Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 12, Problem 21P

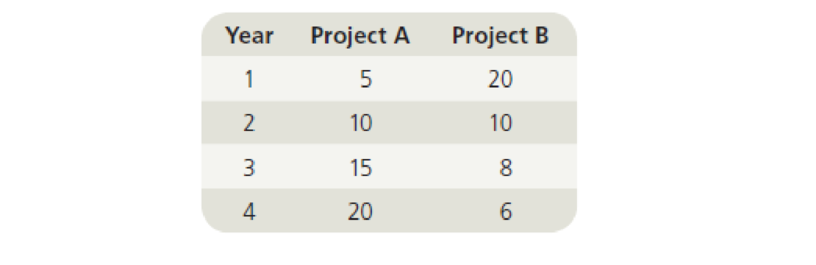

Your division is considering two investment projects, each of which requires an up-front expenditure of $25 million. You estimate that the cost of capital is 10% and that the investments will produce the following after-tax cash flows (in millions of dollars):

- a. What is the regular payback period for each of the projects?

- b. What is the discounted payback period for each of the projects?

- c. If the two projects are independent and the cost of capital is 10%, which project or projects should the firm undertake?

- d. If the two projects are mutually exclusive and the cost of capital is 5%, which project should the firm undertake?

- e. If the two projects are mutually exclusive and the cost of capital is 15%, which project should the firm undertake?

- f. What is the crossover rate?

- g. If the cost of capital is 10%, what is the modified

IRR (MIRR) of each project?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Your division is considering two investment projects, each of which requires an up-front expenditure of $25 million. You estimate that the cost of capital is 10% and that the investments will produce the following after-tax cash flows (in millions of dollars):

Year

Project A

Project B

1

5

20

2

10

10

3

15

8

4

20

6

.

What is the regular payback period for each of the projects?

What is the discounted payback period for each of the projects?

If the two projects are independent and the cost of capital is 10%, which project or projects should the firm undertake?

If the two projects are mutually exclusive and the cost of capital is 5%, which project should the firm undertake?

If the two projects are mutually exclusive and the cost of capital is 15%, which project should the firm undertake?

What is the crossover rate?

If the cost of capital is 10%, what is the modified IRR (MIRR) of each project?

Your division is considering two investment projects, each of which requires an up-front expenditure of $25 million. You estimate that the cost of capital is 10 percent and that the investments will produce the following after-tax cash flows (in millions of dollars):

Year

Project A

Project B

1

5

20

2

10

10

3

15

8

4

20

6

What is the regular payback period for each of the projects?

What is the discounted payback period for each of the projects?

What is the accounting rate of return for each of the projects?

If the cost of capital is 11 percent, what is the modified IRR (MIRR) of each project?

Your division is considering two investment projects, each of which requires an up-front expenditure of 25 million. You estimate that the cost of capital is 10 percent and that the investments will produce the following after-tax cash flows (in millions of dollars):

Year

Project A

Project B

1

5

20

2

10

10

3

15

8

4

20

6

Required

a. What is the regular payback period for project B.

b. What is the discounted payback period for each of the projects?

Chapter 12 Solutions

Intermediate Financial Management (MindTap Course List)

Ch. 12 - What types of projects require the least detailed...Ch. 12 - Prob. 3QCh. 12 - Prob. 4QCh. 12 - Prob. 5QCh. 12 - A project has an initial cost of 40,000, expected...Ch. 12 - IRR Refer to Problem 12-1. What is the projects...Ch. 12 - Prob. 3PCh. 12 - Prob. 4PCh. 12 - Prob. 5PCh. 12 - Prob. 6P

Ch. 12 - Your division is considering two investment...Ch. 12 - Edelman Engineering is considering including two...Ch. 12 - Prob. 9PCh. 12 - Project S has a cost of $10,000 and is expected to...Ch. 12 - Prob. 11PCh. 12 - After discovering a new gold vein in the Colorado...Ch. 12 - Prob. 13PCh. 12 - Prob. 14PCh. 12 - The Pinkerton Publishing Company is considering...Ch. 12 - Shao Airlines is considering the purchase of two...Ch. 12 - The Perez Company has the opportunity to invest in...Ch. 12 - Filkins Fabric Company is considering the...Ch. 12 - The Ulmer Uranium Company is deciding whether or...Ch. 12 - The Aubey Coffee Company is evaluating the...Ch. 12 - Your division is considering two investment...Ch. 12 - The Scampini Supplies Company recently purchased a...Ch. 12 - You have just graduated from the MBA program of a...Ch. 12 - Prob. 2MCCh. 12 - Define the term “net present value (NPV).” What is...Ch. 12 - Prob. 4MCCh. 12 - Prob. 5MCCh. 12 - What is the underlying cause of ranking conflicts...Ch. 12 - Prob. 7MCCh. 12 - Prob. 8MCCh. 12 - Prob. 9MCCh. 12 - Prob. 10MCCh. 12 - In an unrelated analysis, you have the opportunity...Ch. 12 - Prob. 12MC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Your division is considering two investment projects, each of which requires an up-front expenditure of 15 million. You estimate that the investments will produce the following net cash flows: a. What are the two projects net present values, assuming the cost of capital is 5%? 10%? 15%? b. What are the two projects IRRs at these same costs of capital?arrow_forwardProject S has a cost of $10,000 and is expected to produce benefits (cash flows) of $3,000 per year for 5 years. Project L costs $25,000 and is expected to produce cash flows of $7,400 per year for 5 years. Calculate the two projects’ NPVs, IRRs, MIRRs, and PIs, assuming a cost of capital of 12%. Which project would be selected, assuming they are mutually exclusive, using each ranking method? Which should actually be selected?arrow_forwardThere are two projects under consideration by the Rainbow factory. Each of the projects will require an initial investment of $35,000 and is expected to generate the following cash flows: If the discount rate is 12%, compute the NPV of each project.arrow_forward

- Buena Vision Clinic is considering an investment that requires an outlay of 600,000 and promises a net cash inflow one year from now of 810,000. Assume the cost of capital is 10 percent. Required: 1. Break the 810,000 future cash inflow into three components: a. The return of the original investment b. The cost of capital c. The profit earned on the investment 2. Now, compute the present value of the profit earned on the investment. 3. Compute the NPV of the investment. Compare this with the present value of the profit computed in Requirement 2. What does this tell you about the meaning of NPV?arrow_forwardThere are two projects under consideration by the Rainbow factory. Each of the projects will require an initial investment or $28.000 and is expected to generate the following cash flows: If the discount rate is 5% compute the NPV of each project and make a recommendation of the project to be chosen.arrow_forwardFalkland, Inc., is considering the purchase of a patent that has a cost of $50,000 and an estimated revenue producing life of 4 years. Falkland has a cost of capital of 8%. The patent is expected to generate the following amounts of annual income and cash flows: A. What is the NPV of the investment? B. What happens if the required rate of return increases?arrow_forward

- Your company is currently considering two investment projects. Each project requires an upfront expenditure of $25 million. You estimate that the cost of capital is 10% and the investments will produce the after tax cash flows on the attached image . a)Calculate the payback period for both projects,then compare to identify which project the firm should undertake. b)Evaluate the advantages and disadvantages of using the payback method in investment decisions and assess the situations where it should be used .arrow_forwardYour division is considering two investment projects, each of which requires an up-front expenditure of 25 million. You estimate that the cost of capital is 10 percent and that the investments will produce the following after-tax cash flows (in millions of dollars): Year Project A Project B 1 5 20 2 10 10 3 15 8 4 20 6 Required a. What is the regular payback period for project A.arrow_forwardYour division is considering two investment projects, each of which requires an up-front expenditure of $22 million. You estimate that the cost of capital is 8% and that the investments will produce the following after-tax cash flows (in millions of dollars): Year Project A Project B 1 5 20 2 10 10 3 15 4 20 a. What is the regular payback period for each of the projects? Round your answers to two decimal places. Project A: years Project B: b. What is the discounted payback period for each of the projects? Do not round intermediate calculations. Round your answers to two decimal places. Project A: years years Project B: years c. Calculate the NPV of the two projects. Do not round intermediate calculations. Round your answers to the nearest cent. Project A: $ Project B: $ Calculate the IRR of the two projects. Do not round intermediate calculations. Round your answers to two decimal places. Project A: % Project B: If the two projects are independent and the cost of capital is 8%, which…arrow_forward

- Using Excel Your division is considering two investment projects, each of which requires an up-front expenditure of $25 million. You estimate that the cost of capital is 10% and that the investments will produce the following after-tax cash flows (in millions of dollars): What is the regular payback period for each of the projects? What is the discounted payback period for each of the projects? I need the solution in Excel.arrow_forwardYour division is considering two projects. The required rate of return for both projects is 12%. Below are the cash flows of both the projects: (Note: show all computations) Projects Initial investment Year 1 Year 2 Year 3 Year 4 A -$50 $7 $12 $17 $25 B -$50 $20 $18 $12 $11 Calculate the Payback period and discounted payback period. Why are they different? Calculate the NPV for both the projects Which projects should be accepted on the basis of IRR?arrow_forwardYou must analyze two projects, X and Y. Each project costs$10,000, and the firm’s WACC is 12%. The expected cash flows are as follows:a. Calculate each project’s NPV, IRR, MIRR, payback, and discounted payback.b. Which project(s) should be accepted if they are independent?c. Which project(s) should be accepted if they are mutually exclusive?d. How might a change in the WACC produce a conflict between the NPV and IRR rankingsof the two projects? Would there be a conflict if WACC were 5%? (Hint: Plot theNPV profiles. The crossover rate is 6.21875%.)e. Why does the conflict exist?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License