Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

10th Edition

ISBN: 9781337902571

Author: Eugene F. Brigham, Joel F. Houston

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 16, Problem 14P

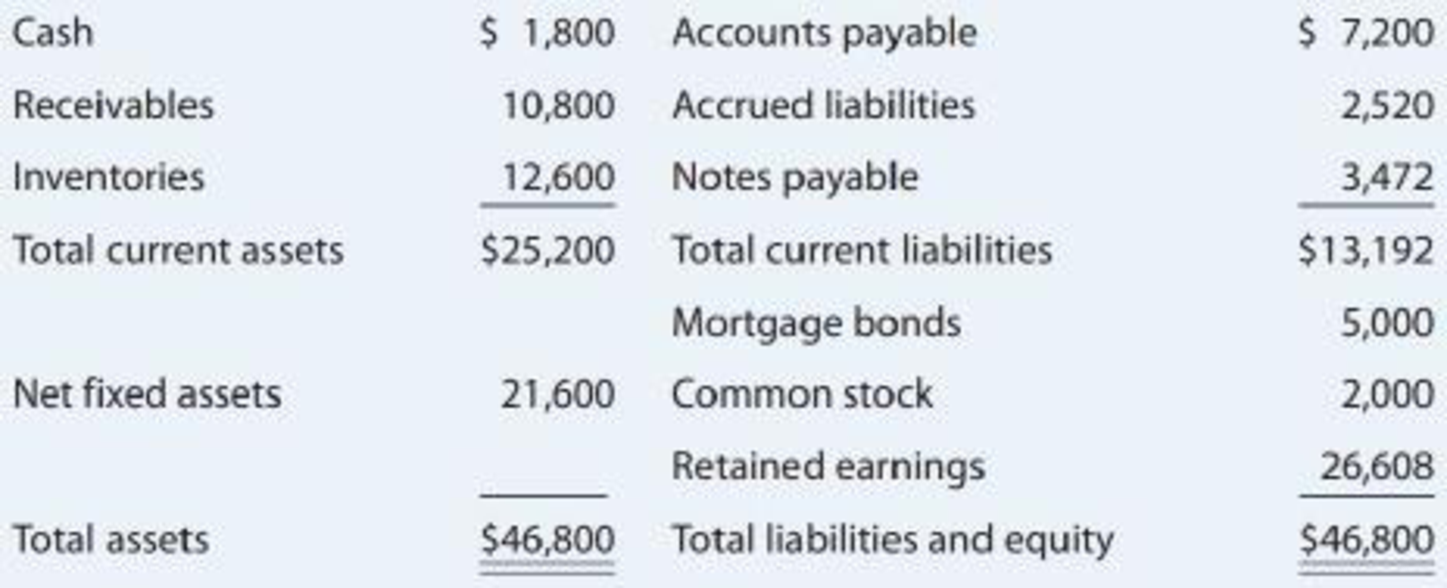

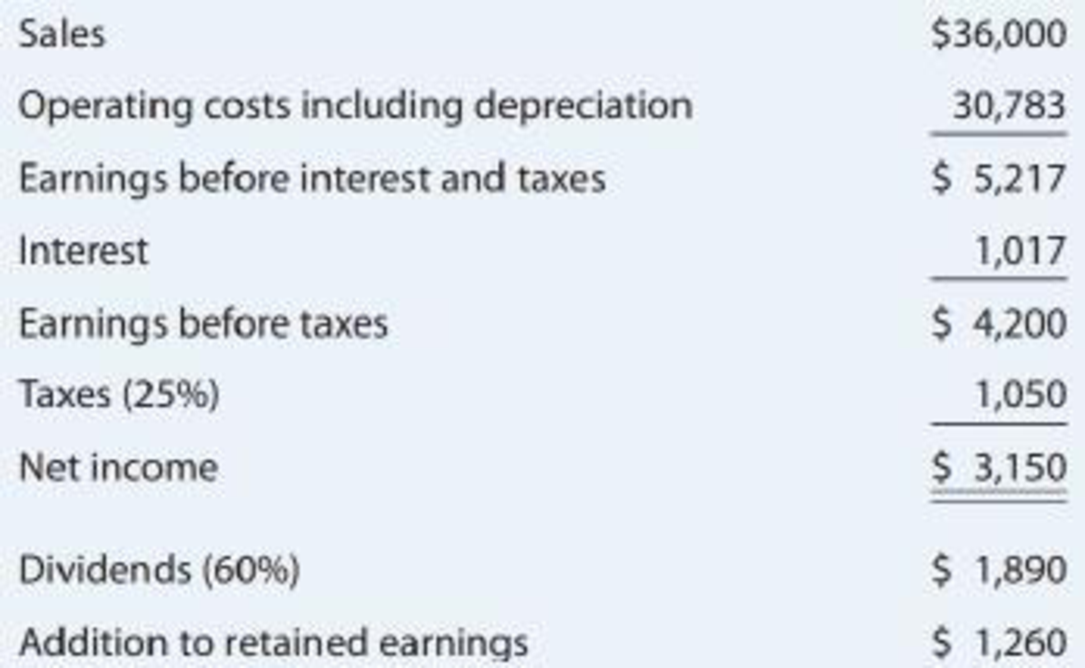

EXCESS CAPACITY Krogh Lumber’s 2019 financial statements are shown here.

Krogh Lumber:

Krogh Lumber: Income Statement for December 31, 2019 (thousands of dollars)

- a. Assume that the company was operating at full capacity in 2019 with regard to all items except fixed assets; fixed assets in 2019 were being utilized to only 75% of capacity. By what percentage could 2020 sales increase over 2019 sales without the need for an increase in fixed assets?

- b. Now suppose 2020 sales increase by 25% over 2019 sales. Assume that Krogh cannot sell any fixed assets. All assets other than fixed assets will grow at the same rate as sales; however, after reviewing industry averages, the firm would like to reduce its operating costs/sales ratio to 82% and increase its total liabilities-to-assets ratio to 42%. The firm will maintain its 60% dividend payout ratio, and it currently has 1 million shares outstanding. The firm plans to raise 35% of its 2020 forecasted interest-bearing debt as notes payable, and it will issue bonds for the remainder. The firm

forecasts that its before-tax cost of debt (which includes both short- and long-term debt) is 11%. Any stock issuances or repurchases will be made at the firm’s current stock price of $40. Develop Krogh’s projected financial statements like those shown in Table 16.2. What are the balances of notes payable, bonds, common stock, andretained earnings ?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Krogh Lumber's 2019 financial statements are shown here.

a. Assume that the company was operating at full capacity in 2019 with regard to all items except fixed assets; fixed assets in 2019 were being utilized to only 75% of capacity. By what percentage could 2020 sales increase over 2019 sales without the need for an increase in fixed assets?b. Now suppose 2020 sales increase by 25% over 2019 sales. Assume that Krogh cannot sell any fixed assets. All assets other than fixed assets will grow at the same rate as sales; however, after reviewing industry averages, the firm would like to reduce its operating costs/sales ratio to 82% and increase its total liabilities-to-assets ratio to 42%. The firm will maintain its 60% dividend payout ratio, and it currently has 1 million shares outstanding. The firm plans to raise 35% of its 2020 forecasted inter est-bearing debt as notes payable, and it will issue bonds for the remainder. The firm forecasts that its before-tax cost of debt…

Pro forma income statement The marketing department of Metroline Manufacturing estimates that its sales in 2020 will be $1.53 million. Interest expense is expected to remain unchanged at $35,000, and the firm plans to pay $65,000 in cash dividends during 2020.

Metroline Manufacturing's income statement for the year ended December 31, 2019, is given, along with a breakdown of the firm's cost of goods sold and operating expenses into their fixed and variable components.

a. Use the percent-of-sales method to prepare a pro forma income statement for the year ended December 31, 2020.

b. Use fixed and variable cost data to develop a pro forma income statement for the year ended December 31, 2020.

c. Compare and contrast the statements developed in parts a. and b. Which statement probably provides the better estimate of 2020 income? Explain why.

a. Use the percent-of-sales method to prepare a pro forma income statement for the year ended December 31, 2020.

Complete the pro forma income…

Pro forma income statement The marketing department of Metroline Manufacturing estimates that its sales in 2020 will be $1.53 million. Interest expense is expected to remain unchanged at $39,000, and the firm plans to pay

$74,000 in cash dividends during 2020. Metroline Manufacturing's income statement for the year ended December 31, 2019, is given, along with a breakdown of the firm's cost of goods sold and operating expenses into their fixed

and variable components.

a. Use the percent-of-sales method to prepare a pro forma income statement for the year ended December 31, 2020.

b. Use fixed and variable cost data to develop a pro forma income statement for the year ended December 31, 2020.

c. Compare and contrast the statements developed in parts a. and b. Which statement probably provides the better estimate of 2020 income? Explain why.

Complete the pro forma income statement for the year ended December 31, 2020 below: (Round the percentage of sales to four decimal places and the pro…

Chapter 16 Solutions

Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

Ch. 16 - Prob. 1QCh. 16 - Assume that an average firm in the office supply...Ch. 16 - Would you agree that computerized corporate...Ch. 16 - Certain liability and net worth items generally...Ch. 16 - Suppose a firm makes the following policy changes....Ch. 16 - AFN EQUATION Carlsbad Corporations sales are...Ch. 16 - AFN EQUATION Refer to Problem 16-1. What...Ch. 16 - AFN EQUATION Refer to Problem 16-1 and assume that...Ch. 16 - PRO FORMA INCOME STATEMENT Austin Grocers recently...Ch. 16 - EXCESS CAPACITY Williamson Industries has 7...

Ch. 16 - Prob. 6PCh. 16 - PRO FORMA INCOME STATEMENT At the end of last...Ch. 16 - LONG-TERM FINANCING NEEDED At year-end 2019, total...Ch. 16 - SALES INCREASE Paladin Furnishings generated 4...Ch. 16 - REGRESSION AND RECEIVABLES Edwards Industries has...Ch. 16 - REGRESSION AND INVENTORIES Charlies Cycles Inc....Ch. 16 - Prob. 12PCh. 16 - ADDITIONAL FUNDS NEEDED Morrissey Technologies...Ch. 16 - EXCESS CAPACITY Krogh Lumbers 2019 financial...Ch. 16 - Prob. 1TCLCh. 16 - FORECASTING THE FUTURE PERFORMANCE OF ABERCROMBIE ...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Pro forma income statement The marketing department of Metroline Manufacturing estimates that its sales in 2020 will be $1.59 million. Interest expense is expected to remain unchanged at $36,000, and the firm plans to pay $66,000 in cash dividends during 2020. Metroline Manufacturing's income statement for the year ended December 31, 2019, is given LOADING... , along with a breakdown of the firm's cost of goods sold and operating expenses into their fixed and variable components. a. Use the percent-of-sales method to prepare a pro forma income statement for the year ended December 31, 2020. b. Use fixed and variable cost data to develop a pro forma income statement for the year ended December 31, 2020. c. Compare and contrast the statements developed in parts a. and b. Which statement probably provides the better estimate of 2020 income? Explain why.arrow_forwardBajaj Ltd. reported the following statistics and results for 2020: Net operating income Return on sales $ 54,000 Asset turnover 2.5 Residual income $ 10,880 Required: 1. What was the value of Bajaj's average operating assets in 2020? Average operating assets 2 If the required rate of return is 7% what Is the ROI? (Round your answer to 2 decimal places.) ROIarrow_forwardWhat is the gross profit declined due to increase in cost in the amount? The management of Bataan Corporation ask you to submit an analysis of the increase in their gross profit in2021 based on their past two-year comparative income statements which show: 2021 2020 Sales 1,237,500 1,000,000 950,000 287,000 Cost of sales 800,000 Gross profit 200,000 The only known factor given is the sales price increased 12.5% beginning January 2021.arrow_forward

- The portion of the functional income statements of BP Company for 2021 and 2020 are presented below: 2021 2020 Sales Cost of goods sold Gross margin P890,000 P800,000 530,000 450.000 360.000 350.000 Assuming that effective January of 2021 the unit cost is higher by 6 percent, calculate the change in sales due to change in volume rounded to nearest thousands.arrow_forwardCompany prepared the following income statement for the year 2020: Sales 6,000,000 Cost of goods sold (2,800,000) Gross Income 3,200,000 Gain on sale of equipment 100,000 Total Income 3,300,000 Operating expenses (500,000) Casualty loss (300,000) Income before tax 2,500,000 Income tax- 30% 750,000 Net Income 1,750,000 Third…arrow_forwardHow do you figure: Income from continuing Operation and Discontinued Operation for this problem? Selected information about income statement accounts for the Reed Company is presented below (the company's fiscal year ends on December 31): 2021 2020 Sales revenue $ 4,400,000 $ 3,500,000 Cost of goods sold 2,860,000 2,000,000 Administrative expense 800,000 675,000 Selling expense 360,000 302,000 Interest revenue 150,000 140,000 Interest expense 200,000 200,000 Loss on sale of assets of discontinued component 48,000 — On July 1, 2021, the company adopted a plan to discontinue a division that qualifies as a component of an entity as defined by GAAP. The assets of the component were sold on September 30, 2021, for $48,000 less than their book value. Results of operations for the component (included in the above account balances) were as follows: 1/1/2021–9/30/2021 2020 Sales revenue $ 400,000 $ 500,000 Cost…arrow_forward

- 18. The following data for the years ended December 31, 2019 and 2020 were presented to the management Zigzag Company: 2020 = Net sales: 1,363,000, Cost of Sales: 911,800, Gross Profit: 451,200; 2019 = Net Sales: 1,250,000, Cost of Sales: 776,000, Gross Profit: 474,000. The management requested you to determine the cause of the decline in gross profit on sales in spite of the favorable information given by the sales division that the quantity sold in 2020 was higher than in 2019 and that the production costs in 2020 were lower than that of 2019 by 6%. The increase (decrease) in net sales due to cost factor is:a. (P135,800)b. P135,800c. (P58,200)d. P58,200arrow_forwardPercentage of Sales Models Here are the abbreviated financial statements for Planner's Peanuts Income Statement , 2019 Sales $2,000 Cost 1,500 Net Income $ 500 Balance Sheet, Year End 2018 2019 2018 2019 Assets $2,500 $3,000 Debt $ 833 $1,000 Equity 1,667 2,000 Total $2,500 $3,000 Total $2,500 $3,000 a. if sales increase by 20% in 2020 and the company uses a strict percentage of sales planning model (meaning that all items on the income and balance sheet also increase by 20%), what must be the balancing item? b. what will be the value of this balancing item?arrow_forwardThe portion of the functional income statements of Brief Company for 2021 and 2020 are presented below: 2021 2020 Sales P890,000 P800,000 Cost of goods sold 530,000 450,000 Gross margin 360,000 350,000 Assuming that effective January of 2021 the unit cost is higher by 6 percent, calculate the change in sales due to change in volume rounded to nearest thousands. Group of answer choices P85,000 Favorable P88,000 Favorable P88,000 Unfavorable P85,000 Unfavorablearrow_forward

- Pro forma balance sheet Peabody & Peabody has 2019 sales of $10.5 million. It wishes to analyze expected performance and financing needs for 2021—2 years ahead. Given the following information, respond to parts a. and b. (1) The percents of sales for items that vary directly with sales are as follows: Accounts receivable; 11.9%, Inventory; 17.7%; Accounts payable, 13.6%; Net profit margin, 3.5%. (2) Marketable securities and other current liabilities are expected to remain unchanged. (3) A minimum cash balance of $482,000 is desired. (4) A new machine costing $653,000 will be acquired in 2020, and equipment costing $848,000 will be purchased in 2021. Total depreciation in 2020 is forecast as $288,000, and in 2021 $388,000 of depreciation will be taken. (5) Accruals are expected to rise to $504,000 by the end of 2021. (6) No sale or retirement of long-term debt is expected. (7) No sale or repurchase of common stock is expected. (8) The dividend payout of…arrow_forwardHere are the abbreviated financial statements for Planner's Peanuts: INCOME STATEMENT, 2019 Sales Cost $ 9,000 7,100 Net income $ 1,900 BALANCE SHEET, YEAR-END 2018 Assets $ 6,500 2019 $ 9,500 Total $ 6,500 $ 9,500 Debt Equity Total 2018 $ 853 2019 $1,000 5,647 $6,500 $9,500 8,500 a. If sales increase by 25% In 2020 and the company uses a strict percentage of sales planning model (meaning that all items on the Income and balance sheet also increase by 25%), what must be the balancing item? b. What will be the value of this balancing item? Answer is not complete. a. Balancing item Dividends b. Valuearrow_forwardHere are the abbreviated financial statements for Planner’s Peanuts: INCOME STATEMENT, 2019 Sales $ 5,000 Cost 3,900 Net income $ 1,100 BALANCE SHEET, YEAR-END 2018 2019 2018 2019 Assets $ 7,500 $ 12,100 Debt $ 833 $ 1,000 Equity 6,667 11,100 Total $ 7,500 $ 12,100 Total $ 7,500 $ 12,100 a. If sales increase by 10% in 2020 and the company uses a strict percentage of sales planning model (meaning that all items on the income and balance sheet also increase by 10%), what must be the balancing item? b. What will be the value of this balancing item?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...

Finance

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Financial Projections for Startups Basic Walkthrough; Author: Mike Lingle;https://www.youtube.com/watch?v=7avegQF4dxI;License: Standard youtube license