5 years. Mutually exclusive Project L requires an initial outlay at t = 0 of $38,500, and its expected cash flows would be $9,200 per year for 5 years. If both projects have a WACC of 15%, which project would you recommend? Select the correct answer. Oa. Both Projects S and L, because both projects have NPV's > 0. Ob. Project S, because the NPVs > NPVL Oc. Both Projects S and L, because both projects have IRR's > 0. Od. Neither Project S nor L, because each project's NPV NPVs.arrow_forward

- Your firm uses the IRR method and asks you to evaluate the following mutually exclusive projects: Using the appropriate IRR method, evaluate these proposals assuming a required rate of return of 10 per cent. Compare your answer with the net present value method.arrow_forwardProject Q requires an initial outlay at t = 0 of $20,000, and its expected cash flows would be $5,000 per year for 5 years. Mutually exclusive Project L requires an initial outlay at t = 0 of $26,000, and its expected cash flows would be $13,600 per year for 5 years. If both projects have a WACC of 16%, which project would you recommend? Select the correct answer. a. Neither Project S nor L, since each project's NPV < 0. b. Project S, since the NPVS > NPVL. c. Project L, since the NPVL > NPVS. d. Both Projects S and L, since both projects have IRR's > 0. e. Both Projects S and L, since both projects have NPV's > 0.arrow_forwarda) Calculate the payback period for each project. The maximum allowable payback period setby the company for all projects is 3 years. b) Calculate the net present value (NPV) for each project c) Calculate the profitability index (PI) for each project d) Calculate the internal rate of return (IRR) for each project. e) Based on the answer in (a) – (d), explain briefly which project should be accepted. f) If the project is independent project, how would your answer change in part (e) Note: 1. I need only e,f no question answer. only e and f 2. No need excel formulaarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License