Excel Applications for Accounting Principles

4th Edition

ISBN: 9781111581565

Author: Gaylord N. Smith

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 18, Problem 4R

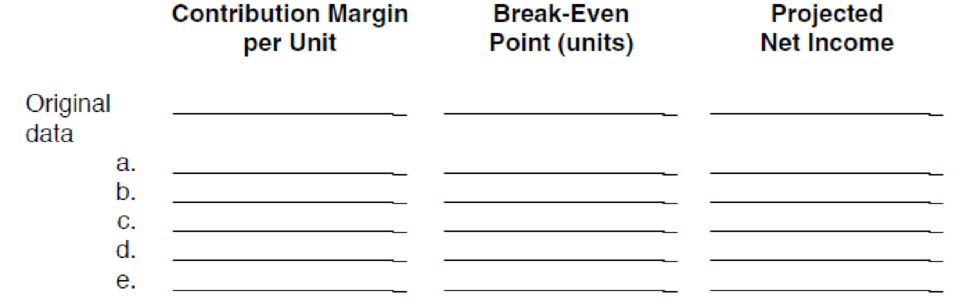

The president of Poleski would like to know the effect that each of the following suggestions for improving performance would have on contribution margin per unit, sales needed to break even, and projected net income for next year. Each change should be considered independently. Reset the Data Section to its original values after each suggestion is analyzed. Fill in the table following the suggestions with the results of your analysis.

- a. The president suggests cutting the productʼs price. Since the market is relatively sensitive to price, “. . . a 10% cut in price ought to generate a 30% increase in sales (to 156,000 units). How can you lose?”

- b. The sales manager feels that putting all sales personnel on straight commission would help. This would eliminate $77,000 in fixed sales salaries expense. Variable sales commissions would increase to $2.00 per unit. This move would also increase sales volume by 30%.

- c. Poleskiʼs head of product engineering wants to redesign the package for the product. This will cut $1.00 per unit from direct materials and $0.50 per unit from direct labor, but will increase fixed factory overhead by $100,000 for additional depreciation on the new packaging machine. The package redesign would not affect sales volume.

- d. The firmʼs consumer marketing manager suggests undertaking a new advertising campaign on Facebook. This would cost $30,000 more than is currently planned for advertising but would be expected to increase sales volume by 30%.

- e. The production superintendent suggests raising quality and raising price. This will increase direct materials by $1.00 per unit, direct labor by $0.50 per unit, and fixed factory overhead by $110,000. With improved quality, “. . . raise the price to $18.50 and advertise the heck out of it. If you double your current planned advertising, Iʼll bet you can increase your sales volume by 30%.”

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The Miramar Company is going to introduce one of three new products: a widget, a hummer, or a nimnot. The market conditions (favorable, stable, or unfavorable) will determine the profit or loss the company realizes, as shown in the following payoff table: a. Compute the expected value for each decision and select the best one. b. Develop the opportunity loss table and compute the expected opportunity loss for each product. c. Determine how much the firm would be willing to pay to a market research firm to gain better information about future market conditions.

Your team is conducting a CVP analysis for a new product. Different sales projections have different incomes. One member suggests picking numbers yielding favorable income because any estimate is “as good as any other.” Another member suggests dropping unfavorable data points for cost estimation. What do you do?

Maximus Steel plans to introduce one of three new products code-named: Wren, Hawk, and Nightingale. The marketing department indicated that the success of any product depends on the market conditions (Favorable, Neutral, or Unfavorable). The profit the company will earn also depends on the market conditions.

The table below shows the probability estimated for each market condition and the profits Maximus Steel will realize within those conditions:

Product Code

Market Conditions

Favorable

P = 0.2

Neutral

P = 0.7

Unfavorable

P = 0.1

Wren

$120,000

$70,000

($30,000)

Hawk

$60,000

$40,000

$20,000

Nightingale

$35,000

$30,000

$30,000

Part 1 Instructions:

Compute the expected value for each alternative. What is the best option for the company?

Chapter 18 Solutions

Excel Applications for Accounting Principles

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- We can get a sense of how model output responds to changes in inputs from sensitivity analyses. Some argue that we might draw very different conclusions when using different boundaries, especially when model output is a non-linear function of inputs. For example, we compute the net present value (NPV) of a business with a 10% discount rate. We can choose +/- 1% for our sensitivity analysis, or +/-5% for our analysis. For this reason, some argue that one can manipulate sensitivity analysis to support one’s prior. What do you think of this comment?arrow_forwardIn response to the weak economy, your company’ssales force is urging you, the sales manager, to changesales terms from 1/10, n/30 to 2/10, n/45. Explain whatthese terms mean and how this switch could increase ordecrease your company’s profits.arrow_forwardIn a strategy meeting, a manufacturing company’s president said, “If we raise the price of our product, the company’s break-even point will be lower.” Thefinancial vice president responded by saying, “Then we should raise our price. The company will be less likely to incur a loss.” Do you agree with the president? Why? Do you agree with the financial vice president? Why?arrow_forward

- Earl Massey, director of marketing, wants to reduce the selling price of his company’s products by 15% to increase market share. He says, “I know this will reduce our gross profit rate, but the increased number of units sold will make up for the lost margin.” Before this action is taken, what other factors does the company need to consider?arrow_forwardInternal production supervisors of a company’s product line would be MOST likely to ask which of the following questions? Select answer from the options below 1.How much profit can the company expect to earn this year? 2.What can the company afford to pay its employees this year? 3.Which product line is the least profitable and should be eliminated? 4.How much should the company charge for its products to maximize its profit?arrow_forwardThe Gizmo Manufacturing Company is considering making and selling a new product. The following data have been provided to management: Some managers are reluctant to launch a new product because of the uncertainty of future sales. To provide management with information that might make it easier to draw the correct conclusion, a break-even analysis will be performed for annual sales required to economically justify introducing the new product.What is the break-even value of units sold annually?arrow_forward

- Industry analysts have predicted a sharp decline in housing demand in the months ahead. After learning of this prediction, Nest Home Builders opts to convert as many of its variable costs to fixed costs as possible. This decision O is a wise one, because it will decrease the firm's degree of operating leverage and thus reduce the firm's degree of risk. O is a poor one, because it will increase the firm's degree of operating leverage and thus increase the firm's degree of risk. O is a poor one, because it will decrease the firm's degree of operating leverage and thus increase the firm's degree of risk. O is a wise one, because it will increase the firm's degree of operating leverage and thus reduce the firm's degree of risk. Save for Later Submit Answerarrow_forwardIn 400-500 words please answer the following: Management decides to increase the selling price from $50 to $55 per unit. Assume that the cost of the product and the fixed operating expenses are not changed by this pricing decision. What cost-volume relationships should Paulsen take into consideration for the original price and the proposed new selling price? Discuss the non-monetary factors that should be taken into consideration before raising a selling price.arrow_forwardIn a strategy meeting, the president of a manufacturing company said, “If we were to raise the price of our product, the company’s break-even point would be lower.” The vice-president of finance responded by saying, “Then we should raise our price. The company will be less likely to incur a loss.” Do you agree with the president? Why/why not? Do you agree with the vice president? Why/why not?arrow_forward

- Knight Shades Inc. is considering adding new line of sunglasses to their designer series. The glasses will sell for $1,100 per pair and have a variable cost of $400 per unit. The company has spent $101,000 for a marketing study that estimates the company will sell 74,000 sunglasses per year for seven years. The fixed costs each year to produce the sunglasses will be $5,040,000. The company has also spent $706,000 on research and development for the new glasses. The new plant and equipment will cost $12,000,000 at start-up and will be depreciated on a straight-line basis to zero over the seven years. At the end of the seven years the plant and equipment will be worthless. The new sunglasses will also require an increase in net working capital of $664,000 that will be returned at the end of the project. The tax rate is 40 percent, and the cost of capital is 9 percent. The marketing study also estimates that introducing the new sunglasses will reduce sales of the company's high-priced…arrow_forwardThe advantages of calculating Contribution Margins of a company’s products seem to be overwhelming according to the author. One can quickly calculate their break-even point and evaluate pricing changes and product quality improvements. But after reviewing several annual reports, apparently, no one is using this technique. What’s missing in this analysis?arrow_forwardDirections: For each situation, select one option you think will help increase profit. Put the letter of your choice in the blank. Below each answer, write your rationale. When you have finished, ask your instructor for a copy of the answer guide to verify your responses. A. Avoid extra payroll expenses. B. Get the best rates on advertising. C. Change the product you provide. D. Use resources wisely. E. Beat the competition. F. Get the best rates on supplier purchases. G. Eliminate some free services. H. Increase worker e iciency. _1. A shop that sells fine glassware offers gift wrapping at no extra cost. Rationale: 2. Two stores sell the same video game at the same price. Rationale: 3. There are 12 places to buy the yarn needed for a knitting factory. Rationale: 4. Employees at a printing company do not have a system for completing their tasks quickly and accurately. Rationale: 5. At a sign-making company, the extra metal is discarded. Rationale:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Cost-Volume-Profit (CVP) Analysis and Break-Even Analysis Step-by-Step, by Mike Werner; Author: Accounting Step by Step;https://www.youtube.com/watch?v=D0MOfse9OWk;License: Standard Youtube License