Financial Accounting (12th Edition) (What's New in Accounting)

12th Edition

ISBN: 9780134725987

Author: C. William Thomas, Wendy M. Tietz, Walter T. Harrison Jr.

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 12, Problem 12.56AP

LO 1, 2, 4

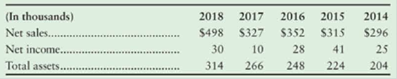

(Learning Objectives 1, 2, 4: Calculate trend percentages, return on sales, asset turnover, and ROA and compare with industry averages) Net sales, net income and total assets for Azul Shipping, Inc., for a five-year period follow:

Requirements

- 1. Calculate trend percentages for each item for 2015 through 2018. Use 2014 as the base year and round to the nearest percent

- 2. Calculate the

rate of return on net sales for 2016 through 2018, rounding to three decimal places. Explain what this means - 3. Calculate asset turnover for 2016 through 2018 Explain what this means

- 4. Use a DuPont Analysis to calculate the rate of return on average total assets (ROA) for 2016 through 2018.

- 5. How does Azul Shipping’s return on net sales for 2018 compare with previous years? How does it compare with that of the industry? In the shipping industry, rales above 9% are considered good, and rates above 11% are outstanding

- 6. Evaluate the company’s ROA for 2018, compared with previous years and against an 18% benchmark for the industry

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

1. Using the data in the student spreadsheet file Ethan Allen Financials.xlsx forecast the 2019 income statement and balance sheet for Ethan Allen. Use the percent of sales method and the following assumptions: (1) sales in FY 2019 will be $797.3359; (2) the tax rate will be 35%; (3) each item that changes with sales will be the five-year average percentage of sales; (4) net fixed assets will increase to $300; and (5) the common dividend will be $0.75 per share. Use your judgment on all other items. a. What is the discretionary financing needed in 2019? Is this a surplus or deficit? b. Assume that the DFN will be absorbed by long-term debt and that the interest rate is 4% of LTD. Set up an iterative worksheet to eliminate it.

Examine the selected data over the 5-year period as shown in the table below for Dumbledore

Ltd.

Item

Sales

Cost of sales

EBIT

Interest

NPAT

Current assets

Total assets

current liabilities

Total liabilities

Equity

Gross margin

Interest coverage

Current ratio

2021

$m

286.41

180.03

51.18

37.07

35.13

43.85

226.18

55.99

98.99

127.19

0.37

1.38

0.78

Year

2020

$m

280.80

166.69

51.08

33.70

35.10

43.20

221.75

53.58

91.66

130.09

0.41

1.52

0.81

2019

$m

275.29

154.35

50.98

30.64

35.06

42.56

217.40

51.27

84.87

132.53

0.44

1.66

0.89

2018

$m

269.89

142.91

50.88

27.85

35.03

41.93

213.13

49.06

78.58

134.56

0.47

1.83

U.OJ

2017

$m

264.60

134.19

49.88

25.32

34.51

41.31

206.93

47.40

74.48

132.44

0.49

1.97

0.87

2016

$m

252.00

126.00

48.90

24.00

34.00

40.70

200.90

45.80

70.60

130.30

0.50

2.04

0.89

E12-24B Vertical analysis (Learning Objective 2) 15-20 min.

Simpson Painting, Inc., requested that you perform a vertical analysis

of its balance sheet to determine the component percentages of its

assets, liabilities, and stockholders' equity. Round to the nearest tenth

of a percent.

P. Donnelly, Inc.

Comparative Income Statement

Years Ended December 31, 2018 and 2017

Revenue

Expenses:

Cost of Goods Sold

Selling and General Expenses

Interest Expense

Income Tax Expense

Total Expenses

Net Income

2018

$500,000

$245,000

111,000

10,000

54,700

420,700

$ 79,300

2017

$439,500

$236,000

103,500

6,500

44,400

390,400

$ 49,100

Chapter 12 Solutions

Financial Accounting (12th Edition) (What's New in Accounting)

Ch. 12 - Prob. 1QCCh. 12 - Prob. 2QCCh. 12 - Prob. 3QCCh. 12 - Prob. 4QCCh. 12 - Expressing accounts receivable as a percentage of...Ch. 12 - Kincaid Company reported the following data (in...Ch. 12 - Prob. 7QCCh. 12 - Ratios that measure liquidity include all of the...Ch. 12 - Verba Corporation has an inventory turnover of 15...Ch. 12 - The measure of a companys ability to collect cash...

Ch. 12 - A ratio that measures a companys profitability is...Ch. 12 - Prob. 12QCCh. 12 - Prob. 13QCCh. 12 - Prob. 14QCCh. 12 - Prob. 12.1ECCh. 12 - Prob. 12.1SCh. 12 - Prob. 12.2SCh. 12 - Prob. 12.3SCh. 12 - Prob. 12.4SCh. 12 - Prob. 12.5SCh. 12 - (Learning Objective 4: Evaluate a companys quick...Ch. 12 - Prob. 12.7SCh. 12 - (Learning Objective 4: Measure ability to pay...Ch. 12 - (Learning Objective 4: Measure profitability using...Ch. 12 - Prob. 12.10SCh. 12 - (Learning Objective 4: Use ratio data to...Ch. 12 - Prob. 12.12SCh. 12 - (Learning Objective 4: Analyze a company based on...Ch. 12 - Prob. 12.14SCh. 12 - Prob. 12.15SCh. 12 - Prob. 12.16AECh. 12 - Prob. 12.17AECh. 12 - Prob. 12.18AECh. 12 - Prob. 12.19AECh. 12 - Prob. 12.20AECh. 12 - Prob. 12.21AECh. 12 - Prob. 12.22AECh. 12 - Prob. 12.23AECh. 12 - Prob. 12.24AECh. 12 - Prob. 12.25AECh. 12 - Prob. 12.26AECh. 12 - Prob. 12.27BECh. 12 - Prob. 12.28BECh. 12 - Prob. 12.29BECh. 12 - Prob. 12.30BECh. 12 - Prob. 12.31BECh. 12 - LO 4 (Learning Objective 4: Calculate ratios;...Ch. 12 - Prob. 12.33BECh. 12 - Prob. 12.34BECh. 12 - Prob. 12.35BECh. 12 - Prob. 12.36BECh. 12 - Prob. 12.37BECh. 12 - Prob. 12.38QCh. 12 - Prob. 12.39QCh. 12 - Prob. 12.40QCh. 12 - Prob. 12.41QCh. 12 - Prob. 12.42QCh. 12 - Prob. 12.43QCh. 12 - Prob. 12.44QCh. 12 - Use the Orlando Medical Corporation financial...Ch. 12 - Prob. 12.46QCh. 12 - Use the Orlando Medical Corporation financial...Ch. 12 - Prob. 12.48QCh. 12 - Prob. 12.49QCh. 12 - Prob. 12.50QCh. 12 - Prob. 12.51QCh. 12 - Prob. 12.52QCh. 12 - Prob. 12.53QCh. 12 - Prob. 12.54QCh. 12 - Prob. 12.55QCh. 12 - LO 1, 2, 4 (Learning Objectives 1, 2, 4: Calculate...Ch. 12 - Prob. 12.57APCh. 12 - Prob. 12.58APCh. 12 - LO 4 (Learning Objective 4: Use ratios to evaluate...Ch. 12 - Prob. 12.60APCh. 12 - LO 2, 4, 5 (Learning Objectives 2, 4, 5: Analyze...Ch. 12 - Group B LO 1, 2, 4 (Learning Objectives 1, 2, 4:...Ch. 12 - Prob. 12.63BPCh. 12 - Prob. 12.64BPCh. 12 - LO 4 (Learning Objective 4: Use ratios to evaluate...Ch. 12 - Prob. 12.66BPCh. 12 - LO 2, 4, 5 (Learning Objectives 2, 4, 5: Analyze...Ch. 12 - Prob. 12.68CEPCh. 12 - Prob. 12.69CEPCh. 12 - (Learning Objectives 2, 3.4: Use trend...Ch. 12 - (Learning Objectives 4, 5: Calculate and analyze...Ch. 12 - Prob. 12.72DCCh. 12 - Prob. 12.73DCCh. 12 - Prob. 12.74EICCh. 12 - Focus on Financials Apple Inc. LO 1, 2, 3, 4, 5...Ch. 12 - Comprehensive Financial Statement Analysis Project...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Net sales revenue, net income, and common stockholders' equity for Eyesight Mission Corporation, a manufacturer of contact lenses, follow for a four-year period. E (Click the icon to view the net sales revenue, net income, and common equity) Read the requirements. Requirement 1. Compute trend analyses for each item for 2017 2019 Use 2016 as the base year, and round to the nearest whole percent. Begin by computing Eyesight Mission Corporation's trend analysis for net sales revenue, then compute Eyesight Mission Corporation's trend analysis for net income and finally compute Eyesight Mission Corporation's trend analysis for common stockholders' equity 2019 2018 2017 2016 Net Sales Revenue $4 766,000 $4 708 000 644 000 664,000 Trend Percentages 100 % Requirements 2019 2018 2017 2016 766,000 $ 708,000 $ 644,000 $ 664,000 44,000 Net Sales Revenue $4 Net Income 60,000 38,000 36,000 Ending Common Stockholders' Equity 368,000 352,000 326,000 296,000arrow_forward(Learning Objective 2: Analyze accounts payable turnover) Barnacle Sales, Inc.’s,comparative income statements and balance sheets show the following selected information for2017 and 2018:2018$2,850,000$ 800,000$ 600,000$ 305,0002017$2,700,000$ 600,000$ 400,000$ 255,000Cost of goods sold.......................................................Ending inventory.........................................................Beginning inventory ....................................................Average accounts payable ...........................................Requirements1. Calculate the company’s accounts payable turnover and days’ payable outstanding (DPO)for 2017 and 2018.2. On the basis of this computation alone, has the company’s liquidity position improved ordeteriorated during 2018?arrow_forwardNet sales revenue, net income, and common stockholders' equity for Eyesight Mission Corporation, a manufacturer of contact lenses, follow for a four-year period. E (Click the icon to view the net sales revenue, net income, and common equity) Read the requirements. Requirement 1. Compute trend analyses for each item for 2017-2019. Use 2016 as the base year, and round to the nearest whole percent. Begin by computing Eyesight Mission Corporation's trend analysis for net sales revenue, then compute Eyesignt Mission Corporation's trend analysis for net income and finally compute Eyesight Mission Corporation's trend analysis for com 2019 2018 2017 2016 Net Sales Revenue 766,000 708,000 644.000 664,000 Trend Percentages 115 % 107 % 97 % 100 % Net Income 60,000 $4 38,000 $ 36.000 2. 44.000 Trend Percentages 136 % 86 % 82 % 100 % Ending Common Stockholdors' Equity 368,000 352 000 $ 326,000 $ 296,000 Trend Percentages 124 % 119 % 110 100 % % OTI Requirement 2. Compute the rate of return on…arrow_forward

- (Learning Objective 7: Calculate return on assets) Handley Grocery Corporationreported the following information in its comparative financial statements for the fiscal yearended January 31, 2018:January 31,2018January 31,2017Net sales....................................Net earnings..............................Average total assets...................$50,000$ 2,200$40,000$48,350$ 2,100$39,300Requirements1. Compute the net profit margin ratio for the years ended January 31, 2018, and 2017. Did itimprove or worsen in 2018?2. Compute asset turnover for the years ended January 31, 2018, and 2017. Did it improve orworsen in 2018?3. Compute return on assets for the years ended January 31, 2018, and 2017. Did it improveor worsen in 2018? Which component—net profit margin ratio or asset turnover—wasmostly responsible for the change in the company’s return on assets?arrow_forwardCompleting a comprehensive financial statement analysis In its annual report, XYZ Athletic Supply, Inc. includes the following five-year financial summary: Requirements Analyze the company’s financial summary for the fiscal years 2014-2018 to decide whether to invest in the common stock of XYZ. Include the following sections in your analysis. Trend analysis for net sales revenue and net income (use 2014 as the base year). Profitability analysis. Evaluation of the ability to sell merchandise inventory. Evaluation of the ability to pay debts. Evaluation of dividends. Should you invest in the common stock of XYZ Athletic Supply, Inc.? Fully explain your final decision.arrow_forward(Learning Objective 7: Calculate return on assets) Hometown Supply Companyreported the following information in its comparative financial statements for the fiscal yearended January 31, 2018:January 31,2018January 31,2017Net sales....................................Net earnings..............................Average total assets...................$84,000$ 4,200$70,000$82,600$ 4,050$69,450Requirements1. Compute the net profit margin ratio for the years ended January 31, 2018, and 2017. Did itimprove or worsen in 2018?2. Compute asset turnover for the years ended January 31, 2018, and 2017. Did it improve orworsen in 2018?3. Compute return on assets for the years ended January 31, 2018, and 2017. Did it improveor worsen in 2018? Which component—net profit margin ratio or asset turnover—wasmostly responsible for the change in the company’s return on assets?arrow_forward

- Required: Compute the following ratios for 2020: 1. Current Ratio 2. Quick Ratio 3. Receivable Turnover 4. Average Collection Period 5. Inventory Turnover 6. Average Sales Period 7. Working Capital 8. Debt Ratio 9. Equity Ratio 10. Debt to Equity Ratio 11. Time Interest Earned 12. Gross Profit Ratio 13. Operating Profit Margin 14. Net Profit Margin 15. Return on Assetsarrow_forwardProblem 1: Viance Queen Company Required: Compute for the company’s profitability and operating efficiency ratios for 2019 Compute for the financial health ratios of the company for 2019 B.Operating Efficiency Days in Inventory AR Turnover Days in ARarrow_forwardGIVE THE FORMULAS FOR THE FOLLOWING EFFICIENCY RATIOS OF NESTLE. THANK YOU Ratio Analysis Efficiency Asset turnover Inventory turnover Receivables turnover Summary of Financial Ratios of Nestle 2020 2019 Average collection period (days) 0.68 4.254 7.849 46.519 0.724 4.993 7.867 46.323 Industry Average 449 days 68 days 34 daysarrow_forward

- 8. Trend Ratios, Application of some Financial Ratios and their Interpretation Some of the balance sheet and income statement figures of Sapphire Mfg. CO. for 2016, 2017 and 20181 are as follows. 2018 P30,000 2016 2017 Quick assets P40,000 P48,000 65,000 25,000 80,000 50,000 Current assets 50,000 40,000 110,000 200,000 Investments 160,000 135,000 Plants, property and equipment, net Total assets 250,000 265,000 Current liabilities 45,000 50,000 100,000 75,000 Long Term debt Total stockholders' equity 40,000 50,000 105,000 125,000 125,000 Total liabilities and stockholders' Equity 200,000 400,000 240,000 250,000 265,000 Sales 375,000 500,000 Cost of goods sold Operating expenses (including Depreciation of P10,000) 255,000 290,000 110,000 95,000 105,000 Net income 50,000 50,000 130,000 a) Compute for the trend ratios based on the above given data and give your interpretation of the 2017 and 2018 figures.arrow_forwardMuscat Industrial Company has the following data which is extracting from its financial statements at the beginning 2020. Calculate the following ratios : Total Asset Turnover (TAT). Debt Ratio (DR%). Net Profit Margin 10% Sales 2500 thousand (OMR) Financial Leverage Multiplier 1.5 Times Return on Asset (ROA) 8 %arrow_forwardProblem 1: Viance Queen Company Required: Compute for the company’s profitability and operating efficiency ratios for 2019 Compute for the financial health ratios of the company for 2019 A.Profitability ratio a. Return on Assets: ROA (NI/Total Assets) ROA (NI/Average Assets) ROA (EBIT/Total Assets) ROA (EBIT/Average Assets) ROE (NI/Capital) ROE (NI/Average Capitalarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License