(Learning Objectives 4, 5: Calculate and analyze ratios and earnings quality for a company in the restaurant industry)

Note: This case is part of The Cheesecake Factory serial case contained in every chapter in this textbook.

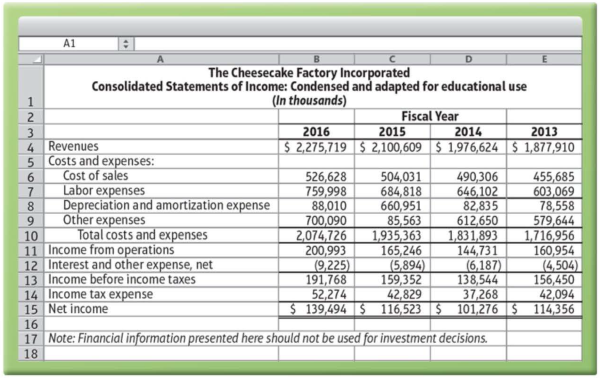

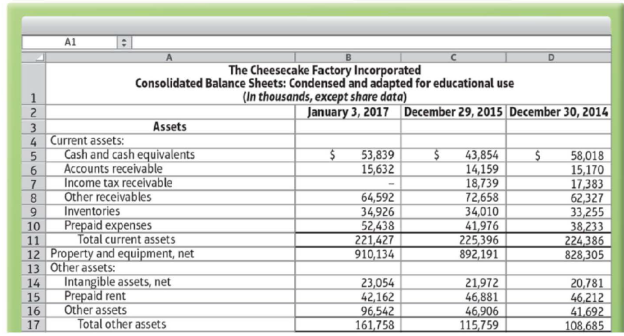

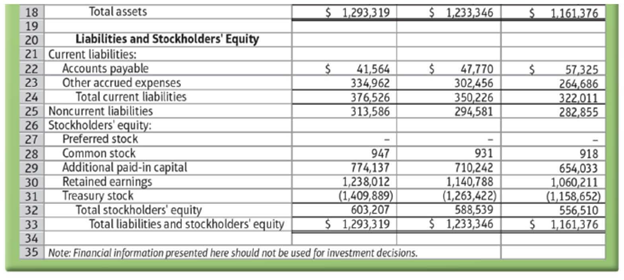

To follow are The Cheesecake Factory Incorporated's financial statements from its 2016 Form 10-K.

Data from the US. Securities and Exchange Commission EDGAR Company filings, www.sec.gov

Data from the U.S. Securities and Exchange Commission EDGAR Company filings, www.sec.gov

The preceding financial statements have been condensed and adapted for educational use and should not be used for investment decisions.

Requirements

1. Calculate The Cheesecake Factory’s net

2. Calculate The Cheesecake Factory’s

3. Calculate The Cheesecake Factory’s quick ratio for 2015 and 2016. Did the quick ratio improve or deteriorate?

4. How would you assess The Cheesecake Factory’s overall ability to pay its current liabilities? Explain.

5. Calculate inventory turnover for 2016. Next, calculate days' inventory outstanding. What does this number mean?

6. Calculate accounts receivable turnover for 2016. Assume all net revenue is from credit sales. Next, calculate days’ sales outstanding. What does this number mean?

7. Calculate accounts payable turnover for 2016. Next. calculate days’ payable outstanding. What does this number mean?

8. Calculate the cash conversion cycle (in days). Explain what this cash conversion cycle number means.

9. Calculate the debt ratio for 2016 and for 2015. Has the debt ratio increased or decreased?

10. Calculate the times-interest-earned ratio for 2016. Use “interest and other expense, net” as interest expense. What does this ratio mean?

11. Calculate the following profitability ratios for 2016:

- a. Gross margin percentage

- b. Operating income percentage

- c.

Rate of return on sales - d. Rate of return on assets

12. Comment on The Cheesecake Factory’s profitability in 2016 based on the profitability ratios you just calculated.

13. How would you evaluate the company’s earnings quality?

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

Financial Accounting (12th Edition) (What's New in Accounting)

- Please help, we have this example out of our textbook tthat we have to do for preperation for our test next week. Due to online learning I don not understand the steps or formulas needed to complete this question You are an investment analyst at FI Investments tasked to value FBC firm a Southern Agricultural Conglomerate. The following financial information was recently released for FBC. The company’s 2015 and 2014 annual financial reports are contained in the tables below, along with important additional information: FBC statement of financial position (R millions) 2015 2014 Cash and equivalents R149 R83 Accounts receivable 295 265 Inventory 275 285 Total current assets R719 R633 Total fixed assets 3 909 3 856 Accounts payable 228 220 Notes payable 0 0 Total current liabilities 228 220 Long term debt 1 800 1 650 Total liabilities and…arrow_forwardYou are the accountant of Spicy Yummy, a fast food company. The directors of your company require you to analyze and interpret the most recent financial statements and compare its performance with those of previous year. You are presented with the following summarised accounts for Spicy Yummy. Statements of Comprehensive Income for the year ended 31 March 2019 and 2020: 31 March 2019 31 March 2019 $'000 $'000 Sales revenue 2,000 2,900 Cost of sales (see note below) (1200) (1800) Gross profit 800 1100 Distribution costs (160) (250) Administrative expenses (200) (200) Profit from operations 440 650 Finance cost (50) (50) Profit before tax 390 600 Income tax expense (44) (46) Net profit for the period 346 554 Note: 10% and 20% of purchases and sales were for cash respectively. Cost of sales figures are made up as follows: Year ended 31 March 2019 31 March 2019 $'000 $'000 Opening inventory 180 200 Purchases 1220 1960 1400 2160 Less…arrow_forwardIdentify any Two (2) Public Listed Company listed under the Main Market of Bursa Malaysia originating from the same industry. Download the most recent annual report of the companies you have chosen. Analyze and compare the annual reports and critically assess the difficulties in preparing a set of useful financial statements, which exhibits all the primary qualitative characteristics necessary for all users of financial statements( E.g. Comparability ). How well do you feel that your chosen companies have achieved this purpose ? ( Minimum 1200 words )arrow_forward

- (Learning Objectives 1, 2, 5: Analyze current liabilities; evaluate accounts payable turnover; evaluate contingent liabilities) Retrieve the 2016 Under Armour financial statementsat www.sec.gov by clicking on Filings and then searching for “Under Armour” under Company Filings. When you see the list of filings for the company, select the Form 10-K for 2016.Be sure to retrieve the 2016 financial statements, not another year. These financial statementsreport a number of liabilities.Requirements1. The current liability section of Under Armour’s Consolidated Balance Sheet as of December31, 2016, lists four different liabilities. List them and give a brief description of each one.2. For 2016, calculate accounts payable turnover, both as a ratio and in number of days.Describe what this ratio means. Also compute the following other ratios for 2016 (if you havealready computed them as part of your work in previous chapters, refer to them): (1) currentratio, (2) quick ratio, (3) days’ sales…arrow_forwardThe financial statements of Dandy Distributors Ltd. are shown on the "Fcl. Stmts." page. 1 Based on Dandy's financial statements, calculate ratios for the year ended December 31, 2020. Assume all sales are on credit. Show your work. 2 From these ratios, analyze the financial performance of Dandy.arrow_forwardThe Sir Arthur Lewis Community College has recently invited all accounting students in from the Principles of cost and management accounting (ACC115) class to participate in a business degree scholarship with an emphasis in accounting. The award for the highest score is a full scholarship for a degree in Business Administration. The following information for Good Times Inc. has been provided to assess the proficiency of all participants in accounting: Estimates for the period January to June 2021 Purchases ($) Operating expenses ($) 35,000 20,000 Month Sales ($) January February March 350,000 200,000 100,000 250,000 300,000 360,000 210,000 120,000 60,000 150,000 180,000 10,000 25,000 30,000 36,000 April May June 216,000 Relevant data for the Good Times Inc. operations: a. Payment for purchases is made as follows 80% in the month of purchase and the balance in the following the following month. Payments made in the month of purchase are entitled to a 10% discount. b. Sales are made on…arrow_forward

- For each of these itens, list the assumption, principle, information characteristic, or convention that is violated. Write your Learning Task 4: Below are a number of accounting proccdures and practices in Prospere General Merchandise. answer in your notebook. ác company prepares financial reports are based on the SFAS promulgated by the ASC. 4. The assets and owner's couity are reported at fair value but business obliga tions are reported at historical cost. 3. The company maintains only one employee to function as accountant, inter- nal auditor, collector and treasurer. 4. The financial reports are always delayed. 5. Due to recession, estimated future earnings are reported in the current finan- cial reports of Prospere General Merchandise. 6. The accounting methods and procedures used are regularly changed semi- annually. 7. The accountant records transactions as desired by the owner without proper supporting documents. 8. The financial reports do not include minutes of the meeting,…arrow_forwardMany companies make annual reports available on their corporate websire, often under an Investors tab. Annual reports also can be accessed through the SEC's EDGAR system at www.sec.gov (under Filings, click Company Filings Search, type in Company Name, and under Filing Type, search for 10-K). Access the most recent annual report for the following U.S.-based multinational corporations to complete the requiremects: International Business Machines Corporation. Intel Corporation. Required a. Identify the location(s) in the annual report that provides disclosures related to foreign currency translation and foreign currency hedging. b. Determine whether the company's foreign operations have a predominant functional currency.c. Determine the amount of translation adjustment, if any, reported in other comprehensive income in each of the three most recent years. Explain the sign (positive or negative) of the translation adjustment in each of the three most recent years. Compare the relative…arrow_forwardNeed an answer for question B (i ii iii) (b) Obtain the most recent annual reports for TWO FTSE 100 companies of your choice (NOTE: you need to make sure the companies chosen to have more than one operating segment and thus have meaningful segment notes for analysis). Examine the segmental disclosures provided in the segment notes of the annual reports by the selected two companies and comment on the following:i. Based on extracts from the segment notes,• how much and what segmental information is provided in the segment notes?• discuss whether the companies are in compliance with the relevant accounting standard, and• discuss the similarities and differences between their disclosure practices. ii. Comment on whether the information is useful and sufficient to allow shareholders to make informed investment decisions iii. Discuss the implications of your analysis and findings, such as policy implications.arrow_forward

- You have been hired as an analyst for MBJ & Co and your team is working on an independent assessment of Anak Bumi Sdn. Bhd (ABSB). ABSB is a company that specializes in the plantation. Your assistant has provided you with the following data for ABSB and their industry. Ratio 2019 2020 2021 2020- Industry Average Long-term debt 0.45 0.40 0.35 0.35 Inventory Turnover 62.65 42.42 32.25 53.25 Depreciation/Total Assets 0.25 0.02 0.02 0.02 Days’ sales in receivables 113 98 94 130 Debt to Equity 0.75 0.85 0.90 0.88 Profit Margin 0.08 0.07 0.06 0.08 Total Asset Turnover 0.54 0.65 0.70 0.40 Quick Ratio 1.03 1.03 1.03 1.03 Current Ratio 1.33 1.21 1.15 1.25 Times Interest Earned 0.90 4.38 4.45 4.65 Equity Multiplier 1.75 1.85 1.90 1.88 Required: You are required to prepare interim audit report of ABSB for the year 2020.arrow_forwardAssume that you have finished your MBA program and have applied for a position in the FinancialAccounting Department of a large multinational company. The company is struggling with itsaccounting reporting matters and several accounting reports are under regulatory scrutiny. In theinterview board, the recruitment committee members have asked you the following question i. What have you learnt in the BUS 505 (Accounting Principles) course relating to financial accounting?arrow_forwardAssume that you have finished your MBA program and have applied for a position in the Financial Accounting Department of a large multinational company. The company is struggling with its accounting reporting matters and several accounting reports are under regulatory scrutiny. In the interview board, the recruitment committee members have asked you the following questions. What have you learnt in the BUS 505 course relating to financial accounting? How you can contribute the Financial Accounting Department of this company if you are recruited?arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning